The importance of Representative Payee Organizations (RPOs) under the Internal Revenue Codes 501(c)(3) and 501(c)(4) is significant in assisting individuals who are unable to manage their own financial affairs due to various disabilities or challenges. With the backing of the Social Security Administration (SSA), these organizations provide a crucial service by managing the Social Security benefits of persons who are mentally or physically impaired, or elderly, ensuring that their basic living needs are met. As these RPOs play a role in handling disability insurance and supplemental security income benefits, they also have the authority to charge a minimal fee for their services, under specific guidance and regulations set forth by the SSA. The process to become a recognized RPO involves meeting certain criteria, demonstrating that the organization operates with a non-profit motive primarily for religious, charitable, or social welfare purposes, and obtaining exemption status under IRC 501(c)(3) or 501(c)(4). Additionally, the duties of RPOs extend beyond mere financial management; they include safeguarding the interests of the beneficiaries, making informed decisions about the use of benefits, and complying with the SSA's reporting requirements to ensure transparency and proper use of the funds. The article delves into the intricacies of qualifying as an RPO, the regulatory framework that governs their operations, and the responsibilities they bear in serving one of the most vulnerable sections of society.

| Question | Answer |

|---|---|

| Form Name | Payee Organization Form |

| Form Length | 10 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min 30 sec |

| Other names | form omb no 0960, representative payee organizations, representative payee rpos, s payee ssa |

Social Security Administration Representative Payee

Organizations (RPOs) Under IRC 501(c)(3) and 501(c)(4)

S.SOCIAL SECURITY ADMINISTRATION REPRESENTATIVE PAYEE ORGANIZATIONS (RPOs) UNDER

IRC 501(c)(3) and 501(c)(4)

by

John Chappell and Bill Brockner

1. Introduction

Headquarters has received numerous applications for recognition of exemp- tion under IRC 501(c)(3) and 501(c)(4) from organizations that desire to par- ticipate in the Representative Payee Organization (RPO) program of the Social Security Administration (SSA). RPOs, the subject of this article, with the authorization and approval of the Social Security Administration, are permitted to collect disability insurance and supplemental security insurance benefit funds on behalf of those who are mentally or physically debilitated because of drug or alcohol abuse, mental or physical impairments, or old age. The funds are intended to pay for the basic living expenses of the beneficiaries. The RPOs are authorized SSA fees for the services performed for the SSA and the beneficiaries.

This article will identify the criteria that RPOs must satisfy in order to qualify for recognition of exemption. In addition, the article will discuss the foundation classification of RPOs.

2.The SSA RPO Program and its Connection to IRC 501(c) A. The SSA RPO Program

(1) General

Section 5105 of the Omnibus Budget Reconciliation Act of 1990 (P.L.

375

Specifically, section 205(j)(4)(B) of the Social Security Act provides the definition of a qualified organization. This section reads:

... the term "qualified organization" means any state or local government agency whose mission is to carry out income main- tenance, social service, or health

(i)regularly provides services as the representative payee, pursuant to this subsection or section 1631(a)(2), concurrently to 5 or more individuals; and

(ii)demonstrates to the satisfaction of the Commis- sioner of Social Security that such agency is not otherwise a creditor of any such individual.

Before the 1994 SSA Act, only

To further encourage these organizations to become representative payees, the 1994 Act authorized them to charge drug addicts and alcoholics an amount equal to the lesser of 10 percent of the monthly benefit or $50 (in the case of a beneficiary determined by the SSA to be disabled based on such addiction), indexed to the Consumer Price Index.

(2) Qualified Organizations

In 20 CFR 404.2040a of the Code of Federal Regulations, the SSA further defined qualified organizations as follows:

a.A

(b) of this section may request our authorization to collect a monthly fee from a beneficiary for provid- ing representative payee services.

b.We will authorize an organization to collect a fee if all the following requirements are met:

Social Security Administration Representative Payee

Organizations (RPOs) Under IRC 501(c)(3) and 501(c)(4)

(i)It is

(ii)It is a nonprofit social service organization founded for religious, charitable or social welfare purposes and is tax exempt under section 501(c) of the Inter- nal Revenue Code.

