When using the online editor for PDFs by FormsPal, you may complete or change t4 tax form canada here and now. We at FormsPal are aimed at giving you the best possible experience with our tool by constantly releasing new capabilities and improvements. With all of these updates, working with our tool gets better than ever! With a few simple steps, you are able to begin your PDF editing:

Step 1: Click on the "Get Form" button above. It will open up our pdf editor so that you can start completing your form.

Step 2: With this handy PDF editor, you'll be able to do more than merely fill in blank form fields. Express yourself and make your documents appear perfect with customized text put in, or modify the file's original content to excellence - all that backed up by the capability to add stunning photos and sign it off.

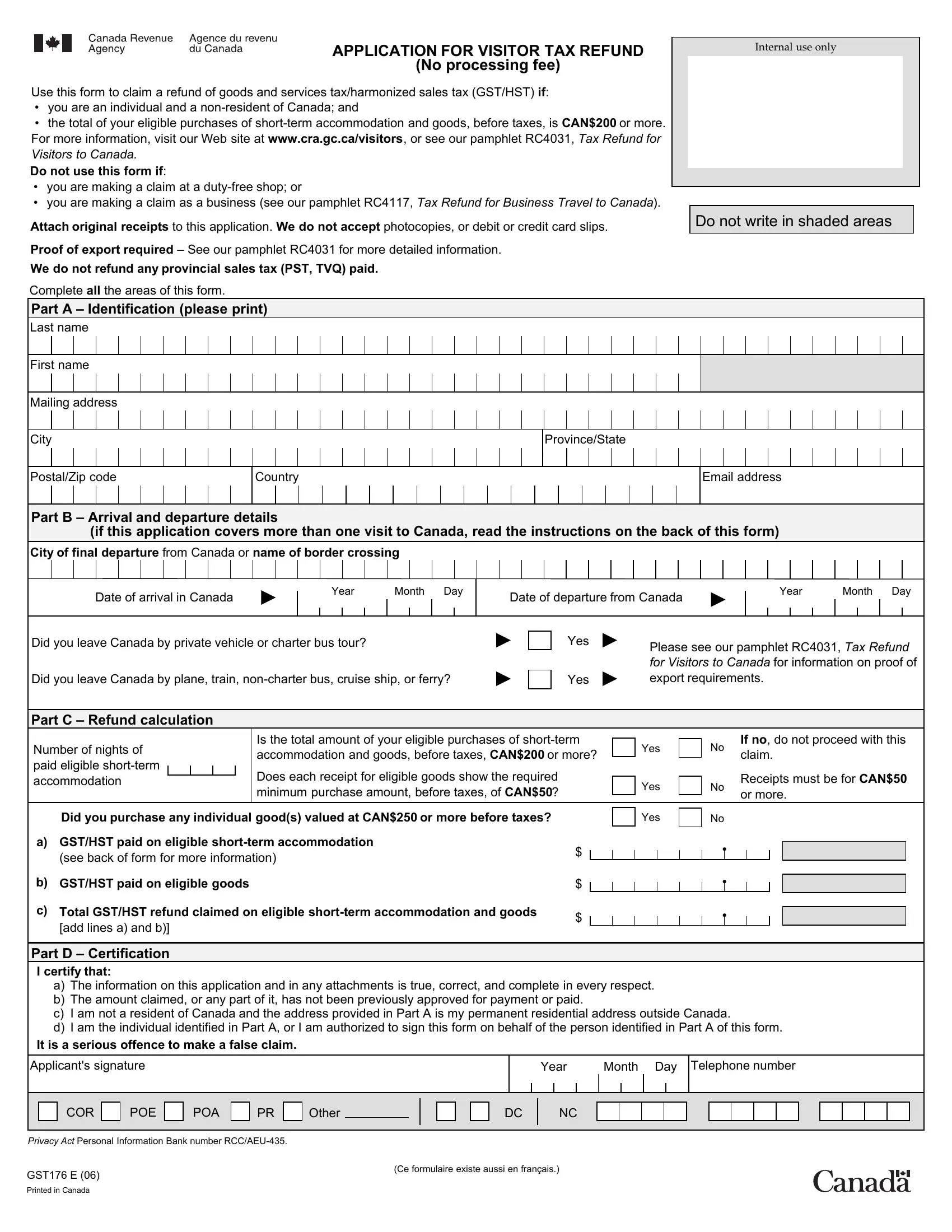

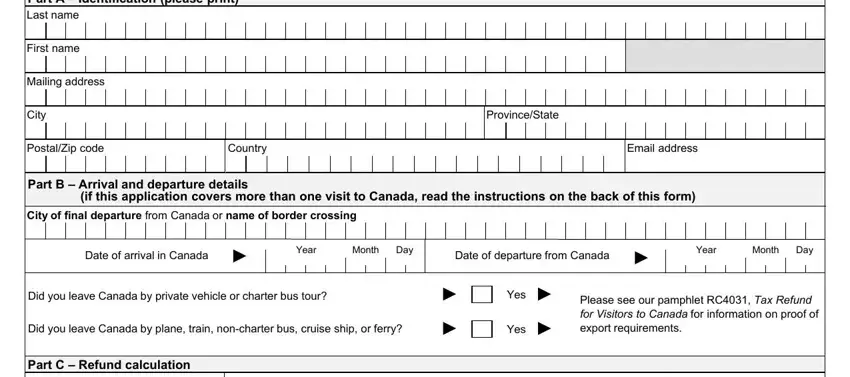

In an effort to complete this form, ensure you provide the necessary details in every blank:

1. The t4 tax form canada necessitates particular details to be inserted. Ensure that the next blanks are filled out:

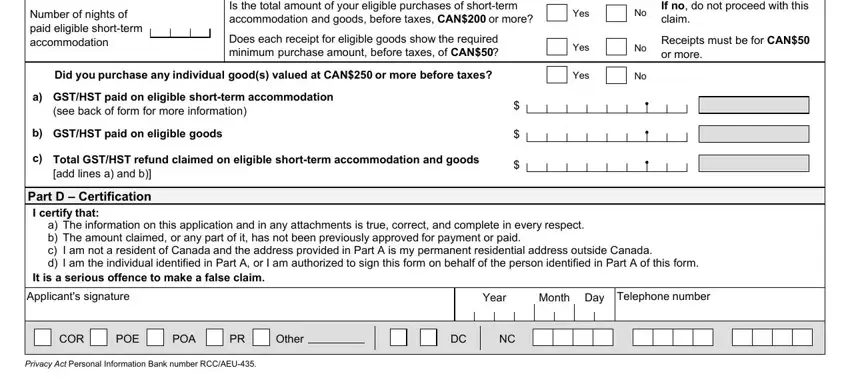

2. Your next part is usually to fill in the next few blank fields: Number of nights of paid eligible, Is the total amount of your, Does each receipt for eligible, Did you purchase any individual, GSTHST paid on eligible shortterm, GSTHST paid on eligible goods, Total GSTHST refund claimed on, Yes, Yes, Yes, cid, cid, cid, If no do not proceed with this, and Receipts must be for CAN or more.

You can easily get it wrong while completing the Is the total amount of your, consequently be sure you reread it prior to when you submit it.

Step 3: Immediately after rereading the form fields, hit "Done" and you're good to go! Join FormsPal right now and immediately get t4 tax form canada, prepared for download. All alterations made by you are kept , enabling you to edit the form at a later stage as needed. FormsPal offers safe document completion devoid of personal data recording or distributing. Rest assured that your information is safe here!