In the oil-rich state of North Dakota, the T-12 form serves as a crucial document for reporting oil gross production and oil extraction taxes. Maintained by the North Dakota Office of State Tax Commissioner, this document requires detailed accounting from both original producers and purchasers of oil within the state. The form, specifically designed for the capture of financial transactions related to oil extraction, outlines various metrics such as gross production tax, applicable penalties, and interest on late payments, ensuring accurate tax remittance to state authorities. With sections dedicated to both production and extraction taxes, the T-12 form includes comprehensive worksheets that demand the disclosure of the taxable value of oil, deductions applicable due to transportation or other costs, and credits for taxes already paid. This meticulous approach to tax reporting underscores North Dakota's commitment to ensuring a fair and just taxation process for its oil industry, emphasizing the importance of precise documentation and adherence to state tax codes. By providing clear instructions and offering support through the Office of State Tax Commissioner, the state facilitates compliance, helping producers and purchasers navigate the complexities inherent in oil tax reporting.

| Question | Answer |

|---|---|

| Form Name | North Dakota Form T 12 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | t12 oil north dakota t12 form |

|

|

|

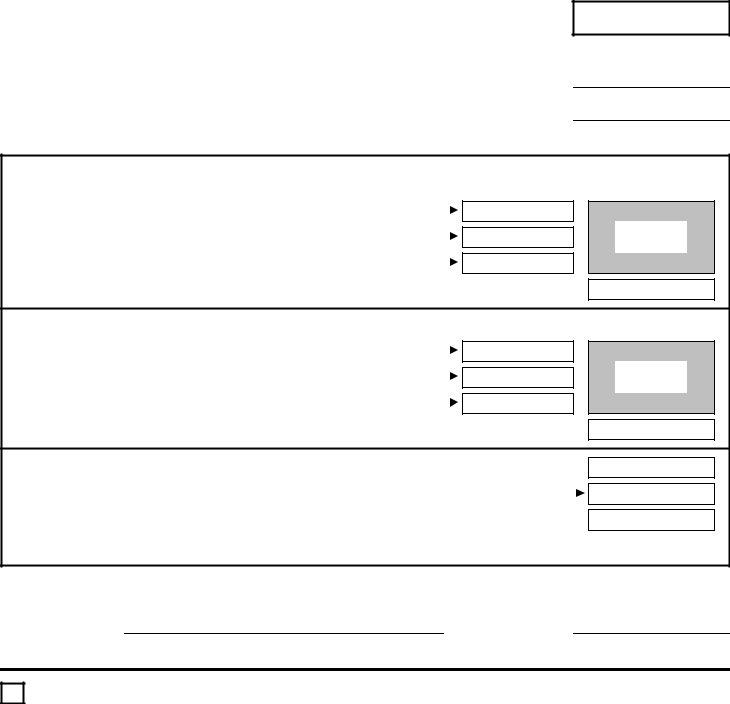

NORTH DAKOTA OFFICE OF STATE TAX COMMISSIONER |

|||||||

|

|

|

600 E. BOULEVARD AVE., BISMARCK, ND |

|||||||

|

|

OIL GROSS PRODUCTION AND OIL EXTRACTION TAX REPORT |

||||||||

|

|

|

|

|

|

|

ORIGINAL |

|

PRODUCER |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

(Check One) |

|

(Check One) |

|

|

|

|

|

|

|

|

|

|||

YEAR/MONTH |

|

|

|

|

|

AMENDED |

|

PURCHASER |

||

|

|

|

|

|

|

|

|

|||

|

|

(i.e., 1999, 2000) |

(i.e., 01, 12) |

|

|

|||||

FEDERAL I.D. NUMBER |

|

|

|

|

|

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

PHONE |

|

CITY |

|

|

|

|

|

STATE/PROV. |

|

|

ZIP CODE |

|

FORM

(August 2000)

For Office Use Only

For instruction booklet or forms contact the Office of State Tax Commissioner:

You must attach all

GROSS PRODUCTION TAX

1. Gross Production Tax Paid With Report ………………….….…………….…………...…………

2. Penalty on Gross Production Tax ………………………… (See Instructions)…………….....………

3. Interest on Late Gross Production Tax …………..…….… (See Instructions)………………..………

4. Total Due ……...…… (Add Lines 1, 2, and 3) …………………..……………………………………………...…………..……………………

Line 1 - Total from

Block 8 on

Worksheet

OIL EXTRACTION TAX

5.Oil Extraction Tax Paid With Report ……………...…………………...……………………………

6.Penalty on Oil Extraction Tax ……………………………… (See Instructions)……………..…………

7.Interest on Late Oil Extraction Tax …………...…………… (See Instructions)…..…………….………

8.Total Due …..……… (Add Lines 5, 6, and 7) ……………………………..…………………………...……………………………………

