It is possible to complete Oregon Form 20 S effectively in our PDFinity® PDF editor. To retain our tool on the cutting edge of convenience, we strive to adopt user-oriented capabilities and enhancements regularly. We're routinely grateful for any suggestions - join us in revolutionizing PDF editing. Here's what you will have to do to get going:

Step 1: Just click the "Get Form Button" in the top section of this webpage to open our pdf file editor. There you'll find everything that is necessary to work with your file.

Step 2: After you launch the tool, you will get the document prepared to be completed. Apart from filling out various blank fields, you might also perform several other actions with the form, particularly putting on any words, changing the initial textual content, adding images, affixing your signature to the document, and a lot more.

It is actually simple to fill out the pdf following this practical guide! Here is what you want to do:

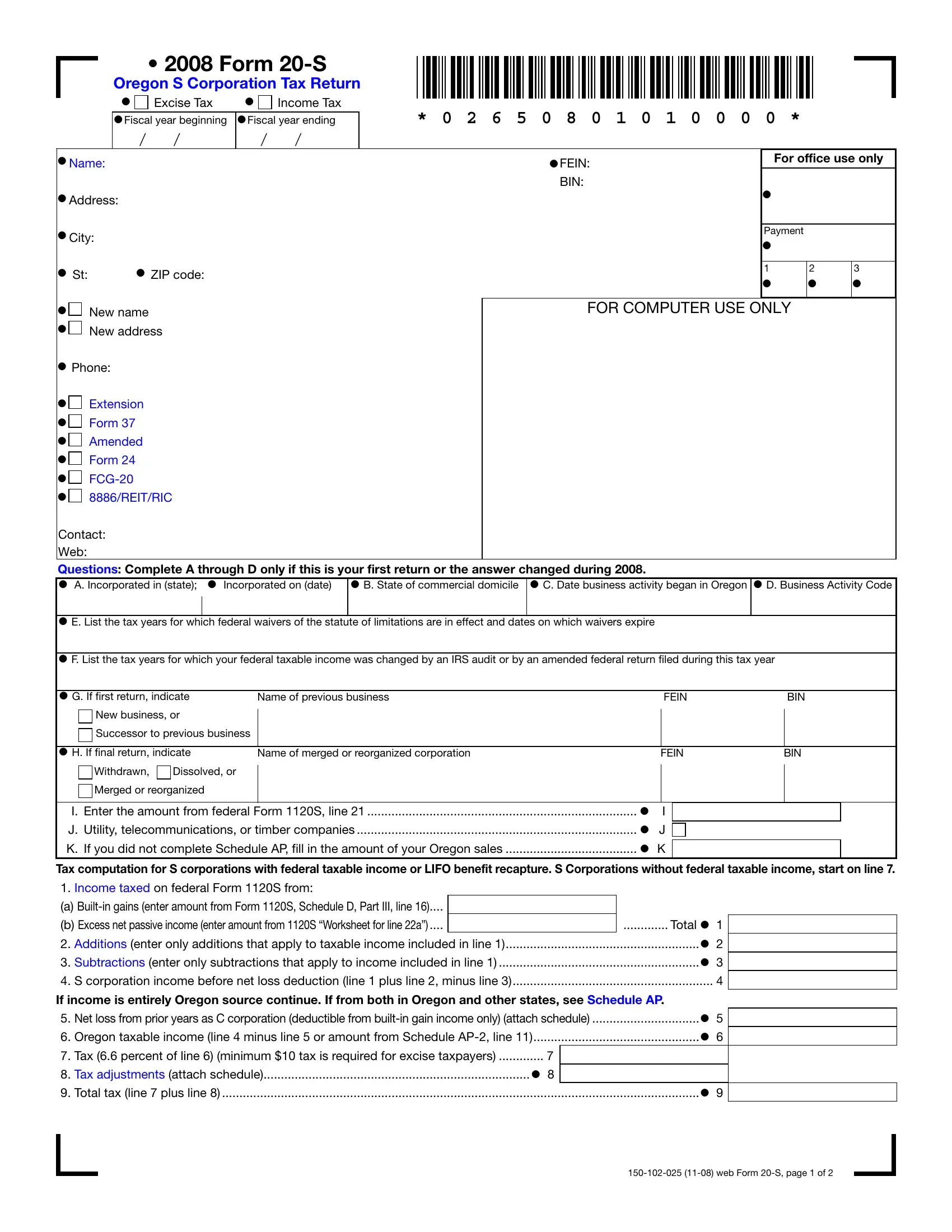

1. First, once filling in the Oregon Form 20 S, start out with the part containing subsequent blanks:

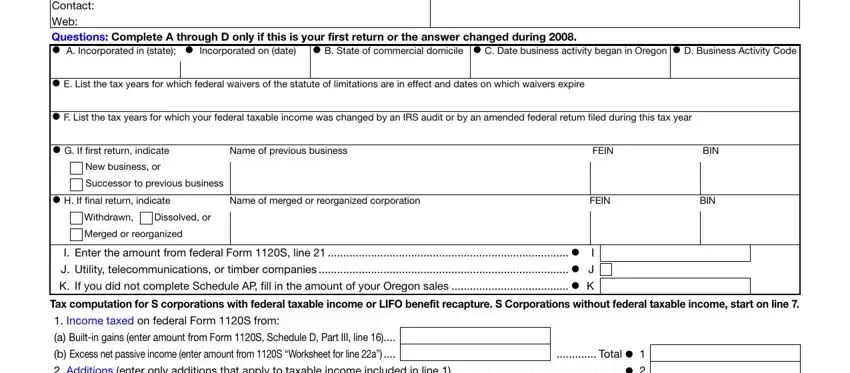

2. Once your current task is complete, take the next step – fill out all of these fields - Contact Web Questions Complete A, B State of commercial domicile C, Incorporated on date, A Incorporated in state E List, Name of previous business, FEIN, BIN, BIN, New business or, Successor to previous business, H If final return indicate, Withdrawn, Dissolved or, Merged or reorganized, and Name of merged or reorganized with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

