FACT SHEET

Instructions for Completing Form MV-4ST, “Vehicle Sales and Use Tax Return/Application for Registration”

(FOR PENNDOT AUTHORIZED AGENTS USE ONLY)

This form is used to obtain a Pennsylvania Certificate of Title for vehicles currently titled in Pennsylvania.

DISTRIBUTION OF FORM COPIES

1.The white copy is always submitted to PennDOT.

2.The yellow copy is always retained by the dealer or full agent and is to be retained for at least three years. If a temporary registration card or registration plate is issued, the yellow copy becomes the dealer/agent’s record of such issuance.

3.The pink copy is always retained by the individual or business in whose name the certificate of title is to be issued.

TRANSFER OF OWNERSHIP

The applicant is the first individual(s), corporation, business, etc., to whom vehicle ownership is assigned on the attached Pennsylvania Certificate of Title. Reassignment to a second applicant is only acceptable if the attached Pennsylvania Certificate of Title assigned is a pre-1989 certificate of title.

The assignment information on the attached Pennsylvania Certificate of Title must be completed, including the odometer, lienholder, purchaser name and address, seller signature(s), purchaser signature(s), and notary public information.

FORM COMPLETION INSTRUCTIONS

SECTION A – VEHICLE PURCHASED

•PA TITLE NUMBER: List the complete title number.

•MAKE OF VEHICLE: List the full trade name of the vehicle.

EXAMPLES: |

Ford Chevrolet |

Chrysler |

|

|

DO NOT LIST MODEL NAMES SUCH AS: |

Mustang |

Cavalier |

New Yorker |

•MODEL YEAR: List the model year of the vehicle as assigned by the manufacturer. This year should agree with what is printed on the proof of ownership document.

•VEHICLE IDENTIFICATION NUMBER (VIN): List the complete VIN as shown on the VIN plate attached to the vehicle by the manufacturer. This number should agree with the VIN shown on the proof of ownership.

•CONDITION: Check the condition of the vehicle.

SECTION B – SELLER

•List the seller’s actual full last name, first name and middle name or full business name.

SECTION C & D – 1st AND 2nd PURCHASER(S)

NOTE: Form MV-4ST allows for a reassignment of ownership to a second applicant (in Section D) ONLY if the Pennsylvania Certificate of Title assigned is a pre-1989 certificate of title.

•List the applicant’s actual full last name, first name and middle name or full business name. Please DO NOT use nicknames or first and middle initials. The applicant’s name is to be listed on the certificate of title application as it appears on the valid Pennsylvania identification credential you examined.

•PA DL/ID# OR BUS ID#: List the applicant’s Pennsylvania Driver’s License or Pennsylvania Identification Card Number. If a business, list the business’s identification number (i.e., EIN number).

•DATE OF BIRTH: List the applicant’s date of birth.

•CO-PURCHASER: If two individuals are applying for joint ownership as applicants, list the second individual’s

actual last name, first name and middle name. NOTE: If there is a co-purchaser, be sure to read the "NOTE" regarding joint tenants with right of survivorship and check the block, if applicable, in Section I.

•STREET: List applicant’s full street address and P.O. Box number, Rural Delivery Route number or apartment

number, if such numbers apply. (NOTE: P.O. Box numbers may be used in addition to the actual address, but cannot be used as the only address.) The applicant’s address listed on the valid Pennsylvania identification credential must agree with the address information that is being recorded on the title application and vehicle record.

The exceptions to this address requirement are U.S. Armed Forces personnel or their dependents; an employee of federal or state government or their immediate families whose workplace is located outside of Pennsylvania; or companies that have no Pennsylvania office and use the vehicle to regularly carry on business within the commonwealth or a Park Model Trailer permanently located in Pennsylvania. If the applicant is entitled to this exception, they must complete and attach Form MV-8, “Self Certification for Proof of Residency.” In addition, they must attach a letter from their employer on their employer’s letterhead to document their out-of-state employment status or attach a copy of their photo ID issued by their employer. If they are an immediate family member of a person meeting one of the allowable exceptions, they must attach documentation for the person entitled to the exception.