Line 5 - Total from Block 13 on

9. |

Total Due With This Report ...….. (Add Lines 4 and 8)………………………………….…………………..……………...………………… |

||||

10. |

Tax Credits Claimed …….……….. (Enter as a positive value) ……………….….………………………………...……….……… |

||||

11. |

Total Gross Production and Oil Extraction Tax Remitted With This Report …………...……… (Line 9 minus Line 10) …… |

||||

|

If Line 11 Results in Credit Balance, Apply to: |

|

Credit |

|

Refund |

|

|

|

|||

|

|

|

|

|

|

I declare under penalties of North Dakota Century Code Section

Report Prepared by: |

Date: |

(Please Print or Type)

Please Do Not Write In This Space

Check here if PAYMENT has been

submitted electronically.

|

|

|

|

|

|

|

|

North Dakota Statement of Oil Purchases/Sales |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

Gross Production & Oil Extraction Tax |

|

|

|

(August 2000) |

||||

YEAR/MONTH |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

(i.e., 1999, 2000) |

(i.e., 01, 12) |

|

|

|

|

|

|

|

|

|

|

|

||

FEDERAL I.D. NUMBER |

|

|

|

|

|

|

TAXPAYER NAME |

|

|

|

|

Page |

|

of |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Production Tax |

|

|

|

Oil Extraction Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barrels of Oil |

|

|

Value of Oil |

|

Value of Exempt |

Taxable Value of Oil |

Pool |

Well |

|

Taxable Value of Oil |

Other Party |

||||||

Purchased/Sold |

|

|

|

Government |

|

Federal I.D. |

|||||||||||

|

|

Purchased/Sold |

|

(Block 2 - Block 3) |

Code |

Code |

|

(Same as Block 4) |

|||||||||

(Round to two Places) |

|

|

|

Royalties |

|

|

Number |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

2 |

|

|

|

|

3 |

4 |

A |

B |

9 |

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil |

|

Posting |

Additional |

Transportation |

Other |

|

Total Production Tax Due |

5 |

Total Extraction Tax Due |

10 |

|

15 |

|

|

|||

Gravity |

|

Code |

Value |

|

Deduction |

Deductions |

|

(5% of Block 4) |

|

(4% or 6.5% of Block 9) |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

D |

E |

F |

|

|

G |

|

Production Tax |

6 |

Extraction Tax |

11 |

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Previously Paid |

|

Previously Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

API Number: |

|

|

|

|

Sequence # |

Condensate |

|

Production Tax Paid |

7 |

Extraction Tax Paid |

12 |

|

17 |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

33 |

- |

|

|

( |

) |

YES |

|

By Others |

|

By Others |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

Production Tax Paid |

8 |

Extraction Tax Paid |

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Well or Lease Name: |

|

|

|

|

|

|

with Report |

|

with Report |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

2 |

|

|

|

|

3 |

4 |

A |

B |

9 |

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil |

|

Posting |

Additional |

Transportation |

Other |

|

Total Production Tax Due |

5 |

Total Extraction Tax Due |

10 |

|

15 |

|

|

|||

Gravity |

|

Code |

Value |

|

Deduction |

Deductions |

|

(5% of Block 4) |

|

(4% or 6.5% of Block 9) |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

D |

E |

F |

|

|

G |

|

Production Tax |

6 |

Extraction Tax |

11 |

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Previously Paid |

|

Previously Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

API Number: |

|

|

|

|

Sequence # |

Condensate |

|

Production Tax Paid |

7 |

Extraction Tax Paid |

12 |

|

17 |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

33 |

- |

|

|

( |

) |

YES |

|

By Others |

|

By Others |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

Production Tax Paid |

8 |

Extraction Tax Paid |

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Well or Lease Name: |

|

|

|

|

|

|

with Report |

|

with Report |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

2 |

|

|

|

|

3 |

4 |

A |

B |

9 |

|

14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil |

|

Posting |

Additional |

Transportation |

Other |

|

Total Production Tax Due |

5 |

Total Extraction Tax Due |

10 |

|

15 |

|

|

|||

Gravity |

|

Code |

Value |

|

Deduction |

Deductions |

|

(5% of Block 4) |

|

(4% or 6.5% of Block 9) |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

D |

E |

F |

|

|

G |

|

Production Tax |

6 |

Extraction Tax |

11 |

|

16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Previously Paid |

|

Previously Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

API Number: |

|

|

|

|

Sequence # |

Condensate |

|

Production Tax Paid |

7 |

Extraction Tax Paid |

12 |

|

17 |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

33 |

- |

|

|

( |

) |

YES |

|

By Others |

|

By Others |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

Production Tax Paid |

8 |

Extraction Tax Paid |

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Well or Lease Name: |

|

|

|

|

|

|

with Report |

|

with Report |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page Total |

|

Page Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sum of Block 8: |

|

Sum of Block 13: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|