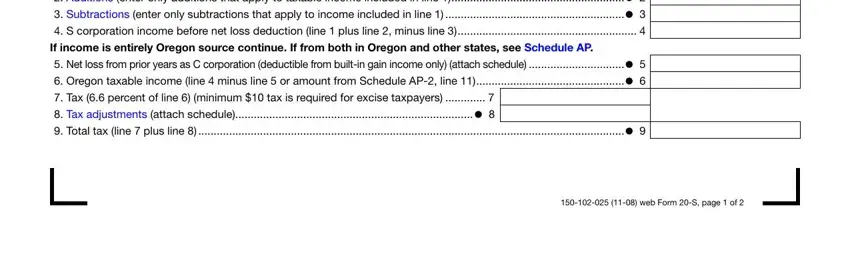

3. Within this stage, examine Total Additions enter only, S corporation income before net, If income is entirely Oregon, Net loss from prior years as C, Tax percent of line minimum, and web Form S page of. Every one of these have to be filled out with utmost attention to detail.

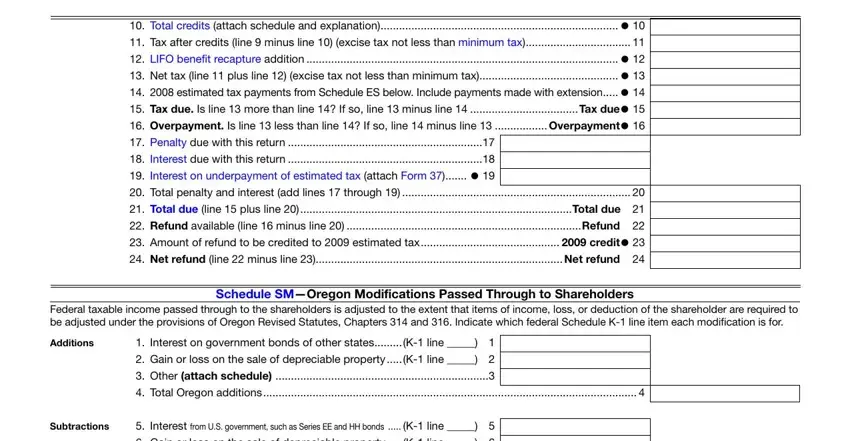

4. Filling in Tax after credits line minus, Total credits attach schedule and, Penalty due with this return, Interest on underpayment of, Total penalty and interest add, Amount of refund to be credited, Net refund line minus line Net, Federal taxable income passed, Schedule SMOregon Modifications, Additions, Interest on government bonds of, Subtractions, and Interest from US government such is key in this fourth part - don't forget to don't hurry and fill in each blank!

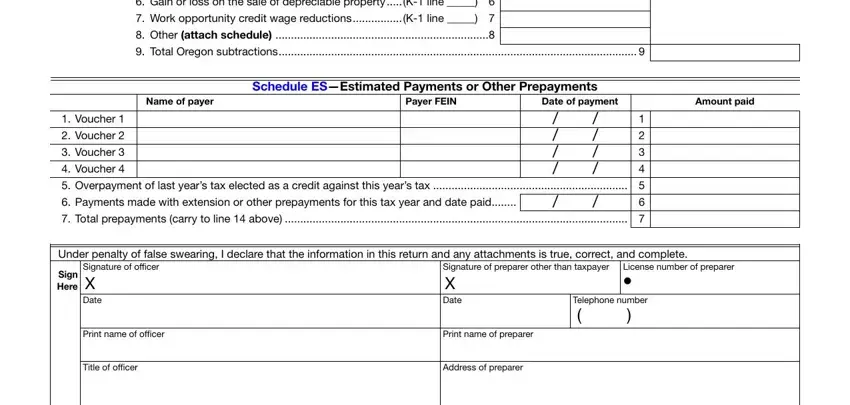

5. To conclude your document, this particular subsection features some extra blank fields. Typing in Subtractions, Interest from US government such, Name of payer, Payer FEIN, Date of payment, Amount paid, Schedule ESEstimated Payments or, Voucher Voucher Voucher, Under penalty of false swearing I, Sign Here, Signature of officer X Date, Print name of officer, Title of officer, Signature of preparer other than, and License number of preparer will conclude everything and you can be done in no time!

It is easy to make errors when completing the Subtractions, hence make sure you look again prior to when you finalize the form.

Step 3: Prior to finalizing the form, make certain that all blank fields are filled out correctly. As soon as you establish that it's fine, click on “Done." Find the Oregon Form 20 S as soon as you register at FormsPal for a 7-day free trial. Readily gain access to the document inside your FormsPal account, along with any modifications and adjustments being conveniently saved! FormsPal guarantees protected document editing with no personal data record-keeping or any kind of sharing. Feel at ease knowing that your data is in good hands here!