The Prudential 401K Loan form is a comprehensive document designed to assist participants of the TEAMSTER-UPS NATIONAL 401(K) TAX DEFERRED SAVINGS PLAN in requesting a hardship loan withdrawal. The form outlines specific instructions and includes a checklist to ensure that applicants provide all necessary information and documentation to support their request. The document requests personal information such as social security number, contact details, and the reason for the hardship request, which could range from medical expenses, education fees, to payments needed to prevent eviction or mortgage foreclosure. Essential to the process is the thorough documentation to evidence financial need, which, if not properly submitted, will lead to the denial of the request. The form also states the terms and conditions pertaining to the application, emphasizing the need for accuracy and the potential financial implications of the withdrawal. Importantly, it includes details about the fees associated with the loan and the expectation of repayment, highlighting the automated process of loan initiation that requires both logging onto an account and the submission of the form with supporting documents. Furthermore, it provides a detailed explanation regarding the definition of a dependent, which is crucial in determining eligibility for the deemed hardship loan withdrawal. Additionally, customer service support is available to guide applicants through the process, ensuring that assistance in various languages is accessible, demonstrating Prudential's commitment to facilitating the needs of its diverse customer base.

| Question | Answer |

|---|---|

| Form Name | Prudential 401K Loan Form |

| Form Length | 18 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 4 min 30 sec |

| Other names | 401k loan worksheet pdf, prudential retiremental 401k hardship loan form, 401k forms for printing, prudential 401k loan |

|

Instructions for Requesting a Hardship Loan Withdrawal |

|

|

||

Instructions |

Please print using blue or black ink. Enclosed are the following items needed to request a hardship loan |

|

|

withdrawal from your retirement plan. Please review and complete each of the items as described in the procedures |

|

|

below. Mail the required documents for approval and processing to the following address or fax it to |

|

|

8602: |

QUESTIONS? |

|

|

|

|

Prudential Retirement |

Call |

|

for assistance. |

|

|

PO Box 5640 |

|

|

Scranton PA 18505 |

|

Procedure Checklist

|

Procedure |

Return to |

ITEM |

|

address above? |

|

|

|

Hardship Loan |

• Complete all relevant sections after reading all the information in the |

Yes |

Withdrawal |

package. |

|

Request Form |

• Indicate the reason for your hardship loan request on the form. |

|

|

• You must also provide the appropriate documentation evidencing |

|

|

financial need. |

|

|

• Sign and date the form. |

|

|

• Return this form to the above address for review, approval and |

|

|

processing. |

|

|

|

|

Attachments to the |

The documents you need to attach to your Request for Hardship Loan |

Yes |

Hardship Loan Request |

Disbursement to substantiate the nature of your hardship loan request are |

|

Form and Hardship |

detailed on the Attachments to the Hardship Loan Request. If any of |

|

Loan Documentation |

the required documents are missing, your request for hardship loan cannot |

|

|

be processed. |

|

|

• You must include acceptable documentation within the specified |

|

|

timeframe with the attachments or your request will be rejected. |

|

|

|

|

Approval / Denial of |

Upon receipt of your hardship loan request, a review of all paperwork will |

No |

Hardship Loan Request |

be completed. |

|

|

• If it is determined that you qualify for a hardship loan based on current |

|

|

|

|

|

|

|

Ed. 1/2010

About You

771

Hardship Loan Information

Plan numberSub plan number

0 |

0 |

6 |

0 |

0 |

9 |

0 |

0 |

0 |

0 |

0 |

1 |

└──┴──┴──┴──┴──┴──┘ |

└──┴──┴──┴──┴──┴──┘ |

||||||||||

Social Security number |

|

|

|

|

|

|

|

||||

|

|

||||||||||

First name |

|

|

|

|

|

MI |

|

Last name |

|

||

└──┴──┴──┴──┴──┴──┴──┴──┴──┴──┘ └──┘ └──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┘

Address

└──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┘

City |

State |

ZIP code |

└──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┘ └──┴──┘

Email address

└──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┴──┘

Date of birth |

|

Gender |

Fax Number |

|

└──┴──┘└──┴──┘└──┴──┴──┴──┘ |

└──┘ M |

└──┘ F |

||

month |

day |

year |

|

area code |

|

|

|

|

am) |

Daytime telephone number |

|

Evening telephone number (Best time to call ____________ pm) |

||

area code |

|

|

|

area code |

Please review all the enclosed information before proceeding.

Ed. 1/2010 |

Important information and signature required on the following pages |

Reason for Hardship Loan Withdrawal

(Choose one reason only per request.)

