nj l 9 can be filled out online very easily. Just open FormsPal PDF editor to complete the task right away. To have our tool on the cutting edge of efficiency, we aim to put into operation user-oriented features and improvements on a regular basis. We are always grateful for any feedback - join us in reshaping how we work with PDF documents. If you are looking to get going, this is what it takes:

Step 1: Hit the orange "Get Form" button above. It is going to open up our tool so that you could begin completing your form.

Step 2: This editor will give you the capability to modify the majority of PDF documents in many different ways. Improve it by writing your own text, adjust existing content, and put in a signature - all within several clicks!

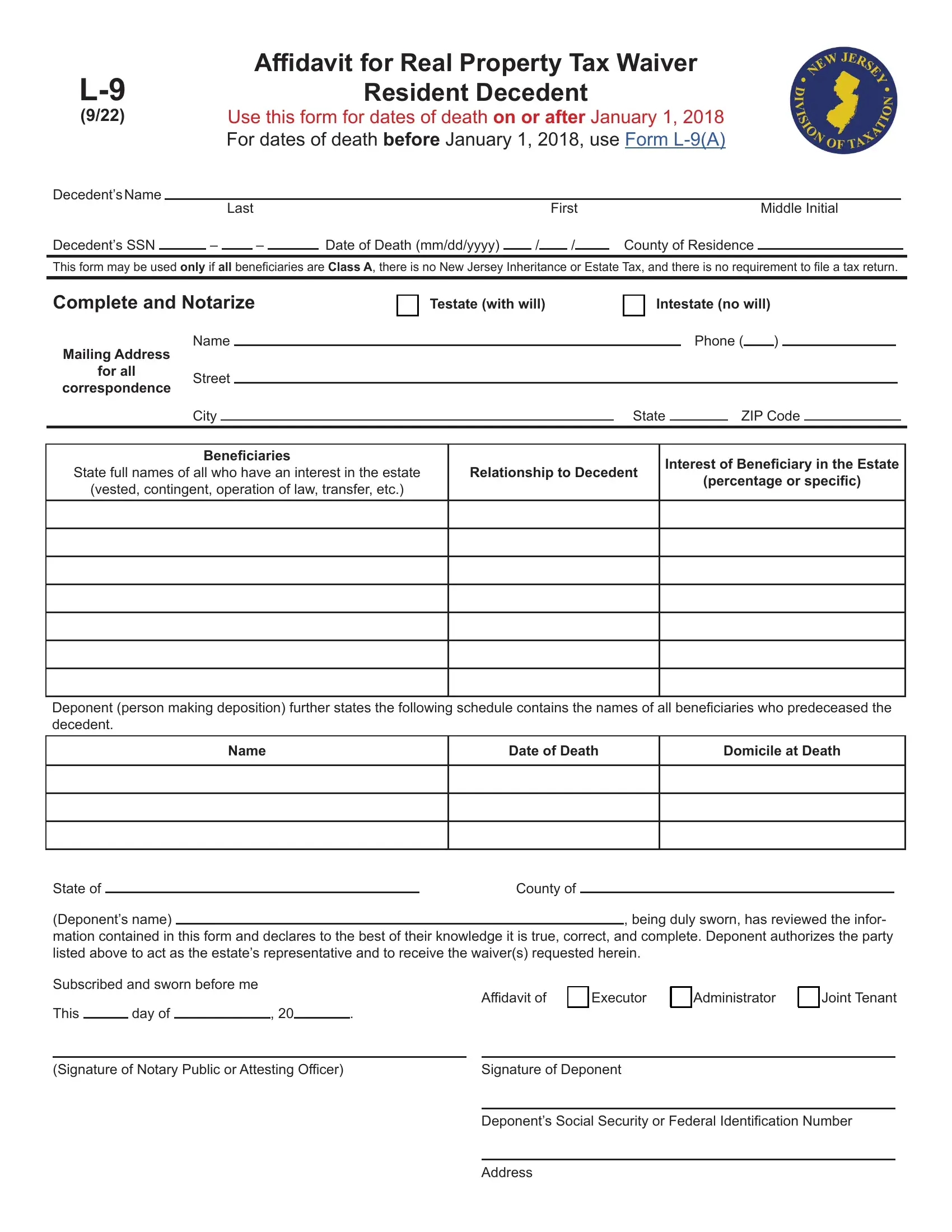

This PDF form will require some specific details; in order to guarantee correctness, don't hesitate to bear in mind the recommendations hereunder:

1. Complete your nj l 9 with a number of major blanks. Consider all the required information and be sure not a single thing forgotten!