(iii)It is bonded or licensed in the state in which it serves as representative payee.

(iv)It regularly provides representative services con- currently to at least five beneficiaries.

(v)It is not a creditor of the beneficiary.

The SSA requires that organizations have a IRC 501(c) exemption letter from the IRS, which SSA accepts as proof that they are both a nonprofit and social service organization. Upon submission of this proof, and a determination by SSA that the other requirements are met, SSA will authorize collection of any appropriate fees.

(3)Duties of RPOs: Extract from SSA Publication No.

a.A Representative Payee’s Duties

As a representative payee, you need to keep in- formed of the individual’s needs so that you can decide how benefits can best be used for his or her personal care and

Any money left after meeting the beneficiary’s current and reasonably foreseeable needs must be saved and maintained in the beneficiary’s behalf. Periodically, Social Security will ask you to com- plete a form accounting for the funds you have received. A sample form is shown on page 13. There’s a worksheet in the center of this booklet that you can use to help keep track of what you spend.*

As a representative payee, you will need to keep Social Security informed of changes that may affect the beneficiary’s eligibility for benefits.

377

Social Security Administration Representative Payee

Organizations (RPOs) Under IRC 501(c)(3) and 501(c)(4)

Representative payees are required by law to use benefits properly. If a payee misuses benefits, he or she must repay the misused funds to the beneficiary. A Payee convicted of misuse may be fined and/or imprisoned.

b.How To Use The Benefits

First, make sure the beneficiary’s

If a beneficiary is in a nursing home or other institution, you should use benefits to pay the usual charges for care, as well as to buy personal items not normally provided by the facility.

Also, if the beneficiary lives in an institution and is eligible for Medicaid or is a member of a family that receives Aid to Families with Dependent Children (AFDC) payments, you should contact the local Social Security office about using benefits to support family members.

*Copies of the SSA worksheet and form are attached as Exhibits A & B.

B. The RPO Program and IRC 501(c) Exemption

As may be gleaned from the SSA discussion above, RPOs must have religious, charitable, or social welfare purposes. Organizations qualifying to participate in the SSA RPO program must first be recognized by the IRS as exempt under IRC 501(c)(3) or 501(c)(4) since these are the only IRC 501(c) categories that would include social service organizations founded for religious, charitable, or social welfare purposes. The discussion that follows will focus on those organizations whose exclusive or primary activities are the performance of RPO functions. IRC 501(c)(3) or 501(c)(4) organizations engaging in RPO activities as secondary activities could have unrelated trade or business issues if the organizations did not operate within the parameters of the criteria discussed in 3 below. Also, private benefit issues could be raised. Private benefit is presumably a more significant concern with IRC 501(c)(4) organiza- tions now because of the recent enactment of the Taxpayers’ Bill of Rights 2

378

Social Security Administration Representative Payee

Organizations (RPOs) Under IRC 501(c)(3) and 501(c)(4)

(TBOR 2) legislation that includes an inurement prohibition applicable to IRC 501(4)s similar to the prohibition applicable to organizations exempt under IRC 501(c)(3). See the Current Developments section of this EO CPE Text for a description of the TBOR 2 legislation.

3. Exemption Recognition under IRC 501(c)(3) or IRC 501(c)(4)

A. RPOs May Further IRC 501(c)(3) and IRC 501(c)(4) Purposes

RPOs may qualify for IRC 501(c)(3) exemption following two

RPOs may also further exempt purposes by relief of the poor and distressed. RPOs assist a class of individuals who are mentally or physically debilitated, or both. By providing, managing, and monitoring funds that pay for their basic necessities of living, an organization may be furthering section 501(c)(3) and 501(c)(4) purposes. See, in general, EOHB IRM 7751, sec. 343.

IRC 501(c)(3) and (c)(4) RPOs are RPOs servicing all eligible beneficiaries of the SSA RPO program. They are distinguishable from commercial trade or business organizations such as the one described in Rev. Rul.

B. RPOs Serving Private Interests

In addition to carrying out exempt purposes, RPOs must satisfy the IRC 501(c)(3) and

379

Social Security Administration Representative Payee

Organizations (RPOs) Under IRC 501(c)(3) and 501(c)(4)

common good and general welfare of the people of the community. As noted in 2B above, IRC 501(c)(4)s are now also subject to an inurement prohibition.

