Our finest software engineers have worked collectively to design the PDF editor that you may go with. The app makes it simple to prepare oesc ez tax express forms shortly and with ease. This is all you have to conduct.

Step 1: To start out, hit the orange button "Get Form Now".

Step 2: It's now possible to modify the oesc ez tax express. Our multifunctional toolbar lets you add, remove, adapt, and highlight text or perhaps perform other commands.

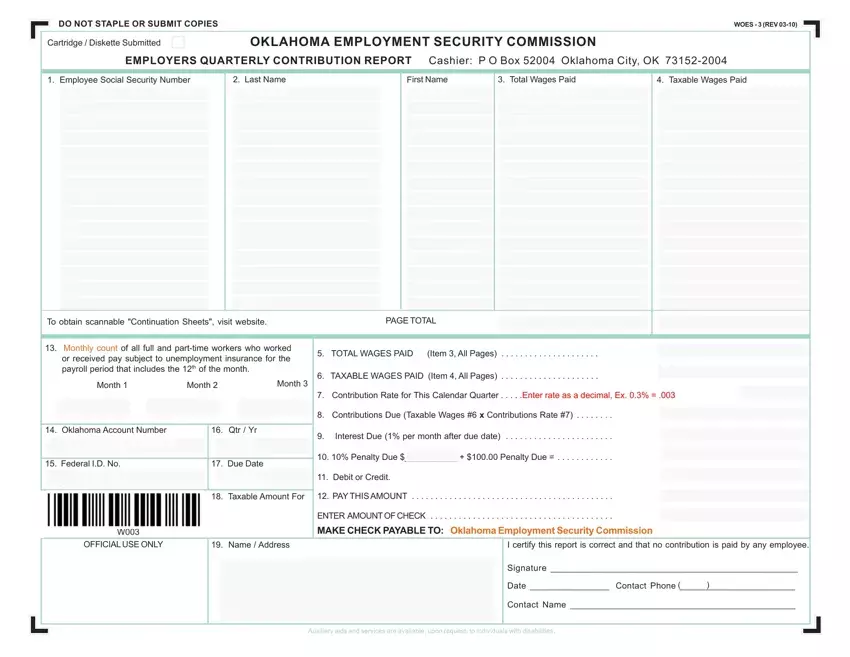

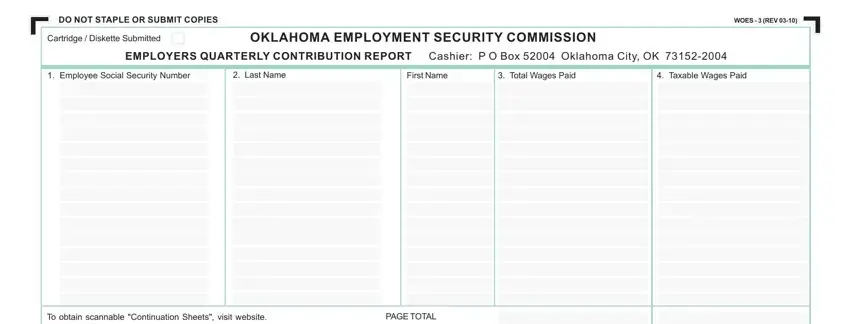

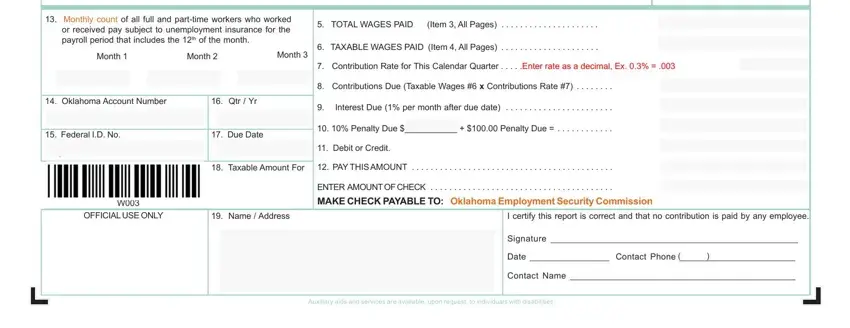

You will need to type in the following information so that you prepare the document:

Put down the information in the Monthly count of all full and, Month, Month, Month, TOTAL WAGES PAID Item All Pages, TAXABLE WAGES PAID Item All, Contribution Rate for This, Oklahoma Account Number, Qtr Yr, Federal ID No, Due Date, Contributions Due Taxable Wages, Interest Due per month after due, Penalty Due Penalty Due, and Debit or Credit field.

Step 3: When you are done, hit the "Done" button to upload the PDF document.

Step 4: Have a duplicate of every file. It would save you time and make it easier to prevent issues as time goes on. Keep in mind, your details isn't distributed or monitored by us.