In case you desire to fill out s petition, you don't need to download any software - simply use our online PDF editor. We at FormsPal are devoted to providing you the perfect experience with our editor by regularly adding new functions and improvements. Our editor has become much more helpful with the newest updates! Now, filling out PDF forms is a lot easier and faster than ever. Getting underway is effortless! All you have to do is adhere to the next easy steps below:

Step 1: Click the orange "Get Form" button above. It will open up our editor so you could begin completing your form.

Step 2: With the help of this online PDF file editor, it is easy to accomplish more than just fill in blank form fields. Edit away and make your docs look high-quality with customized textual content added, or adjust the original content to perfection - all accompanied by an ability to incorporate any type of photos and sign it off.

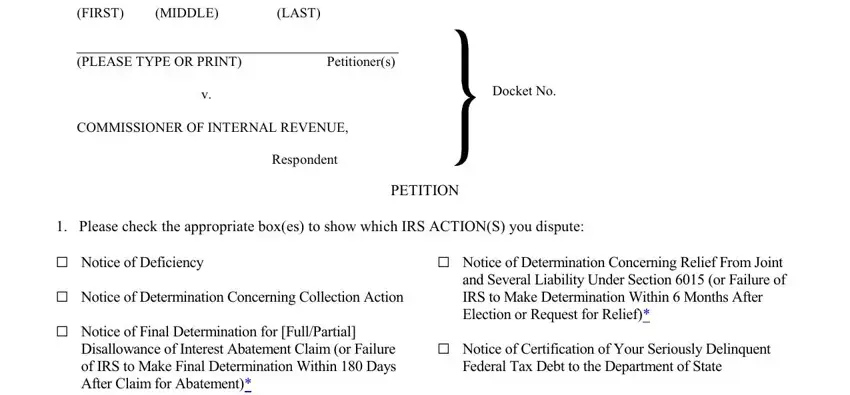

This PDF will need specific information to be typed in, therefore be certain to take some time to fill in exactly what is requested:

1. When filling out the s petition, ensure to complete all of the necessary fields within its corresponding section. This will help facilitate the work, making it possible for your information to be processed efficiently and accurately.

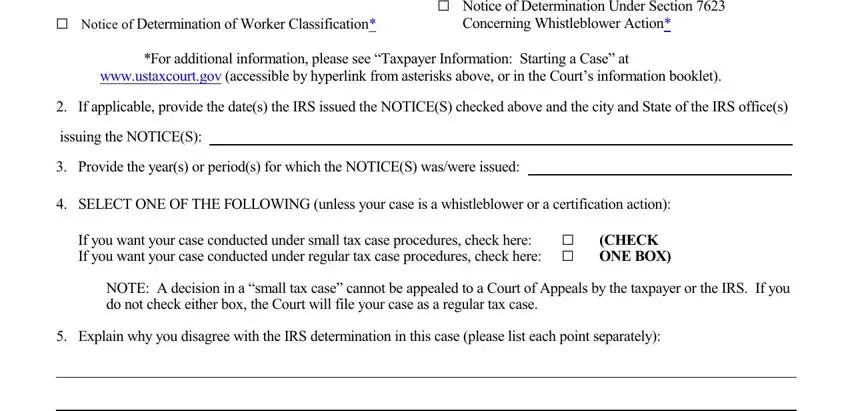

2. The third stage is to fill in the following fields: G Notice of Determination Under, G Notice of Determination of, Concerning Whistleblower Action, For additional information please, wwwustaxcourtgov accessible by, If applicable provide the dates, issuing the NOTICES, Provide the years or periods for, SELECT ONE OF THE FOLLOWING, If you want your case conducted, CHECK ONE BOX, NOTE A decision in a small tax, and Explain why you disagree with the.

3. In this step, take a look at TC FORM REV. All of these have to be filled in with greatest accuracy.

Be really careful when completing TC FORM REV and TC FORM REV, since this is the part where many people make errors.

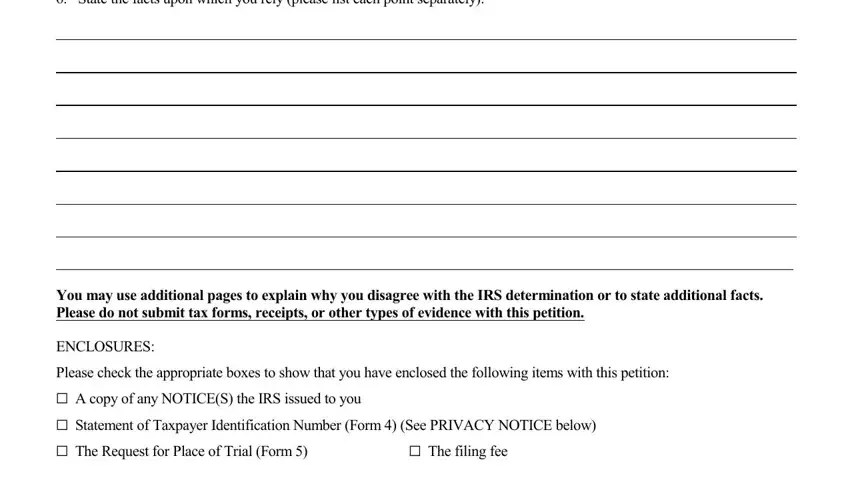

4. This particular subsection comes with these empty form fields to fill out: State the facts upon which you, You may use additional pages to, ENCLOSURES, Please check the appropriate boxes, G A copy of any NOTICES the IRS, G Statement of Taxpayer, G The Request for Place of Trial, and G The filing fee.

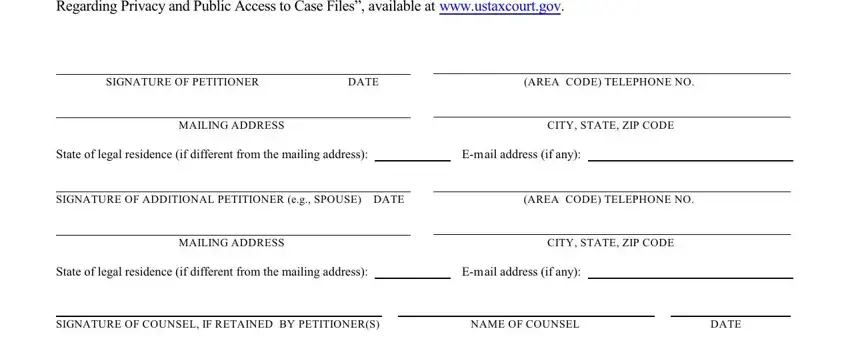

5. Lastly, this final section is what you will have to finish before submitting the form. The blanks in this case include the next: PRIVACY NOTICE Form Statement of, SIGNATURE OF PETITIONER, DATE, AREA CODE TELEPHONE NO, MAILING ADDRESS, CITY STATE ZIP CODE, State of legal residence if, SIGNATURE OF ADDITIONAL PETITIONER, AREA CODE TELEPHONE NO, MAILING ADDRESS, CITY STATE ZIP CODE, State of legal residence if, SIGNATURE OF COUNSEL IF RETAINED, DATE, and NAME OF COUNSEL.

Step 3: As soon as you've looked once again at the information in the file's blanks, simply click "Done" to finalize your form at FormsPal. Right after registering a7-day free trial account at FormsPal, you'll be able to download s petition or email it immediately. The PDF document will also be available through your personal cabinet with your changes. Here at FormsPal, we endeavor to make sure all your information is stored private.