In Philadelphia, navigating municipal taxes can sometimes present as daunting a task as maneuvering through its historic streets. Central to this navigation is understanding the Philadelphia Wage Tax Refund Petition form, an essential document for both individuals and businesses seeking tax refunds for overpayment or incorrect payment of various city taxes, including but not limited to wage tax, real estate tax, and business income and receipts tax. Recognizing the types of refunds available, accurately completing pertinent sections such as petitioner's information, tax account details, and specifying the reason for the refund, is crucial. This form, detailed by the City of Philadelphia Department of Revenue, serves as a gateway for petitioners to correct their tax contributions, ensuring they align with actual liabilities. Careful adherence to the instructions provided on the reverse side of the form, and attaching additional required documentation like letters on company letterhead for wage tax refunds or copies of canceled checks for real estate refunds, underscores the importance of thoroughness in the refund process. By comprehensively understanding and executing the Philadelphia Wage Tax Refund Petition form’s requirements, individuals and businesses can efficiently navigate through the complexities of municipal taxation, moving closer to reclaiming funds that are rightfully theirs.

| Question | Answer |

|---|---|

| Form Name | Philadelphia Wage Tax Refund Petition Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | wage tax refund petition 2020, 2020 wage tax refund petition philadelphia, fillable philadelphia wage tax refund petition, philadelphia wage tax refund petition 2020 |

|

|

|

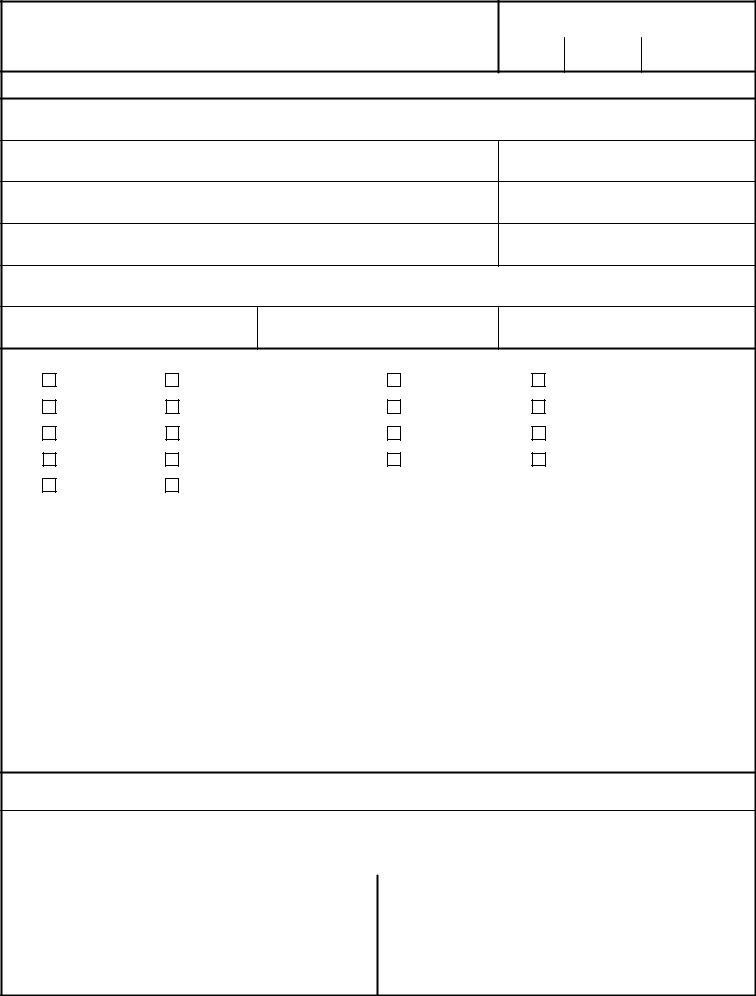

PETITION NUMBER (Office use only) |

|

CITY OF PHILADELPHIA |

DEPARTMENT OF REVENUE |

|

|

|

REFUND PETITION |

|

|

|

|

FUND |

SOURCE |

INDEX |

||

For all refunds except Individual Employee Wage Tax

SEE INSTRUCTIONS ON REVERSE. CLEARLY PRINT OR TYPE ALL INFORMATION.

1. PETITIONER'S NAME (First Name, Middle Initial, Last Name)

2.BUSINESS NAME

3.MAILING ADDRESS

CITY

4.SOCIAL SECURITY NUMBER

5.FEDERAL EMPLOYER IDENTIFICATION NO.

STATE |

ZIP CODE |

|

|

6. PROPERTY ADDRESS (For Real Estate, Water, Commercial Waste and Business Use & Occupancy Refunds only)

7. PHONE NUMBER

FAX NUMBER

8.REFUND TYPE (Check all that apply and list below. For Wage Tax, Real Estate Tax and Other, see important information on reverse.)

|

|

Wage Tax |

|

|

Business Income & Receipts Tax * |

|

|

Net Profits Tax |

|

|

Business Use & Occupancy Tax |

||||

|

|

Parking Tax |

|

|

Amusement Tax |

|

|

|

Water/Sewer |

|

|

Liquor Tax |

|

||

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Hotel Tax |

|

|

Commercial Waste |

|

|

School Income Tax |

|

|

Licenses and Permits |

||||

|

|

|

|

|

|

|

|

||||||||

|

|

Tobacco Tax |

|

|

Earnings Tax |

|

|

|

Police Services |

|

|

Departmental Payments |

|||

|

|

|

|

|

|

|

|

|

|||||||

|

|

Real Estate Tax |

|

|

Other (specify)______________________________________ |

* Business Income & Receipts Tax prior to 2012 |

|||||||||

|

|

|

|

|

was known as Business Privilege Tax. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A. TAX ACCOUNT |

|

B. TAX YEAR OR |

|

C. AMOUNT OF |

|

A. TAX ACCOUNT |

B. TAX YEAR OR |

C. AMOUNT OF |

|||||||

|

NUMBER |

|

PERIOD/YEAR |

|

CLAIM |

|

|

NUMBER |

PERIOD/YEAR |

CLAIM |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. REASON FOR THIS REFUND PETITION

I HEREBY CERTIFY that the statements contained herein and in any supporting schedule or exhibit are true and correct to the best of my knowledge and belief. I understand that if I knowingly make any false statements herein, I am subject to penalties as prescribed by law.

