Filling out the Ohio Form Ins3213 document is not hard with our PDF editor. Keep up with these actions to obtain the document right away.

Step 1: At first, choose the orange "Get form now" button.

Step 2: Now you are on the document editing page. You may edit, add text, highlight particular words or phrases, place crosses or checks, and include images.

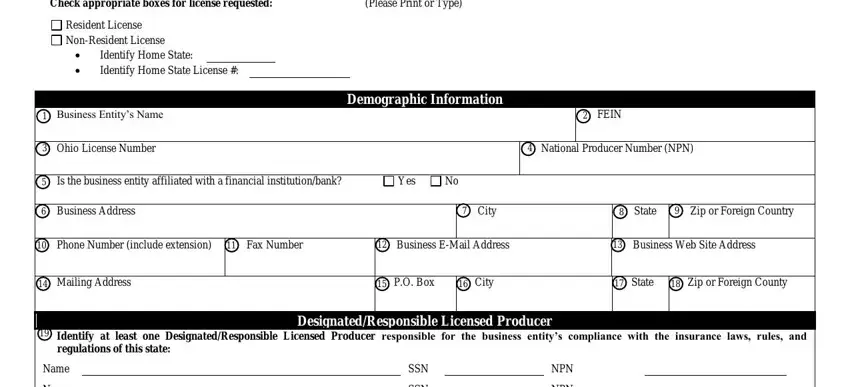

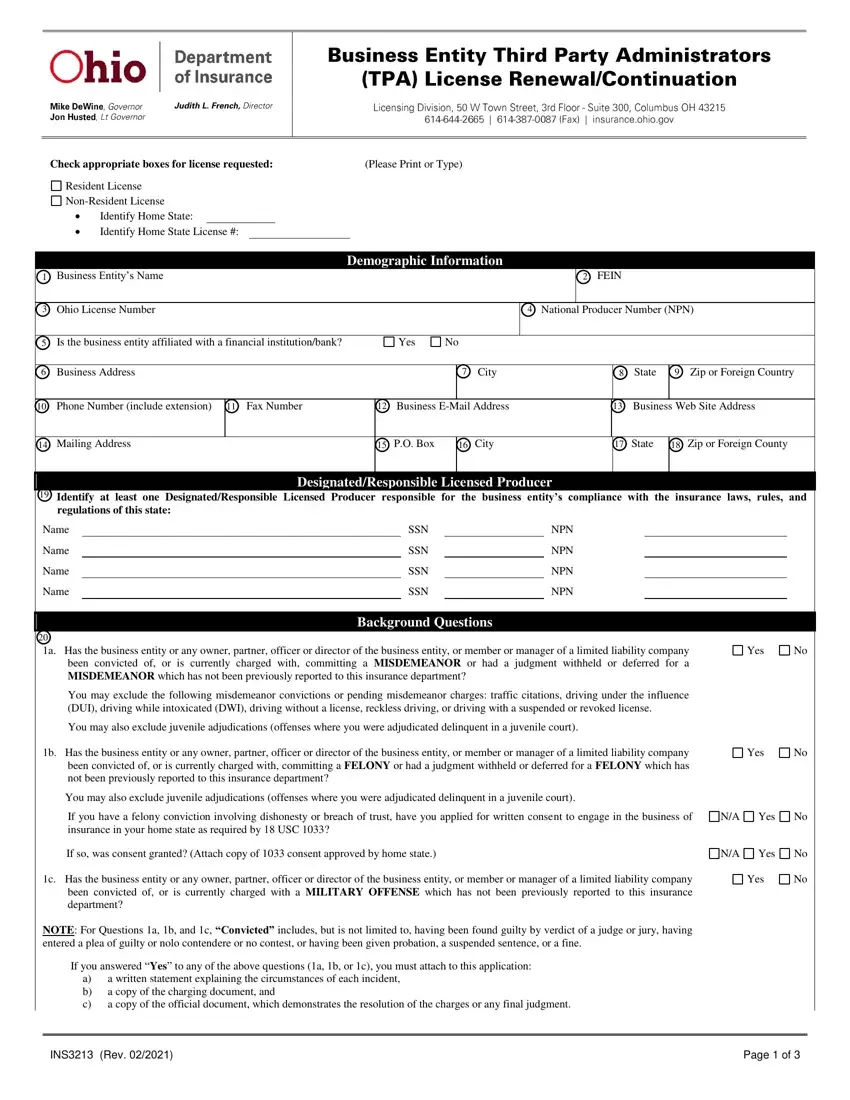

