|

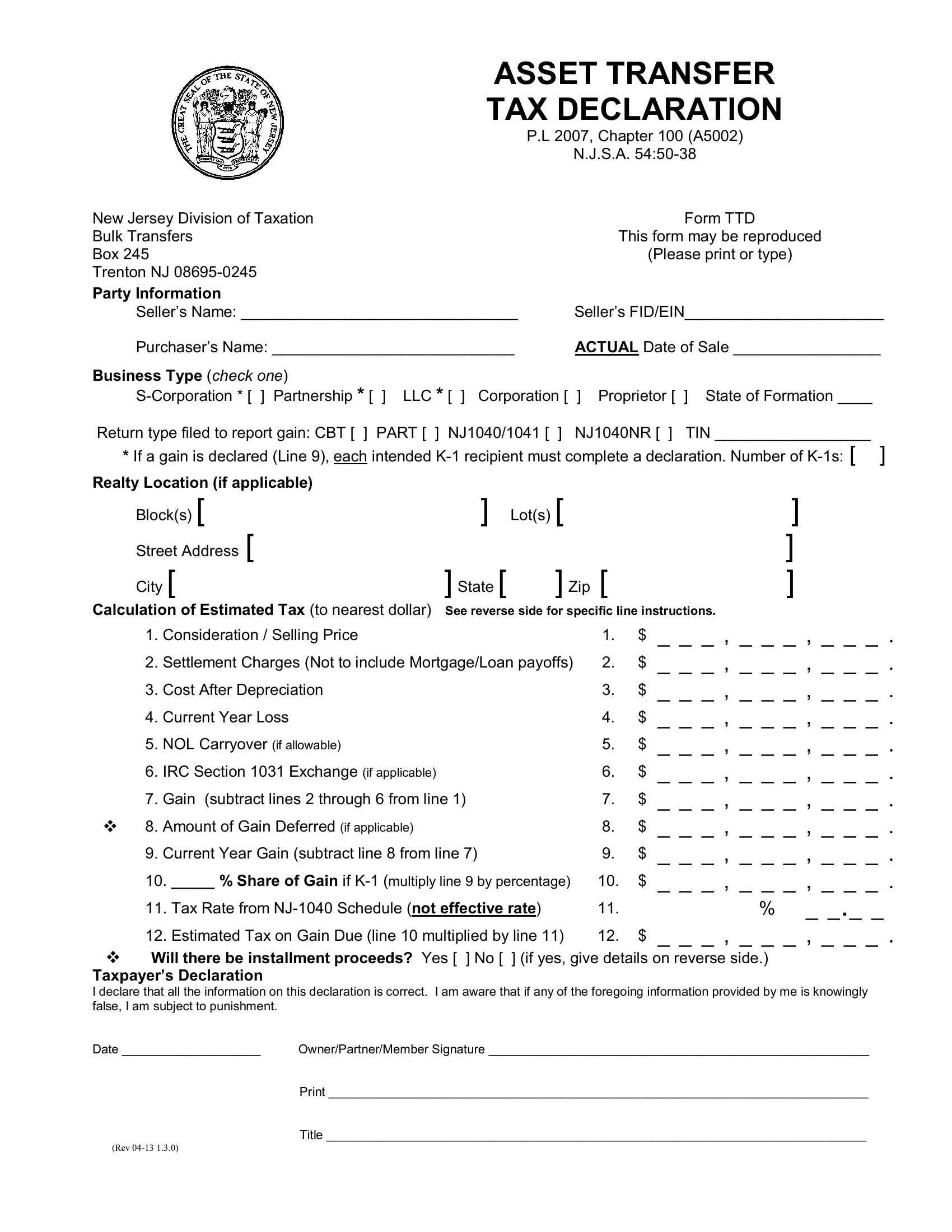

ASSET TRANSFER |

|

TAX DECLARATION |

|

P.L 2007, Chapter 100 (A5002) |

|

|

N.J.S.A. 54:50-38 |

New Jersey Division of Taxation |

|

|

Form TTD |

Bulk Transfers |

|

This form may be reproduced |

Box 245 |

|

(Please print or type) |

Trenton NJ 08695-0245 |

|

|

|

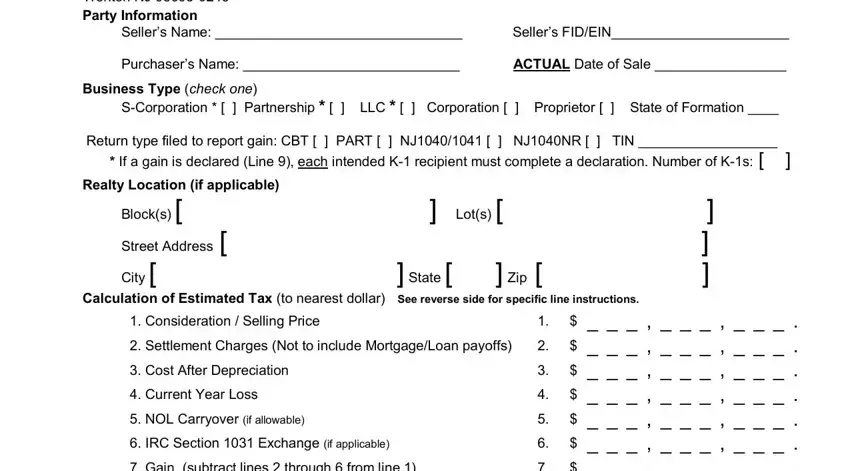

Party Information |

|

|

|

Seller’s Name: ________________________________ |

Seller’s FID/EIN_______________________ |

Purchaser’s Name: ____________________________ |

ACTUAL Date of Sale _________________ |

Business Type (check one) |

|

|

|

S-Corporation * [ ] Partnership * [ |

] LLC * [ ] Corporation [ |

] Proprietor [ |

] State of Formation ____ |

Return type filed to report gain: CBT [ ] |

PART [ ] NJ1040/1041 [ ] |

NJ1040NR [ ] |

TIN __________________ |

* If a gain is declared (Line 9), each intended K-1 recipient must complete a declaration. Number of K-1s: [ ]