•CITY: List the full city name. Please DO NOT abbreviate.

•STATE: List the official state abbreviation designated by the U.S. Postal Service. If Pennsylvania, list PA.

•ZIP: List the full, correct zip code. Please take time to verify the zip code.

•DATE ACQUIRED/PURCHASED: List the date the APPLICANT received or purchased and was assigned

ownership of the vehicle. This date should be listed numerically. EXAMPLE: mm/dd/yyyy.

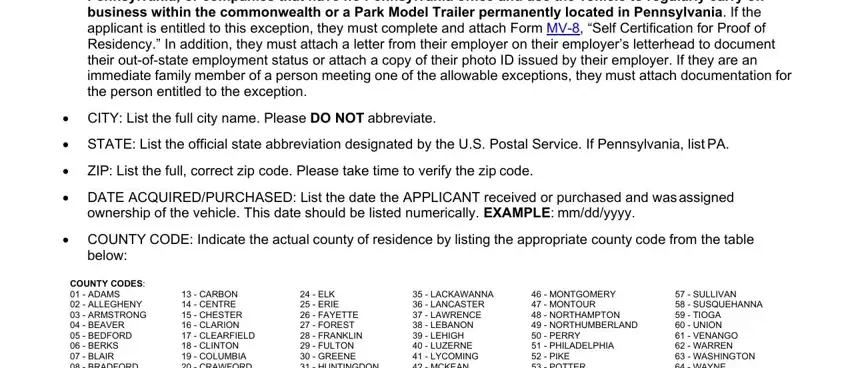

•COUNTY CODE: Indicate the actual county of residence by listing the appropriate county code from the table below:

COUNTY CODES: |

|

|

|

|

|

|

|

|

|

|

01 |

- ADAMS |

13 |

- CARBON |

24 |

- ELK |

35 |

- LACKAWANNA |

46 |

- MONTGOMERY |

57 |

- SULLIVAN |

02 |

- ALLEGHENY |

14 |

- CENTRE |

25 |

- ERIE |

36 |

- LANCASTER |

47 |

- MONTOUR |

58 |

- SUSQUEHANNA |

03 |

- ARMSTRONG |

15 |

- CHESTER |

26 |

- FAYETTE |

37 |

- LAWRENCE |

48 |

- NORTHAMPTON |

59 |

- TIOGA |

04 |

- BEAVER |

16 |

- CLARION |

27 |

- FOREST |

38 |

- LEBANON |

49 |

- NORTHUMBERLAND |

60 |

- UNION |

05 |

- BEDFORD |

17 |

- CLEARFIELD |

28 |

- FRANKLIN |

39 |

- LEHIGH |

50 |

- PERRY |

61 |

- VENANGO |

06 |

- BERKS |

18 |

- CLINTON |

29 |

- FULTON |

40 |

- LUZERNE |

51 |

- PHILADELPHIA |

62 |

- WARREN |

07 |

- BLAIR |

19 |

- COLUMBIA |

30 |

- GREENE |

41 |

- LYCOMING |

52 |

- PIKE |

63 |

- WASHINGTON |

08 |

- BRADFORD |

20 |

- CRAWFORD |

31 |

- HUNTINGDON |

42 |

- MCKEAN |

53 |

- POTTER |

64 |

- WAYNE |

09 |

- BUCKS |

21 |

- CUMBERLAND |

32 |

- INDIANA |

43 |

- MERCER |

54 |

- SCHUYLKILL |

65 |

- WESTMORELAND |

10 |

- BUTLER |

22 |

- DAUPHIN |

33 |

- JEFFERSON |

44 |

- MIFFLIN |

55 |

- SNYDER |

66 |

- WYOMING |

11 |

- CAMBRIA |

23 |

- DELAWARE |

34 |

- JUNIATA |

45 |

- MONROE |

56 |

- SOMERSET |

67 |

- YORK |

12 |

- CAMERON |

|

|

|

|

|

|

|

|

|

|

SECTION E - VEHICLE TRADED

Complete this section only if the applicant traded a vehicle for the vehicle they are acquiring, and they are applying for PA Certificate of Title.