I hereby request a Hardship Loan Withdrawal for the following reason(s). I agree to provide the applicable documentation as described. *Please refer to Important Withdrawal Information for additional information on definition of dependent in IRC Section 152.

Medical/Dental expenses incurred by me, my spouse, or any of my dependents. These are un- reimbursed medical/dental expenses that must be paid to receive medical/dental care for the participant, the participant’s spouse, the participant’s dependents. *Please refer to the Attachment to the Hardship Loan Withdrawal Request: Medical/Dental Expenses for required documentation.

Purchase (excluding mortgage payments) of my principal residence. These are expenses directly related to the purchase of a principal residence in which I shall reside excluding mortgage payments. *Please refer to the Attachment to the Hardship Loan Withdrawal Request: Purchase of a Principal Residence for required documentation.

Payment of tuition for the next 12 months of

Payments needed to prevent eviction or mortgage foreclosure on my principal residence. These payments are necessary to prevent eviction of the participant from the participant’s principal residence or foreclosure on the mortgage of the residence. *Please refer to the Attachment to the Hardship Loan Withdrawal Request: Payments to Prevent Eviction or Foreclosure for required documentation.

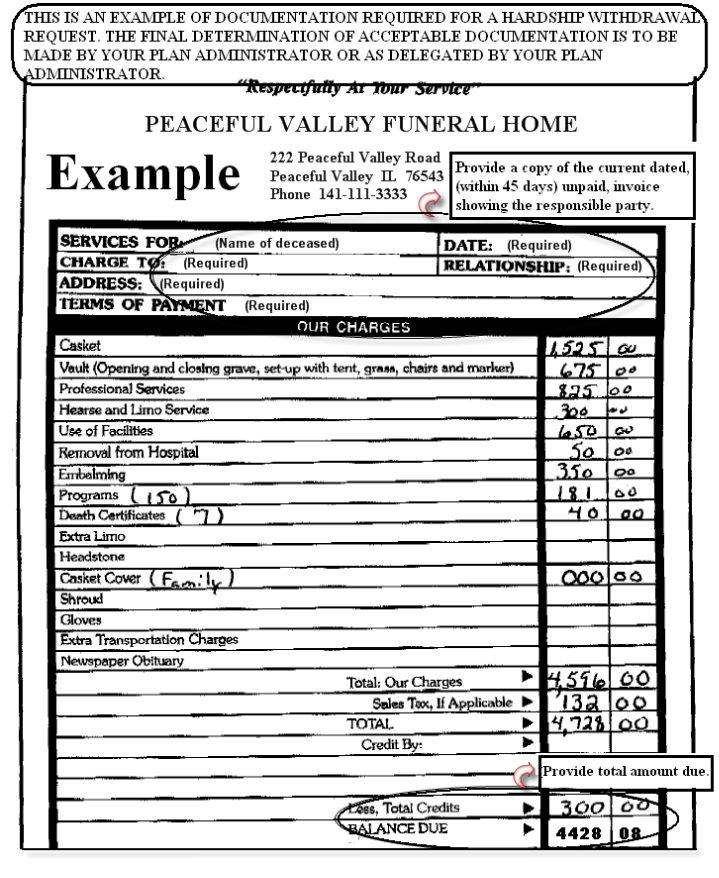

Payment of burial or funeral expenses for my deceased parent, spouse, children, dependents. This includes payment for burial or funeral expenses for the participant’s deceased parents, the participant’s spouse, the participant’s children or dependents. *Please refer to the Attachment to the Hardship Loan Withdrawal Request: Payments for Burial or Funeral Expenses for required documentation.

Expenses for the repair of damage to my principal residence that qualifies for a casualty deduction. This includes a casualty loss to the participant’s principal residence that arose from fire, storm, earthquake or some other casualty. Only the portion of the expense that is not covered by insurance is eligible for this purpose. *Please refer to the Attachment to the Hardship Loan Withdrawal Request: Payments for Damage to Principal Residence for required documentation.

Costs directly related to the placement of a child with the Participant in connection with the adoption of such child by the participant or by the participant and his or her spouse.

This includes costs related to the placement of a child with the Participant and related expenses or costs associated with the adoption process. *Please refer to the Attachment to the Hardship Loan Withdrawal Request: for Adoption Expenses for required documentation.

