In the picturesque state of Oregon, where the economy ranges from agriculture to technology, and the landscapes from coastal vistas to mountain ranges, residents navigate not only the physical terrain but also the complexities of state tax obligations. Among the array of documents pivotal to this process is the Oregon 40 Ext form, a critical tool for taxpayers seeking an extension on their filing due date. While federal tax extensions are commonly discussed, the nuances of state-specific extensions, such as Oregon's, play an equally vital role in ensuring taxpayers can adequately meet their responsibilities without penalty. Designed to provide additional time for individuals to gather necessary documents, review financial transactions, and consult with professionals if needed, the extension does not absolve taxpayers from estimating and paying any taxes due by the original deadline. Thus, the Oregon 40 Ext form embodies a bridge, allowing taxpayers to cross the gap between fiscal years with greater accuracy and peace of mind, albeit under the watchful eye of deadlines and obligations that remain inescapable.

| Question | Answer |

|---|---|

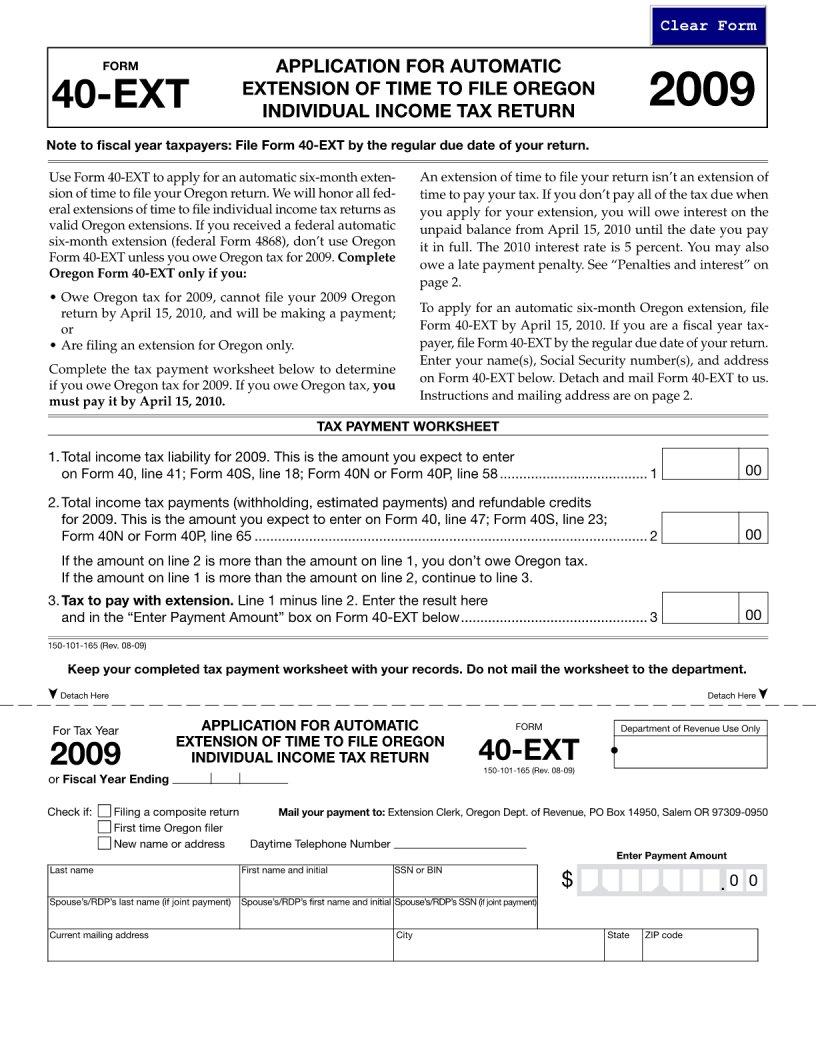

| Form Name | Oregon Form 40 Ext |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 101 165 09fill 40 ext fillable form |