Some RPOs that have applied for recognition of exemption are, in essence, one or two person operations. Typically, such organizations are created and controlled by one or two people who are also the sole or controlling employees. If there are other employees, they may be related to the controlling individual(s). The boards of directors consist of the individual(s) and related persons. The controlling individual(s’) compensation may be the RPO’s primary expenses. RPOs may also be paying rent for use of the controlling persons’ residences.

When an RPO is controlled by one or two individuals or a small, related group, there is an indication that the RPO operates primarily for the benefit of the principals, and not for exempt purposes.

C.Criteria for Determining If a RPO is Serving IRC 501(c)(3) or 501(c)(4) Purposes

In determining whether RPOs qualify for exempt status, the EO Division in Headquarters is applying the following criteria:

(1)The payee services should be provided to all eligible SSA RPO beneficiaries without regard to the benefit amount (and cor- responding RPO service fee) that an eligible beneficiary may receive.

(2)The RPO’s governing body should be composed primarily of members of the community who are not financially interested in the RPO’s activities (i.e., persons other than compensated individuals of the organization or related parties).

(3)The governing body should have exclusive authority to deter- mine compensation of employees and other parties that per- form major services for the RPO. Those persons who are members of the governing body and who are also compen- sated for services provided to the RPO must not be eligible to vote on board decisions involving their personal compensa- tion packages.

(4)The RPO governing body and key employees should demonstrate evidence of experience or background in the social services area.

380

Social Security Administration Representative Payee

Organizations (RPOs) Under IRC 501(c)(3) and 501(c)(4)

(5)Officials of the RPO should represent that the organization will follow the operational requirements of the SSA including fulfilling the duties described in SSA Publication No. 05- 10076, A Guide For Representative Payees, as revised or superseded. See 2A(3) above.

These criteria are not unique to determinations involving

4.

As discussed above, RPOs receive payments for services rendered on behalf of SSA recipients. RPO participants in the program are authorized by the SSA to collect fees for expenses incurred on the beneficiaries’ behalf. All SSA payments (including the fee portion of the payments) to the RPOs are payments for the performance of the organization’s exempt functions, and counted as "support" within the meaning of IRC 509(d).

In determining an RPO’s public charity status, payments received in the manner described above are considered to be payments for the performance of the organization’s exempt function. They are counted as "public support" under section 509(a)(2) in a manner similar to medicare and medicaid payments to health care organizations. See Rev. Rul.

381

Social Security Administration Representative Payee

Organizations (RPOs) Under IRC 501(c)(3) and 501(c)(4)

5. Conclusion

Headquarters is preparing Exempt Organization Handbook and other IRM instructions on the issues discussed in this article. We hope that application of the criteria outlined in the article will promote uniformity in processing applica- tions from organizations seeking exemption as RPOs.

382

Exhibit A

INCOME AND EXPENSES WORKSHEET

|

Amount of |

Expenses |

Expenses for |

|

|

|

Clothing, |

|

|||

Month |

Social Security |

for |

Amount |

||

Medical/Dental, |

|||||

and |

or SSI |

Food |

of Money |

||

Personal Items, |

|||||

Year |

Benefits |

and |

Remaining |

||

Recreation, |

|||||

|

Received |

Shelter |

|

||

|

Miscellaneous |

|

|||

|

|

|

|

Totals For Report |

$____________ |

$____________ |

$____________ |

$____________(1) |

Period |

|

Put this figure on |

Put this figure on |

|

|

|

line 3B of the |

line 3C of the |

|

|

|

Representative |

Representative |

|

|

|

Payee Report |

Payee Report |

|

Show the amount remaining, if any, from earlier report periods. |

|

$____________(2) |

||

Add lines (1) and (2). Put this figure on line 3D of the Representative Payee Report. |

$____________ |

|||

For additional worksheets, you may photocopy this page before you use it, or contact Social Security.

