The PDF editor that you can go with was developed by our best programmers. It is possible to prepare the pa 501 form file instantly and efficiently with this software. Just follow this procedure to get going.

Step 1: The first task is to select the orange "Get Form Now" button.

Step 2: At the moment you are on the file editing page. You can modify and add content to the form, highlight specified content, cross or check particular words, include images, insert a signature on it, delete needless areas, or take them out altogether.

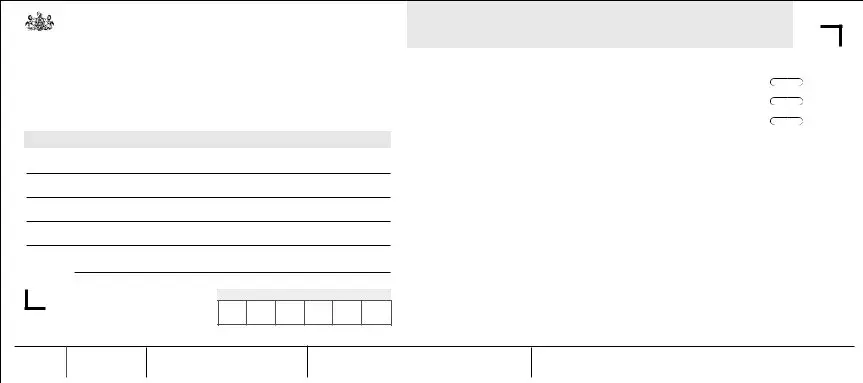

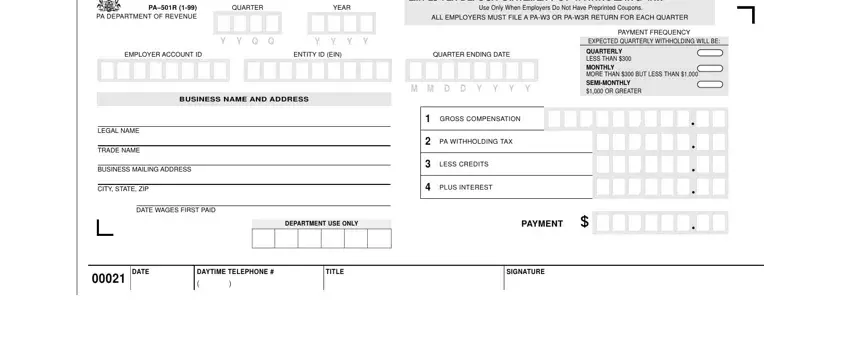

In order to create the file, type in the content the platform will ask you to for each of the appropriate sections:

Step 3: If you're done, select the "Done" button to export your PDF file.

Step 4: Try to get as many copies of your document as you can to remain away from possible misunderstandings.