Are you looking for a fixed-term investment opportunity? If so, consider applying for an Investec Bond. Investec is one of South Africa's leading asset management companies, offering competitive interest rates on bonds and other investments. A bond can provide financial security during uncertain times, making it a wise choice for both short-term and long-term investing goals. In this blog post, we will discuss the steps involved in completing an Investec Bond application form and share some tips to ensure your application goes through without any hitches!

| Question | Answer |

|---|---|

| Form Name | Investec Bond Application Form |

| Form Length | 11 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min 45 sec |

| Other names | investec iselect bond, Investec, Grayston, investec home loan |

InvestecBond

Application form

Please print clearly in block letters

Please fax this application form (pages 1 - 9), the required documentation and the proof of deposit to 0861 500 300 or + 27 11 263 6061 (international fax no.). Alternatively fi nancial advisors can upload this instruction via our secure website at https://www.secure.sso.za.investec.com

No instruction will be processed unless all pages of the form and all required documentation have been completed and received by Investec Investment Management Services (Pty) Ltd (IMS).

This application form and the terms contained in the IMS Combined Terms Document will form the agreement between the investor and IMS. The contents of the IMS Combined Terms Document may be changed from time to time, and it is the responsibility of the investor to consult the most updated IMS Combined Terms Document, to determine the terms applicable to the relationship between the investor and IMS, and the terms relevant to IMS products. This document can be viewed on www.investecassetmanagement.com, alternatively a copy is available from your FSP or IMS.

For a copy of the fund’s Minimum Disclosure Document, please contact the relevant investment fund manager.

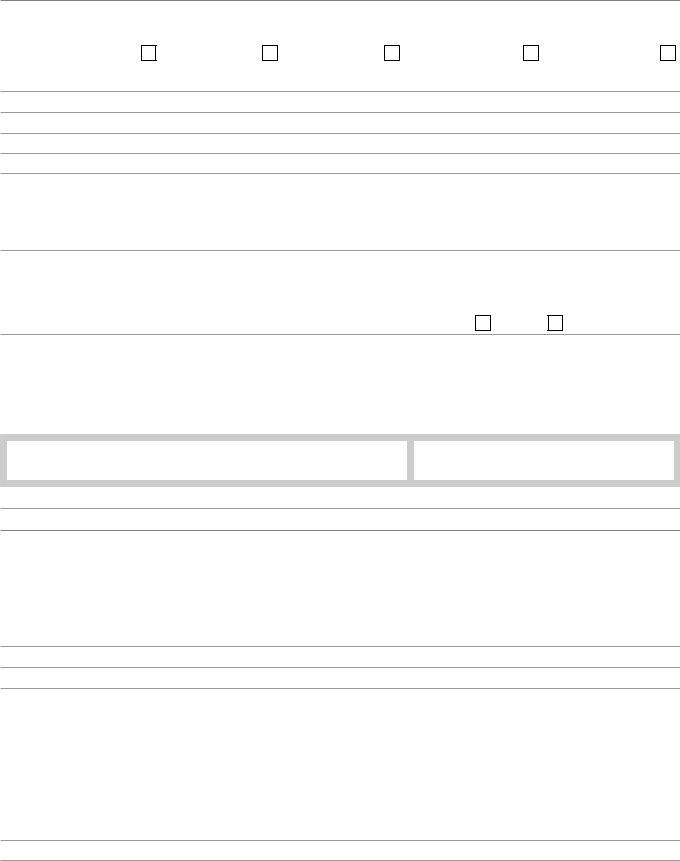

A. Investor details

Investor type |

Individual |

|

|

Legal entity:- |

|

Title |

|

|

or

Close Corporation |

Unlisted Company |

Surname/corporate/entity name

Listed Company

Trust

Unincorporated entity

Name(s) of investor/authorised contact person

Residential address (principal place of business)

|

|

Code |

Country |

|

|

|

|

Postal address |

|

|

|

|

|

|

|

|

|

Code |

Country |

|

|

|

|

Tel (home) (country code) ( |

) |

Tel (work) (country code) ( |

) |

|

|

|

|

Fax (country code) ( |

) |

Tel (cell) (country code) ( |

) |

|

|

|

|

|

|

|

Preferred method of communication email

post

Please note: If no preference is selected and an email address is provided, the default method of communication will be email.

