You are able to complete pbgc form 500 without difficulty in our PDFinity® editor. Our team is focused on providing you with the best possible experience with our tool by regularly introducing new capabilities and enhancements. Our editor is now a lot more user-friendly thanks to the newest updates! Now, filling out PDF files is simpler and faster than before. All it requires is just a few simple steps:

Step 1: Just click the "Get Form Button" in the top section of this page to open our pdf form editing tool. Here you will find everything that is required to work with your document.

Step 2: After you open the PDF editor, there'll be the form prepared to be filled out. Aside from filling out various fields, it's also possible to perform other sorts of actions with the PDF, particularly putting on any words, editing the original textual content, inserting graphics, putting your signature on the document, and much more.

Concentrate when completing this document. Ensure that every blank field is completed accurately.

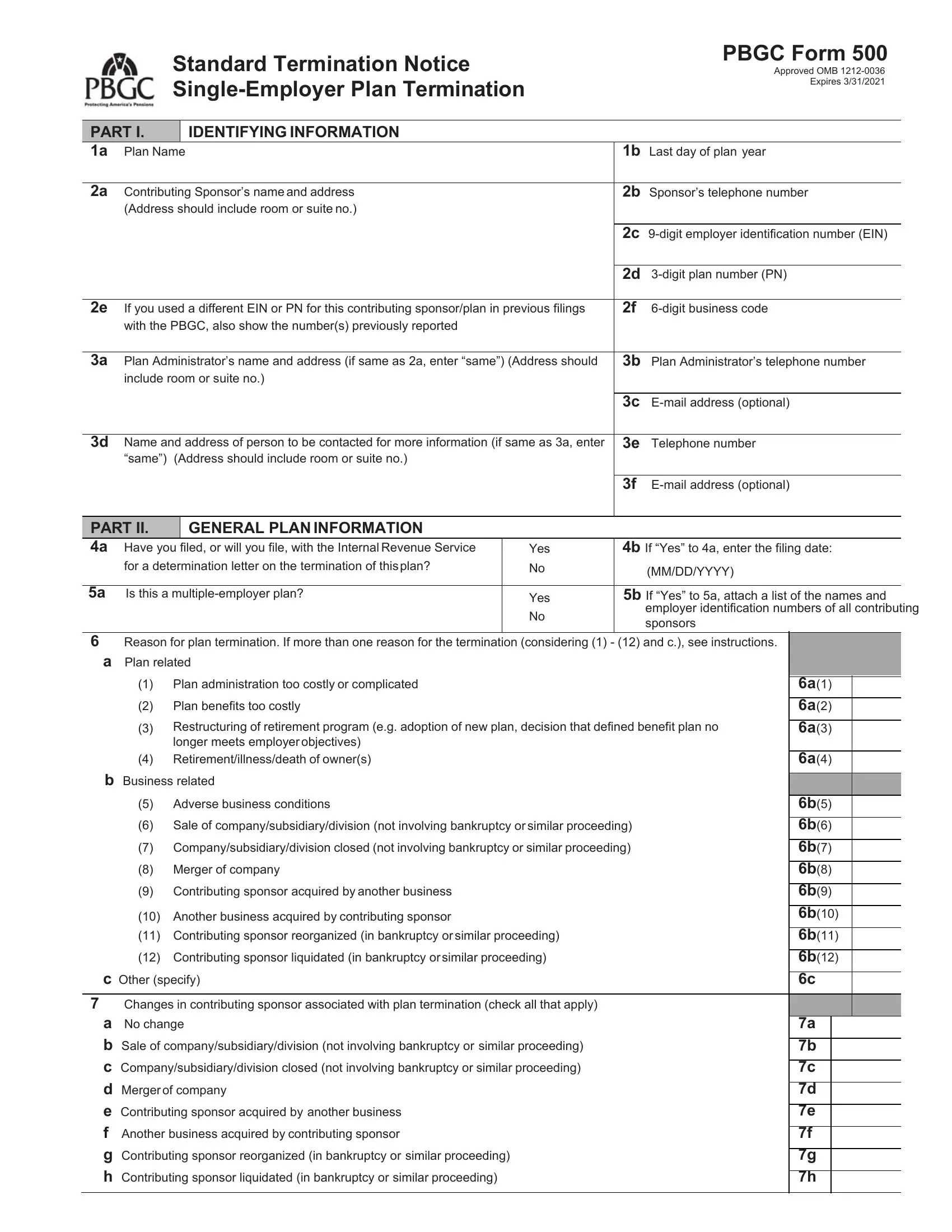

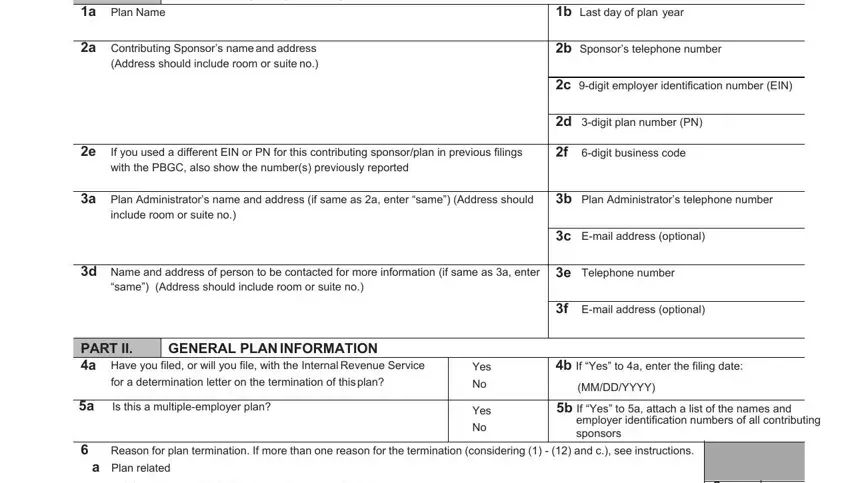

1. It's vital to fill out the pbgc form 500 properly, hence pay close attention while filling in the areas that contain these specific fields:

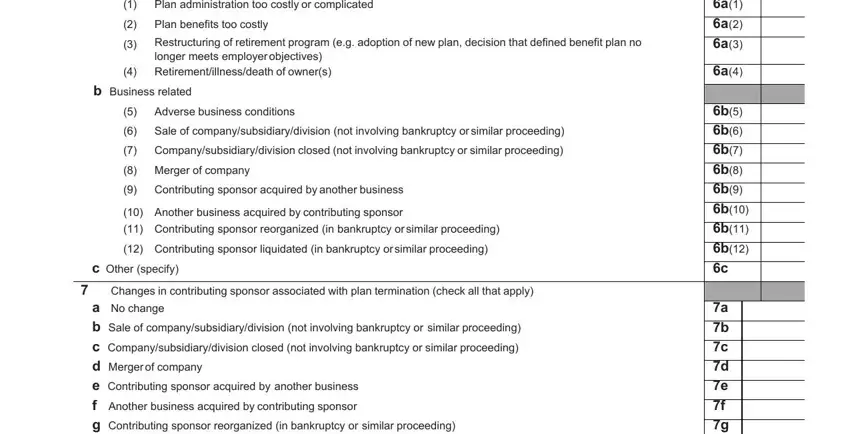

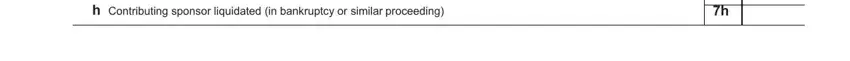

2. Once your current task is complete, take the next step – fill out all of these fields - Plan administration too costly or, Restructuring of retirement, longer meets employer objectives, b Business related, Adverse business conditions Sale, Merger of company Contributing, c Other specify, Changes in contributing sponsor, a No change b Sale of, a a a a, b b b b b b b b c, and a b c d e f g h with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

3. This subsequent segment is normally rather straightforward, a No change b Sale of, and a b c d e f g h - each one of these empty fields is required to be filled in here.

