If you want to fill out official notice bankruptcy get, there's no need to install any sort of applications - simply use our PDF editor. In order to make our editor better and less complicated to work with, we constantly develop new features, bearing in mind suggestions coming from our users. It merely requires just a few basic steps:

Step 1: Firstly, access the pdf tool by pressing the "Get Form Button" in the top section of this webpage.

Step 2: The tool gives you the opportunity to change your PDF document in a variety of ways. Improve it by writing personalized text, correct original content, and put in a signature - all close at hand!

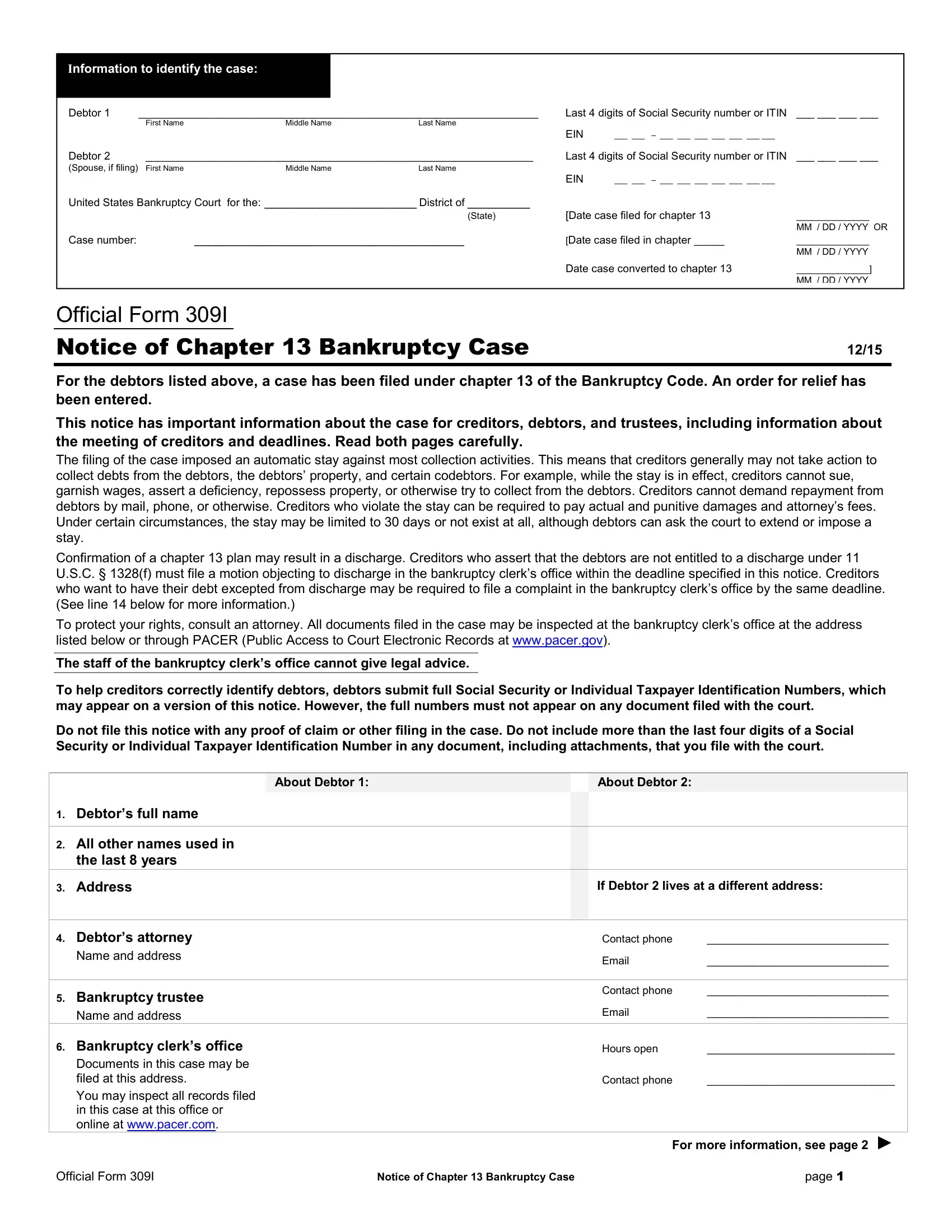

If you want to finalize this PDF document, make sure that you enter the required details in each and every blank field:

1. To start with, while filling out the official notice bankruptcy get, start with the section that has the subsequent blanks:

