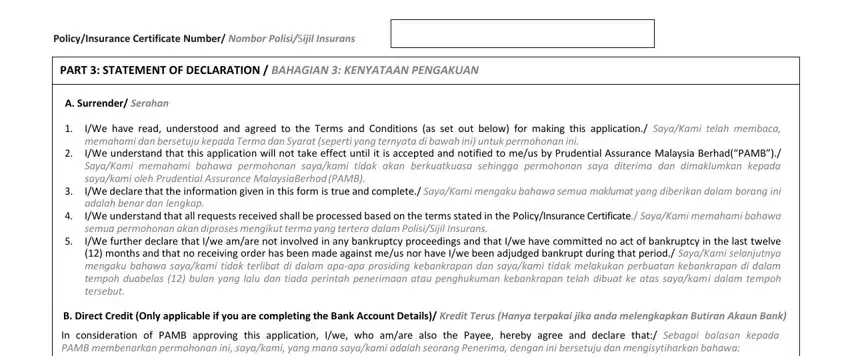

Policy/Insurance Certificate Number/ Nombor Polisi/Sijil Insurans

PART 3: STATEMENT OF DECLARATION / BAHAGIAN 3: KENYATAAN PENGAKUAN

A. Surrender/ Serahan

1.I/We have read, understood and agreed to the Terms and Conditions (as set out below) for making this application./ Saya/Kami telah membaca, memahami dan bersetuju kepada Terma dan Syarat (seperti yang ternyata di bawah ini) untuk permohonan ini.

2.I/We understand that this application will not take effect until it is accepted and notified to me/us by Prudential Assurance Malaysia Berhad(“PAMB”)./ Saya/Kami memahami bahawa permohonan saya/kami tidak akan berkuatkuasa sehingga permohonan saya diterima dan dimaklumkan kepada saya/kami oleh Prudential Assurance MalaysiaBerhad (PAMB).

3.I/We declare that the information given in this form is true and complete./ Saya/Kami mengaku bahawa semua maklumat yang diberikan dalam borang ini adalah benar dan lengkap.

4.I/We understand that all requests received shall be processed based on the terms stated in the Policy/Insurance Certificate./ Saya/Kami memahami bahawa semua permohonan akan diproses mengikut terma yang tertera dalam Polisi/Sijil Insurans.

5.I/We further declare that I/we am/are not involved in any bankruptcy proceedings and that I/we have committed no act of bankruptcy in the last twelve (12) months and that no receiving order has been made against me/us nor have I/we been adjudged bankrupt during that period./ Saya/Kami selanjutnya mengaku bahawa saya/kami tidak terlibat di dalam apa‐apa prosiding kebankrapan dan saya/kami tidak melakukan perbuatan kebankrapan di dalam tempoh duabelas (12) bulan yang lalu dan tiada perintah penerimaan atau penghukuman kebankrapan telah dibuat ke atas saya/kami dalam tempoh tersebut.

B. Direct Credit (Only applicable if you are completing the Bank Account Details)/ Kredit Terus (Hanya terpakai jika anda melengkapkan Butiran Akaun Bank)

In consideration of PAMB approving this application, I/we, who am/are also the Payee, hereby agree and declare that:/ Sebagai balasan kepada PAMB membenarkan permohonan ini, saya/kami, yang mana saya/kami adalah seorang Penerima, dengan ini bersetuju dan mengisytiharkan bahawa:

1.PAMB shall pay and credit the relevant monies payable pursuant to the Proposal and Policy (“Monies”) into the Account;/ PAMB akan membayar

dan mengkreditkan wang yang relevan yang boleh dibayar menurut Cadangan dan Polisi (“Wang”) ke Akaun;

2.PAMB shall continue to pay/credit the Monies into the Account until and unless PAMB receives a written instruction from the Payee to revoke

the authority given to PAMB pursuant to this application or PAMB approves a new application to change the Account details provided in this application;/ PAMB akan terus membayar/mengkreditkan Wang tersebut ke dalam Akaun sehingga dan melainkan PAMB menerima arahan

bertulis daripada Penerima untuk menarik balik kuasa diberikan kepada PAMB menurut permohonan ini atau PAMB meluluskan permohonan yang baru untuk mengubah butiran Akaun diberikan dalam permohonan ini;

3.PAMB shall not be held liable for any losses that I/we may suffer or have suffered, whether directly or indirectly, if for any reason PAMB is unable or delayed to pay and credit the Monies into the Account through no fault of PAMB, including but not limited to, the payment being rejected by the financial institution due to incorrect Account details;/ PAMB tidak bertanggungjawab terhadap sebarang kerugian yang mungkin saya/kami tanggung atau telah tanggung, sama ada secara langsung atau tidak langsung, jika untuk sebarang sebab PAMB tidak dapat atau lewat membayar dan mengkreditkan Wang tersebut ke dalam Akaun atas sebab bukan salah PAMB, termasuk tetapi tidak terhad kepada bayaran ditolak oleh institusi kewangan kerana butiran Akaun yang tidak betul;

