Filling out sales tax exemption certificate tennessee is simple. We designed our software to really make it user-friendly and uncomplicated and allow you to prepare any form online. Here are a few steps that you need to go through:

Step 1: Click the button "Get form here" to open it.

Step 2: So you're on the document editing page. You may change and add content to the file, highlight specified content, cross or check particular words, insert images, sign it, delete unneeded areas, or take them out completely.

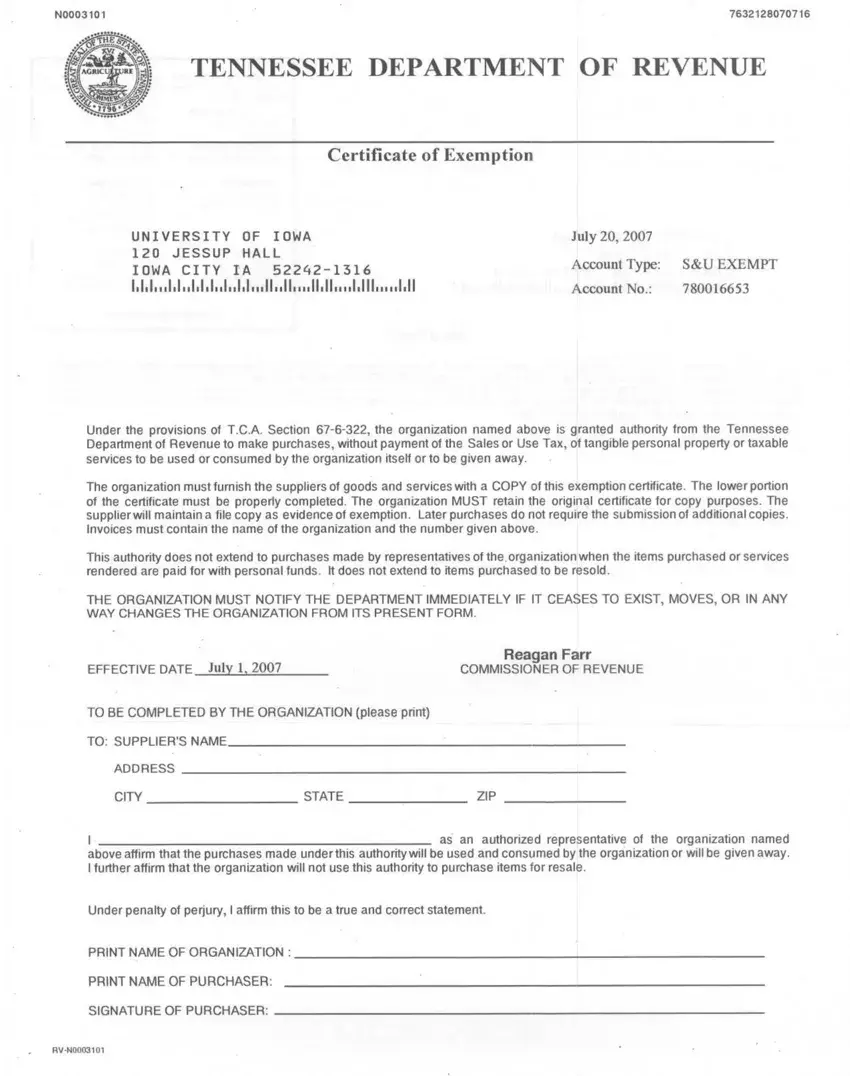

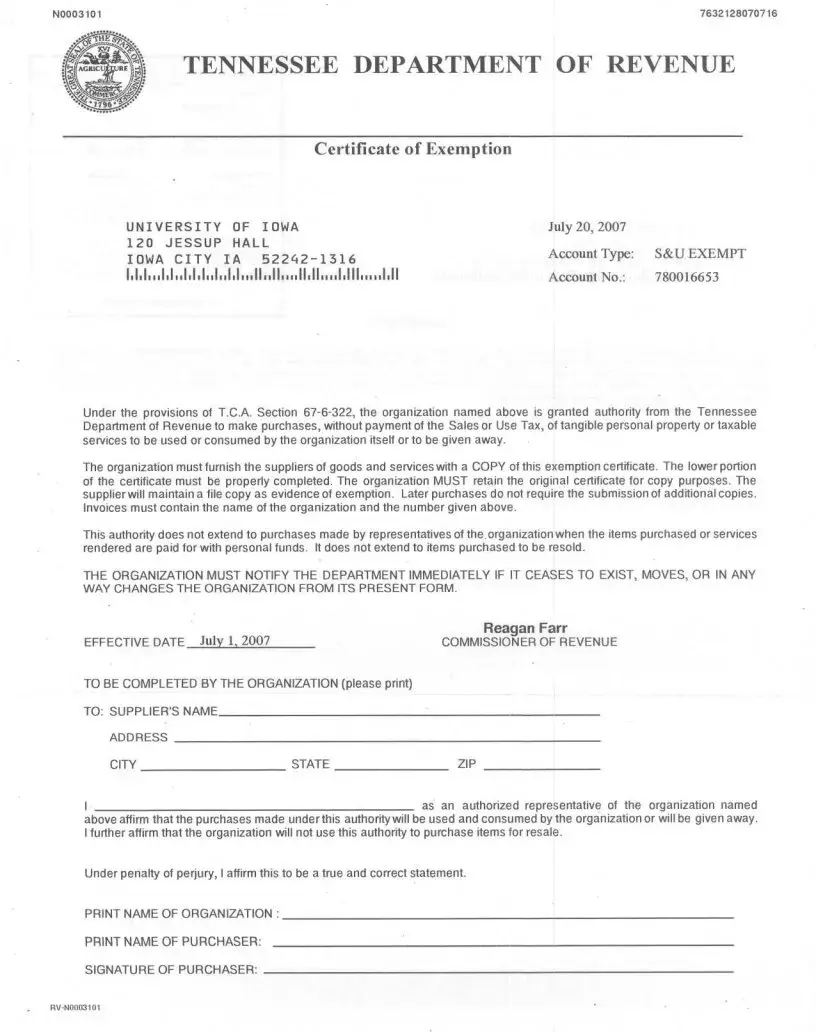

Type in the required information in each segment to complete the PDF sales tax exemption certificate tennessee

Step 3: After you've selected the Done button, your form will be ready for transfer to any electronic device or email address you identify.

Step 4: Generate copies of your form - it may help you keep away from possible future challenges. And don't worry - we cannot disclose or see your details.