Method of identification: |

|

Identity document |

ID no. /registration no./ passport no.

Passport

Founding document

Country of issue (passport) |

|

Date of expiry (passport) |

DD |

/ MM |

/ YYYY |

Date of birth |

DD / MM / YYYY |

Place of birth |

|

|

|

Nationality |

|

Married in community of property |

Yes |

No |

N/a |

Occupation/nature of business activities (if an entity)

Are you an existing IMS investor Yes |

|

No |

|

|

N/a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If yes, existing investment no. |

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

– |

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B. Tax details of the investor

Registered South African taxpayer Yes

No

Tax no.

Dividend withholding tax

Do you qualify for dividends tax exemption in terms of section 64F of the Income Tax Act Yes

No

If yes, please complete the “Dividends Tax Declaration and undertaking for exemption” available on www.investecassetmanagement.com . Failure to do so will result in dividends tax being withheld/payable.

Interest withholding tax for

If you are a

Tax Act Yes

No

If yes, please complete the “Interest Withholding Tax Declaration for

FATCA1

Tax Regulations2 require us to collect information about each investor’s tax residency. In certain circumstances (including if we do not receive a valid

(03/2015 InvBond) 1/10

Individual

If you are not resident in any country(ies) for tax purposes, please tick this box

or

Please indicate all countries in which you are resident for tax purposes and the associated tax reference numbers in the table below.

Country / countries of tax residency (including South Africa) |

Tax reference no. (for US citizen / resident TIN3) |

|

|

|

|

|

|

Legal entity

For all legal entities, a legal entity

Should you be a Passive

Please note: Should your tax details change please notify IMS.

1The term “FATCA” refers to The Foreign Account Tax Compliance provisions contained in the US HIRE Act 2010.

2The term “tax regulations” refers to regulations created to enable automatic exchange of information and include FATCA1, and the OECD Common Reporting Standard for Automatic Exchange of Financial Account Information.

3 The term “TIN” refers to the US Tax Identifi cation No.

C. Bank details of the investor

Please supply proof of bank details (a cancelled cheque or bank statement)

Name of bank |

|

|

Branch country |

|

|

|

|

|

|

|

|

Branch name |

|

|

Branch code |

|

|

|

|

|

|

|

|

Name of account holder(s) |

|

|

|

|

|

|

|

|

|

|

|

Account no. |

|

|

Type of account |

Current |

Savings |

|

|

|

|

||

Universal branch codes will be used for the following banks: |

|

|

|

||

ABSA |

632005 |

Nedbank |

198765 |

Capitec |

470010 |

Standard |

51001 |

First National Bank |

250655 |

Investec |

580105 |

D. Parent / legal guardian acting on behalf of a minor (if applicable)

Title |

Surname |

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

Residential address |

|

|

|

|

|

|

|

|

|

Code |

Country |

|

|

|

|

Contact no. (country code) ( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ID no. / passport no. |