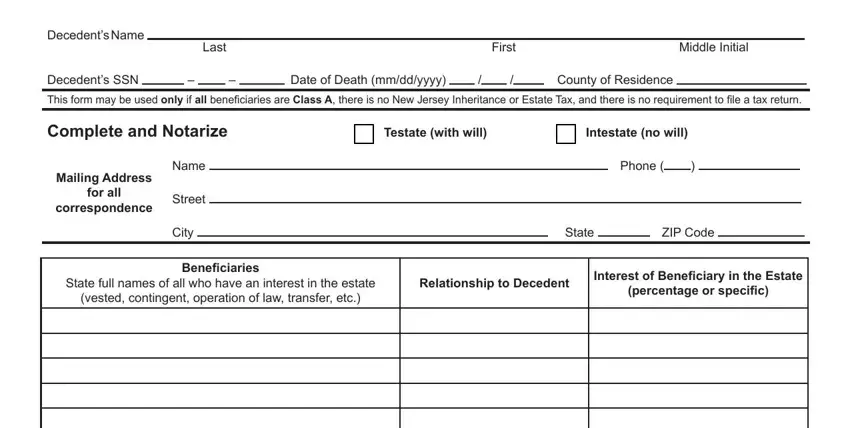

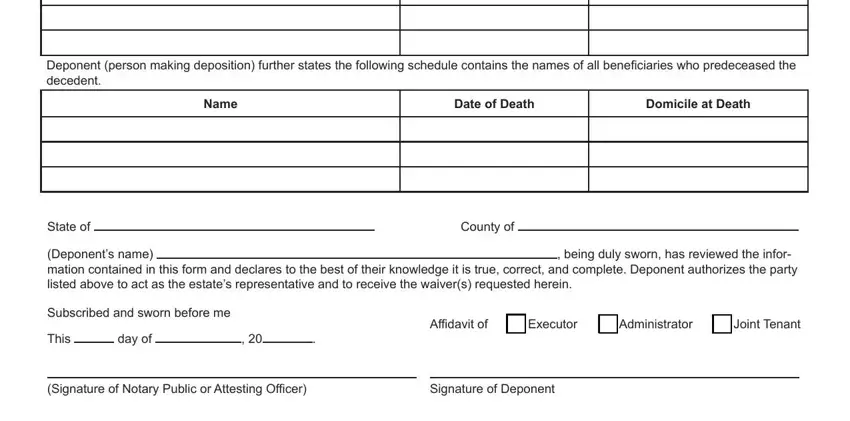

2. Right after filling in the previous part, head on to the next part and fill out the essential details in all these blanks - Deponent person making deposition, Name, Date of Death, Domicile at Death, State of, County of, Deponents name mation contained in, being duly sworn has reviewed the, Subscribed and sworn before me, This, day of, Affidavit of, Executor, Administrator, and Joint Tenant.

3. Within this part, examine Deponents Social Security or, and Address. Each one of these have to be filled out with highest accuracy.

It is possible to make an error while filling out the Deponents Social Security or, for that reason make sure that you take another look before you'll send it in.