List the make of vehicle, Vehicle Identification Number (VIN), model year and body type of the traded vehicle following the guidelines for completion of Section A.

CONDITION: Check the block which best describes the condition of the traded vehicle. NOTE: The condition of the vehicle should, within reason, correspond to the purchase assigned in Section I.

SECTION F - APPLICATION FOR REGISTRATION

•REGISTRATION PLATE INFORMATION:

-If original registration plate issuance, check block indicating either; (1) registration plate is to be issued by PennDOT, (2) exchange registration plate is to be issued by PennDOT, or (3) temporary registration plate is being issued by a full agent. NOTE: If registration plate is to be issued by PennDOT, valid proof of insurance must be attached.

-Temporary Registration Plate Number - Place the sticker for the corresponding registration plate that was issued with the temporary registration plate on the line provided for the temporary registration plate number. A temporary registration plate is valid for 90 days. NOTE: Before placing the sticker on Form MV-4ST, please be sure to “hand write” the registration plate number in the space provided. This will ensure that all three copies of Form MV-4ST have the registration plate information recorded.

Instructions for Completing Form MV-4ST - pg. 2

•TRANSFER OF A PREVIOUSLY ISSUED REGISTRATION PLATE: Check this block if the applicant istransferring a registration plate from another vehicle.

•TRANSFER AND RENEWAL OF REGISTRATION PLATE: Check this block if the applicant is transferring a registration plate from another vehicle. The applicant may be eligible to renew their motor vehicle registration for either a one-year or two-year registration period. Both registration periods and the required fees are provided on the registration renewal form or Form MV-70S, “Bureau of Motor Vehicles Schedule of Fees.” NOTE: If the fee listed in the “2-yr. fee” block on the registration renewal form is “N/A,” the vehicle type is not eligible to renew for a two-year period.

•TRANSFER AND REPLACEMENT OF REGISTRATION PLATE: Check this block if the applicant is transferringa registration plate from another vehicle and replacement of the registration plate is needed. Be sure to collect and submit replacement fee, if appropriate.

•REGISTRATION PLATE NUMBER: List registration plate number being transferred.

•EXPIRES: List month and year of expiration of registration plate as shown on the applicant’s registration card for the registration plate being transferred.

•REASON FOR REPLACEMENT: Check appropriate block for reason for replacement of registration plate. NOTE: If "NEVER RECEIVED" block is checked, applicant must submit a completed Form MV-44.

•TRANSFERRED FROM TITLE NUMBER: List title number of the vehicle from which registration plate is being transferred.

•VIN: List Vehicle Identification Number of vehicle from which registration plate is being transferred.

•SIGNATURE OF PERSON FROM WHOM REGISTRATION PLATE IS BEING TRANSFERRED (if other than applicant): If the registration plate was not taken from a vehicle registered in the applicant’s name, the signature of the person to whom the registration plate was previously registered is required.

•RELATIONSHIP TO APPLICANT: Relationship of person from whom the registration plate is being transferred must be listed. Under Section 1314(a) of the Pennsylvania Vehicle Code, a registration plate may be transferred between spouses or between parent(s) including step-parent(s) or parent(s)-in-law and their child(ren) including step- child(ren) or child(ren)-in-law. A registration plate may also be transferred: (1) to or from a vehicle leased by an individual; and (2) to or from a sole proprietorship by the sole owner of such business.

•Trailers, Trucks or Truck Tractors:

-GVWR (Gross Vehicle Weight Rating): List the Gross Vehicle Weight Rating.

