It won't be hard to complete valic forms applying our PDF editor. This is how it is possible to quickly prepare your form.

Step 1: Initially, choose the orange "Get form now" button.

Step 2: When you have accessed the valic forms editing page you may find the different options you can perform relating to your template in the top menu.

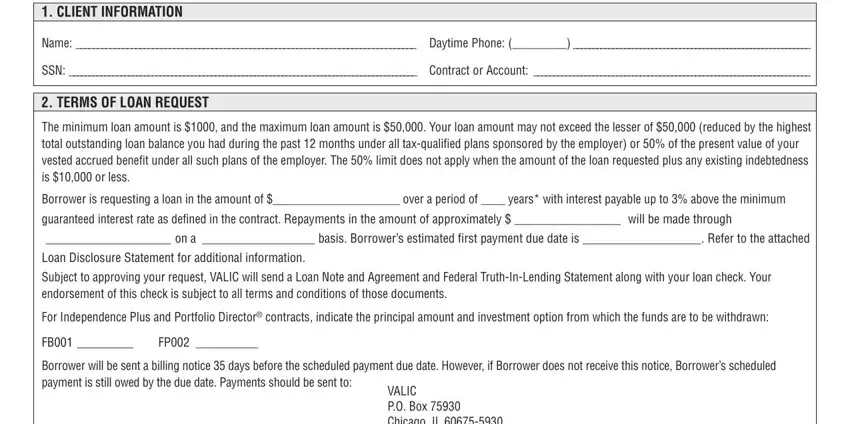

Type in the data requested by the program to get the form.

