You can certainly prepare documents with the help of our PDF editor. Revising the Ohio Form It Ar file is effortless if you adhere to the following steps:

Step 1: Choose the "Get Form Now" button to begin the process.

Step 2: The document editing page is currently available. It's possible to add text or change present details.

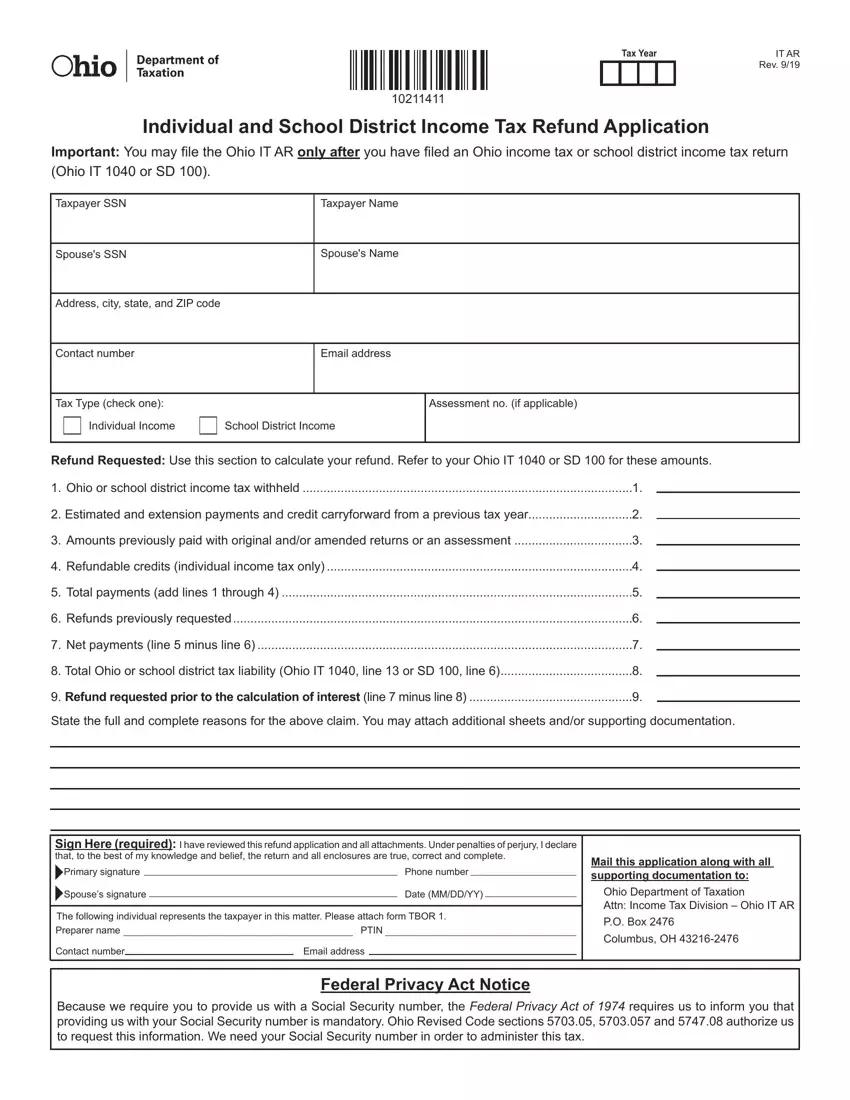

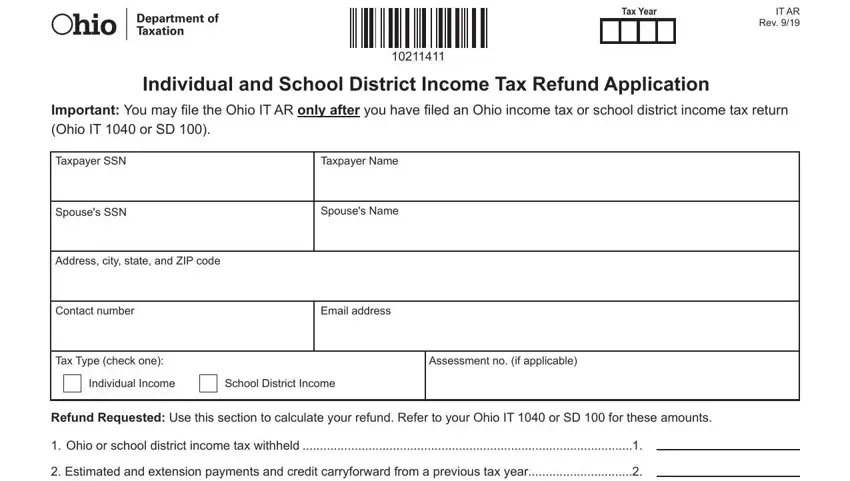

These areas will frame the PDF file that you will be creating:

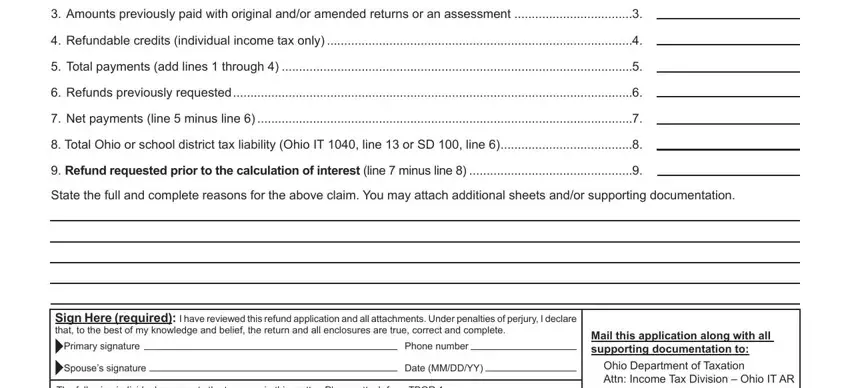

Enter the requested data in the area Amounts previously paid with, Refundable credits individual, Total payments add lines through, Refunds previously requested, Net payments line minus line, Total Ohio or school district tax, Refund requested prior to the, State the full and complete, Sign Here required I have reviewed, Spouses signature, Date MMDDYY, Primary signature, Phone number, The following individual, and Mail this application along with.

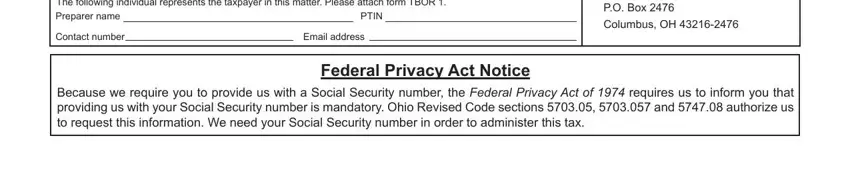

Jot down the necessary particulars in The following individual, PTIN, Contact number, Email address, Mail this application along with, and Federal Privacy Act Notice Because box.

Step 3: Press the "Done" button. Now you may transfer your PDF file to your gadget. In addition, it is possible to send it via email.

Step 4: To prevent yourself from any specific concerns down the road, you should create a minimum of a couple of copies of the form.