Print...

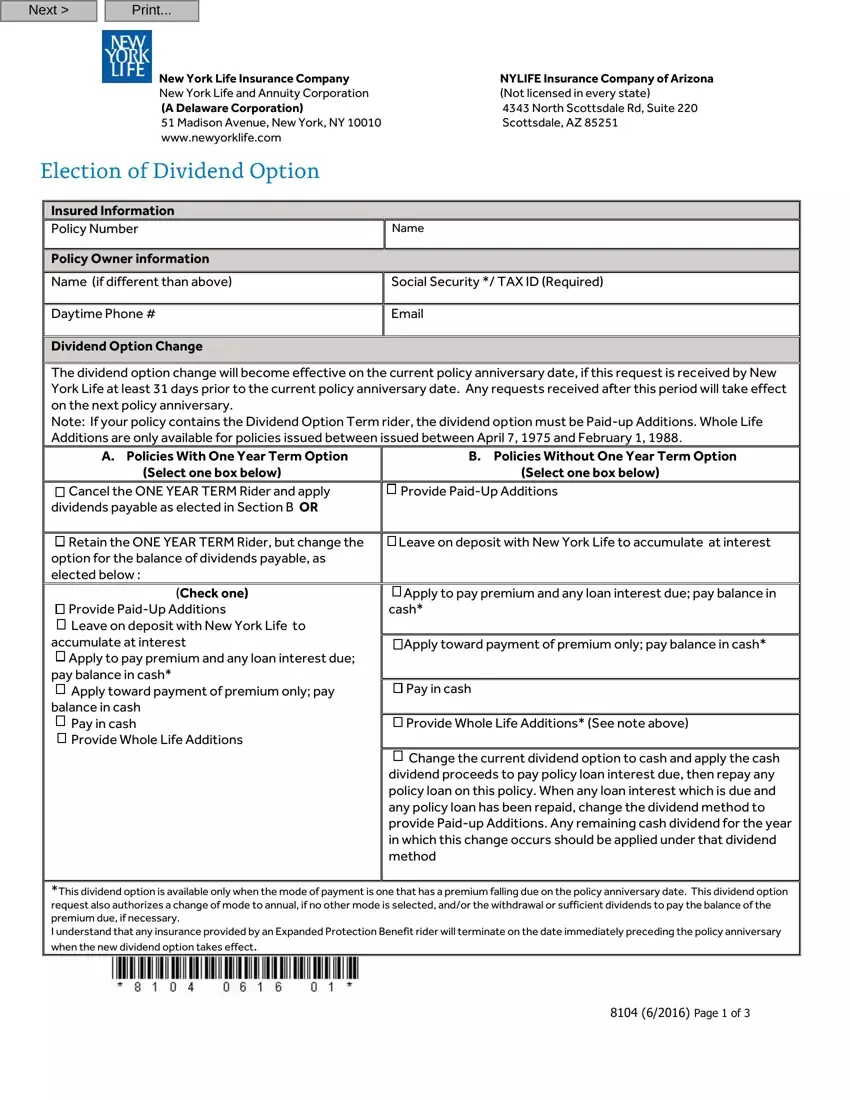

New York Life Insurance Company |

NYLIFE Insurance Company of Arizona |

New York Life and Annuity Corporation |

(Not licensed in every state) |

(A Delaware Corporation) |

4343 North Scottsdale Rd, Suite 220 |

51 Madison Avenue, New York, NY 10010 |

Scottsdale, AZ 85251 |

www.newyorklife.com |

|

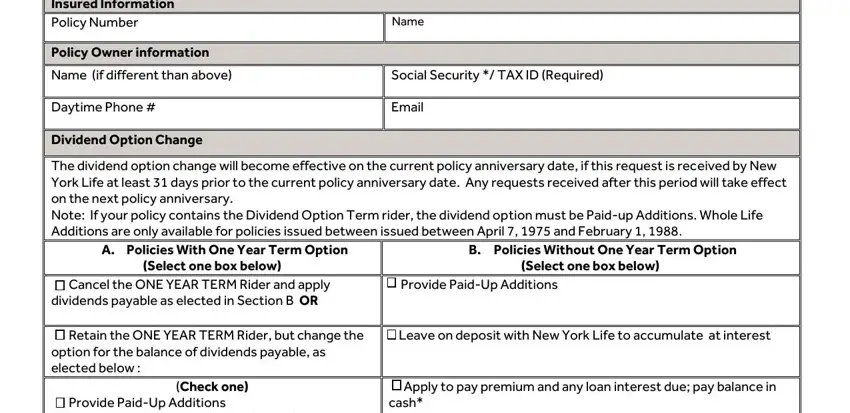

Insured Information

Insured Information

Policy Number |

Name |

|

|

Policy Owner information |

|

|

|

Name (if different than above) |

Social Security */ TAX ID (Required) |

|

|

Daytime Phone # |

Email |

|

|

Dividend Option Change

Dividend Option Change

The dividend option change will become effective on the current policy anniversary date, if this request is received by New York Life at least 31 days prior to the current policy anniversary date. Any requests received after this period will take effect on the next policy anniversary.

