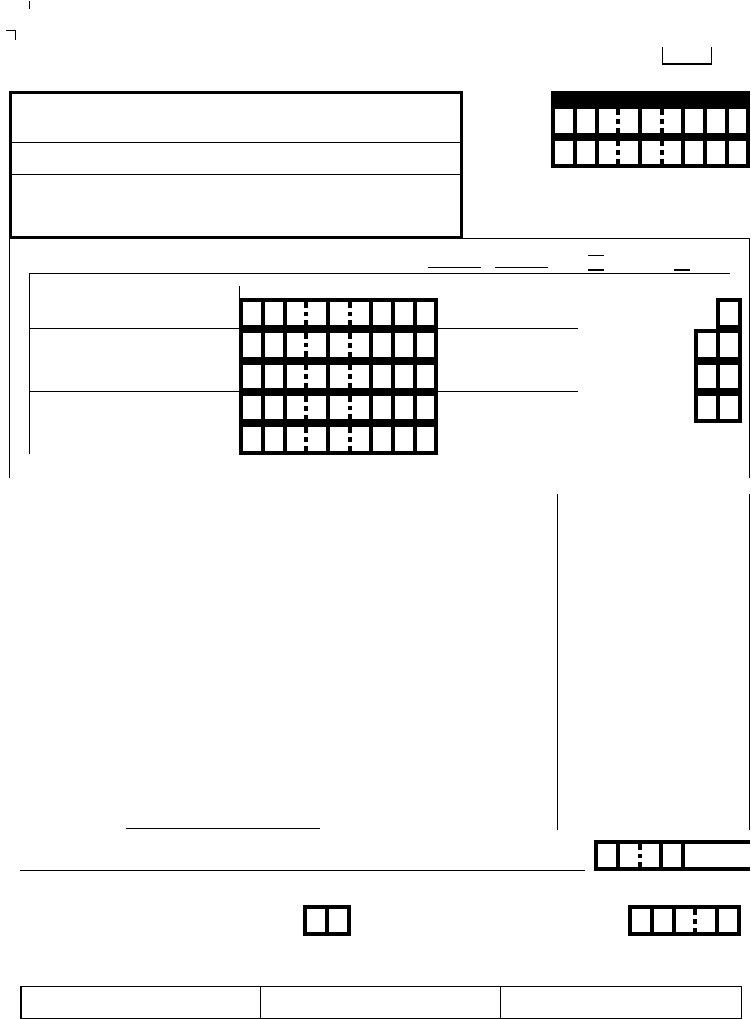

For many, understanding and navigating through tax documents can be daunting. The Oklahoma 538 S form, officially known as the "Claim for Credit or Refund of Sales Tax," offers specific opportunities for individuals residing in Oklahoma to claim sales tax credits or refunds for the year 1996. Key aspects of this form include a detailed instruction section on its reverse side, urging careful completion to avoid processing delays. This form allows certain residents—those who have received aid to the aged, blind, disabled, or Medicaid payments for nursing home care between January 1, 1996, and December 31, 1996—to request a refund of sales taxes paid. However, it explicitly excludes persons who received Aid for Dependent Children (A.F.D.C.) in the tax year 1996 from eligibility. Applicants must enter various personal information, including social security numbers for themselves and dependents, domicile details, and comprehensive income data. The document delineates how to calculate the claimable credit, with the process hinging on both the household's total income and the number of exemptions claimed. Notably, the form underscores conditions under which individuals may not qualify for the credit or refund and elaborates on what constitutes "household income".

| Question | Answer |

|---|---|

| Form Name | Oklahoma Form 538 S |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 538 s oklahoma, 538 s form, 2018538 s oklahoma, oklahoma sales tax relief form 538 s 2020 |

ITI |

0101296 |

000 |

|

|

|

|

|

|

FORM |

OKLAHOMA CLAIM FOR CREDIT OR REFUND OF SALES TAX |

||||

|

|

1 9 9 6 |

||

|

|

|

INSTRUCTIONS ON REVERSE SIDE |

|

|

|

|

AN INCOMPLETE FORM MAY DELAY YOUR REFUND |

YEAR |

|

|

|

|

|

Print first Name, Initial and Last Name (First name & initial of spouse)

Present home address (number and street, including apartment number, or rural route)

City, Town or Post Office, State and |

Zip Code |

Social Security Number

A. Yours

B. Spouse's

NOTICE: PERSONS WHO HAVE RECEIVED A.F.D.C. FOR ANY

MONTH IN THE YEAR OF 1996 WILL NOT BE ELIGIBLE FOR THE SALES TAX REFUND. The D.H.S. will make sales tax refunds to persons who have received aid to the aged, blind, disabled or Medicaid payments for nursing home care from January 1, 1996 to December 31, 1996.

Is above address a Nursing Home |

Oklahoma Resident full year? Yes _____ No _____ |

|

or Public Shelter? Yes _____ No _____ |

Date lived in Oklahoma From |

to |

d. Dependents |

SEE INSTRUCTIONS |

Yearly |

(1) Name (first, initial, and last name) (2) Age |

(3) Social Security Number |

(4) Relationship (5) Income |

Exemptions

a. Yourself b. Spouse

c. No. of boxes checked

in a. and b. above ...................

e.No. of your children from d ...............................

f.No. of other dependents from d ..............................

g.Total Exemptions claimed (Add c., e., and f.) ...

If additional exemptions are claimed, please furnish a schedule listing the information above for each additional exemption.

PART I. Enter Total Income and assistance received by ALL members of your household in the year 1996.