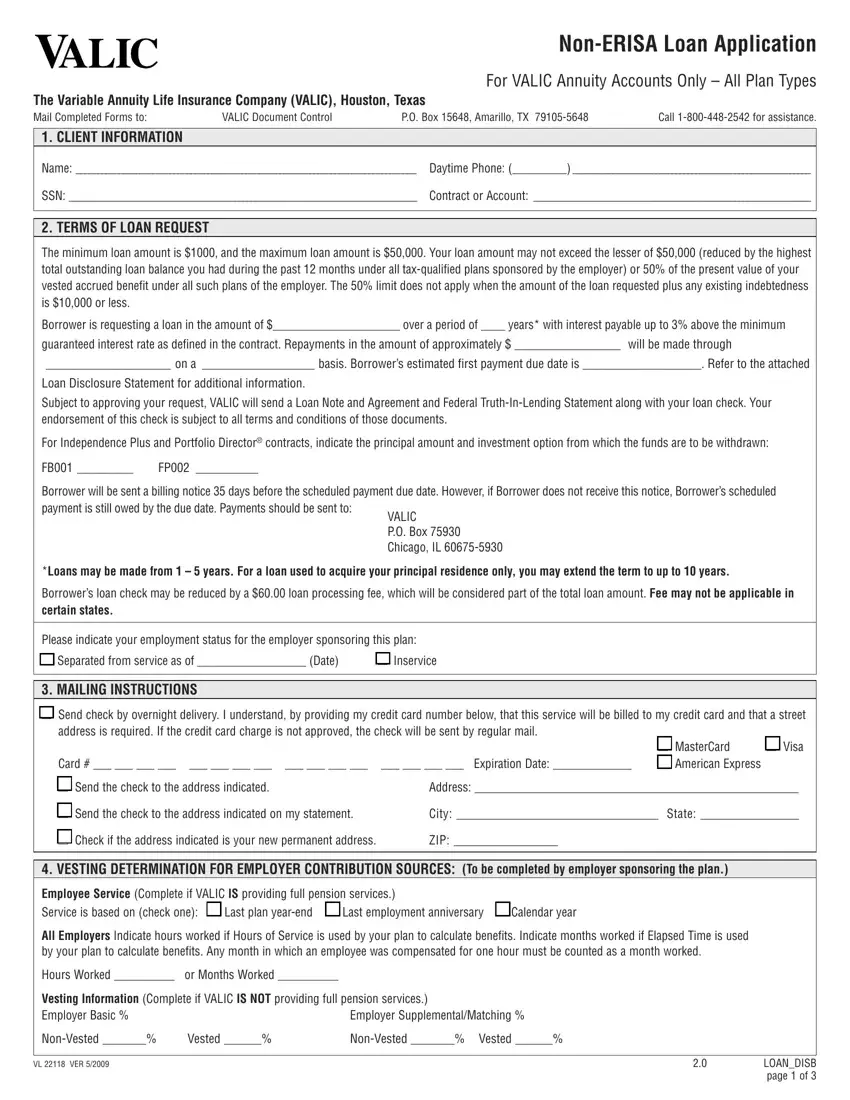

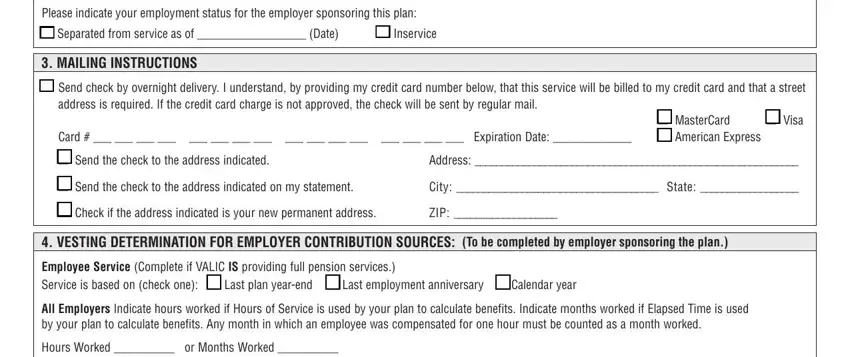

Jot down the details in the Please indicate your employment, l Inservice, MAILINg INsTRuCTIONs, l Send check by overnight delivery, address is required If the credit, Card Expiration, l MasterCard l American Express, l Visa, l Send the check to the address, Address, City State, ZIP, VEsTINg DETERMINATION FOR, Employee service Complete if VALIC, and Hours Worked or Months Worked field.

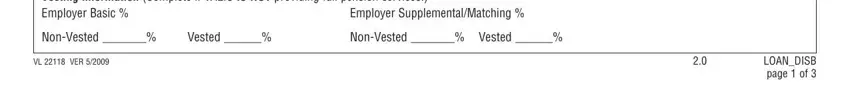

It's essential to write down some data inside the space Vesting Information Complete if, Employer SupplementalMatching, NonVested, Vested, NonVested Vested, VL VER, and LOANDISB page of.

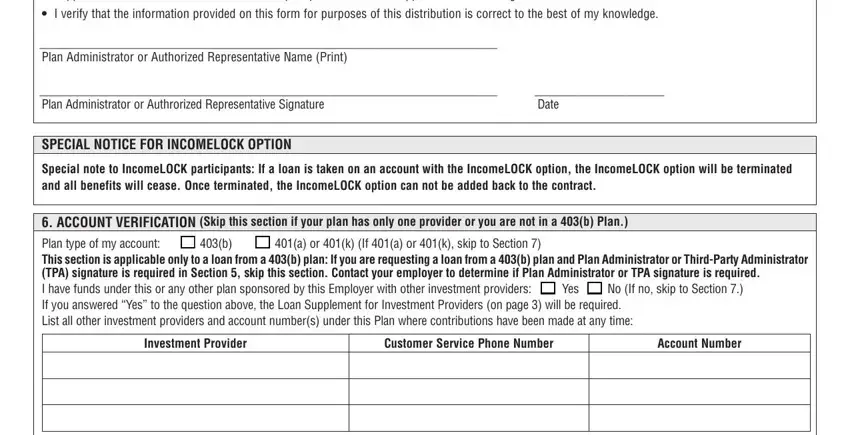

The area I approve this loan in accordance, I verify that the information, Plan Administrator or Authorized, Plan Administrator or Authrorized, Date, sPECIAL NOTICE FOR INCOMELOCK, special note to IncomeLOCK, ACCOuNT VERIFICATION skip this, l a or k If a or k skip to Section, Investment Provider, Customer service Phone Number, and Account Number will be where you insert each side's rights and obligations.

Finish by reading the next sections and preparing them accordingly: information herein subject to the, Borrowers Signature, Date, VL VER, and LOANDISB page of.

Step 3: As soon as you are done, press the "Done" button to transfer the PDF file.

Step 4: In order to prevent all of the complications in the future, be sure to get a minimum of a few copies of your file.