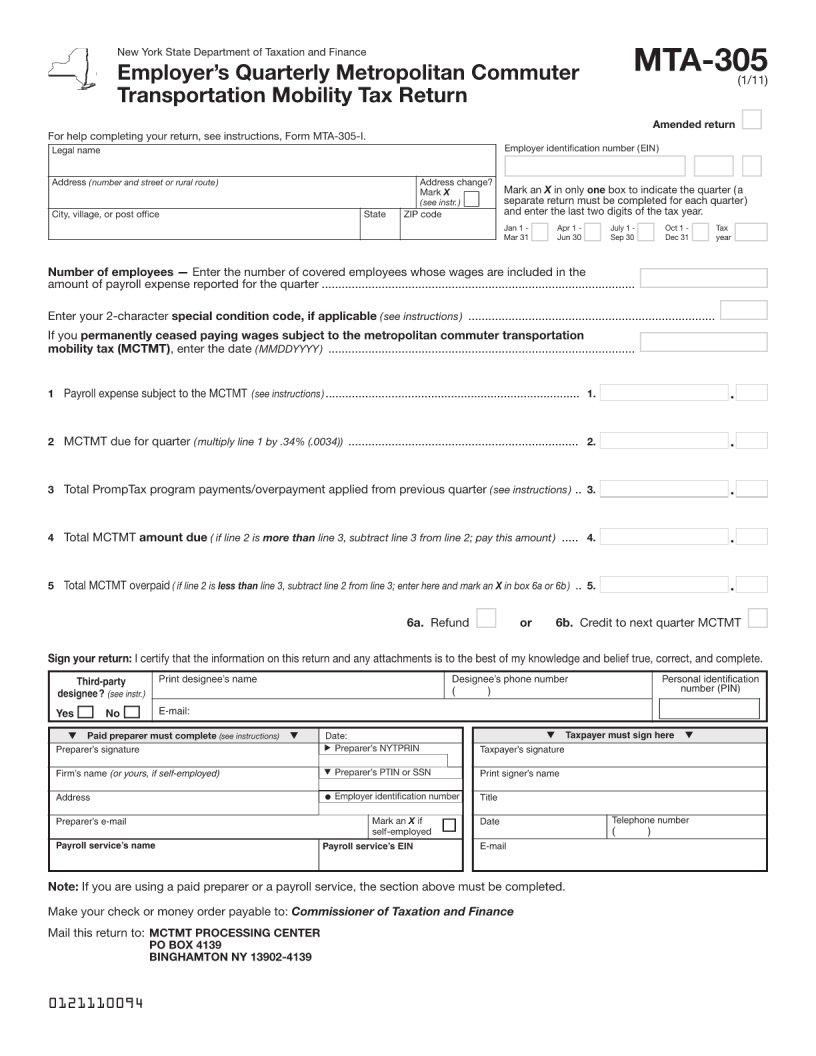

In navigating the labyrinth of legal documents required for managing tax affairs, individuals and businesses often encounter the MTA 305 form. This document plays a pivotal role by serving as a declaration of personal property for tax purposes. Originating in jurisdictions where personal property tax is levated, it aids taxpayers in reporting the value of their non-real estate assets. These may include, but are not limited to, office equipment, machinery, and other tangible goods used in the operation of a business. The accurate completion and timely submission of the MTA 305 form are crucial for compliance with local tax laws, avoiding potential penalties, and ensuring that property assessments are fair and reflective of actual values. By providing a detailed account of one's taxable personal property, the form facilitates a more transparent and efficient tax administration process.

| Question | Answer |

|---|---|

| Form Name | Form Mta 305 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | mta305_111_fill _in f mta 305 form |