-UNLADEN WEIGHT: List the weight of the vehicle fully equipped for service, excluding the weight of any load.

-REQUESTED REGISTERED GROSS WEIGHT (INCLUDING LOAD): List the registered gross weight.

•If the vehicle is a truck or truck tractor which will be operated in combination:

-REQUESTED REGISTERED GROSS COMBINATION WEIGHT: List the registered gross combination weight.

•INSURANCE INFORMATION: List the name of the applicant’s insurance company, policy number, policy effective and policy expiration dates covering this vehicle. If a policy number has not been issued, attach a copy of the insurance binder.

•ISSUING AGENT INFORMATION:

-Month, day and year of issuance of the temporary registration plate or the transfer of temporary registration must be listed. No alteration of the date will be accepted. This date certifies the date the authorized agent verified the applicant had valid proof of financial responsibility.

-Issuing Agent: Print name exactly as registered with the Bureau of Motor Vehicles.

-Agent Number: List card agent identification number, full agent identification number or Dealer/Business Partner Identification Number.

-Issuing Agent Signature: Signature of issuing agent is required.

-Telephone: List area code and business telephone number of issuing agent.

Instructions for Completing Form MV-4ST - pg. 3

NOTE: The issuing agent information must be completed even if no registration was issued. The date would be blank if no registration plate was issued or no transfer of registration was completed.

SECTION G - CERTIFICATION

•CERTIFICATION:

-When the applicant signs this section, after completion of the entire form, it certifies that all statements on this form are true and correct.

-The applicant refers to the person(s) whose name(s) appear in Section C and/or Section D.

-PURCHASER – FIRST ASSIGNMENT: Signature of first purchaser must appear on the first line in the space provided. When the vehicle is in the name of a company/corporation, the signature of an authorized representative is required. The title of the authorized signer for a business must appear on the second line. If applying for joint ownership, the co-purchaser’s signature must appear on the second line in the space provided.

-PURCHASER – SECOND ASSIGNMENT: If a second purchaser is shown in Section D, signature of the second purchaser must appear in the space provided.

SECTION H - TAX/FEES

For a complete listing of motor vehicle fees, refer to Form MV-70S, “Bureau of Motor Vehicle Schedule of Fees,” found on our website at www.dmv.pa.gov.

NOTE: The first column is for the fees owed by the purchaser listed in Section C. The second column is for the fees owed by the purchaser listed in Section D, if applicable.

•PURCHASE PRICE: List the correct purchase price. Purchase price includes any lien or other obligation assumed by the purchaser. Enter total purchase price in Section I, including installation charges on contract sales of mobile homes. If purchase price is less than 80% of the vehicle’s average fair market value, or the vehicle is over 15 years old and the purchase price is less than $500, Form MV-3, "Motor Vehicle Verification of Fair Market Value by the Issuing Agent," must be completed. If tax credit is claimed, evidence of tax paid must be attached.

•LESS TRADE-IN: List amount of trade-in, if applicable.

•TAXABLE AMOUNT: Determine the taxable amount by subtracting the trade-in amount received from the purchase price. If there was no trade-in, the purchase price is the taxable amount.

•Sales Tax:

Multiply taxable amount by 6% (.06).

Multiply taxable amount by 7% (.07), for residents of Allegheny County (additional 1 % sales tax). Multiply taxable amount by 8% (.08), for residents of the City of Philadelphia (additional 2 % sales tax).

1.SALES TAX DUE: Sales tax due is the amount shown in sales tax block unless a tax credit is listed. If sales tax credit is listed, determine sales tax due by subtracting tax credit from 6% sales tax (Allegheny County residents pay 7% sales tax and City of Philadelphia residents pay 8%) and list proper amount.

1a. If claiming a tax exemption, indicate the proper exemption reason code from the reverse side of the white copy of Form MV-4ST [numeric codes 1 through 26 or 0 (explain in detail reason code)] in block 1A.

