nys tax form et 141 can be completed online very easily. Just try FormsPal PDF tool to get it done fast. To have our editor on the leading edge of efficiency, we strive to integrate user-driven capabilities and improvements regularly. We are at all times looking for suggestions - assist us with remolding PDF editing. To start your journey, take these easy steps:

Step 1: Firstly, open the pdf tool by pressing the "Get Form Button" above on this site.

Step 2: With the help of our advanced PDF tool, it is possible to accomplish more than simply complete blank form fields. Try all of the features and make your documents appear professional with custom textual content added, or optimize the file's original input to perfection - all that comes along with the capability to insert almost any pictures and sign the document off.

Filling out this form requires attentiveness. Ensure that every single field is filled in accurately.

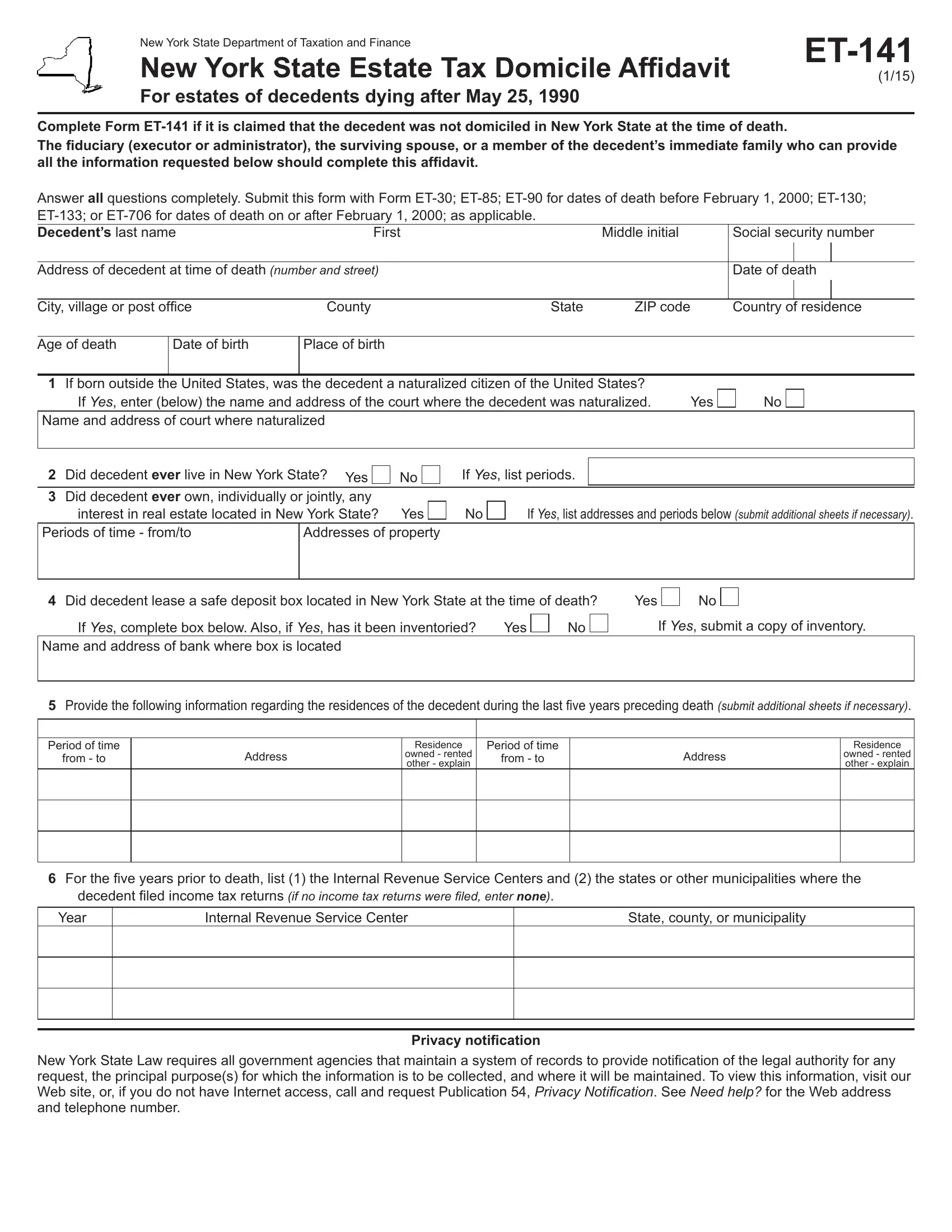

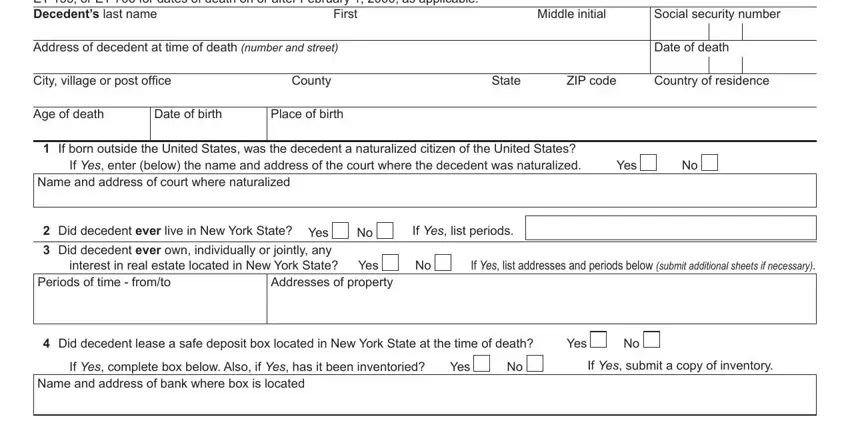

1. Whenever completing the nys tax form et 141, ensure to complete all essential fields within the relevant form section. This will help to speed up the work, enabling your information to be handled promptly and correctly.

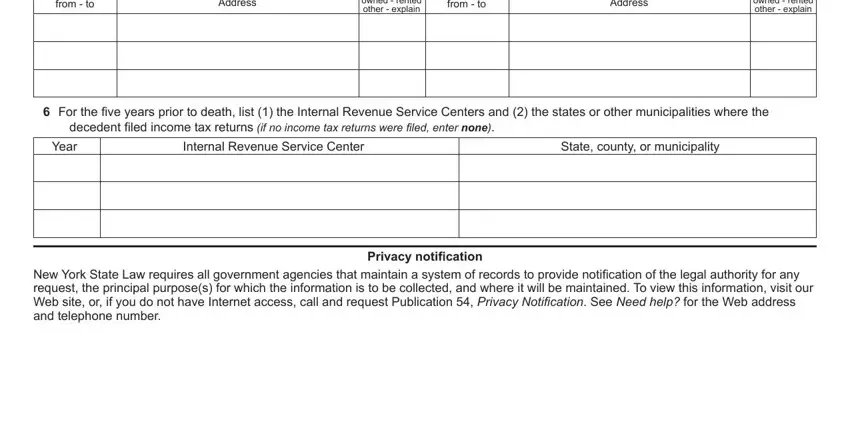

2. After completing the previous section, head on to the next step and enter all required details in all these blanks - Period of time, from to, Address, owned rented other explain, Period of time, from to, Address, owned rented other explain, For the ive years prior to death, decedent iled income tax returns, Internal Revenue Service Center, State county or municipality, New York State Law requires all, and Privacy notiication.