Relationship to investor |

|

|

|

|

|

|

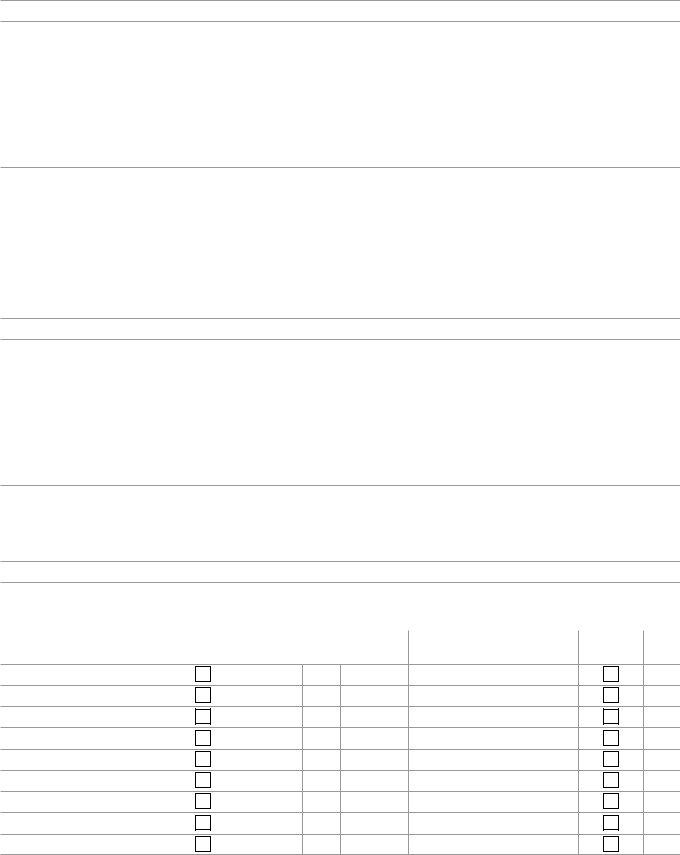

E. Investment details

|

|

|

|

Tick relevant options |

|

|

|

|

|

|

|

Product platform |

|

|

|

Sections to be completed and notes |

|

|

iSelect |

|

|

Should neither platform be selected the default, |

|

|

|

|

|||

|

|

|

|||

|

FundSelect/FundChoice |

|

|

iSelect will be applied |

|

|

|

|

|||

|

|

|

|

||

|

|

|

|

|

|

Investment type |

Lump sum |

Electronic funds |

|

|

Section E, E1, E2, E3 - attach proof of deposit |

|

|

||||

|

|

|

|

||

|

|

|

|

||

|

|

transfer |

|

|

|

|

|

|

|

Section E, E1, E2, E3 and F - Please note this amount is restricted to |

|

|

|

|

|

||

|

|

|

|

|

R500 000 and the bank details in Section C will be debited |

|

|

|

|

|

|

|

Recurring investments (debit order) |

|

|

Section G |

|

|

|

|

|||

|

|

|

|||

|

Transfer |

Unit transfer |

|

|

Section H (a) and H (d) |

|

|

|

|||

|

|

|

|

||

|

|

|

|

||

|

|

Cash transfer |

|

|

Section H (b) and H (d) |

|

|

|

|

||

|

|

|

|

||

|

|

Share portfolio |

|

|

Section H (c) and H (d) |

|

|

|

|

||

|

|

|

|

||

|

|

transfer |

|

|

|

|

|

|

|

|

|

Deals (for multiple sources) |

Combine into a single deal |

|

|

|

|

|

|

|

|||

|

|

|

Should no selection be made, a new deal will be created |

||

|

Separate deals |

|

|

||

|

|

|

|

||

|

|

|

|

|

|

2/10 (03/2015 InvBond)

1.Please refer to the IMS Combined Terms Document for minimum investment amounts and debit order terms.

2.The investor is required to hold a minimum of 3% (in addition to the amount required to provide an income) in investment instruments (section E1). A maximum of 97% of the total investment amount may be invested in a share portfolio (Section E2).

3.Where the investor requires an income withdrawal from the investment, the amount will be withdrawn from the investment portfolio (E1) portion of the investment. The investor must ensure that a suffi cient percentage of the total investment is invested in investment instruments to provide for the income withdrawal.

Bank details for InvestecBond

IMS does not accept cash deposits.

Please state either South African ID no./passport no., company or trust registration no. as per the application form, to reference your deposit.

Name of account |

Grayston Nominees (Pty) Ltd Investec Investor Bond |

||

Name of Bank |

Standard Bank |

|

|

Branch |

Killarney |

Branch code |

007205 |

Account no. |

001668609 |

ReferenceID no./registration no. (if applicable) |

|

|

|

|

|

E1. Source of funds for investment (where the funds for investment are coming from):

Salary |

|

Investment proceeds |

|

Property sale |

||

|

|

|

|

|

|

|

Other income source |

|

(please specify) |

|

|||

|

|

|||||

Inheritance

Business profi ts

E2. Lump sum

Investment type

Electronic funds transfer

Investment portfolio

Share portfolio

Total

R

R

%

%

100 %

E3. Investment portfolio details (lump sum - not applicable to transfers from other MANCOS or LISPS and debit orders)

Investment instruments |

*FundSelect |

% of Investment |

||

(excluding share portfolios) |

(tick) |

amount |

||

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

100% |

|

|

|

|

|

|

*Investors without fi nancial advisors or invested through the iSelect product platform may not select FundSelect in the tick boxes above.