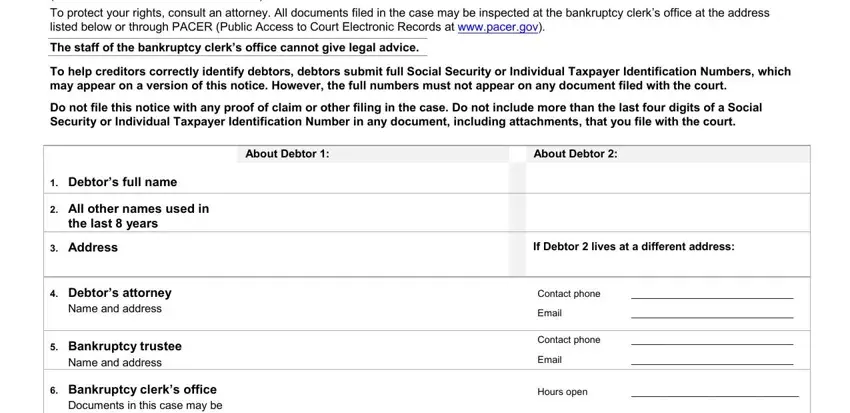

2. After completing the last part, go to the next step and fill in the necessary details in these fields - Bankruptcy clerks office, For more information see page, Official Form I, Notice of Chapter Bankruptcy Case, and page.

Those who use this form frequently get some things wrong while filling out Bankruptcy clerks office in this part. Be certain to revise what you type in here.

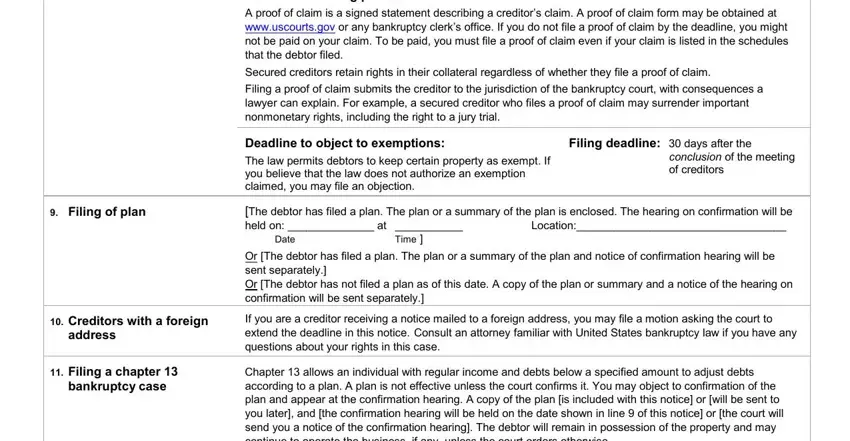

3. Completing Filing of plan, Deadlines for filing proof of claim, A proof of claim is a signed, Secured creditors retain rights in, Filing a proof of claim submits, Deadline to object to exemptions, Filing deadline days after the, The law permits debtors to keep, conclusion of the meeting of, The debtor has filed a plan The, Date, Time, Or The debtor has filed a plan The, Creditors with a foreign, and address is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

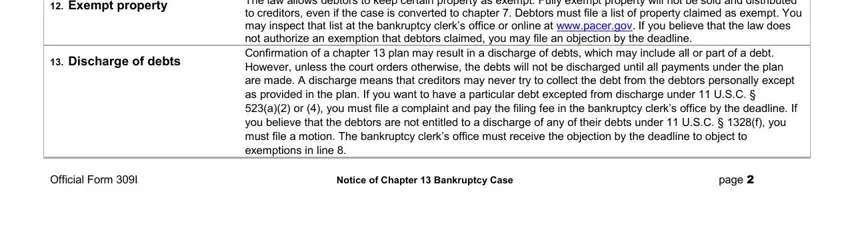

4. Filling in Exempt property, Discharge of debts, The law allows debtors to keep, Official Form I, Notice of Chapter Bankruptcy Case, and page is essential in this next form section - ensure to spend some time and be mindful with every blank area!

Step 3: Check the information you've inserted in the blank fields and click on the "Done" button. Sign up with us right now and instantly obtain official notice bankruptcy get, ready for downloading. Each and every edit you make is handily saved , which enables you to modify the document at a later stage anytime. FormsPal ensures your information confidentiality via a secure method that in no way records or distributes any kind of private information involved. Be confident knowing your paperwork are kept safe any time you use our services!