This PDF editor makes it simple to prepare forms. There's no need to undertake much to enhance nys unemployment yes forms. Just check out the following actions.

Step 1: Click on the "Get Form Here" button.

Step 2: Now you are on the file editing page. You can edit, add information, highlight particular words or phrases, insert crosses or checks, and insert images.

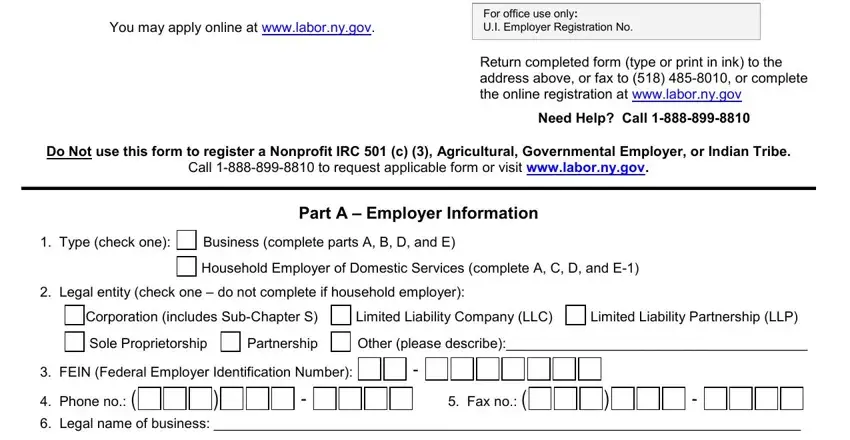

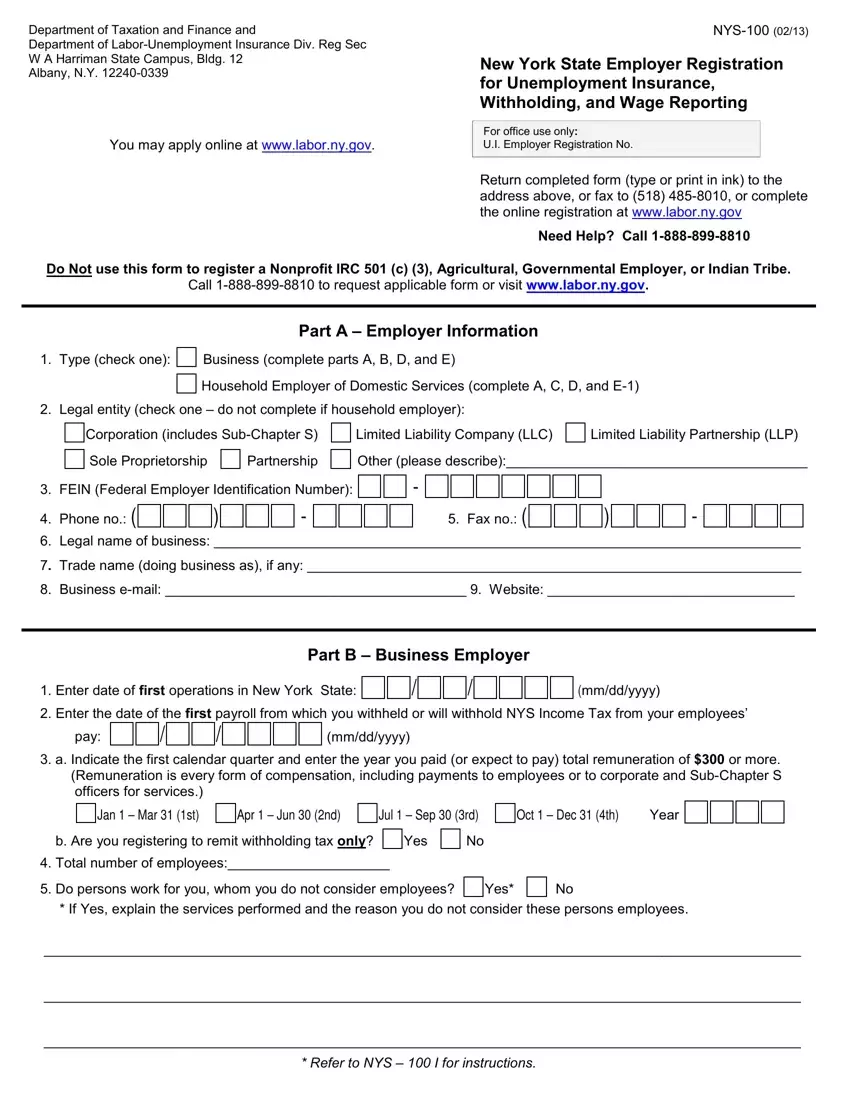

Fill out the nys employer registration PDF by entering the text required for every single part.

