It really is very easy to fill in the pa100. Our PDF editor was meant to be help you complete any PDF efficiently. These are the basic actions to take:

Step 1: The very first step is to hit the orange "Get Form Now" button.

Step 2: The file editing page is now available. Include text or enhance existing information.

If you want to prepare the template, type in the content the platform will request you to for each of the following sections:

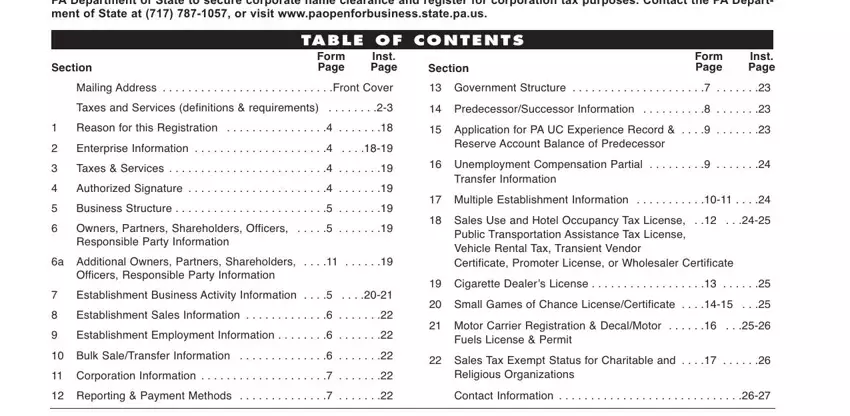

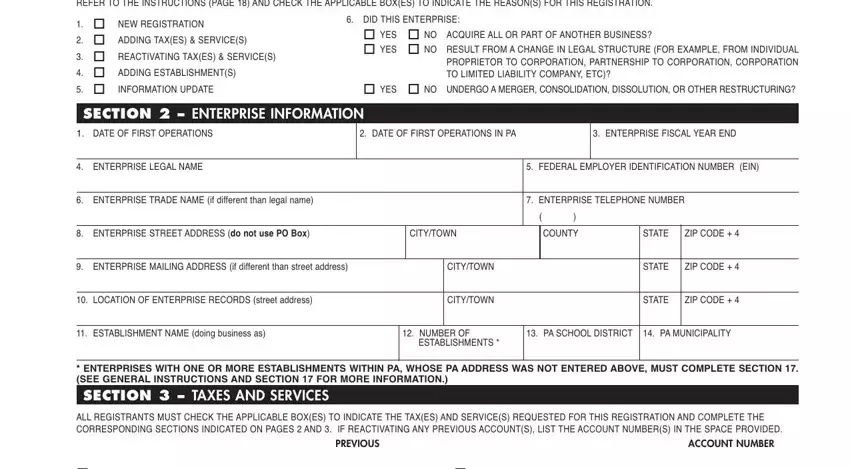

Type in the details in the Section, TABLE, OF, CONTENTS Form, Page In, st, Page Section, Form, Page In, st, Page mailing, Address, front, Cover government, structure Predecessor, successor, information Reason, for, this, Registration Application, for, PAu, C, experience, Record enterprise, information Taxes, services and Authorized, signature field.

Write any details you may need in the area onew, RegisTRATion o, ADDing, TAxes, seRviCes o, ReACTivATing, TAxes, seRviCes o, ADDing, esTAblishmenTs o, infoRmATion, uPDATe SECTION, ENTERPRISE, INFORMATION esTAblishmenTs, and ACCOUNT, NUMBER

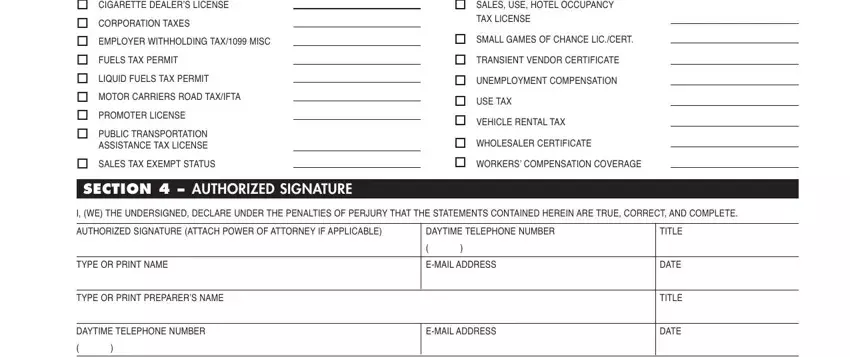

Indicate the rights and responsibilities of the sides inside the box o, CigAReTTe, DeAleRs, liCense o, CoRPoRATion, TAxes o, emPloyeR, wiThholDing, TAx, misC o, fuels, TAx, PeRmiT o, liQuiD, fuels, TAx, PeRmiT o, moToR, CARRieRs, RoAD, TAxi, fT, A o, PRomoTeR, liCense o, sAles, TAx, exemPT, sTATus o, sAles, use, hoTel, oCCuPAnCy, TAx, liCense o, smAll, gAmes, of, ChAnCel, iCC, eRT o, TRAnsienT, venDoR, CeRTifiCATe o, unemPloymenT, ComPensATion ouse, TAx o, vehiCle, RenTAl, TAx and o, wholesAleR, CeRTifiCATe

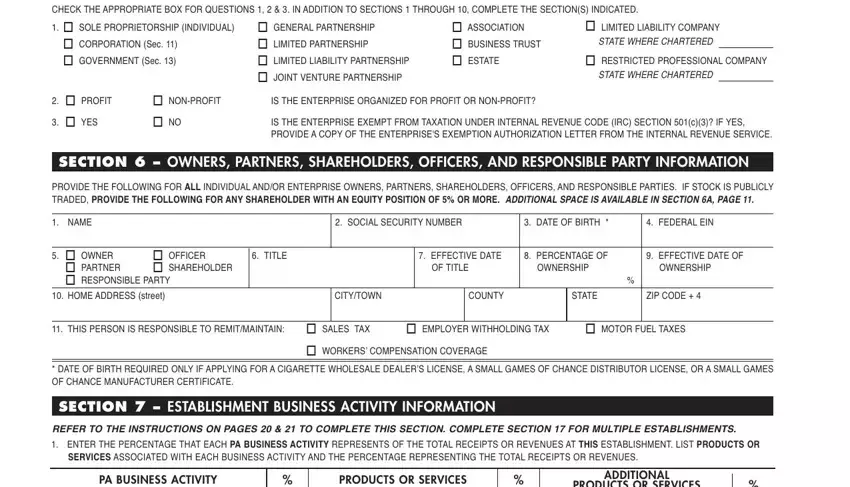

End by taking a look at all these fields and filling them in as required: STATE, WHERE, CHARTERED o, JoinT, venTuRe, PARTneRshiP STATE, WHERE, CHARTERED owneRshiP, of, TiTle owneRshiP, o, woRKeRs, ComPensATion, CoveRAge PA, BUSINESS, ACTIVITY PRODUCTS, OR, SERVICES ADDITIONAL, and PRODUCTS, OR, SERVICES

Step 3: Hit the button "Done". The PDF document is available to be exported. You can easily upload it to your laptop or email it.

Step 4: Make duplicates of your form - it will help you stay away from potential concerns. And don't worry - we are not meant to display or see your data.