Many people generally make mistakes when completing a No change b Sale of in this section. You should definitely read twice everything you type in here.

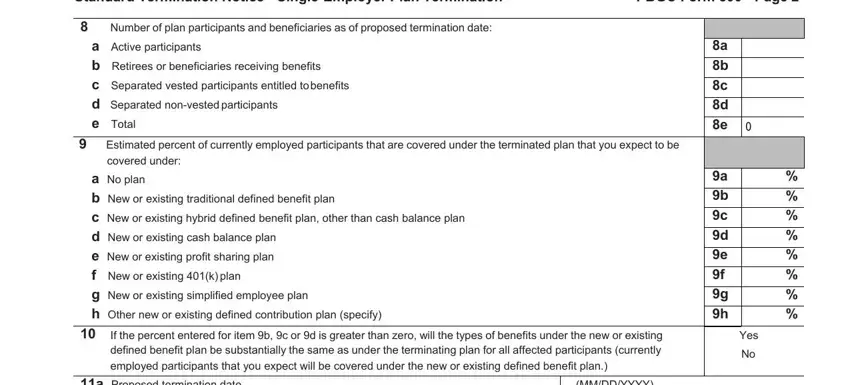

4. It is time to fill in this fourth portion! In this case you will get all these Estimated percent of currently, Standard Termination Notice, Number of plan participants and, a Active participants b Retirees, covered under a No plan b New or, If the percent entered for item b, a Proposed termination date b, MMDDYYYY MMDDYYYY, PBGC Form Page, a b c d e, a b c d e f g h, and Yes No empty form fields to complete.

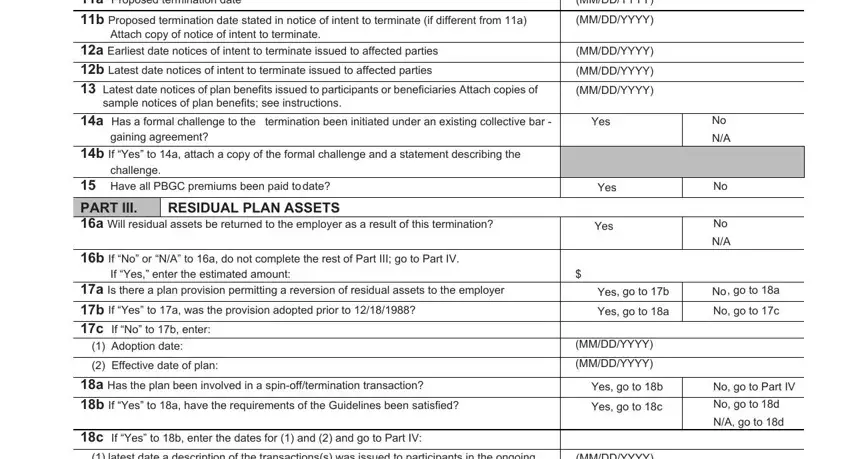

5. The very last section to complete this document is essential. Ensure to fill out the mandatory blanks, and this includes a Proposed termination date b, MMDDYYYY MMDDYYYY, Attach copy of notice of intent to, a Earliest date notices of intent, sample notices of plan benefits, a Has a formal challenge to the, gaining agreement, challenge, b If Yes to a attach a copy of the, Have all PBGC premiums been paid, b If No or NA to a do not complete, If Yes enter the estimated amount, a Is there a plan provision, Adoption date Effective date of, and a Has the plan been involved in a, before using the pdf. Neglecting to do it could end up in a flawed and possibly unacceptable form!

Step 3: Just after proofreading your completed blanks, click "Done" and you are good to go! Find your pbgc form 500 after you sign up for a free trial. Easily use the pdf inside your FormsPal cabinet, with any edits and adjustments being automatically synced! FormsPal ensures your information confidentiality via a secure system that in no way records or shares any kind of private data used. Rest assured knowing your docs are kept safe whenever you work with our editor!