1.Enter total wages, salaries, fees, commissions, bonuses, tips, dividends, royalties, income from partnerships and estates and trusts, and gains from the sale or

(Round to the nearest whole dollar.)

Yearly Income

|

exchange of property (Taxable and Nontaxable) |

1. |

2. |

Enter gross rental, business and farm income (Enclose Federal Return including schedules) |

2. |

3. |

Enter total interest income received |

3. |

4.All other household income (Include all other income (Taxable and Nontaxable) received from each of the sources listed below:)

a. |

Social Security payments (Total including Medicare) ... MONTHLY |

4. a. |

b. |

Veteran's Disability Payments |

b. |

c. |

Railroad Retirement Benefits |

c. |

d. |

Other pensions & annuities |

d. |

e. |

Workmen's Compensation / Loss of Time Insurance |

e. |

f. |

Support Money |

f. |

g. |

Alimony |

g. |

h. |

Public Assistance (Include Housing Assistance, cash, etc.) |

h. |

i. |

Gross Income from |

i. |

j. |

Unemployment |

j. |

k. |

1995 Earned Income Credit received in 1996 |

k. |

l. |

Total of Dependent's Income |

l. |

m. |

Other (Specify) |

m. |

5.Total household income (Total of lines 1. thru 4. m. - Part I)

If line 5. is over $12,000, no credit or refund is allowed ..................................................................

PART II. Sales Tax Credit Computation - For Households with an Income of $12,000 or Less.

5.

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

0 0

6. Total Exemptions Claimed from box g. above |

|

0 |

0 |

||

X $40 per exemption (Credit claimed) ........ 6. |

|

||||

If you are required to file an Income Tax Return, you must claim the amount on line 6 as a credit on Form 511 line 52 or Form 511EZ |

|

||||

line 17, and enclose this form with your return. If you are NOT REQUIRED to file a return, see instructions on the back side of this form. |

|

||||

Under penalty of perjury I declare that the information contained in this document and any attachments is true and correct to the best of my knowledge and belief. |

|

||||

Taxpayer's Signature |

Date |

Spouse's Signature |

Date |

Occupation(s) |

|

NOTICE

THE DEPARTMENT OF HUMAN SERVICES (D.H.S.) WILL MAKE SALES TAX REFUNDS TO PERSONS WHO HAVE CONTINUOUSLY RECEIVED AID TO THE AGED, BLIND, DISABLED OR MEDICAID PAYMENTS FOR NURSING HOME CARE FROM JANUARY 1, 1996 TO DECEMBER 31, 1996.

PERSONS WHO HAVE RECEIVED AID FOR DEPENDENT CHILDREN (A.F.D.C.) FOR ANY MONTH IN THE YEAR OF 1996 WILL NOT BE ELIGIBLE FOR THE SALES TAX CREDIT OR REFUND.

INSTRUCTIONS

Beginning in 1990, anyone who is an Oklahoma resident and lives in Oklahoma for the entire year and whose gross household income does not exceed Twelve Thousand Dollars ($12,000) may file for sales tax relief.

For 1996 the amount shall be Forty Dollars ($40) multiplied by the number of qualified personal exemptions and qualified dependents to which you would be entitled for Oklahoma Income Tax.

EXCEPTIONS:

There is no exemption for blindness.

There is no exemption for age

A person convicted of a felony shall not be permitted to file a claim for sales tax relief for any period of time during which the person is an inmate in the custody of the Department of Corrections.

Individuals living in Oklahoma under a Visa will not qualify for the sales tax credit or refund.

If a taxpayer or spouse died during the tax year, they will not qualify for the sales tax credit or refund. If a taxpayer or spouse died after 12/31/96, but before this tax form was filed, the sales tax credit or refund for the deceased will be issued to their estate. Please indicate date of death.

If using an

To qualify as a dependent for the sales tax credit or refund, you must qualify and be claimed as a dependent for Federal Income Tax purposes. THE NAME, SOCIAL SECURITY NUMBER, AGE, RELATIONSHIP AND YEARLY INCOME (if any) MUST BE ENTERED FOR ALL DEPENDENTS. All other sales tax credit or refund requirements must also be met to qualify (Example: Resident of and lives in Oklahoma for entire year).

DEPENDENT CHILD: Enter Age and Social Security Number for all dependents. If nineteen (19) years of age, or over, enter age and “D” if disabled, or “S” if a Student. CHECK ALL SOCIAL SECURITY NUMBERS FOR ACCURACY.

OTHER DEPENDENT: A dependent on the Federal return other than your child.

For this form the “Gross Household Income” means the amount of income of every type, regardless of the source (except for gifts) received by ALL persons living in the same household, whether the income was taxable or not for income tax purposes. This includes pensions, annuities, social security, unemployment payments, veteran’s disability compensation, school grants or scholarships, public assistance payments, alimony, support money, workmen’s compensation,

If you are required to file an Oklahoma State Income Tax Return, you must claim the amount of line 6., Part II, as a credit on your tax return

If you are NOT required to file an Oklahoma State Income Tax Return, this form must be received by the Oklahoma Tax Commission on or before the 30th day of June following the close of the taxable year. If you have withholding or made a payment on estimate and are filing for a refund on Form 511RF, you must enclose this form with the 511RF; otherwise, complete, sign, and date this form and mail your completed form to: Oklahoma Tax Commission, Income Tax, 2501 Lincoln Blvd., Oklahoma City, Ok

All information must be furnished or the processing of your claim or refund will be delayed.