It is possible to fill in employment security department nucs 4075 effectively by using our online tool for PDF editing. To retain our tool on the forefront of practicality, we aim to integrate user-driven capabilities and improvements regularly. We're always pleased to get feedback - assist us with revolutionizing how we work with PDF documents. By taking a couple of easy steps, you may begin your PDF journey:

Step 1: Simply hit the "Get Form Button" at the top of this site to launch our pdf editing tool. Here you will find all that is necessary to work with your document.

Step 2: After you start the file editor, you will find the document prepared to be completed. Aside from filling out different blanks, you can also do several other actions with the form, namely adding your own text, editing the original textual content, adding illustrations or photos, putting your signature on the PDF, and much more.

It is simple to fill out the document with this practical tutorial! This is what you want to do:

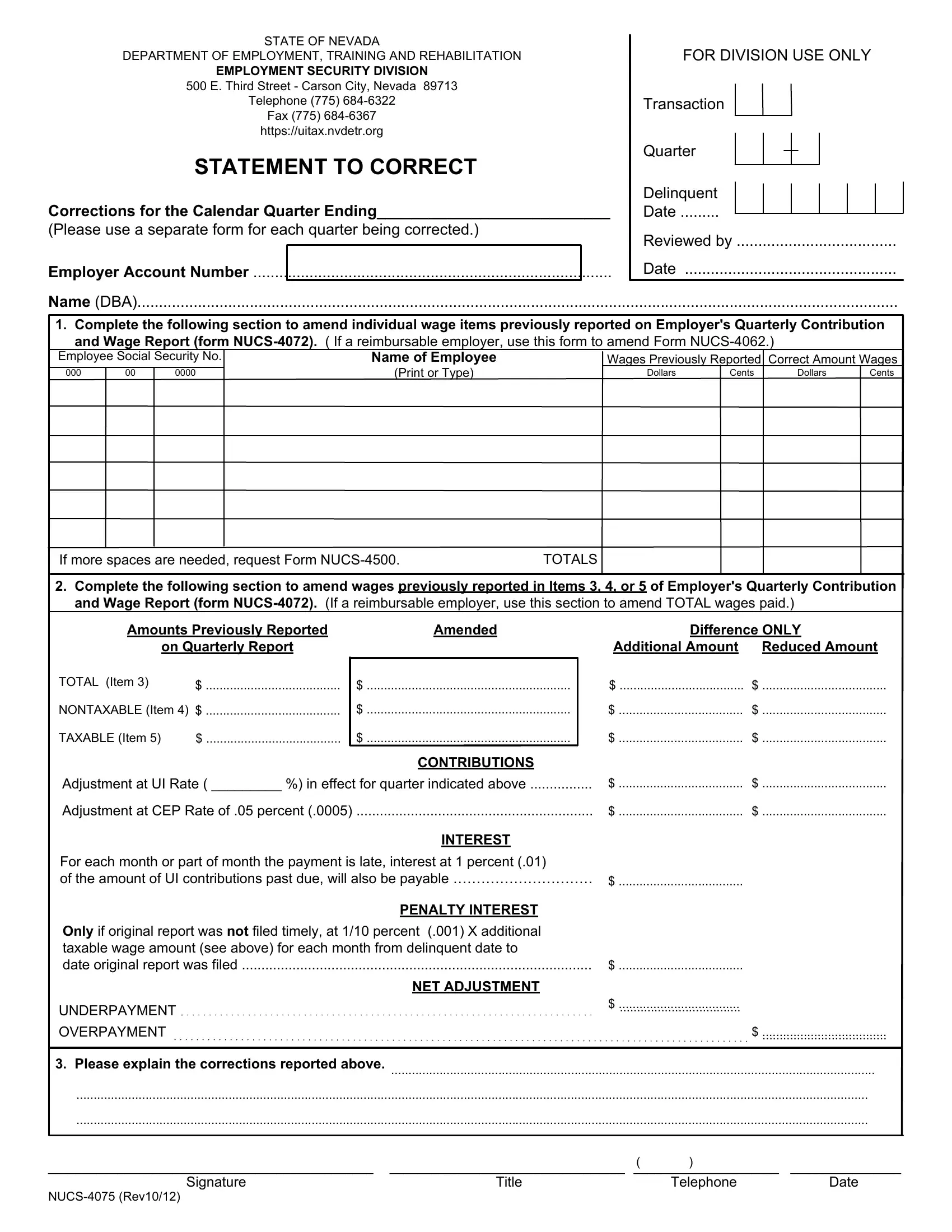

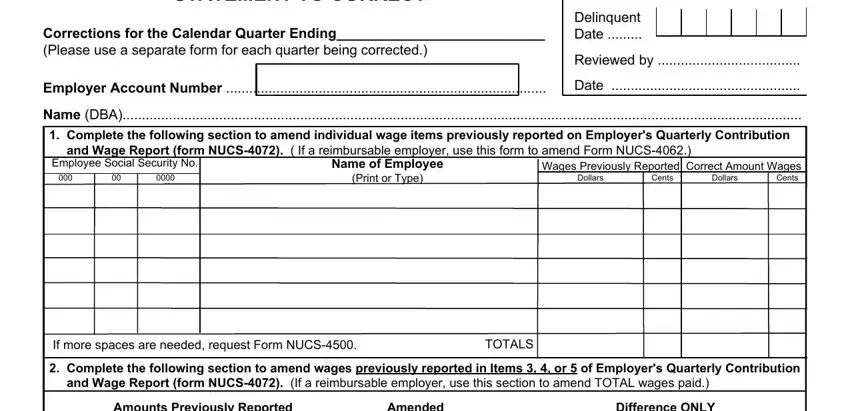

1. It is crucial to complete the employment security department nucs 4075 correctly, thus be careful when filling out the sections comprising these particular fields:

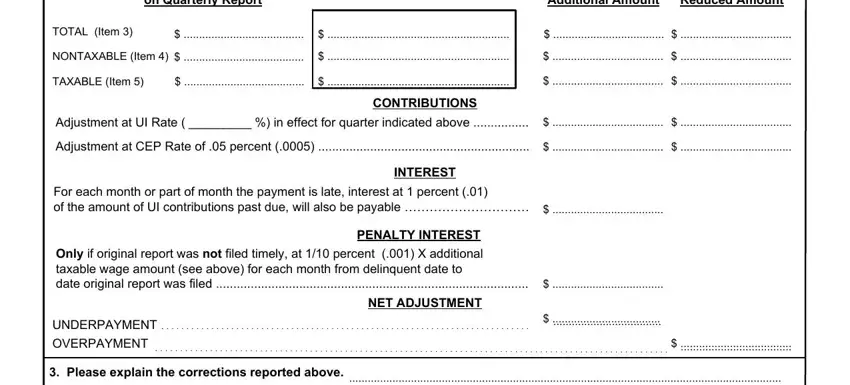

2. After this section is completed, go to type in the suitable information in all these - on Quarterly Report, Additional Amount, Reduced Amount, TOTAL Item, NONTAXABLE Item, TAXABLE Item, Adjustment at UI Rate in effect, Adjustment at CEP Rate of percent, CONTRIBUTIONS, For each month or part of month, INTEREST, Only if original report was not, PENALTY INTEREST, NET ADJUSTMENT, and UNDERPAYMENT.

3. Your next part is going to be straightforward - fill in all the fields in NUCS Rev, Signature, Title, Telephone, and Date to complete this part.

Always be very mindful when filling out Signature and Title, as this is the section in which many people make a few mistakes.

Step 3: Once you have reread the information in the document, click "Done" to conclude your form at FormsPal. Try a 7-day free trial subscription at FormsPal and gain instant access to employment security department nucs 4075 - downloadable, emailable, and editable from your FormsPal account page. FormsPal is committed to the confidentiality of all our users; we always make sure that all information put into our system stays protected.