Note: If your policy contains the Dividend Option Term rider, the dividend option must be Paid-up Additions. Whole Life Additions are only available for policies issued between issued between April 7, 1975 and February 1, 1988.

A.Policies With One Year Term Option (Select one box below)

Cancel the ONE YEAR TERM Rider and apply dividends payable as elected in Section B OR

Cancel the ONE YEAR TERM Rider and apply dividends payable as elected in Section B OR

Retain the ONE YEAR TERM Rider, but change the option for the balance of dividends payable, as elected below :

Retain the ONE YEAR TERM Rider, but change the option for the balance of dividends payable, as elected below :

(Check one)

Provide Paid-Up Additions

Provide Paid-Up Additions

Leave on deposit with New York Life to accumulate at interest

Leave on deposit with New York Life to accumulate at interest

Apply to pay premium and any loan interest due; pay balance in cash*

Apply to pay premium and any loan interest due; pay balance in cash*

Apply toward payment of premium only; pay balance in cash

Apply toward payment of premium only; pay balance in cash

Pay in cash

Pay in cash

Provide Whole Life Additions

Provide Whole Life Additions

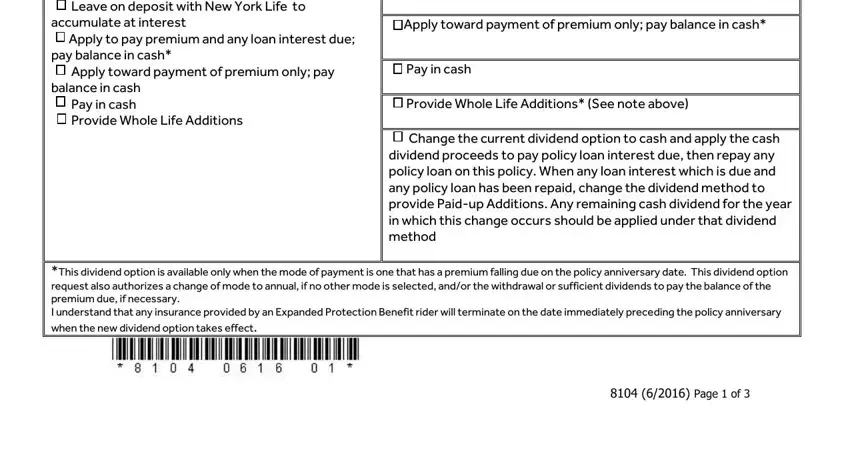

*This dividend option is available only when the mode of payment is one that has a premium falling due on the policy anniversary date. This dividend option request also authorizes a change of mode to annual, if no other mode is selected, and/or the withdrawal or sufficient dividends to pay the balance of the premium due, if necessary.

I understand that any insurance provided by an Expanded Protection Benefit rider will terminate on the date immediately preceding the policy anniversary when the new dividend option takes effect.

8104 (6/2016) Page 1 of 3

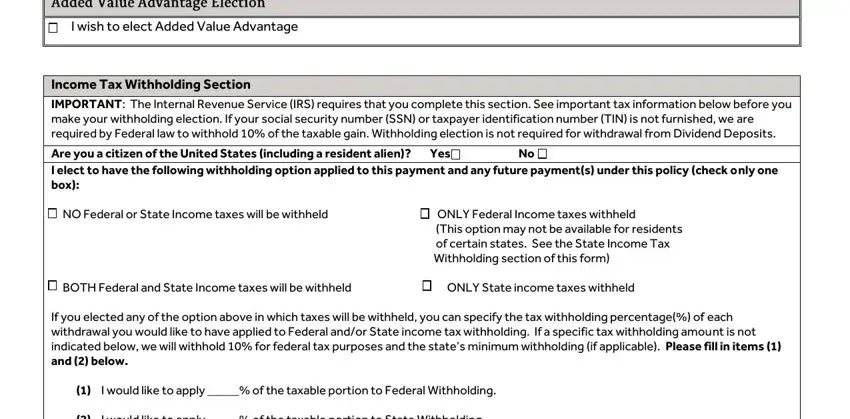

I wish to elect Added Value Advantage

Income Tax Withholding Section

Income Tax Withholding Section

IMPORTANT: The Internal Revenue Service (IRS) requires that you complete this section. See important tax information below before you make your withholding election. If your social security number (SSN) or taxpayer identification number (TIN) is not furnished, we are required by Federal law to withhold 10% of the taxable gain. Withholding election is not required for withdrawal from Dividend Deposits.

