Using PDF documents online is actually a breeze using our PDF tool. You can fill in oklahoma 215 franchise tax return here painlessly. The editor is continually maintained by us, getting new features and becoming more versatile. Should you be looking to get going, here is what it will take:

Step 1: Click on the "Get Form" button at the top of this webpage to open our editor.

Step 2: With our advanced PDF tool, it is easy to accomplish more than merely fill in blank fields. Edit away and make your documents appear sublime with custom textual content added, or optimize the original content to perfection - all accompanied by the capability to incorporate any kind of pictures and sign the file off.

It is straightforward to finish the form using this helpful guide! This is what you must do:

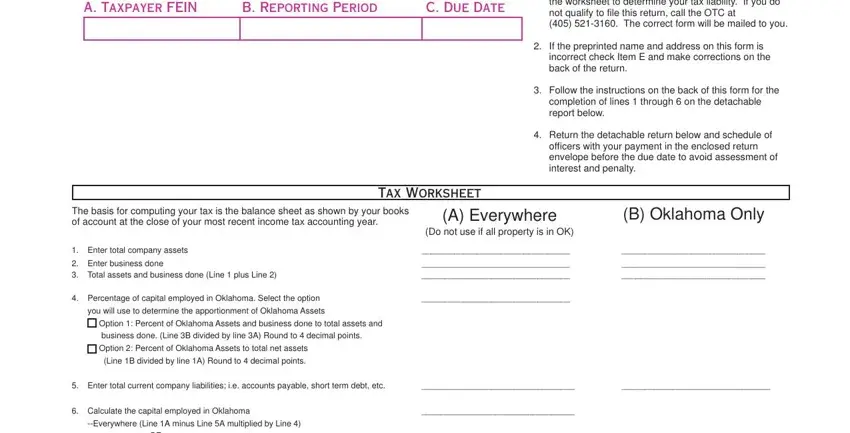

1. The oklahoma 215 franchise tax return needs particular information to be inserted. Be sure the subsequent blank fields are finalized:

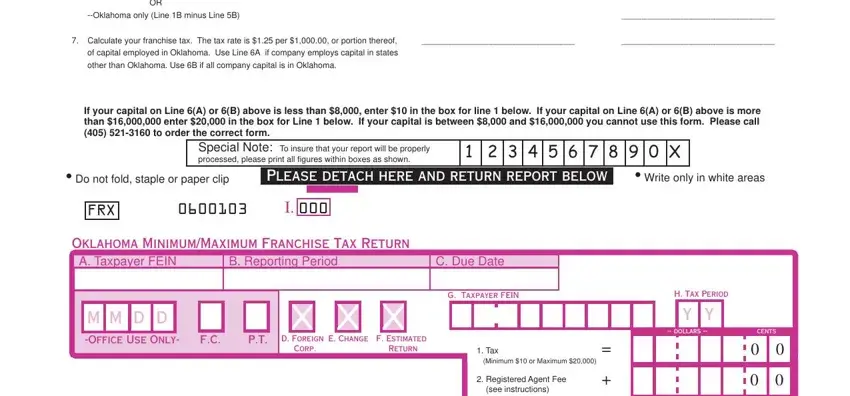

2. The next stage is to submit all of the following fields: Oklahoma only Line B minus Line B, Calculate your franchise tax The, of capital employed in Oklahoma, other than Oklahoma Use B if all, If your capital on Line A or B, Special Note To insure that your, Do not fold staple or paper clip, Please detach here and return, Write only in white areas, FRX, Oklahoma MinimumMaximum Franchise, A Taxpayer FEIN, B Reporting Period, C Due Date, and M M D D.

When it comes to Oklahoma MinimumMaximum Franchise and other than Oklahoma Use B if all, make sure that you do everything properly in this section. The two of these are definitely the most important fields in this form.

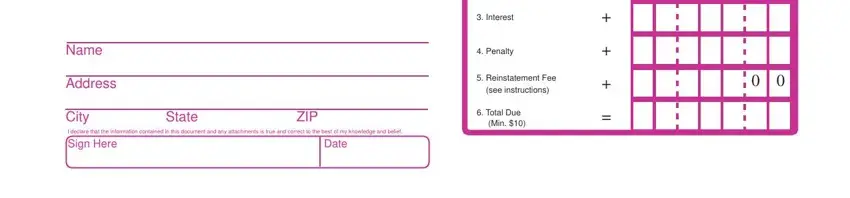

3. Completing Name, Address, City, State, ZIP, I declare that the information, Sign Here, Date, Interest, Penalty, Reinstatement Fee see instructions, and Total Due Min is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

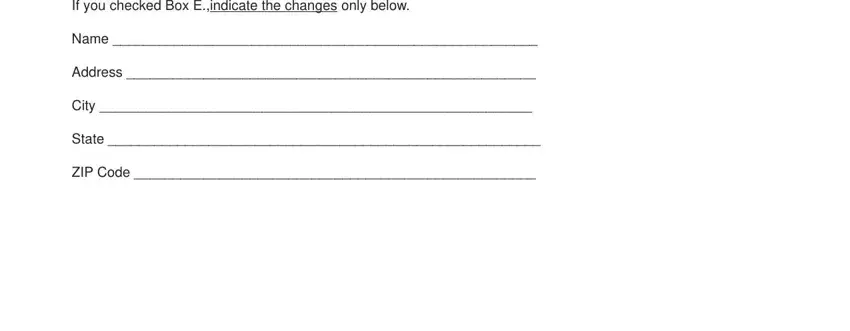

4. It is time to complete the next segment! In this case you've got these Changes in PrePrinted Information, Name, Address, City, State, and ZIP Code form blanks to complete.

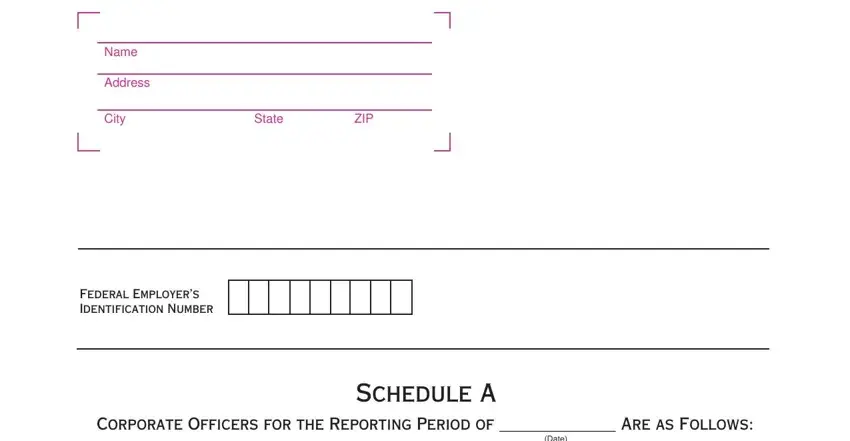

5. To wrap up your form, this particular area incorporates a number of additional fields. Completing Name, Address, City, State, ZIP, Federal Employers Identification, Corporate Officers for the, Date, and Schedule A should conclude everything and you'll definitely be done very fast!

Step 3: Once you have looked over the details in the blanks, simply click "Done" to complete your form. After getting afree trial account at FormsPal, you'll be able to download oklahoma 215 franchise tax return or send it through email at once. The PDF will also be readily accessible through your personal account menu with your each and every modification. When you work with FormsPal, you're able to complete forms without needing to be concerned about database incidents or records getting shared. Our protected software ensures that your personal data is stored safe.