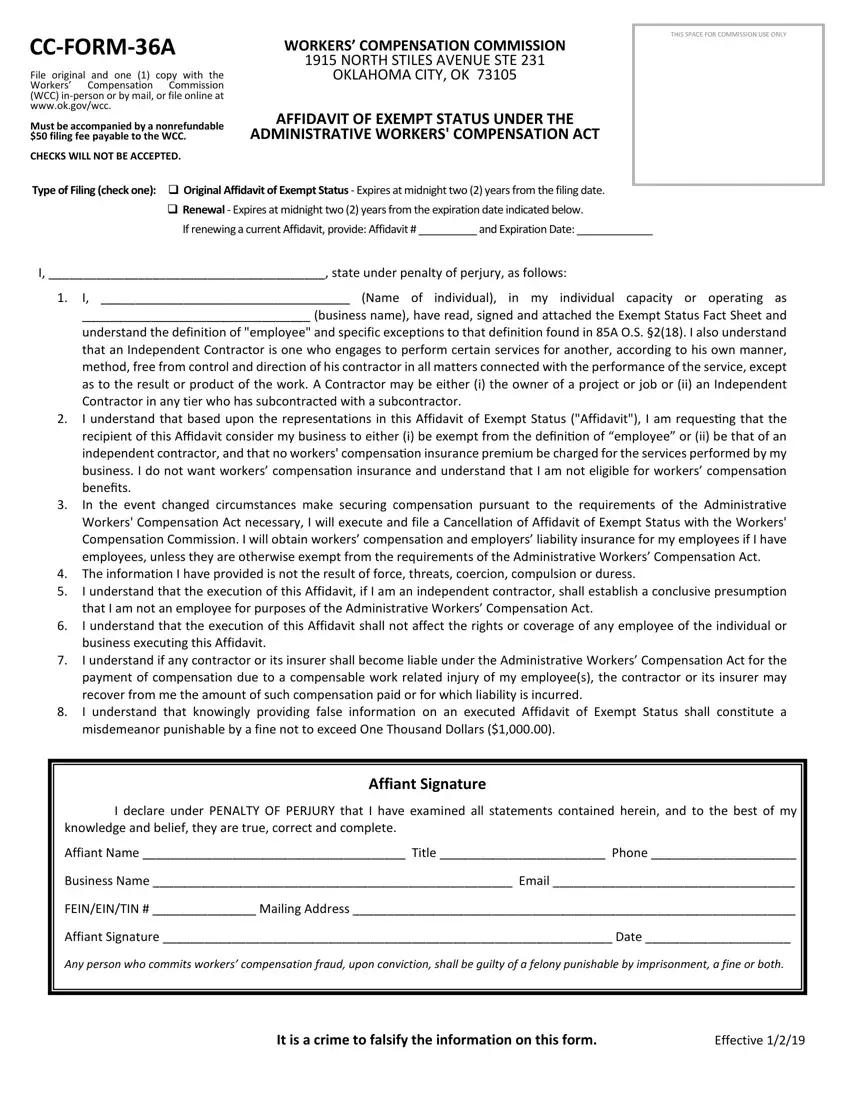

THIS SPACE FOR COMMISSION USE ONLY

CC-FORM-36A |

WORKERS’ COMPENSATION COMMISSION |

|

1915 NORTH STILES AVENUE STE 231 |

File original and one (1) copy with the |

OKLAHOMA CITY, OK 73105 |

Workers’ Compensation Commission |

|

(WCC) in-person or by mail, or file online at |

|

www.ok.gov/wcc. |

AFFIDAVIT OF EXEMPT STATUS UNDER THE |

Must be accompanied by a nonrefundable |

$50 filing fee payable to the WCC. |

ADMINISTRATIVE WORKERS' COMPENSATION ACT |

CHECKS WILL NOT BE ACCEPTED. |

|

Type of Filing (check one): Original Affidavit of Exempt Status - Expires at midnight two (2) years from the filing date.

Renewal - Expires at midnight two (2) years from the expiration date indicated below.

If renewing a current Affidavit, provide: Affidavit # __________ and Expiration Date: _____________

I, ________________________________________, state under penalty of perjury, as follows:

1.I, ____________________________________ (Name of individual), in my individual capacity or operating as

_________________________________ (business name), have read, signed and attached the Exempt Status Fact Sheet and understand the definition of "employee" and specific exceptions to that definition found in 85A O.S. §2(18). I also understand that an Independent Contractor is one who engages to perform certain services for another, according to his own manner, method, free from control and direction of his contractor in all matters connected with the performance of the service, except as to the result or product of the work. A Contractor may be either (i) the owner of a project or job or (ii) an Independent Contractor in any tier who has subcontracted with a subcontractor.

2.I understand that based upon the representations in this Affidavit of Exempt Status ("Affidavit"), I am reques�ng that the recipient of this Affidavit consider my business to either (i) be exempt from the defini�on of “employee” or (ii) be that of an independent contractor, and that no workers' compensa�on insurance premium be charged for the services performed by my business. I do not want workers’ compensa�on insurance and understand that I am not eligible for workers’ compensa�on benefits.

3.In the event changed circumstances make securing compensation pursuant to the requirements of the Administrative Workers' Compensation Act necessary, I will execute and file a Cancellation of Affidavit of Exempt Status with the Workers' Compensation Commission. I will obtain workers’ compensation and employers’ liability insurance for my employees if I have employees, unless they are otherwise exempt from the requirements of the Administrative Workers’ Compensation Act.

4.The information I have provided is not the result of force, threats, coercion, compulsion or duress.

5.I understand that the execution of this Affidavit, if I am an independent contractor, shall establish a conclusive presumption that I am not an employee for purposes of the Administrative Workers’ Compensation Act.

6.I understand that the execution of this Affidavit shall not affect the rights or coverage of any employee of the individual or business executing this Affidavit.

7.I understand if any contractor or its insurer shall become liable under the Administrative Workers’ Compensation Act for the payment of compensation due to a compensable work related injury of my employee(s), the contractor or its insurer may recover from me the amount of such compensation paid or for which liability is incurred.

8.I understand that knowingly providing false information on an executed Affidavit of Exempt Status shall constitute a misdemeanor punishable by a fine not to exceed One Thousand Dollars ($1,000.00).

Affiant Signature

I declare under PENALTY OF PERJURY that I have examined all statements contained herein, and to the best of my knowledge and belief, they are true, correct and complete.

Affiant Name ______________________________________ Title ________________________ Phone _____________________

Business Name ____________________________________________________ Email ___________________________________

FEIN/EIN/TIN # _______________ Mailing Address ________________________________________________________________

Affiant Signature _________________________________________________________________ Date _____________________

Any person who commits workers’ compensation fraud, upon conviction, shall be guilty of a felony punishable by imprisonment, a fine or both.