Important information and signature required on the following page

Fees |

• The processing fee is $75.00 and will be automatically charged to your account. The processing fee is non- |

|

refundable and will be deducted from your account even if your hardship loan is not processed. |

||

|

||

|

• A $25.00 annual maintenance fee will be charged to your account in the amount of $6.25 per quarter for the |

|

|

duration of the hardship loan. |

Your Authorization

I certify that the information I have provided is true and correct and will be relied upon in processing my request and the tax implications regarding this disbursement. I understand that any failure in this regard, inaccurate assertion or misrepresentation may jeopardize the ability of my employer to offer a plan and may subject me to disciplinary action, including severance from employment. I will be responsible for its accuracy in the event any dispute arises with respect to the transaction. I certify all other distributions (other than hardship distributions) and

Privacy Act Notice:

Since your Plan engages the services of Prudential Retirement to qualify hardships on their behalf, this information is to be used by Prudential Retirement in determining whether you qualify for a financial hardship under your retirement Plan. It will not be disclosed outside Prudential Retirement except as required by your Plan and permitted by law for regulatory audits. You do not have to provide this information, but if you do not, your application for a hardship may be delayed or rejected.

Consent:

By signing below, I consent to allow Prudential Retirement to request and obtain information for the purposes of verifying my eligibility for a financial hardship under this Plan.

The Plan will assess a 2 percent

X |

Date |

Participant’s signature

-

Important |

Terms and Conditions |

|

Withdrawal |

Important: Loan initiations for the Teamster UPS 401k plan are automated. There are two steps to completing a |

|

Information |

||

loan initiation. |

||

|

1.You must initiate the loan by either: Logging onto your account at www.prudential.com/online /retirement or by calling the

2.You must submit this form along with the required back up documentation for the loan to process.

•The minimum amount for a loan is $1,000.00.

•The maximum amount for a loan is 50% of the account balance (excluding SMA and not to exceed $50,000 in a 12 month period). Across all UPS sponsored plans in which you participate or have participated, if you have/had an outstanding loan, it may impact your maximum amount for a new loan.

•Maximum duration for hardship loan is 5 years.

•Maximum duration for a primary residence hardship loan is 15 years.

•No more than 2 loans may be outstanding at any one time.

•If a loan defaults, it will not affect your credit, but will be reported as a distribution and you will be responsible for any applicable taxes or penalties. You will not be permitted to take another loan until the defaulted loan is repaid.

Please be sure to print and return a completed "Hardship Loan Information" form along with all required supporting documentation to ensure that all pages are received and matched with your hardship loan request. Documentation submitted without this form may be delayed if we are unable to verify your account information and match it to your hardship loan request based on the information provided.

Dependent

The definition of "dependent" is important in the application of the "deemed hardship loan" withdrawal standards that pertain to 401(k) plans. Unless a specific exception applies, a dependent must either be a "qualifying child" or a "qualifying relative". These terms are defined as follows:

Qualifying Child

A qualifying child is a child or descendant of a child of the taxpayer. A child is a son, daughter, stepson, stepdaughter, adopted child or eligible foster child of the taxpayer. A qualifying child also includes a brother, sister, stepbrother or stepsister of the taxpayer or a descendant of any such relative. In addition, the individual must have the same principal place of abode as the participant for more than half of the taxable year, the individual must not have provided over half of his own support for the calendar year, and the individual must not have attained age 19 by the end of the calendar year. An individual who has attained age 19 but is a student who will not be 24 as of the end of the calendar year and otherwise meets the requirements above is also considered a qualifying child. Special rules apply to situations such as divorced parents, disabled individuals, citizens or nationals of other countries, etc. Please see your tax advisor for further details regarding special situations.

Qualifying Relative

A qualifying relative is an individual who is not the participant's "qualifying child", but is the participant's: child, descendant of a child, brother, sister, stepbrother, stepsister, father, mother, ancestor of the father or mother, stepfather, stepmother, niece, nephew, aunt, uncle,

If you are requesting a hardship loan withdrawal to cover expenses that pertain to the individuals listed below, copies of the following additional documents must also be submitted:

•Your dependent: Your most recent Form 1040 US Income tax return.

ATTACHMENT TO THE HARDSHIP LOAN WITHDRAWAL REQUEST

Medical/Dental Expenses

Definition: Expenses for (or necessary to obtain) medical/dental care that would be deductible under IRC section 213(d) (determined without regard to whether the expenses exceed 7.5% of adjusted gross income.

IMPORTANT: PLEASE READ AND COMPLETE BEFORE SUBMISSION OF REQUEST

The approved hardship loan amount will be limited to the amount deemed necessary to satisfy the immediate need as determined by the supporting documentation provided.

