When managing the complexities of one’s estate, the designation of a personal representative stands as a fundamental step in ensuring a seamless transition of assets and responsibilities upon an individual’s passing. This designation, achieved through the meticulous completion of a Personal Representative Designation form, is pivotal for the clear articulation of the decedent’s wishes regarding asset distribution and the management of their estate. It requires the granter to nominate a trusted individual or entity to act on their behalf, handling all matters related to their estate, including but not limited to, the execution of their will, payment of debts, and distribution of property as per the decedent's directives. The form serves not only as a beacon of one’s intentions but also as a legally binding document that empowers the nominated representative to undertake significant responsibilities. It’s imperative that individuals understand the gravity of this form, as it encompasses considerations such as the representative’s scope of authority, any limitations to their powers, and the process for their appointment, all of which are crucial for the effective management of estate affairs. This designation, when executed with forethought and legal guidance, provides peace of mind to the grantor, ensuring that their legacy is preserved and their final wishes are honored without dispute.

| Question | Answer |

|---|---|

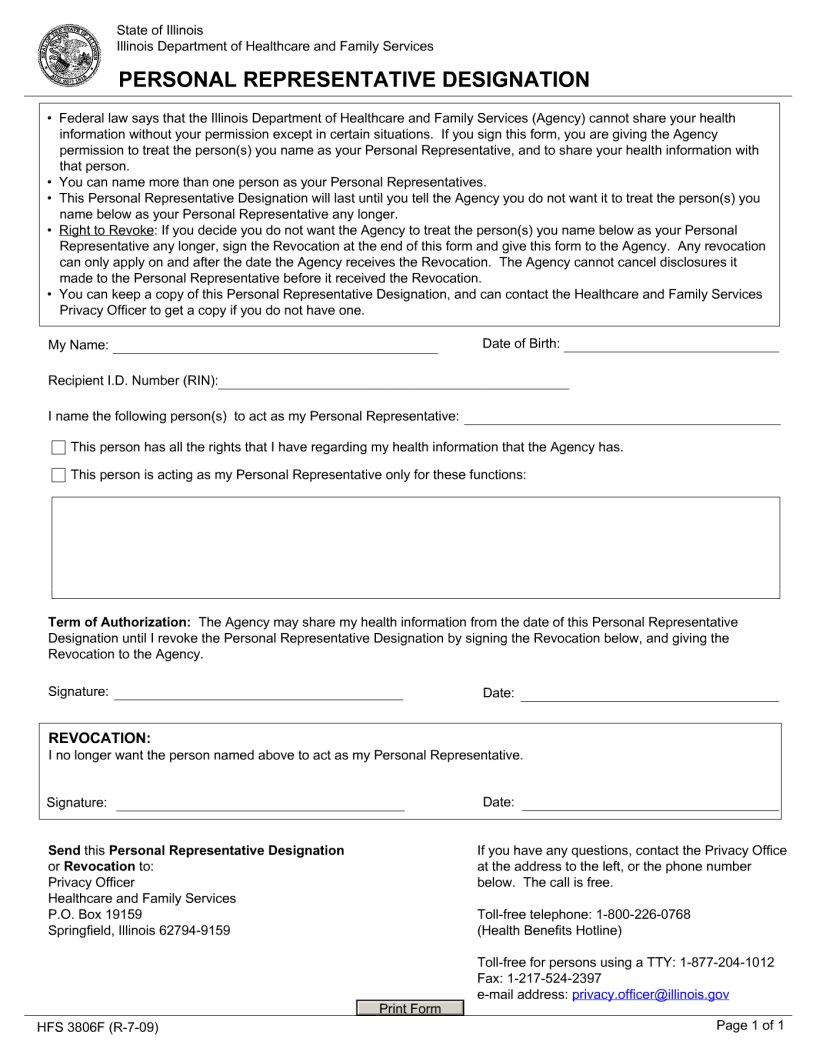

| Form Name | Personal Representative Designation Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | designation my illinois, personal designation, representative below illinois, representative designation |