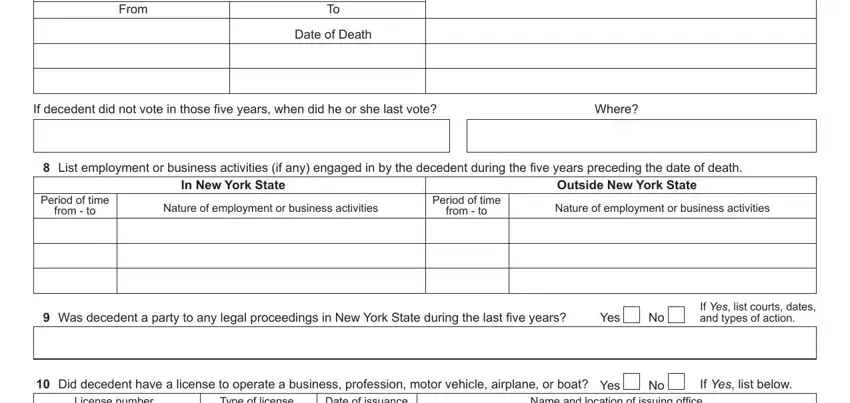

3. The following portion is about From, Date of Death, If decedent did not vote in those, Where, List employment or business, In New York State, Period of time, from to, Nature of employment or business, Period of time, from to, Outside New York State Nature of, Was decedent a party to any legal, Yes, and If Yes list courts dates and types - complete each of these fields.

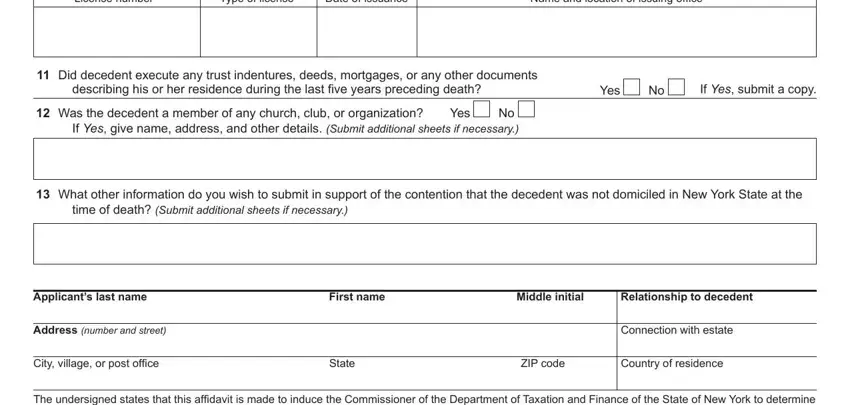

4. You're ready to fill out the next part! Here you'll have these Did decedent have a license to, Date of issuance, License number, Type of license, Name and location of issuing ofice, describing his or her residence, Did decedent execute any trust, No If Yes give name address and, Yes, Yes, If Yes submit a copy, What other information do you, time of death Submit additional, Applicants last name, and Address number and street empty form fields to fill in.

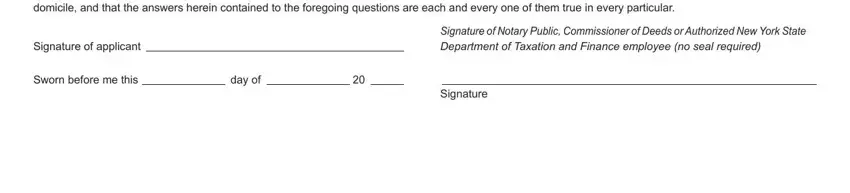

5. To conclude your document, this final section incorporates a number of additional blanks. Entering The undersigned states that this, Signature of applicant, Sworn before me this, Signature of Notary Public, day of, and Signature is going to wrap up everything and you will be done in a snap!

Always be really attentive when completing Signature and The undersigned states that this, since this is the part in which most people make errors.

Step 3: Soon after double-checking your entries, hit "Done" and you're all set! Sign up with us now and immediately get nys tax form et 141, all set for downloading. Each edit you make is conveniently saved , helping you to edit the form at a later stage if needed. At FormsPal.com, we do our utmost to ensure that your information is stored private.