Working with PDF forms online is always a breeze using our PDF tool. Anyone can fill out philadelphia transfer tax form here painlessly. In order to make our tool better and simpler to utilize, we consistently come up with new features, taking into consideration suggestions coming from our users. Starting is simple! All you have to do is stick to the following easy steps down below:

Step 1: First of all, access the pdf tool by clicking the "Get Form Button" above on this page.

Step 2: When you start the editor, you will see the form prepared to be filled in. Other than filling out different fields, you can also do various other actions with the PDF, such as adding custom words, changing the original text, inserting images, signing the PDF, and more.

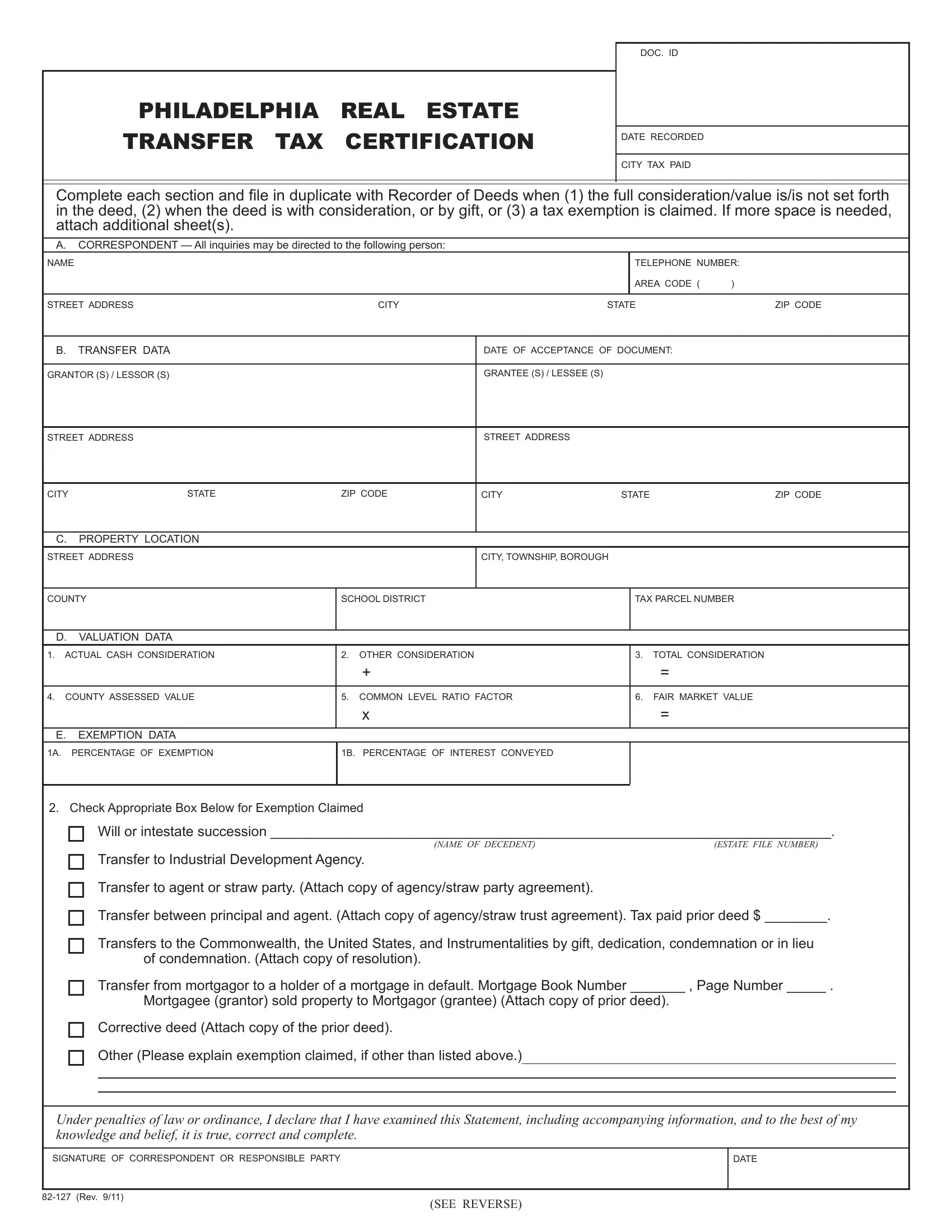

This PDF will need particular data to be filled in, so make sure to take the time to fill in exactly what is requested:

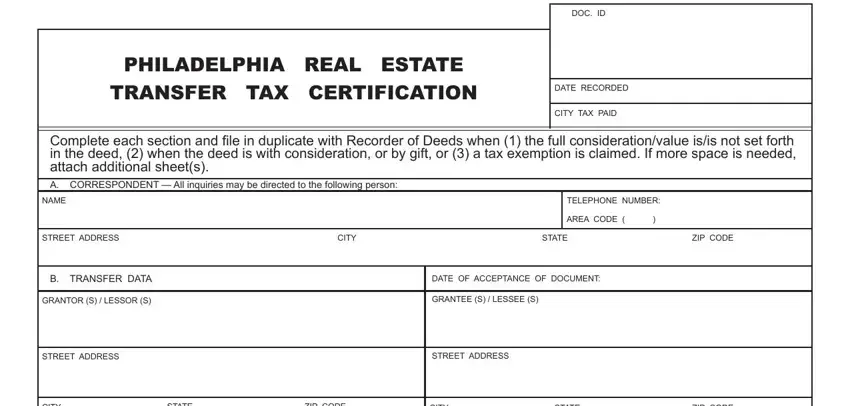

1. First of all, once filling out the philadelphia transfer tax form, begin with the area with the next blank fields:

2. Soon after finishing the last step, go on to the subsequent part and enter all required particulars in all these blanks - CITY, STATE, ZIP CODE, CITY, STATE, ZIP CODE, C PROPERTY LOCATION, STREET ADDRESS, CITY TOWNSHIP BOROUGH, COUNTY, SCHOOL DISTRICT, TAX PARCEL NUMBER, D VALUATION DATA, ACTUAL CASH CONSIDERATION, and COUNTY ASSESSED VALUE.

It's simple to get it wrong when filling in your STATE, hence make sure that you take a second look before you'll finalize the form.

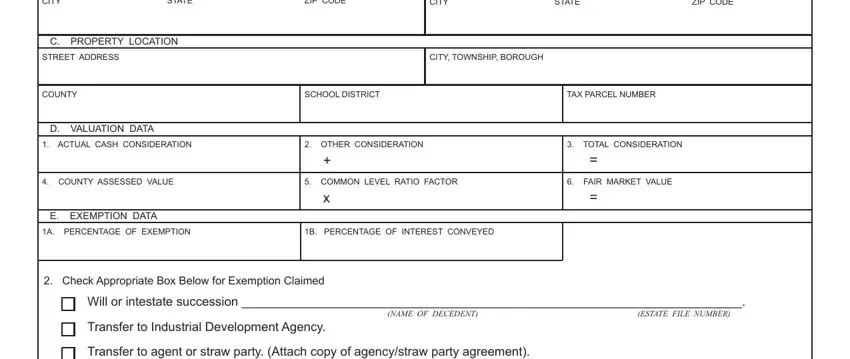

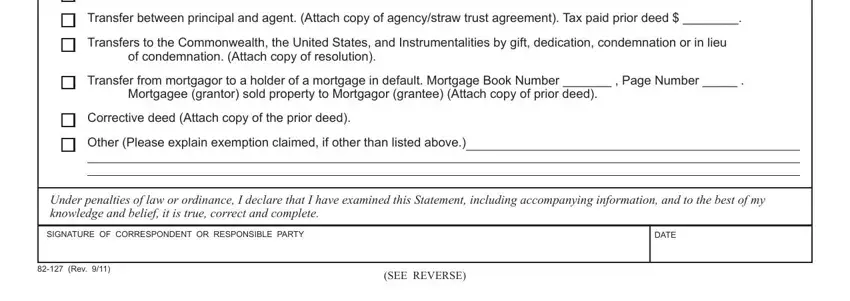

3. In this particular part, review Transfer to agent or straw party, Transfer between principal and, Transfers to the Commonwealth the, of condemnation Attach copy of, Transfer from mortgagor to a, Mortgagee grantor sold property to, Corrective deed Attach copy of the, Other Please explain exemption, Under penalties of law or, SIGNATURE OF CORRESPONDENT OR, DATE, Rev, and SEE REVERSE. All these are required to be filled in with greatest precision.

Step 3: Confirm that your details are right and then press "Done" to progress further. Right after creating a7-day free trial account here, it will be possible to download philadelphia transfer tax form or send it through email promptly. The PDF form will also be accessible from your personal cabinet with your each and every change. FormsPal offers risk-free document tools without data recording or sharing. Feel safe knowing that your details are secure here!