4.I/We agree to immediately refund to PAMB in full the Monies which is paid by mistake or which I/we am/are not entitled to receive;/ Saya/ Kami bersetuju untuk membayar balik dengan serta-merta dan secara penuh Wang tersebut yang telah tersalah bayar atau wang yang saya/kami

tidak ada hak untuk menerimanya;

5. PAMB is kept harmless and fully indemnified against any and all actions, claims, proceedings, costs (including legal costs on solicitor and client basis) and damages, including any compensation paid by PAMB to settle such claim, that may howsoever arise from or be incidental to my/our instruction pursuant to this application. This authorization and indemnity contained in this application shall be binding upon my/our respective successors-in-title, executors, administrators, personal representatives and/or heirs; and/ PAMB dilindungi dan dilepaskan secara sepenuhnya

daripada sebarang dan semua tindakan, tuntutan, prosiding, kos (termasuk kos perundangan atas dasar peguamcara dan pelanggan) serta kerugian, termasuk sebarang pampasan dibayar oleh PAMB untuk menyelesaikan tuntutan sedemikian, yang mungkin timbul dalam apa cara sekalipun daripada atau berkaitan dengan arahan saya/kami menurut permohonan ini. Pemberian kuasa dan tanggung rugi ini adalah mengikat ke atas pengganti hak milik, wasi, pentadbir dan wakil peribadi serta/atau waris saya/kami; dan

C. Data Privacy Declaration/ Pengakuan Data Peribadi

I/We understand and agree to the following Data Privacy Declaration:/ Saya/Kami faham dan bersetuju kepada Pengakuan Data Peribadi berikut:

1.Any personal data collected or held by PAMB (whether given now or subsequently to PAMB) can be processed and used to process this application, for data matching, fraud detection and prevention, discharging PAMB’s duties as an insurer, updating PAMB’s records, marketing and promotion of other financial products and services by PAMB, group of companies of PAMB and Prudential plc, as well as communicating with me/us for any of these purposes (“Purposes”);/ Sebarang data peribadi yang dikumpul dan dipegang oleh PAMB (sama ada yang diberikan sekarang atau pada masa hadapan kepada PAMB) boleh diproses dan digunakan untuk memproses permohonan ini, pemadanan data, mengesan dan mencegah frod, melaksanakan tugas-tugas PAMB sebagai syarikat insurans, mengemaskini rekod PAMB, pemasaran dan promosi produk dan perkhidmatan kewangan lain oleh PAMB, kumpulan syarikat bagi PAMB dan Prudential plc, serta berkomunikasi dengan saya/kami untuk mana-mana tujuan disebut di atas (“Tujuan-Tujuan”);

2.To achieve these Purposes, PAMB (and any third party appointed by PAMB) can transfer and disclose the personal data to third parties such as financial institutions, reinsurers, claims investigator companies, other insurers, industry associations, PAMB’s intermediaries, individuals or entities within PAMB, group of companies of PAMB and Prudential plcs, as well as other third party service providers PAMB has appointed. As some of these third parties are not located in Malaysia, PAMB can transfer the personal data to places outside of Malaysia;/ Bagi mencapai Tujuan-Tujuan di atas, PAMB (dan mana- mana pihak ketiga yang dilantik oleh PAMB) boleh memindah dan mendedahkan data peribadi kepada pihak-pihak ketiga seperti institusi kewangan, penanggung insurans semula, syarikat siasatan tuntutan, syarikat insurans lain, persatuan berkaitan dengan industri insurans, pihak pengantara bagi PAMB, individu atau entiti dalam PAMB, kumpulan syarikat bagi PAMB dan Prudential plc, dan juga pemberi perkhidmatan pihak ketiga lain yang telah dilantik oleh PAMB. Oleh sebab sesetengah pihak-pihak ketiga ini tidak terletak di dalam Malaysia, PAMB boleh memindahkan data peribadi tersebut ke tempat-tempat di luar Malaysia;

3.I/We understand that I/we have a right to get access and request for correction of any personal data held by PAMB. Such requests can be made at PAMB’s Customer Service Centre; and/ Saya/Kami faham bahawa saya/kami mempunyai hak untuk akses dan memohon pembetulan dibuat ke atas mana- mana data peribadi yang dipegang oleh PAMB. Permohonan tersebut boleh dibuat di Pusat Perkhidmatan Pelanggan PAMB; dan