Please note: If the investor is investing into the iSelect or FundSelect/FundChoice product, then the investor will be placed in the default class applicable to the associated fi nancial advisor.

|

No |

Please tick here if the fi rst

Please tick here if the fi rst

Number of monthly occurrences thereafter |

|

|

months |

or

1.If the investor wishes to invest a portion of the above investment into a Capital Gains Tax (CGT) expense account, the Money Market Expense Account instrument must be included in the portfolio details above, failing which annual fees and charges will be recovered by redeeming units proportionately from the investment instruments.

2.The minimum

3.No

4.Please indicate if the nominated instrument is a FundSelect instrument, failing which the

(03/2015 InvBond) 3/10

E4. Share portfolio |

|

|

Name of stockbroker |

|

Name of share portfolio |

|

|

|

Mandate type |

Discretionary (stockbroker managed) |

|

|

|

|

1.Please ensure that the relevant stockbroker addendum is completed.

2.*Where the share portfolio is IFA managed the IFA must enter into an agreement with IMS. IMS cannot process this instruction unless the agreement with the IFA has been signed.

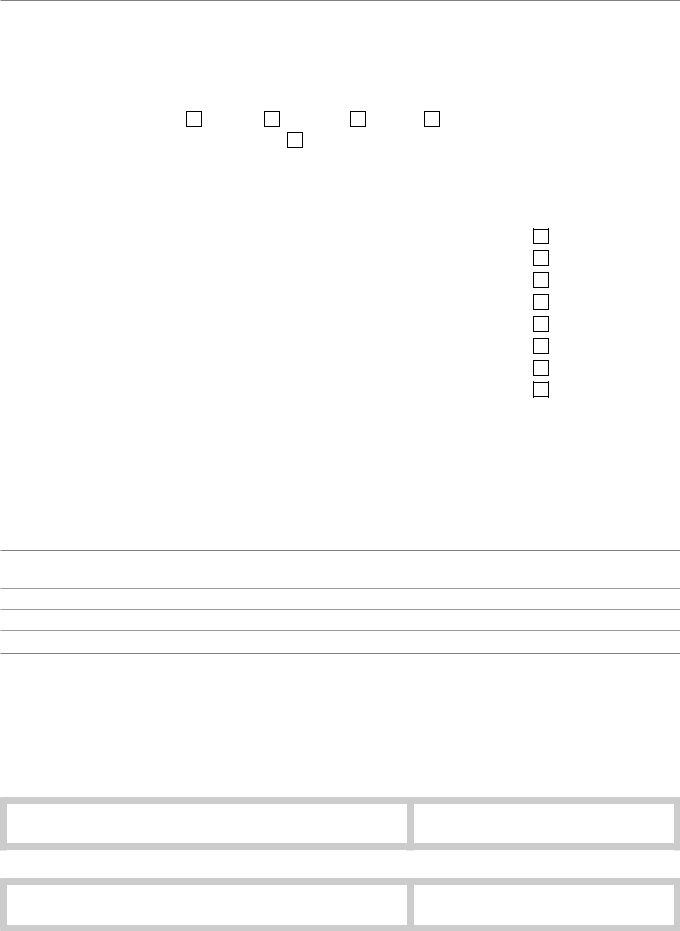

F.

I/We, the undersigned, request IMS to draw against my/our bank account in any manner agreed on between IMS and my/our bank the amount necessary for payment of the amount indicated in Section E above.

Please note: This instruction is only possible providing the following criteria are met:

–The date the account is to be debited is a business day and all requirements have been met. The investor’s account will be debited within two business days.

–This instruction form may only be signed by the investor who must also be the account holder.

–In the event that the investor is not a natural person, a resolution from the legal entity (trust, company, close corporation or partnership) giving the signatory(ies) authority to sign on behalf of the legal entity, may be required. IMS shall not be liable or responsible, for any reason, in the event that the signatory(ies) is/are not duly authorised and the signatory(ies) indemnifi es IMS against any and all damages and/or loss arising from such event.