Are you a citizen of the United States (including a resident alien)? Yes |

No |

I elect to have the following withholding option applied to this payment and any future payment(s) under this policy (check only one box):

NO Federal or State Income taxes will be withheld |

ONLY Federal Income taxes withheld |

|

(This option may not be available for residents |

|

of certain states. See the State Income Tax |

|

Withholding section of this form) |

BOTH Federal and State Income taxes will be withheld

BOTH Federal and State Income taxes will be withheld

ONLY State income taxes withheld

If you elected any of the option above in which taxes will be withheld, you can specify the tax withholding percentage(%) of each withdrawal you would like to have applied to Federal and/or State income tax withholding. If a specific tax withholding amount is not indicated below, we will withhold 10% for federal tax purposes and the state’s minimum withholding (if applicable). Please fill in items (1) and (2) below.

(1)I would like to apply _____% of the taxable portion to Federal Withholding.

(2)I would like to apply _____% of the taxable portion to State Withholding.

If you elect to have Federal Income tax withheld, we are required to withhold at least 10% of the taxable portion of the distribution. If your state requires withholding, we will withhold the state’s minimum amount if you select an amount that is less than the minimum. Please see Important State Income Tax Withholding Information section.

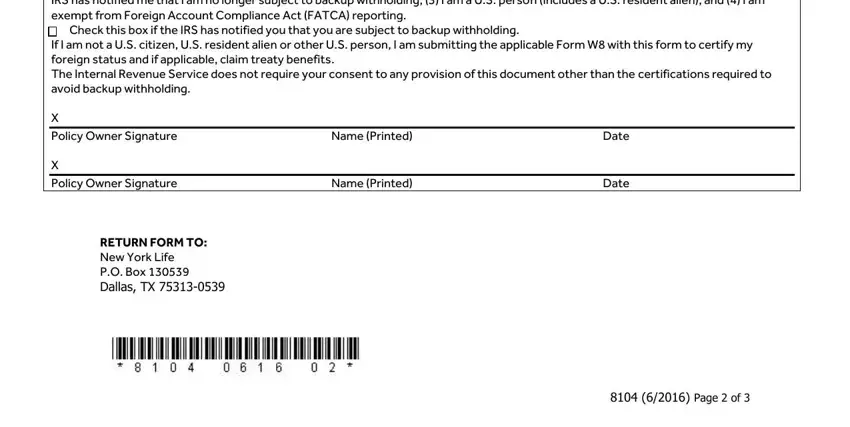

Policyowner’s Signature (REQUIRED)

Policyowner’s Signature (REQUIRED)

Under penalties of perjury, I (as owner named) certify: (1) my social security number or Tax ID number shown on this form is my correct taxpayer identification number, (2) I am not subject to back withholding because (a) I am exempt from backup withholding; or (b) I have not been notified by the IRS that I am subject to backup withholding as a result of a failure to report all interest or dividend income; or (c) the IRS has notified me that I am no longer subject to backup withholding, (3) I am a U.S. person (includes a U.S. resident alien), and (4) I am exempt from Foreign Account Compliance Act (FATCA) reporting.

Check this box if the IRS has notified you that you are subject to backup withholding.

If I am not a U.S. citizen, U.S. resident alien or other U.S. person, I am submitting the applicable Form W8 with this form to certify my foreign status and if applicable, claim treaty benefits.

The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup withholding.

X

|

Policy Owner Signature |

Name (Printed) |

Date |

|

|

X |

|

|

|

|

|

|

|

|

|

Policy Owner Signature |

Name (Printed) |

Date |

|

|

RETURN FORM TO: |

|

|

|

|

New York Life |

|

|

|

|

P.O. Box 130539 |

|

|

|

|

Dallas, TX 75313-0539 |

|

|

|

8104 (6/2016) Page 2 of 3

Important Tax Information

Important Tax Information

You should consider very carefully which box you check above. You should consult with your personal tax advisor, plan administrator, State income tax authority, or your local IRS office if you have any questions about income tax withholding. IRS publication 505 (Tax Withholding and Estimated Tax) and IRS forms W-9 and W-4P.

