The farm tax exemption form completing procedure is hassle-free. Our editor lets you use any PDF file.

Step 1: Click the button "Get form here" to get into it.

Step 2: Now you are capable of manage farm tax exemption form. You have many options with our multifunctional toolbar - you'll be able to add, erase, or alter the text, highlight the particular parts, and conduct several other commands.

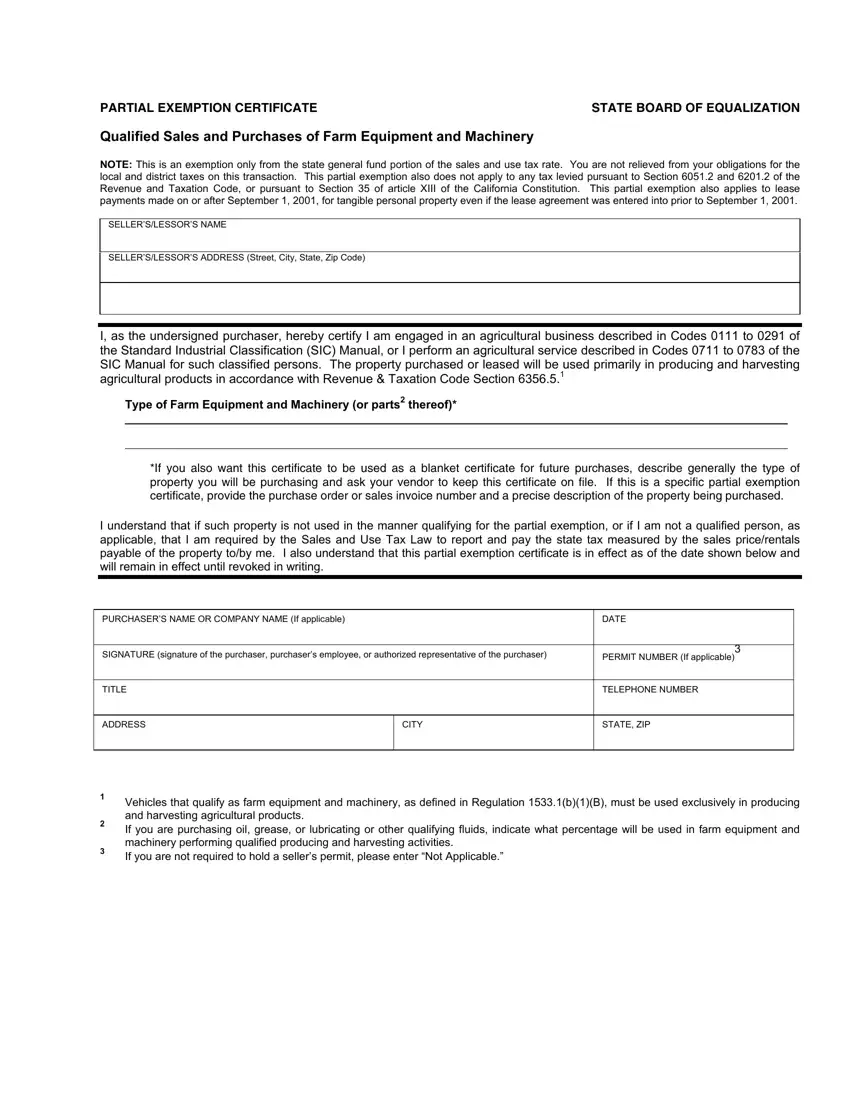

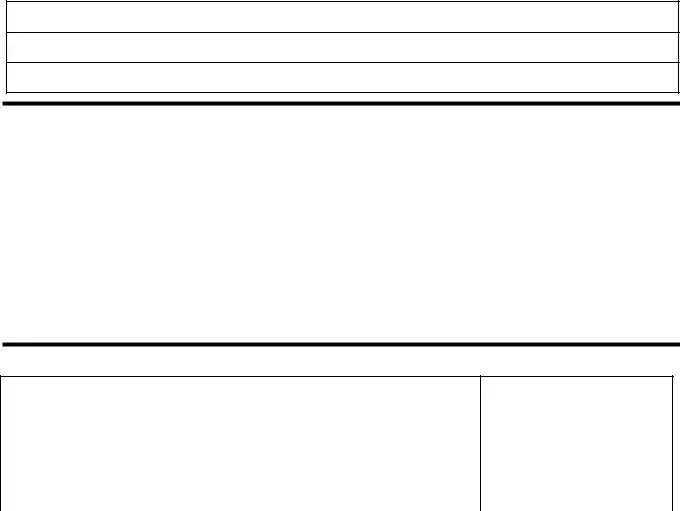

Prepare the particular segments to fill in the file:

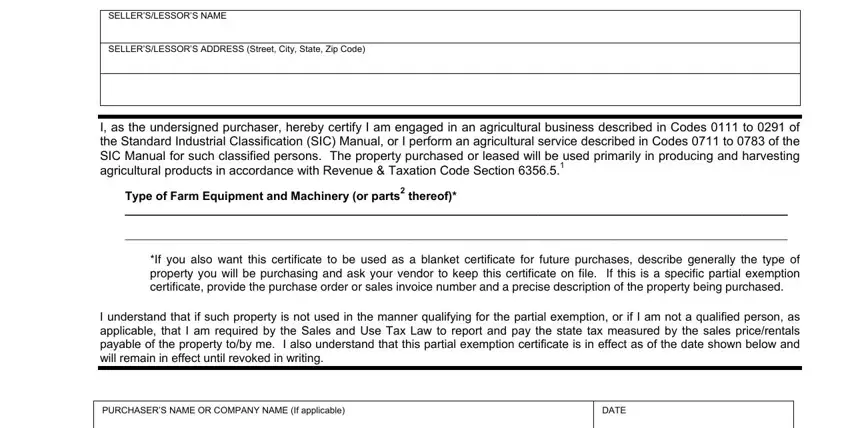

Within the field SIGNATURE signature of the, PERMIT NUMBER If applicable, TELEPHONE NUMBER, CITY, STATE ZIP, TITLE, ADDRESS, and Vehicles that qualify as farm type in the particulars the software requests you to do.

Step 3: Click the "Done" button. Next, you can export the PDF file - download it to your device or send it by means of email.

Step 4: To protect yourself from probable forthcoming troubles, it is important to obtain up to a few duplicates of every form.