Through the online PDF editor by FormsPal, you are able to complete or edit nis application form right here and now. The tool is consistently maintained by our staff, getting awesome functions and becoming better. With a few basic steps, you can begin your PDF editing:

Step 1: Just click the "Get Form Button" in the top section of this webpage to launch our pdf editing tool. This way, you will find everything that is needed to work with your document.

Step 2: With this online PDF file editor, you're able to do more than simply complete blank form fields. Edit away and make your forms seem perfect with customized text added, or tweak the file's original content to perfection - all that accompanied by the capability to add just about any images and sign the file off.

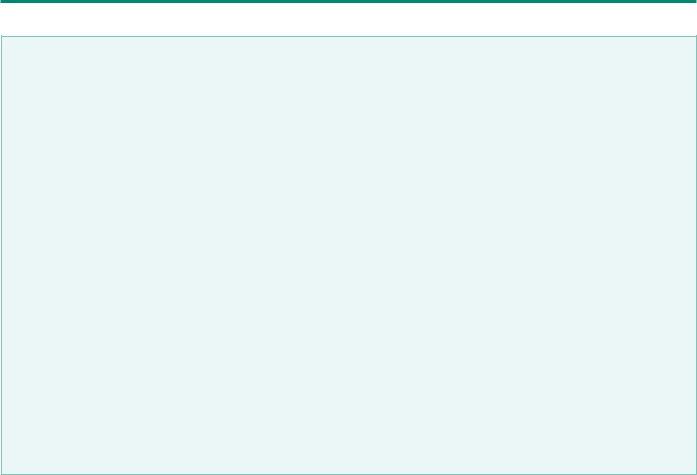

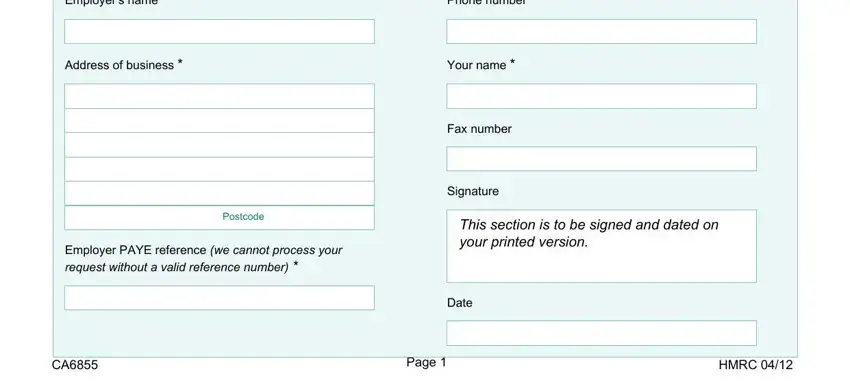

This PDF form will require specific information; to ensure accuracy, make sure you take heed of the next steps:

1. Complete the nis application form with a group of necessary blanks. Note all the information you need and make certain there is nothing overlooked!

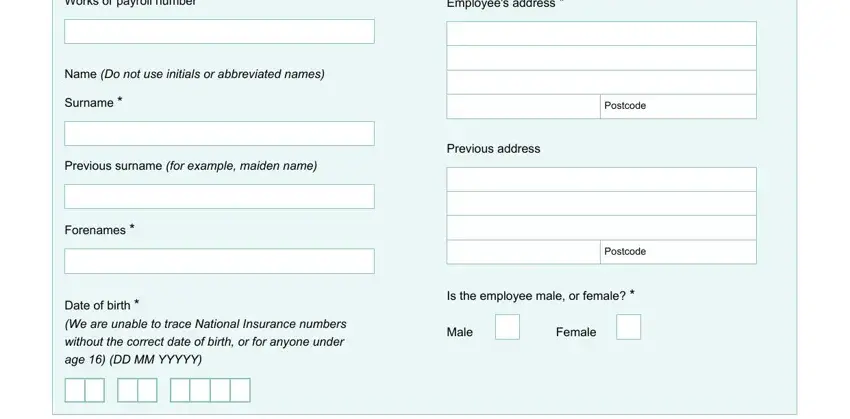

2. Once your current task is complete, take the next step – fill out all of these fields - Works or payroll number, Employees address, Name Do not use initials or, Surname, Previous surname for example, Previous address, Forenames, Postcode, Postcode, Date of birth, We are unable to trace National, without the correct date of birth, age DD MM YYYYY, Is the employee male or female, and Male with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

A lot of people generally make mistakes when filling out Works or payroll number in this area. Be certain to go over what you enter here.

Step 3: Immediately after taking another look at the fields and details, hit "Done" and you are done and dusted! Right after starting a7-day free trial account with us, it will be possible to download nis application form or send it through email immediately. The PDF will also be accessible in your personal account with your every single edit. Here at FormsPal, we do our utmost to be sure that all of your information is stored protected.