Federal Income Tax Withholding

Federal Income Tax Withholding

A dividend withdrawal from your policy may result in a taxable gain reportable to the IRS on Form 1099. Federal income taxes must be withheld at a flat 10% rate from the taxable portion of your payment (as determined from our records), unless you elect not to have withholding apply by checking the appropriate box in the Income Tax Withholding Election section on this form. Non-persons such as corporations, companies, trusts, etc. or U.S. citizens living outside the United States cannot elect out of withholding. (Your election as to whether taxes are or are not to be withheld will apply to any other payments from the same policy. You may change your withholding election at any time.) In addition, a 10% IRS penalty may be imposed if you receive the withdrawal prior to age 59½, unless you are disabled or some other exception applies.

Even if you elect not to have Federal income tax withheld, you are liable for payment of such tax on the taxable portion of your payment. There are penalties under the estimated tax payment rules if enough tax has not been paid through either estimated tax payments or withholding. If the taxable portion of a payment when added to the taxable portion of all other payments during the year is less than $200, Federal income tax is not required to be withheld.

State Income Tax Withholding

State Income Tax Withholding

In addition to the Federal income tax withholding requirements, some states require withholding on policy gains when federal income tax is withheld. As of January 1, 2012, the following states require state income tax withholding when federal income tax withholding is in effect: Iowa, Kansas, Maryland, Massachusetts, Nebraska, Oklahoma, and Virginia. If you live in Arkansas, California, Delaware, Georgia, Maine, North Carolina, Oregon, or Vermont we are required to withhold state income tax if federal income tax withholding is in effect, unless you elect not to have state income tax withheld. If you live in Michigan, we are required to withhold state income tax from the taxable portion of your payments, unless you provide us with a properly completed Form MI W-4P and you claim an exemption from withholding. Certain exceptions and special rules apply in some states. For more information regarding the withholding requirements applicable in your state, please consult your tax advisor or state tax authority.

If you reside in any of the following states and request state tax withholding, you must also specify the percentage of state tax withholding that you choose to apply to the taxable portion of the withdrawal: Alabama, Colorado, Connecticut, District of Columbia, Idaho, Illinois, Indiana, Kentucky, Louisiana, Minnesota, Missouri, Montana, New Jersey, New Mexico, New York, North Dakota, Ohio, South Carolina, Utah, West Virginia, and Wisconsin. In these states, if a percentage is not specified, state tax will not be

withheld.

8104 (6/2016) Page 3 of 3

Insured Information

Insured Information

Dividend Option Change

Dividend Option Change Cancel the ONE YEAR TERM Rider and apply dividends payable as elected in Section B

Cancel the ONE YEAR TERM Rider and apply dividends payable as elected in Section B  Retain the ONE YEAR TERM Rider, but change the option for the balance of dividends payable, as elected below :

Retain the ONE YEAR TERM Rider, but change the option for the balance of dividends payable, as elected below :

Provide

Provide  Leave on deposit with New York Life to accumulate at interest

Leave on deposit with New York Life to accumulate at interest

Apply to pay premium and any loan interest due; pay balance in cash*

Apply to pay premium and any loan interest due; pay balance in cash* Apply toward payment of premium only; pay balance in cash

Apply toward payment of premium only; pay balance in cash

Pay in cash

Pay in cash

Provide Whole Life Additions

Provide Whole Life Additions

Provide

Provide

Leave on deposit with New York Life to accumulate at interest

Leave on deposit with New York Life to accumulate at interest Apply to pay premium and any loan interest due; pay balance in cash*

Apply to pay premium and any loan interest due; pay balance in cash*

Apply toward payment of premium only; pay balance in cash*

Apply toward payment of premium only; pay balance in cash*

Pay in cash

Pay in cash

Provide Whole Life Additions* (See note above)

Provide Whole Life Additions* (See note above) Change the current dividend option to cash and apply the cash dividend proceeds to pay policy loan interest due, then repay any policy loan on this policy. When any loan interest which is due and any policy loan has been repaid, change the dividend method to provide

Change the current dividend option to cash and apply the cash dividend proceeds to pay policy loan interest due, then repay any policy loan on this policy. When any loan interest which is due and any policy loan has been repaid, change the dividend method to provide

Income Tax Withholding Section

Income Tax Withholding Section

BOTH Federal and State Income taxes will be withheld

BOTH Federal and State Income taxes will be withheld Policyowner’s Signature (REQUIRED

Policyowner’s Signature (REQUIRED

Federal Income Tax Withholding

Federal Income Tax Withholding State Income Tax Withholding

State Income Tax Withholding