PETITIONER'S SIGNATURE |

|

DATE |

|

|

|

AUTHORIZED SIGNATURE FOR OTHER DEPARTMENT |

TITLE |

DATE |

|

|

|

MAIL COMPLETED REFUND PETITION TO: |

REFUND INFORMATION: |

|

|

OR FAX TO: |

|

||

TELEPHONE: |

|||

CITY OF PHILADELPHIA |

|||

FAX: |

|

||

DEPARTMENT OF REVENUE |

|

||

|

|||

P.O. BOX 1137 |

|

||

INTERNET: www.phila.gov/revenue |

|||

PHILADELPHIA, PA |

|||

|

|

||

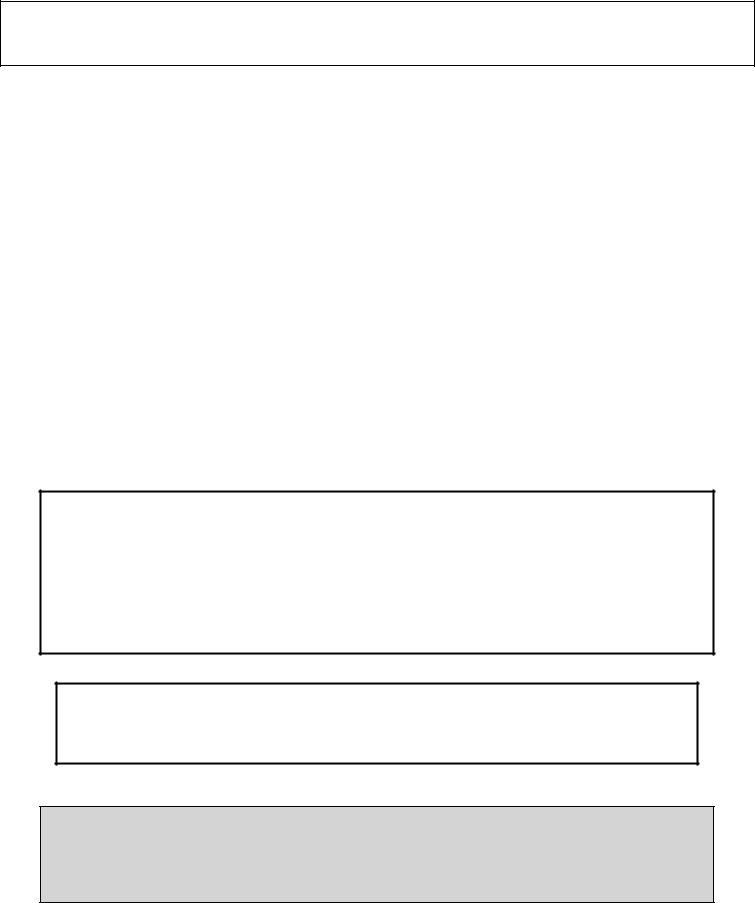

Instructions for Completing the Refund Petition

This form is to be used for all refund requests except Individual Employee Wage Tax. If you need to file an individual employee wage petition, refer to the contact information on the front of this form. Employers must use this petition for withheld wage tax refund requests.

1.Individuals - Enter the name of the petitioner.

2.Business Name - For

3.Mailing Address - Enter the address where the refund is to be mailed.

4 and 5. Social Security and Federal Employer Identification Numbers - Individuals must enter a Social

Security number. All other entities must enter a Federal Employer Identification Number.

6.Property Address - This is required for all Real Estate, Water/Sewer, Commercial Waste and Business Use & Occupancy petitions. Enter the address of the property for which the refund is being requested.

7.Contact Information - Provide a phone number, fax number and

8.Refund Type - Check the appropriate block(s). If the type is not listed on the front of this form, check "Other" and specify the type of refund requested. A single Refund Petition may be used for multiple tax types and years.

A.Tax Account Number - Enter the tax specific account number(s).

B.Tax Years and/or Tax Periods - If tax is an annual tax, enter year. If tax is periodic,

e.g., quarterly or monthly, enter period(s) and year(s).

C.Amount of Claim - Enter the amount of the refund requested.

9.Reason for Refund - Enter reason for refund. If you have additional documentation, attach to this petition.

Wage Tax - Additional information is required before a decision can be made on your refund request. Provide a letter on company letterhead (signed by an officer of the company) stating that the additional tax withheld has been returned to the employees. If your refund request is resulting from a duplicate payment, provide supporting documentation. If you have questions about your filing requirements, application of payments or tax balances, call Taxpayer Services at

Real Estate - Refund requests must be accompanied by a copy of the front and back of the canceled check(s). If the refund is due to a sale of the property or refinancing, you must also supply a copy of the settlement sheet. Mortgage companies must supply a copy of the disbursement/check listing.

This petition must be signed and dated! If you have any questions regarding the preparation of this petition, see the contact information on the front of this form.

OFFICE USE ONLY - Licenses and Permits; Interdepartmental Refunds and Other - All petitions must include the signature and title of the Department's authorized designee, along with the Fund, Source and Index Code of the payment in addition to the petitioner's signature.