1b. List exemption authorization number (issued by Revenue Department, ICC or PUC) in block 1B, if applicable.

2.TITLE FEE: List $58 fee.

3.LIEN FEE: List $28 fee, if recording a lien against this vehicle. NOTE: An additional $28 fee is required for each subsequent lien recorded.

4.REGISTRATION OR PROCESSING FEE: If the applicant is applying for a registration plate from PennDOT ora temporary registration plate has been issued, list appropriate registration fee or list the processing fee amount in this block. The applicant may be eligible to register their motor vehicle for either a one-year or two-year registration period. Required fees are provided on Form MV-70S, “Bureau of Motor Vehicles Schedule of Fees.”

(a)If claiming retired status, Form MV-371, “Application for a Retired Person’s $10.00 Processing Fee on a Vehicle Registration,” must be submitted.

Instructions for Completing Form MV-4ST - pg. 4

(b)If requesting a street rod registration plate, a $57 fee is required when transferring and replacing a previously issued registration plate. NOTE: If a street rod registration plate is being requested on a newly purchased vehicle, the $57 fee must accompany the vehicle’s appropriate registration fee.

(c)For organizations covered under Section 1901(c) of the Pennsylvania Vehicle Code, include a $10 processing fee. NOTE: If an applicant is eligible for a processing fee in lieu of registration, they cannot obtain a two-year registration.

FEE EXEMPT CODE: If the applicant is a PennDOT-approved organization qualifying under Section 1901(c) of the Pennsylvania Vehicle Code, list the 5-digit exemption code number assigned by PennDOT.

(d)If requesting a farm truck certificate of exemption (Type A, Type B, Type C or Type D), use Form MV-77A, “Application for Farm Vehicle 2 Year Certificate of Exemption,” in conjunction with Form MV-1 or Form MV- 4ST. For a listing of the applicable certificate of exemption fees by type, refer to Form MV-70s, “Bureau of Motor Vehicles Schedule of Fees” found on our website at www.dmv.pa.gov.

5.COUNTY FEE: The applicant’s county of residence may implement an annual fee of $5 for each non-exempt vehicle registered to an address in that county. The $5 county fee is collected by PennDOT at the time a vehicle is registered and at the time registration is renewed. This means registrants applying for a two-year period of registration will pay a $10 Fee for Local Use; registrants applying for a 5-year period of registration for a trailer will pay a $25 Fee for Local Use. For a listing of participating counties that enacted a fee for local use, refer to the Fee for Local Use – Participating Counties Fact Sheet, found on our website at www.dmv.pa.gov.

6.DUPLICATE REGISTRATION CARD FEE AND NUMBER OF CARDS: A $2 fee for each duplicate registration card is due at the time of registration, replacement of registration plate or transfer of registration plate. List appropriate fee and number of cards desired.

7.TRANSFER FEE: If the applicant is transferring a registration plate, list the transfer fee.

8.INCREASE FEE: If the applicant is transferring a registration plate from a vehicle to another vehicle in a higher class and the registration fee is greater, list the increase in fee due.

9.REPLACEMENT FEES:

a.Registration Plate: The fee for a replacement registration plate is $11. In conjunction with replacement of your registration plate, you will receive one registration card. If additional registration cards are desired, there is a $2 fee for each additional registration card. (See #6 above.)

b.Weight Class Sticker: There is no fee for a replacement weight class sticker. Along with the replacement of your weight class sticker, you will receive one registration card. If additional registration cards are desired, there is a fee for each additional registration card. (See #6 above.)

10.TOTAL PAID 1st Purchaser: Add blocks 1 thru 9 and list total amount due for column in box10.

11.TOTAL PAID 2nd Purchaser: Add blocks 1 thru 9 and list total amount due for column in box 11.

12.GRAND TOTAL: Add blocks 10 & 11. List the total amount in Block 12. Send one check or money order payable to the Commonwealth of Pennsylvania.