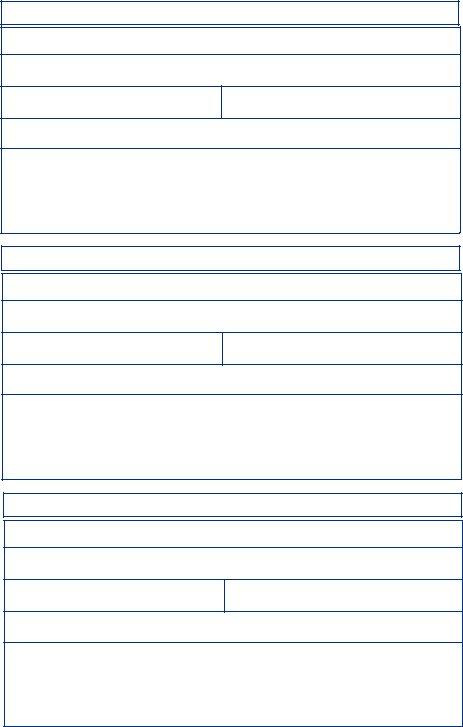

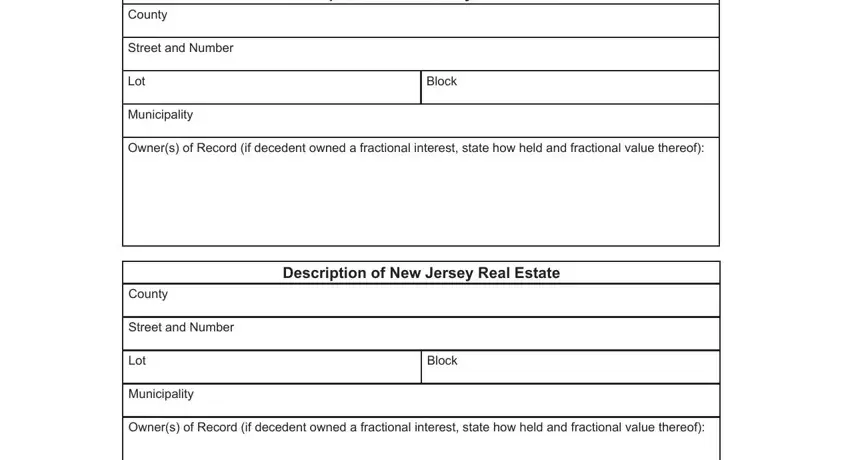

4. The subsequent part will require your details in the following places: Description of New Jersey Real, Block, County, Street and Number, Lot, Municipality, Owners of Record if decedent owned, Description of New Jersey Real, Block, County, Street and Number, Lot, Municipality, and Owners of Record if decedent owned. Just be sure you type in all of the needed details to go further.

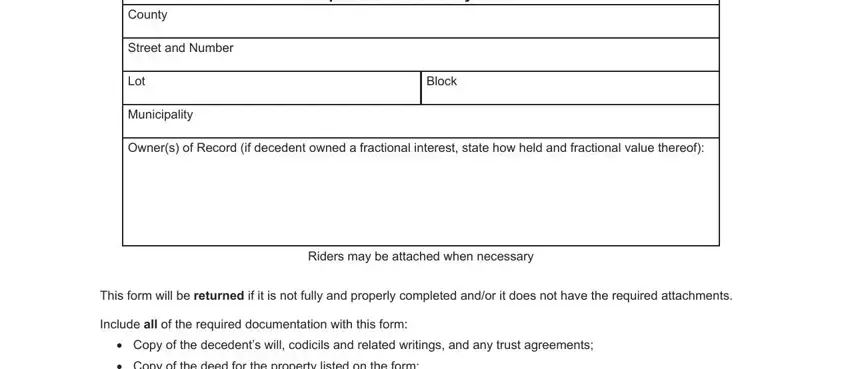

5. The pdf needs to be finished with this particular section. Below there can be found a detailed set of form fields that have to be completed with appropriate details to allow your document usage to be accomplished: Description of New Jersey Real, Block, County, Street and Number, Lot, Municipality, Owners of Record if decedent owned, Riders may be attached when, This form will be returned if it, Include all of the required, and Copy of the decedents will.

Step 3: Just after going through the filled out blanks, hit "Done" and you're all set! Create a 7-day free trial option with us and gain instant access to nj l 9 - with all adjustments saved and available inside your FormsPal cabinet. FormsPal ensures your information privacy via a protected method that in no way records or shares any type of private information provided. Be confident knowing your docs are kept safe whenever you work with our services!