REQUIRED

Medical Expenses Qualified Documentation (Check all that apply and enclose with Hardship Loan Withdrawal Request Form and documentation)

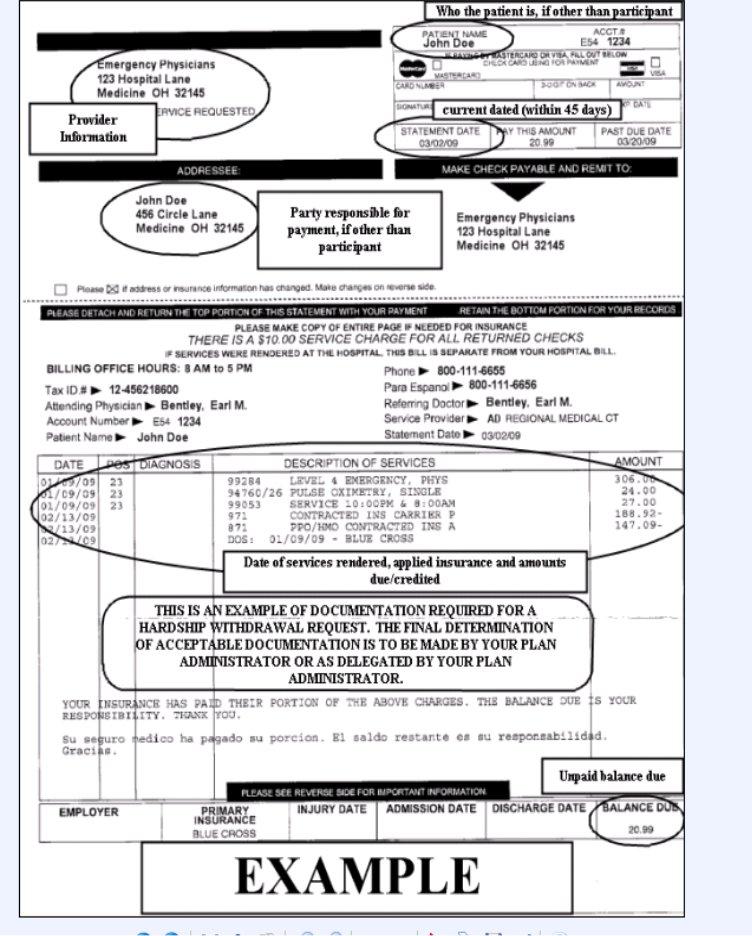

Medical/Dental Expenses: Copy of the medical bill (including Copy of Explanation of Benefits Form from your insurance carrier) listing the medical expenses and totals on letterhead of the medical or insurance provider showing the participant or the dependent as the patient or the insured. Bill must not be older than 45 days. Itemized insurance and medical/dental bills must show the insured and uninsured portion of the expenses. If doctor, hospital, or other health care bills are not covered, the provider must verify this information directly on the medical bill in addition to signing and providing their title.

If the physician/dentist refuses to perform future treatment without payment in advance, include a signed treatment plan from the doctor’s office, including the title of the person signing, stating the future date of the appointment and that payment is expected at the time service is rendered. The treatment plan must show the estimated insurance portion and the amount due by the patient.

Insurance Premiums for Medical Expenses or Long – Term Care Services: Copy of insurer’s bill for premiums on letterhead showing the participant or dependent as the patient or insured. These premiums must not be reimbursed by any Employer. Bill must not be older than 45 days.

Lodging expenses while away from home primarily for and essential to medical care: Copy of bill from provider on letterhead showing the participant or dependent as customer with accompanying medical expense bill indicating the dates of service. Bill must be dated within 45 days and participant can only submit lodging expenses up to $50 per person, per night.

I am requesting this amount due to my: |

|

Own medical/dental expenses |

|

Spouse’s medical/dental expenses |

|

Child’s medical/dental expenses |

|

Dependent’s medical/dental expenses |

|

Dependent Name______________________________ |

Relationship ___________________ |

I certify that the expenses for which I am requesting a hardship loan withdrawal: 1) have not and will not be reimbursed through insurance or otherwise, and 2) were incurred for medically necessary services.

Signature |

X |

Date |

The participant may request a hardship loan withdrawal for qualifying medical expenses incurred by the participant, the participant's spouse, children or dependent, Please see the "Important Withdrawal Information" page for a detailed definition of dependent. “Medical/Dental care" includes amounts paid for any of the following:

1.For the diagnosis, cure, mitigation, treatment or prevention of disease, or for the purpose of affecting any structure or function of the body.

2.For transportation primarily for and essential to "medical care" as defined above.

3.For qualified

4.For insurance covering medical care as described in 1. and 2. above, or for eligible

5.For lodging away from home that is primarily for and essential to medical care, subject to the limits of IRC section 213(d)(2).

6.For prescribed drugs that require a prescription of a physician.