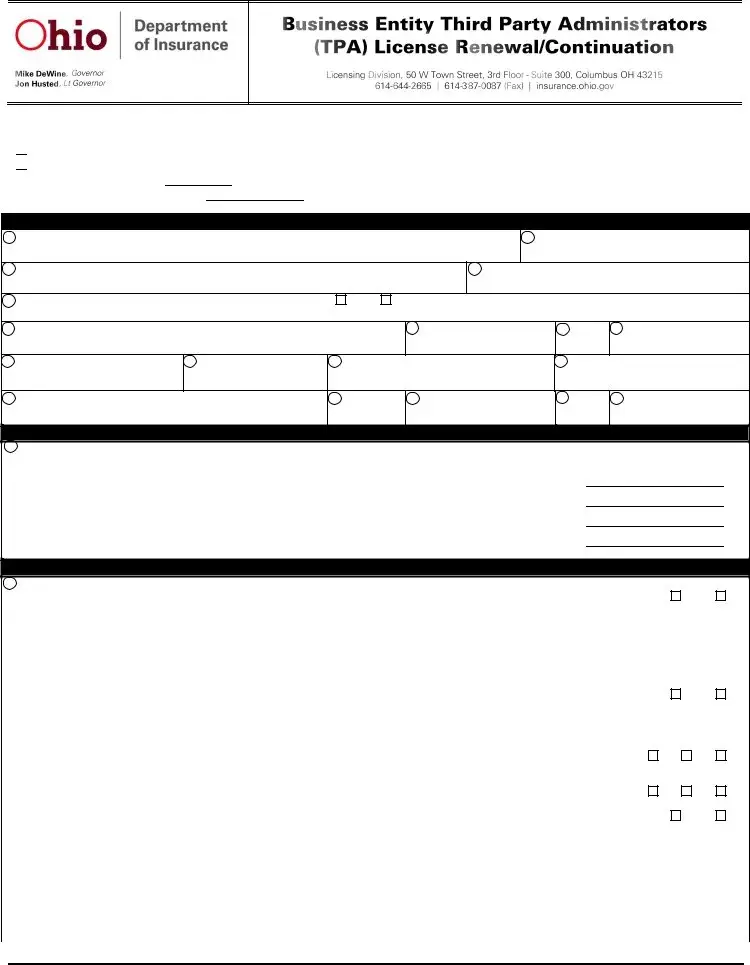

Fill out the Ohio Form Ins3213 PDF by providing the data meant for every single section.

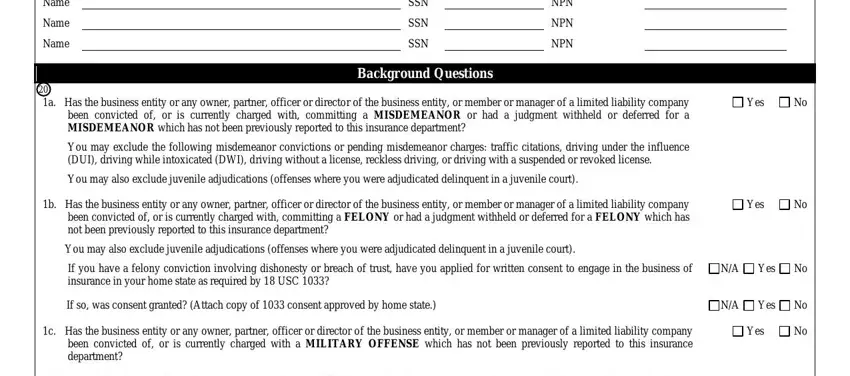

You need to enter the crucial details in the Name, Name, Name, SSN, SSN, SSN, NPN, NPN, NPN, Background Questions, a Has the business entity or any, Yes, You may exclude the following, You may also exclude juvenile, and b Has the business entity or any field.