SECTION I – ADDITIONAL TITLE INFORMATION

•JOINT OWNERSHIP: When applying for a certificate of title with a co-purchaser other than a spouse, the information contained in the "NOTE" is important. If the block is not checked, the certificate of title will be issued as

"TENANTS IN COMMON."

-JOINT TENANTSWITH RIGHT OF SURVIVORSHIP refers to a vehicle titled to more than one person, where on the death of one owner, the vehicle goes to the surviving owner(s). This automatically applies for a spouse.

-TENANTS IN COMMON refers to a vehicle titled to more than one person, where on the death of one owner of the vehicle, the deceased owner’s interest in the vehicle will go to his or her heirs or estate.

•LEASE VEHICLE: Check block and complete Form MV-1L, if the vehicle is being leased. If the vehicle is leased and registration is to be issued and Form MV-1L is not attached, the application will be rejected.

APPLICATIONS FOR CERTIFICATE OF TITLE FOR MOBILE HOME OR MANUFACTURED HOME

When transferring ownership of a mobile home or manufactured home, additional documentation must be included.

If a mobile home or manufactured home that has been anchored to the ground to facilitate connection with electricity, water and sewerage and that has been previously titled in Pennsylvania and used as a residence in Pennsylvania

Instructions for Completing Form MV-4ST - pg. 5

immediately preceding its sale or transfer, is offered for sale or transfer, the transferor shall obtain a tax status certification from the Tax Claim Bureau of the county in which the home is situated, showing the county, municipal and school district real estate taxes due on the home as shown by the Tax Bureau records as of the date of the certification. This includes any delinquent taxes turned over to a third party for collection. This tax certification shall be provided to the transferee and PennDOT in conjunction with the transfer of ownership.

NOTE: If a new mobile home or manufactured home is being titled using the Manufacturer’s Certificate of Origin (MCO) as the proof of ownership, neither the tax status certification nor Form MV-16T is required.

The tax status certification must include the following information:

•The parcel number assigned to the home.

•The amount of current or delinquent taxes owed from the parcel number.

•The date upon which a tax for the parcel number will accrue and the taxing period that the tax will cover.

•The address and telephone numbers of the tax collection authority and tax claim bureau or equivalent office.

If taxes are due for the home, the transferor shall pay the delinquent real estate taxes in full or cause the taxes to be paid in full and an updated tax status certification must be obtained and provided to the transferee and PennDOT before the transfer is completed.

If the mobile home or manufactured home is NOT anchored to the ground to facilitate connections with electricity, water and sewerage OR was not used as a residence in Pennsylvania or isn’t titled in Pennsylvania, Form MV-16T, “Self- Certification of Exemption from Tax Status Certificate When Transferring Ownership of a Mobile Home or Manufactured Home,” must be provided in lieu of the tax status certification. Form MV-16T is to be completed by the transferors of the mobile home or manufactured home and provided to the transferee to be submitted with the completed application for a Pennsylvania Certificate of Title.

MAILING REQUIREMENTS

Please use the unique post office box number printed in the upper right corner of Form MV-4ST when mailing the application to PennDOT. Completed applications and supporting documents must be submitted to PennDOT within 20 days from date of sale. NOTE: Dealers applying for a dealer certificate of title only should mail the application and supporting documents to Bureau of Motor Vehicles, P.O. Box 67470, Harrisburg, PA 17106-7470.

Please Note: Authorized agents are under contract with PennDOT and may charge a market driven service (delivery) fee. These are in addition to any PennDOT statutory fees for temporary, or in some cases, permanent motor vehicle registration plates and cards or other related products and services offered by the agent. The agent’s service (delivery) fees are market driven and vary by agent. To compare service (delivery) fees, you are encouraged to contact the authorized agents in your area for the applicable service (delivery) fees charged.

Instructions for Completing Form MV-4ST - pg. 6