Realty Location (if applicable) |

|

|

|

|

|

Block(s) [ |

] |

Lot(s) [ |

|

|

] |

Street Address [ |

|

|

|

|

] |

City [ |

] State [ |

] Zip [ |

|

] |

Calculation of Estimated Tax (to nearest dollar) |

See reverse side for specific line instructions. |

1. |

Consideration / Selling Price |

|

|

1. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

2. |

Settlement Charges (Not to include Mortgage/Loan payoffs) |

2. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

3. |

Cost After Depreciation |

|

|

3. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

4. |

Current Year Loss |

|

|

4. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

5. |

NOL Carryover (if allowable) |

|

|

5. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

6. |

IRC Section 1031 Exchange (if applicable) |

|

|

6. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

7. |

Gain (subtract lines 2 through 6 from line 1) |

|

7. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

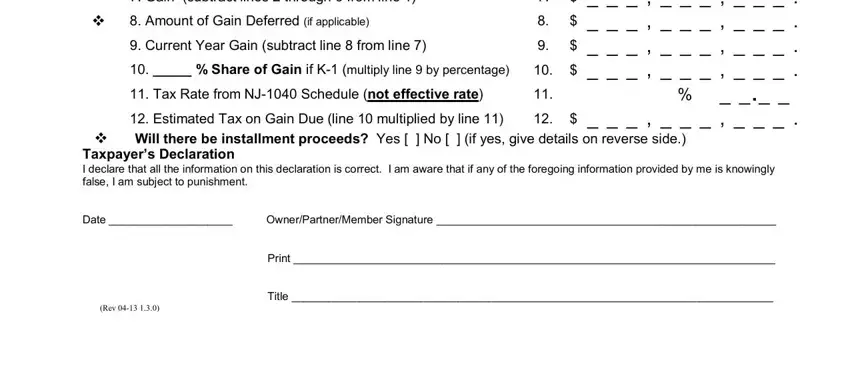

8. Amount of Gain Deferred (if applicable) |

|

|

8. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

9. |

Current Year Gain (subtract line 8 from line 7) |

|

9. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

10. _____ % Share of Gain if K-1 (multiply line 9 by percentage) |

10. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

11. Tax Rate from NJ-1040 Schedule (not effective rate) |

11. |

|

% _ _._ _ |

12. Estimated Tax on Gain Due (line 10 multiplied by line 11) |

12. |

$ |

_ _ _ , _ _ _ , _ _ _ . |

Will there be installment proceeds? Yes [ ] No [ ] (if yes, give details on reverse side.)

Taxpayer’s Declaration

I declare that all the information on this declaration is correct. I am aware that if any of the foregoing information provided by me is knowingly false, I am subject to punishment.

Date ____________________ |

Owner/Partner/Member Signature _______________________________________________________ |

|

Print ______________________________________________________________________________ |

|

Title ______________________________________________________________________________ |

(REV 04-13 1.3.0) |

|

N.J.S.A. 54:50-38 instructs the Director, Division of Taxation, to notify the purchaser, transferee or assignee of business assets of any possible claim for State taxes. This directive includes all final business tax returns and payment.

Procedure

The estimated tax on the gain portion of the escrow to be held at closing is initially calculated by multiplying the gross consideration by the tax rate of the taxpayer.

Upon completion of this declaration, submission to and review by the Division, the estimated tax on the gain portion of the escrow may be reduced appropriately.

Upon closing of the transaction, the escrow will be held by the transferee’s attorney and the estimated tax on the gain portion of the escrow will be demanded by the Division to be applied to the appropriate tax type and year. A confirmation of receipt and the application of the estimated tax payment will be sent to the transferor’s attorney.

The taxpayer files their year end business tax return, claims credit for the payment and pays any additional tax due. They may request a refund or credit if an overpayment exists.

Specific Line Instructions for Estimated Tax Calculation

Special Note: Lines 1 through 9 establish gain. Line 10 assigns share.

Line 1: Total sale price or consideration of all assets currently being transferred.

Line 2: Total amount of settlement charges to transferor associated with this transaction.

Line 3: If fully depreciated enter zero.

Line 8: Calculate amount deferred based on installment or short term notes.

Line 9: For NJ1065 filers: If any member/partner is not an individual or if the number of nonresident member/partners exceeds five (5) stop here and attach the most current membership directory. The Division will calculate and communicate the estimated tax for resident filers and/or withholding amount for nonresident filers.

Line 11: Individual tax rates may be found in the most current NJ-1040 instructions. Corporate tax rate 6.5% ($1-$50,000), 7.5% ($50,001-$100,000) or 9% (above $100,000).

Line 12:

•C-Corporation - use the greater of declared tax or minimum tax. ($500, $750, $1,000, $1,500 or $2,000 based on NJ Gross Receipts.)

•S-Corporation - minimum tax applies in addition to any tax on gain.

This is the declared amount that the Division will demand from escrow to be applied to the taxpayer’s account(s).

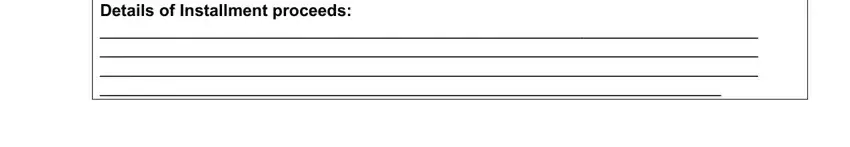

Details of Installment proceeds:

_______________________________________________________________________

_______________________________________________________________________

_______________________________________________________________________

___________________________________________________________________