nys it 255 instructions can be completed online with ease. Simply make use of FormsPal PDF tool to get the job done right away. Our editor is constantly evolving to present the best user experience possible, and that is because of our commitment to continual improvement and listening closely to user feedback. To get the ball rolling, consider these easy steps:

Step 1: Firstly, access the pdf tool by pressing the "Get Form Button" in the top section of this webpage.

Step 2: The tool lets you change PDF files in a range of ways. Transform it by writing personalized text, correct existing content, and place in a signature - all when you need it!

Be attentive when filling out this form. Make certain all necessary fields are completed correctly.

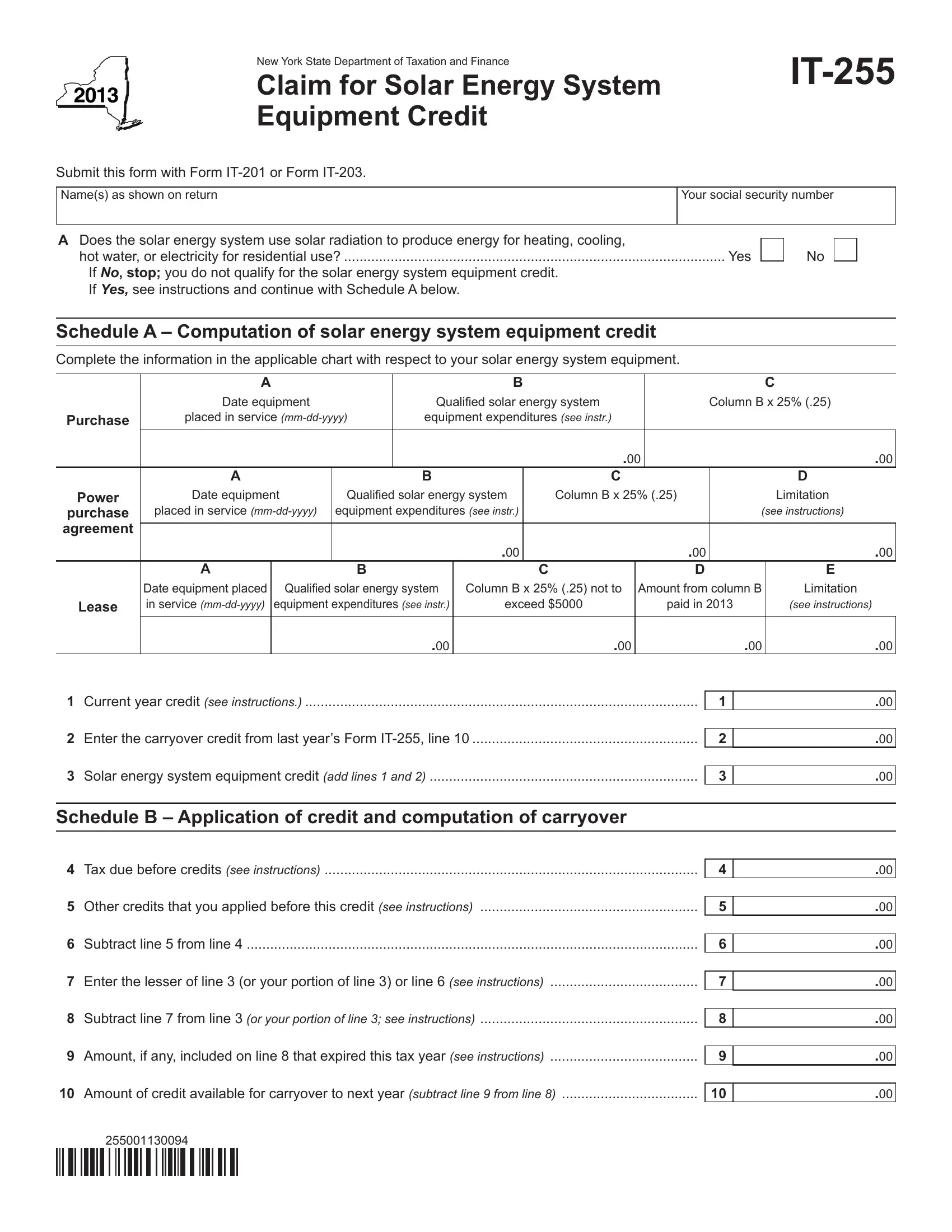

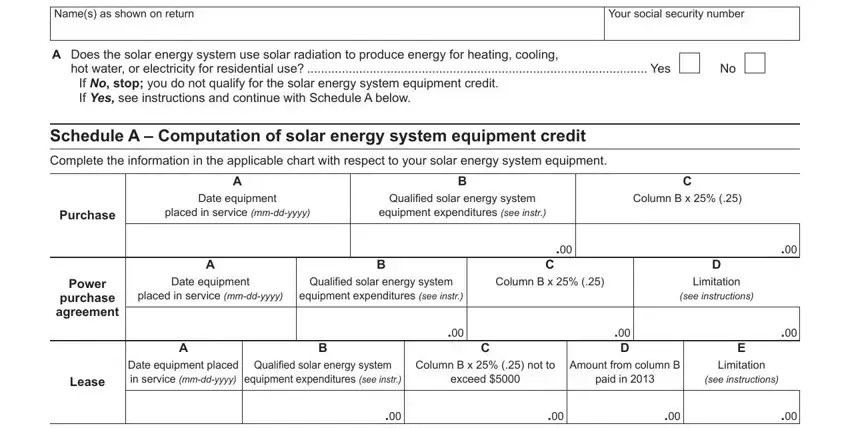

1. It is crucial to complete the nys it 255 instructions properly, hence take care when filling out the areas containing these blanks:

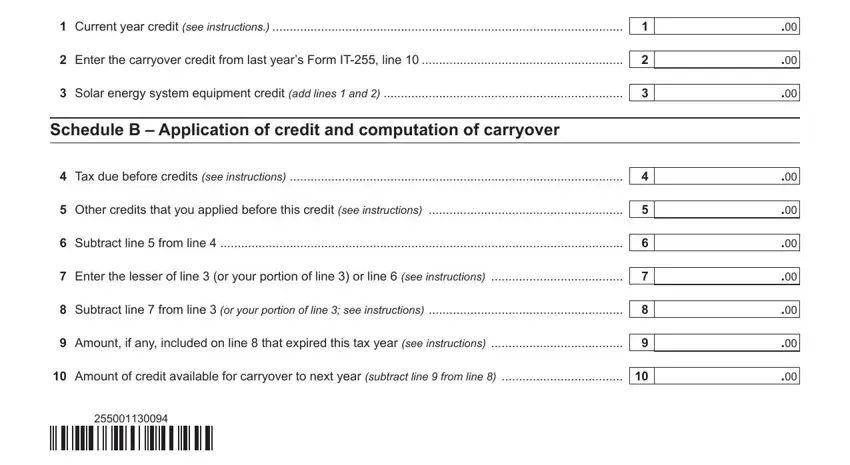

2. Right after completing the previous part, go to the subsequent step and fill in the essential particulars in all these blanks - Current year credit see, Enter the carryover credit from, Solar energy system equipment, Schedule B Application of credit, Tax due before credits see, Other credits that you applied, Subtract line from line, Enter the lesser of line or your, Subtract line from line or your, Amount if any included on line, and Amount of credit available for.

Those who work with this document generally make some errors when completing Subtract line from line or your in this section. Be sure to double-check everything you enter right here.

Step 3: Immediately after taking one more look at the entries, press "Done" and you are good to go! Grab the nys it 255 instructions as soon as you sign up at FormsPal for a free trial. Conveniently get access to the pdf file inside your FormsPal account, together with any modifications and adjustments being conveniently preserved! FormsPal ensures your information privacy via a protected method that in no way saves or shares any sort of private information typed in. Be confident knowing your files are kept safe whenever you work with our editor!