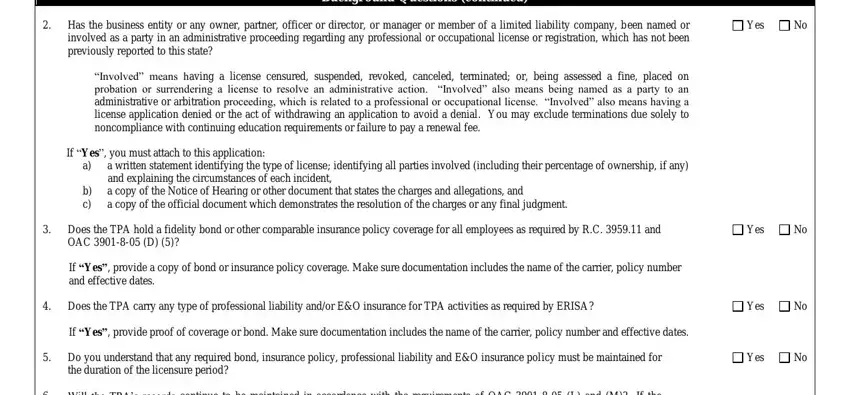

Jot down all data you may need inside the area Has the business entity or any, Yes, Background Questions continued, Involved means having a license, If Yes you must attach to this, b c, a written statement identifying, Does the TPA hold a fidelity bond, Yes, If Yes provide a copy of bond or, Does the TPA carry any type of, Yes, If Yes provide proof of coverage, Do you understand that any, and Yes.

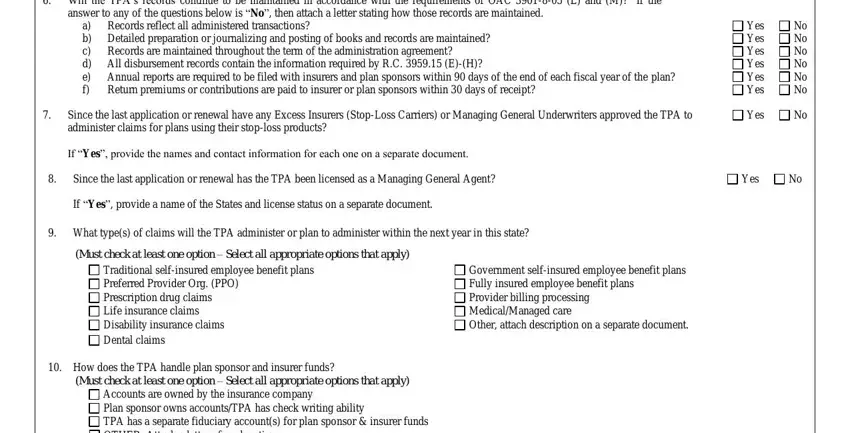

The Will the TPAs records continue to, answer to any of the questions, Records reflect all administered, a b Detailed preparation or, Annual reports are required to be, Since the last application or, If Yes provide the names and, Yes Yes Yes Yes Yes Yes, No No No No No No, Yes, Since the last application or, Yes, If Yes provide a name of the, What types of claims will the TPA, and Must check at least one option section is the place where either side can put their rights and responsibilities.

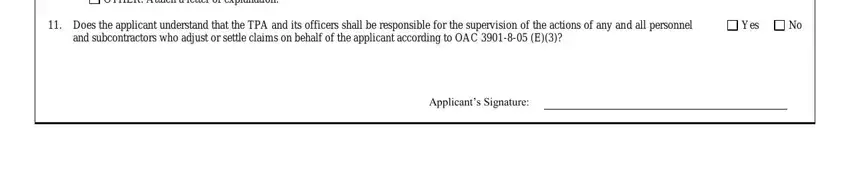

Finish by checking the following fields and typing in the pertinent details: Accounts are owned by the, Does the applicant understand, Yes, and subcontractors who adjust or, and Applicants Signature.

Step 3: Press the button "Done". Your PDF form may be transferred. You will be able download it to your laptop or email it.

Step 4: You will need to create as many copies of your file as you can to prevent potential problems.

Resident License

Resident License