Signature of bank account holder

Date DD / MM / YYYY

G. Recurring investments (debit order)

Bank debit order authority Investor

Third party

I hereby request, instruct and authorise IMS or its assignees to draw against my account with the bank noted in section B (or any other bank or

branch to which I may transfer my account), the sum of R |

(amount in words) |

|

|

|

being my contribution commencing on (date) 01 / MM / YYYY |

Thereafter IMS or its assignees will endeavour to draw the amount on the 1st business day of each month in which such instalment becomes payable. I understand that all such withdrawals from my bank account shall be treated as though they had been signed by me personally.

Monthly |

Quarterly |

|

Escalation date DD |

/ MM / YYYY |

Escalation |

Annually

% per annum

Debit order fund selection

Investment instruments |

*FundSelect |

% of debit |

||

|

(tick) |

order amount |

||

|

|

|

|

|

%

%

%

%

%

%

%

%

*Investors without fi nancial advisors or invested through the iSelect product platform may not select FundSelect in the tick boxes above.

Please note: If the investor is investing into the iSelect or FundSelect/FundChoice product, then the investor will be placed in the default class applicable to the associated fi nancial advisor.

4/10 (03/2015 InvBond)

Third party details

Personal details for FICA purposes

Investor type |

Individual |

Close Corporation

Unlisted Company

Listed Company Trust

Unincorporated entity

TitleSurname/corporate/entity name

Name(s) of authorised contact person

Residential address (principal place of business)

CodeCountry

ID no. / passport no.

Please note: FICA declaration signed by the advisor is only applicable to the investor and not to the third party. Please provide the required FICA documentation.

Third party bank account details

Please supply proof of bank details (a cancelled cheque or bank statement)

Name of bank |

Branch country |

|

|

|

|

Branch name |

Branch code |

|

|

|

|

Name of account holder(s) |

|

|

|

|

|

Account no. |

Type of account Current |

Savings |

–I agree to pay any bank charges and costs relating to the debit order authority.

–I acknowledge that I may cancel this authority by giving IMS not less than 30 calendar days’ written notice.

–I agree that receipt of this instruction by IMS shall be regarded as receipt thereof by my bank.

–I agree that if IMS receives any of the information or required documentation relevant to this application after the monthly

Authorised signature of third party bank account holder

Date DD / MM / YYYY

Initial and surname of signatory

H. Transfer of units, cash or share portfolios

1.This instruction must be used where the investor holds existing unit trusts with another management company (MANCO) or Linked Investment Service Provider (LISP) and would like to transfer to the InvestecBond.

2.Either a unit, cash or share transfer may be done per application form submitted. Please complete the relevant section a), b) or c) below.

3.Please attach a statement from the MANCO/LISP or stockbroker not older than one month.

4.Please state the names of the transferring company(s) in the space provided below.

5.Fees:

5.1No initial fees will apply to any of the below transfers.

5.2Consequently no initial fees will be paid to your Financial Services Provider (FSP), unless a FSP fee is indicated in the Financial Services Provider appointment section.

a) Unit transfers

I/We hereby authorise the abovementioned unit trust manager(s) and/or LISP to transfer the specific units from my/our accounts detailed below into the InvestecBond.

Name of MANCO/LISP

Investment instrument name

Account no. |

Number of units |

|

|

Name of MANCO/LISP |

|

|

|

Investment instrument name |

|

|

|

Account no. |

Number of units |

|

|

(03/2015 InvBond) 5/10

Name of MANCO/LISP

Investment instrument name

Account no. |

Number of units |

|

|

Name of MANCO/LISP |

|

|

|

Investment instrument name |

|

|

|

Account no. |

Number of units |

|

|

Name of MANCO/LISP |

|

|

|

Investment instrument name |

|

|

|

Account no. |

Number of units |

b) Cash transfers (if allowed by Transferring Companies)

I/We hereby authorise the abovementioned unit trust manager(s) and/or LISP to convert the specific units/funds from my/our accounts detailed below to cash and transfer the proceeds to the following bank account:

Name of account: |

Grayston Nominees (Pty) Ltd Investec Investor Bond |

Name of Bank: |

Standard Bank |

Branch: |

Killarney |

Branch code: |

007205 |

Account no: |

001668609 |

Name of MANCO/LISP

Investment instrument name

Account no. |

Amount R |

|

|

Name of MANCO/LISP |

|

|

|

Investment instrument name |

|

|

|

Account no. |

Amount R |

|

|

Name of MANCO/LISP |

|

|

|

Investment instrument name |

|

|

|

Account no. |

Amount R |

c) Share portfolio transfers

I/We hereby confirm that I/we have instructed the transferring stockbroker to transfer my/our share portfolio to the transferee stockbroker.

Name of transferring stockbroker

Account no.

d)Investment portfolio after completion of the transfer to IMS Investments to be switched

Source (From) |

*FundSelect |

|

Amounts |

|

Fund/share portfolio name(s) |

(tick) |

Rands |

% |

Units |

|

|

|

|

|

Destination (To) Fund/share portfolio name(s)

*FundSelect

(tick)

%

*Investors without fi nancial advisors or invested through the iSelect product platform may not select FundSelect in the tick boxes above.

Please note: – If the investor is investing into the iSelect or FundSelect/FundChoice product, then the investor will be placed in the default class applicable to the associated fi nancial advisor.

– The destination fund selection above must be aligned to the product platform

6/10 (03/2015 InvBond)

I. Income withdrawals

Total withdrawal amount |

R |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you have selected separate deals in section D please stipulate source deal for income: |

|

|

||||||||||||

Lump sum |

R |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||||

Transfer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Frequency |

Monthly |

|

Quarterly |

Annually |

|

|

||||||||

Income source |

Proportionate across all funds |

Nominated |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|||||||||

Annual escalation |

|

|

|

|

|

% (if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Nominated instruments (only applicable if “Nominated” is selected above) |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment instruments |

|

|

|

|

|

|

|

|

|

|

*FundSelect |

% |

||

(excluding share portfolios) |

|

|

|

|

|

|

|

|

|

|

(tick) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

100% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Investors without fi nancial advisors or invested through the iSelect product platform may not select FundSelect in the tick boxes above.

1.Regular withdrawals cannot be made from a debit order investment or from the share portfolio portion of the investment.

2.Please indicate if the nominated instrument is a FundSelect instrument, failing which the

3.If a proportionate withdrawal has been selected above, withdrawals will be generated by redeeming instruments proportionately across the investor’s entire portfolio. If the investor has selected withdrawals from a nominated source above, withdrawals will be generated by redeeming the nominated instruments only. If one of the nominated instruments has insuffi cient value, IMS will draw the total withdrawal amount proportionately from the remaining nominated instrument(s). If there is insuffi cient value in all of the nominated instrument(s), IMS will automatically revert to drawing the amount proportionately from all available instruments, until further funds become available in the nominated instruments.

J. Special instructions

K. Declaration by investor

I/We have read, understand and agree to be bound by the provisions of this application form as well as the terms contained in the latest version of the IMS Combined Terms Document.

I/We warrant that the information contained herein is true and complete, and that, if this application form is signed in a representative capacity, I/ we have the necessary authority and capacity to do so and that this transaction is within my/our powers.

I/We consent to IMS processing my/our personal information as described in the IMS Combined Terms Document. I/We further confi rm that the information provided by me/us is true and correct and undertake to notify IMS should any of the information change.