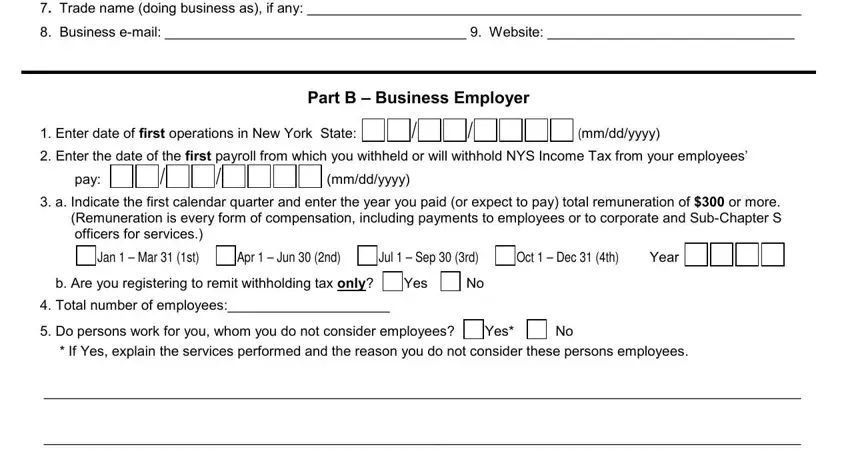

Enter the requested data in Trade name doing business as if, Business email Website, Enter date of first operations in, mmddyyyy, Part B Business Employer, Enter the date of the first, pay, mmddyyyy, a Indicate the first calendar, Jan Mar st, Apr Jun nd, Jul Sep rd, Oct Dec th Year, b Are you registering to remit, and Yes box.

Focus on the most important data the Refer to NYS I for instructions segment.

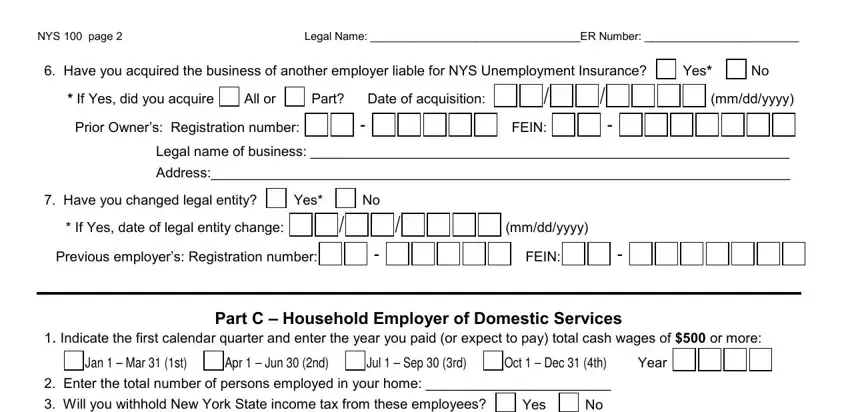

The NYS page Legal Name ER Number, Have you acquired the business of, If Yes did you acquire, All or, Part Date of acquisition, Prior Owners Registration number, FEIN, Yes, mmddyyyy, Legal name of business, Address, Have you changed legal entity, Yes, If Yes date of legal entity change, and Previous employers Registration box is going to be place to indicate the rights and responsibilities of each side.

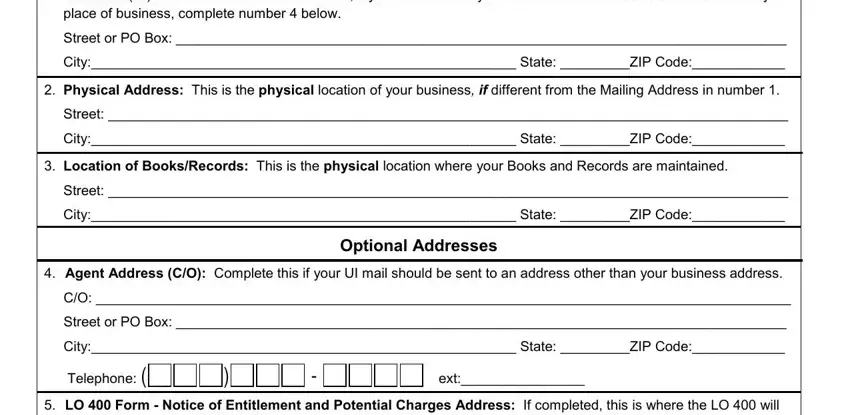

End by looking at these areas and completing the appropriate details: Mailing Address This is your, Street or PO Box, City State ZIP Code, Physical Address This is the, Street, City State ZIP Code, Location of BooksRecords This is, Street, City State ZIP Code, Optional Addresses, Agent Address CO Complete this if, Street or PO Box, City State ZIP Code, Telephone LO Form Notice of, and ext.

Step 3: Click "Done". You can now export your PDF form.

Step 4: Generate duplicates of your form. This should save you from future problems. We don't look at or publish your information, so be assured it's going to be safe.

Previous employer’s: Registration number:

Previous employer’s: Registration number: