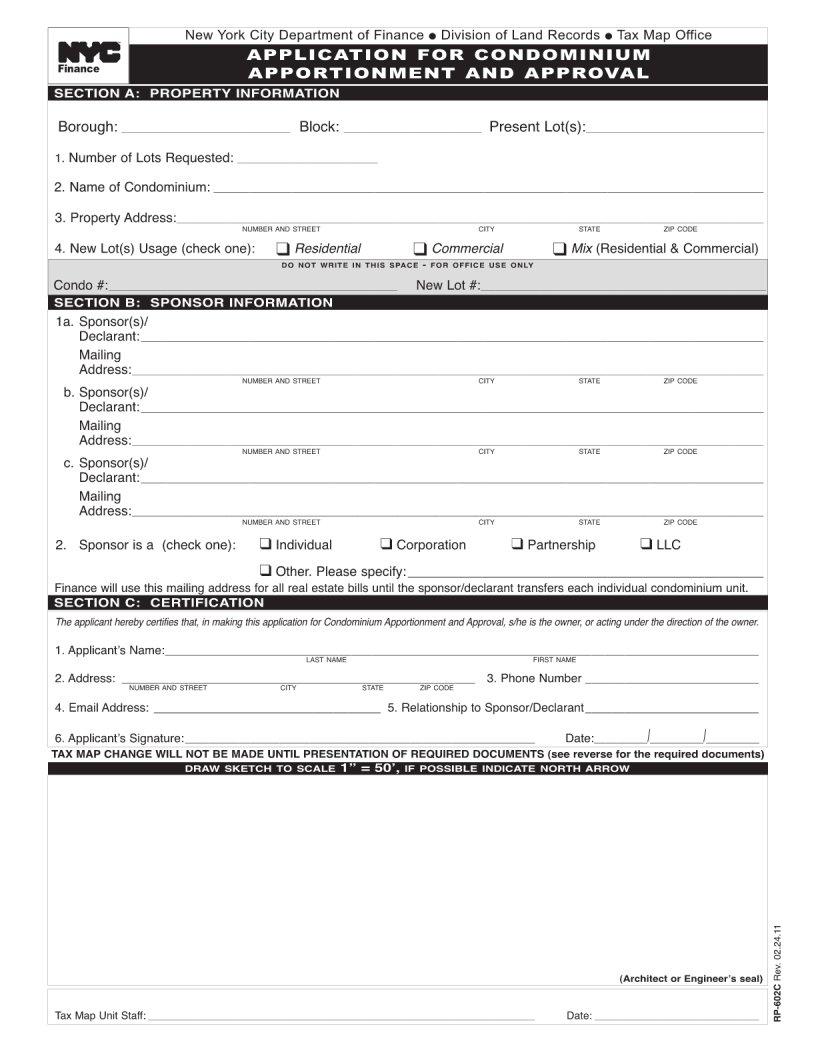

In navigating the complexities of property tax benefits in New York City, property owners are often introduced to various forms and documents, one of which is the NYC RP-602C form. This document plays a crucial role for those seeking to apply for, or maintain, property tax exemptions based on ownership status and property use. Primarily, it serves individuals, corporations, and organizations that are entitled to receive tax relief under specific conditions, such as veterans, seniors, or non-profit entities. The importance of accurately completing and timely submitting this form cannot be overstated, as it directly impacts eligibility and the extent of tax benefits received. Moreover, the NYC RP-602C form is a testament to the city's commitment to providing financial relief to eligible parties, reinforcing the necessity for applicants to understand the criteria, documentation requirements, and deadlines associated with this process. Through this form, a transparent pathway is established for applicants to demonstrate their qualifications for tax relief, making it an essential component of the property tax administration system in New York City.

| Question | Answer |

|---|---|

| Form Name | Nyc Form Rp 602C |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | rp 602c, NYCRR, rp602c, New_York |