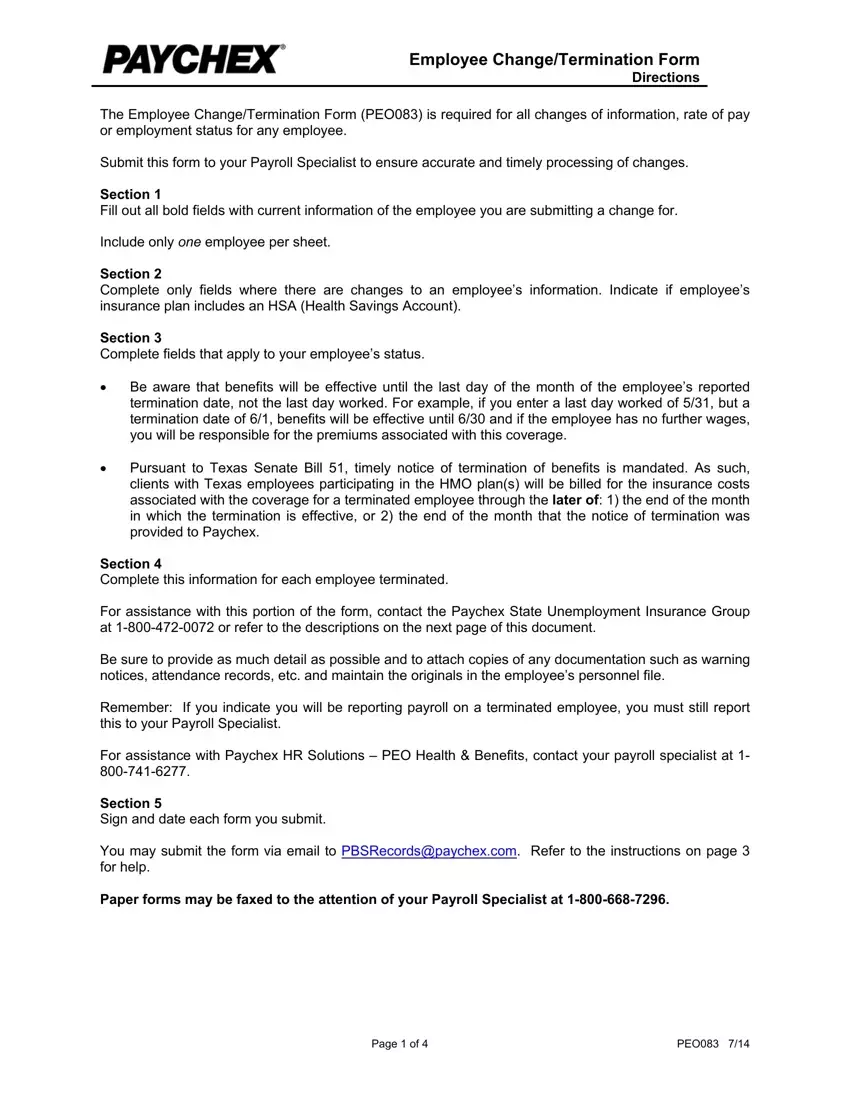

Lack of Work

A common non-disqualifying separation that usually results in charges against the employer’s account and includes reduction in work hours, completed assignments, plant shutdowns, and per diem work.

Voluntary

If the claimant establishes he quit “with good cause” related to work, the state may grant benefits which can be charged to your reserve account. To establish the claimant voluntarily quit without good cause attributable to the employer, or he failed to do everything possible to preserve his job, ensure you can support your position by answering these questions:

Was an exit interview conducted?

Did the employee submit a written resignation? If so, to whom was the resignation given? Was it signed?

Did the employee give a reason for resigning? If so, what was the reason?

Was there any change to the employee’s job duties, pay, hours, etc.?

Had the employee previously expressed any dissatisfaction? If so, with whom was this discussed?

Did the employee request a transfer or leave of absence?

What actions, if any, were taken by the company to resolve any complaints of the employee?

These questions provide a basis for documenting most voluntary resignation situations. However, depending on the employee’s exact reason for resigning, additional information may be needed to determine if he quit “with good cause.”

Discharge

A discharge is a permanent separation, initiated by the employer, in which the employee does not meet employer expectations either through lack of ability or misconduct. Misconduct is described as a willful or deliberate act the claimant knew, or reasonably should have known, could cause harm to the employer. Discharges for unsatisfactory work performance (no misconduct) are usually charged to the employer’s account unless misconduct can be established.

To disqualify the employee from receiving benefits, you must establish the employee was discharged “with good cause” connected to work. If you are unable to establish good cause, the state may award the claimant benefits that can be charged to your reserve account. To ensure you have the information necessary to effectively present your case, answer the following questions:

What was the final incident prior to the employee’s discharge?

What progressive disciplinary steps were taken prior to the employee’s discharge (verbal warning, written warning, suspension)?

Did the employee sign any written warnings?

What was the adverse effect of the misconduct to your business?

What is the company policy regarding the reason for discharge?

How was the employee made aware of the policy?

Did the employee sign an acknowledgement that he received and understood the policy?

Was the employee made aware through the company handbook or warnings that his actions could result in discharge?

Were there any witnesses to the incidents leading up to the discharge? If so, who?

These questions will apply to most discharge situations. However, additional information relating to specific issues may be needed to support your position.

Leaves of Absence (code as “other”)

In most states, an individual may only collect unemployment benefits if he is able, available, and actively seeking suitable work. When an employee is on a leave of absence, he is likely restricting his availability for work and, therefore, would be ineligible for benefits. Some individuals on leave may not be able to work because of physical limitations.

While most employees will not be able to collect unemployment benefits during a leave of absence, an individual may be eligible if his job is no longer available at the end of the leave. The state may consider this a layoff and your account can be charged for any unemployment benefits paid.

Note: Depending on the state where the claimant has applied for benefits, the above information may not protect your chargeability for unemployment insurance. For state-specific guidelines, contact your State Unemployment Insurance Service specialist.