Signature of investor

Date DD / MM / YYYY

Signature of authorised signatory / guardian of investor

Date DD / MM / YYYY

Name of authorised signatory |

Capacity of authorised signatory |

|

|

Please note: Should you not wish to receive any marketing information you may

(03/2015 InvBond) 7/10

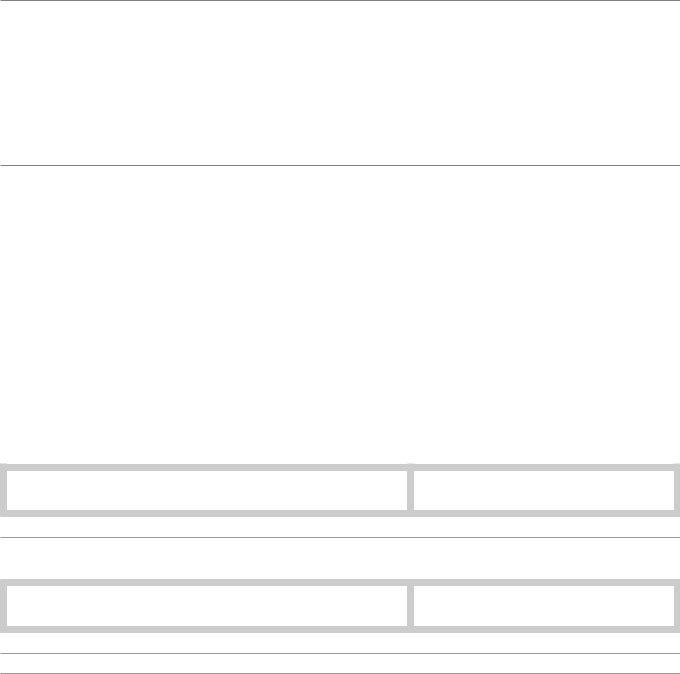

L. Financial Services Provider appointment

To be completed by the investor |

|

|

1. I/We appoint |

as my/our fi nancial advisor(s) as |

|

|

|

|

|

the authorised representative of |

|

|

|

|

|

[Financial Services Provider (FSP)]; FSP no. |

. |

|

|

|

2.In the case where my/our FSP is an approved investment manager/discretionary fi nancial services provider, I/we agree and understand that he/she may give IMS investment instructions directly, and I/we herewith authorise IMS to adhere to this fi nancial advisor’s instructions on my/ our behalf.

M. Financial advisor fee

Fee type |

|

Percentage |

|

|

(excluding VAT) |

|

|

|

Initial fees |

|

|

|

|

|

Initial lump sum fee in respect of FundChoice, iSelect and FundSelect funds |

% |

|

|

|

|

Initial debit order fee in respect of FundChoice, iSelect and FundSelect funds |

% |

|

|

|

|

Initial fee in respect of transfer indicated in Section G |

% |

|

|

|

|

Annual fees |

|

|

|

|

|

Annual fee for FundChoice and iSelect funds (annual fees in respect of FundSelect instruments are set out in the IMS |

% |

|

Combined Terms Document) |

|

|

|

|

|

Annual fee in respect of the share portfolio |

% |

|

|

|

|

Please note: – Should a fee percentage not be indicated above, the fee will default to zero.

–Only fees applicable to this application form and corresponding to the relevant completed section should be indicated in the table above.

Signature of investor

Date DD / MM / YYYY

Name of investor

Signature of authorised signatory / guardian of investor

Date DD / MM / YYYY

Name of authorised signatory

Capacity of authorised signatory

8/10 (03/2015 InvBond)

N. Declarations by FSP

Name of FSP |

|

Code |

|||

|

|

|

|

|

|

Name of fi nancial advisor(s) |

|

Code |

|||

|

|

|

|

|

|

Tel |

|

|

|||

|

|

|

|

|

|

Fax |

|

|

|||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

Name of alternate contact person at FSP |

|

|

|||

|

|

|

|

|

|

Tel |

|

|

|||

|

|

|

|

|

|

Fax |

|

|

|||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

% will be |

|

A fi nancial advisor fee rebate of |

|

|

|

|

|

FundSelect instruments. The FundSelect fee rebate does not include VAT. VAT on the original fee is applied.

Please tick the applicable declaration(s)

FAIS declaration – I/We confi rm that I am/we are an authorised FSP in terms of FAIS.

FICA declaration – I/We hereby confi rm that the independent FSP, is the primary accountable institution (as described in the regulations to FICA) in respect of the investors on whose behalf I/we establish business relationships or conclude single transactions with IMS (the secondary accountable institution), and that I/we will have established and verifi ed the identity of each such investor in terms of section 21 of FICA. I/We confi rm that I/we will keep a record of the investors’ records as is required in terms of section 22 of FICA.