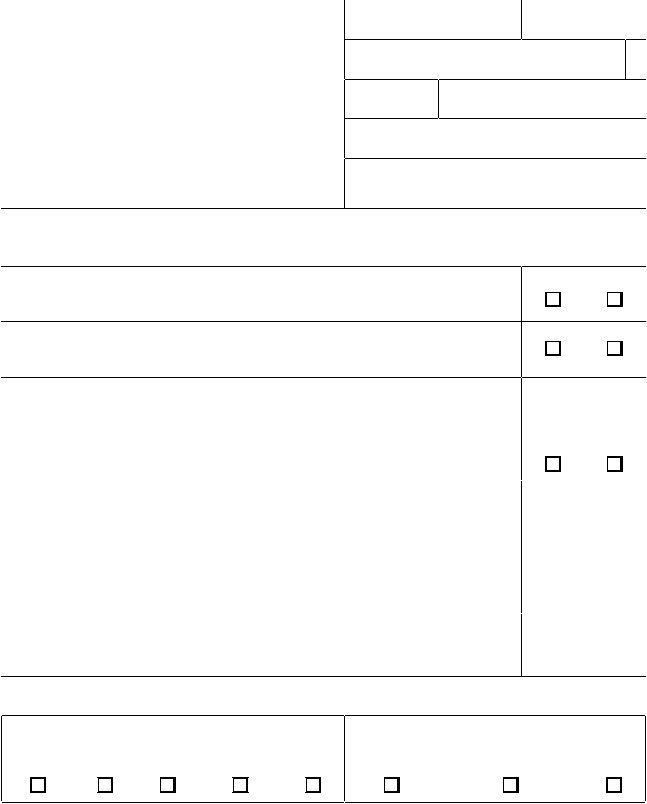

Exhibit B

Representative Payee Report

Social Security Administration, P.O. Box XXXX,

FORM APPROVED OMB NO.

PAYEE’S NAME AND ADDRESS |

REPORT PERIOD |

|

|

|

SOCIAL SECURITY NUMBER |

|||

|

FROM: |

TO: |

|

|

|

|

|

|

|

BENEFICIARY |

|

|

|

|

|

FP |

|

|

ID |

PFC |

BIC D |

TP |

CC |

GB |

PC |

DOC |

|

|

DOB |

|

MBC |

|

CF |

|

TAA |

This report is about the benefits you received between XX/XX/XX and XX/XX/XX for the beneficiary, XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX. Please read the enclosed

instructions before completing this form to help you answer each question.

Were you (the payee) convicted of a crime considered to be a felony

1. between XX/XX/XX and XX/XX/XX?

If YES, please explain in REMARKS on the back of this form

Did the beneficiary live with the same person or in the same institution

2. from XX/XX/XX and XX/XX/XX?

If NO, please explain in REMARKS on the back of this form

Benefits paid to you between XX/XX/XX and XX/XX/XX |

= $ |

00,000 |

|

3. Benefits you reported saved by you from prior years |

= |

$ |

000 |

|

|

|

|

Total accountable amount |

= $ |

00,000 |

|

YESNO

Did you (the payee) decide how the $00,000 was spent or saved?

A. If NO, please explain in REMARKS on the back of this form.

How much of the $00,000 did you spend for the beneficiary’s food and B. shelter between XX/XX/XX and XX/XX/XX?

How much of the $00,000 did you spend on other things for the C. beneficiary such as clothing, education, medical and dental expenses,

recreation, or personal items between XX/XX/XX and XX/XX/XX?

How much, if any, of the $00,000 did you save for the beneficiary D. as of XX/XX/XX? If none, show

YESNO

DOLLAR AMOUNT

(NO CENTS)

,

,

,

4. If you showed an amount in 3.D. above, place an "X" in the boxes below to show how you are saving the benefits. If you have more than one account, you may mark more than one box in each question.

|

A. TYPE OF ACCOUNT |

|

B. TITLE OR OWNERSHIP |

|

|||

Savings/ |

|

|

|

|

|

|

|

Checking |

U.S. Savings |

Certificates |

Collective Savings/ |

|

Beneficiary’s Name |

Your Name for |

|

Account |

Bonds |

of Deposit |

Patient’s Fund |

Other |

by Your Name |

Beneficiary’s Name |

Other |