Please note: Should the FSP not wish to make use of the FICA declaration please refer to the FICA documentation checklist available on www.investecassetmanagement.com and attach all the relevant FICA documents to the application form.

Share portfolio declaration – I/We confi rm that we are appropriately licensed in terms of FAIS to provide advice and/or intermediary services in respect of and/or manage a share portfolio on behalf of the investor.

Signature of appointed representative of FSP

Date DD / MM / YYYY

Initial and surname of appointed representative of FSP

O. Complaints procedure

For information regarding our complaints procedure please go to our website at:

(03/2015 InvBond) 9/10

INVESTOR DOCUMENTATION CHECKLIST

Please note: |

– Investors are obliged to submit the following documentation to IMS, together with their signed application |

|

forms |

|

– Additional documentation may be requested to satisfy FICA requirements. The FICA requirements are detailed |

|

on a separate FICA documentation checklist on www.investecassetmanagement.com |

|

– Investors must notify IMS of any changes to their details and fax updated documentation to |

|

0861 500 300 or +27 (11) 263 6061 (international fax no.). |

Individual investor/sole proprietors/partners to a partnership agreement

copy of ID of each individual investor/sole proprietor/partner (+ one specimen signature), or copy of passport (if

cancelled cheque/bank statement bearing the logo of the bank as proof of the bank details in the name of the individual/partnership, and dividends tax declaration (if applicable) and

power of attorney (if applicable) and

unabridged birth certifi cate/court order appointing legal guardian (if minor investor)

Close Corporations

copy of CK1 (certifi cate of registration), and a copy of CK 2A where applicable (name change certifi cate), and

resolution of members appointing authorised signatories to act on behalf of the close corporation in respect of this investment, and cancelled cheque/bank statement bearing the logo of the bank as proof of bank details in the name of the CC, and

copy of ID for each authorised signatory (+ one specimen signature), and dividends tax declaration

Companies

copy of CM1 or CoR 14.3 (certifi cate of incorporation), and copy of CM29 or Form CoR 39 (list of directors), and

resolution of directors appointing authorised signatories to act on behalf of the company in respect of this investment, and cancelled cheque/bank statement bearing the logo of the bank as proof of bank details in the name of the company, and copy of ID for each authorised signatory (+ one specimen signature), and

dividends tax declaration

Trusts

copy of trust deed or copy of other document by which trust is created, and letters of authority (as issued by the Master of the High Court), and

resolution of trustees appointing authorised signatories to act on behalf of the trust in respect of this investment, and cancelled cheque/bank statement bearing the logo of the bank as proof of bank details in the name of the trust, and copy of ID for each of the authorised signatories only (+ one specimen signature), and

list of names of benefi ciaries, and dividends tax declaration (if applicable)

Retirement funds

copy of proof of Financial Services Board (FSB) registration number (copy of registration certifi cate/letter from the FSB confi rming / containing registration number), and

resolution of trustees appointing authorised signatories in respect of this investment, and signatory list (this could sometimes form part of the resolution), and

cancelled cheque/bank statement bearing the logo of the bank as proof of bank details of the Retirement Fund, and copy of ID’s for each authorised signatory (+ one specimen signature), and

dividends tax declaration

Other entities

copy of document by which the entity is founded, and

resolution appointing authorised signatories to act on behalf of the entity in respect of this investment, and cancelled cheque/bank statement bearing the logo of the bank as proof of bank details in the name of the entity, and copy of ID for each authorised signatory (+ one specimen signature), and

dividends tax declaration (if applicable)

10/10 (03/2015 InvBond)

CLIENT SERVICE CENTRE

100 Grayston Drive Sandown Sandton 2196 PO Box 785700 Sandton 2146 Telephone: 0860 500 100

Fax: 0861 500 300 or (2711)

email: comcentre@investecmail.com

www.investecassetmanagement.com

Investec Investment Management Services (Pty) Ltd

(Reg. No. 1992/003608/07)

Investec Asset Management and Investec Investment Management |

|

Services are authorised fi nancial services providers |

InvBond |

|

|

|

Inv/72378 (03/2015) |

03/2015 InvBond