“Medical care” does not include cosmetic surgery or similar procedures unless it is necessary to ameliorate a deformity related to a congenital abnormality, a personal injury resulting from an accident or trauma, or a disfiguring disease.

ATTACHMENT TO THE HARDSHIP LOAN WITHDRAWAL REQUEST

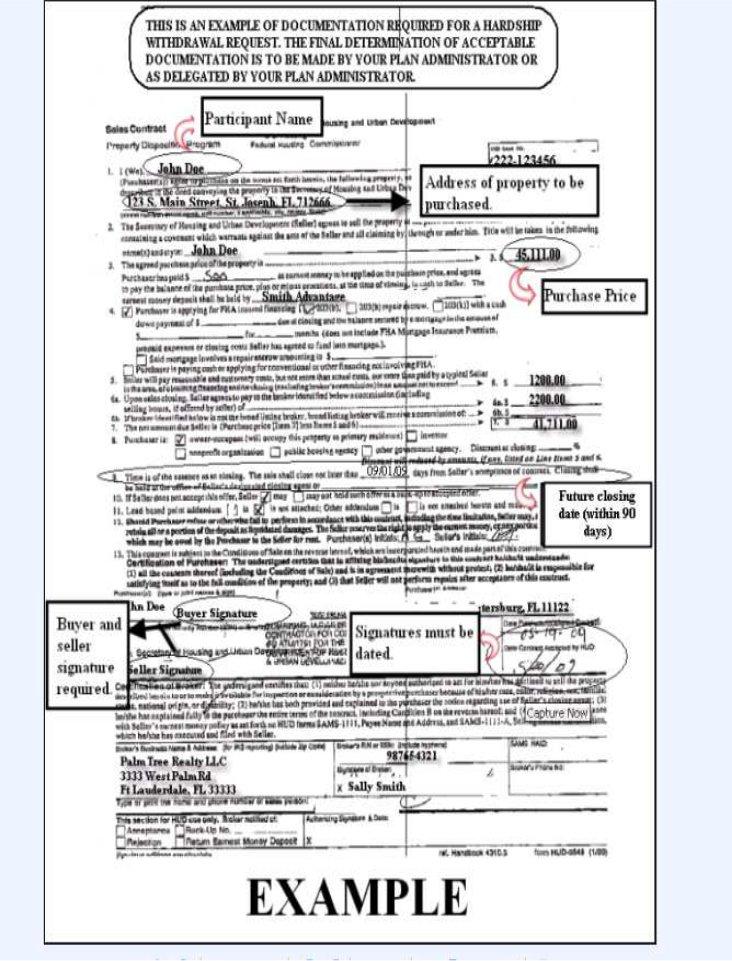

Purchase of a Principal Residence

Definition: Expenses directly related to the purchase of a principal residence for the employee (excluding mortgage payments).

IMPORTANT: PLEASE READ AND COMPLETE BEFORE SUBMISSION OF REQUEST

The approved hardship loan amount will be limited to the amount deemed necessary to satisfy the immediate need as determined by the supporting documentation provided.

REQUIRED

Purchase of a Principal Residence Documentation (Check all that apply and enclose with Hardship Loan Withdrawal Request Form and documentation)

Provide a copy of the binding contractual agreement, including addendums if any, to build a home or purchase agreement that is signed/dated by both parties (buyer and seller.) These agreements must include the address of the property, the total purchase price, and a future closing/settlement date not to exceed 90 days from the request date..

Please provide one of the below documents to verify the “estimated costs due at closing”. The purchase price and the property address listed on the below document MUST match the purchase price and property address listed on the purchase agreement.

1.The “Initial Fee Worksheet” (dated within 45 days) containing your name, the property address and the estimated costs due (out of pocket expenses) at time of closing.

2.A letter from the Lender (dated within 45 days) verifying the amount of “estimated costs due at closing”. The letter must be on financial institution’s letterhead referencing the participant’s name, property address and it will need to be signed & titled by a representative from the facility.

3.A copy of the (typed) Uniform Residential Loan Application (dated within 45 days) containing the “estimated costs due at closing”. The loan application must contain your name and the property address.

If a future closing date is not on the sales agreement, provide a letter from the mortgage company that includes the future closing date. The letter must be on letterhead, reference your name and the property address, and it must be signed/titled by a representative from the mortgage company.

The participant can only qualify for a hardship loan withdrawal for this reason when he is purchasing a dwelling that will be his principal residence. This means that he expects to move into the residence within a fairly short period of time after purchasing it.

ATTACHMENT TO THE HARDSHIP LOAN WITHDRAWAL REQUEST

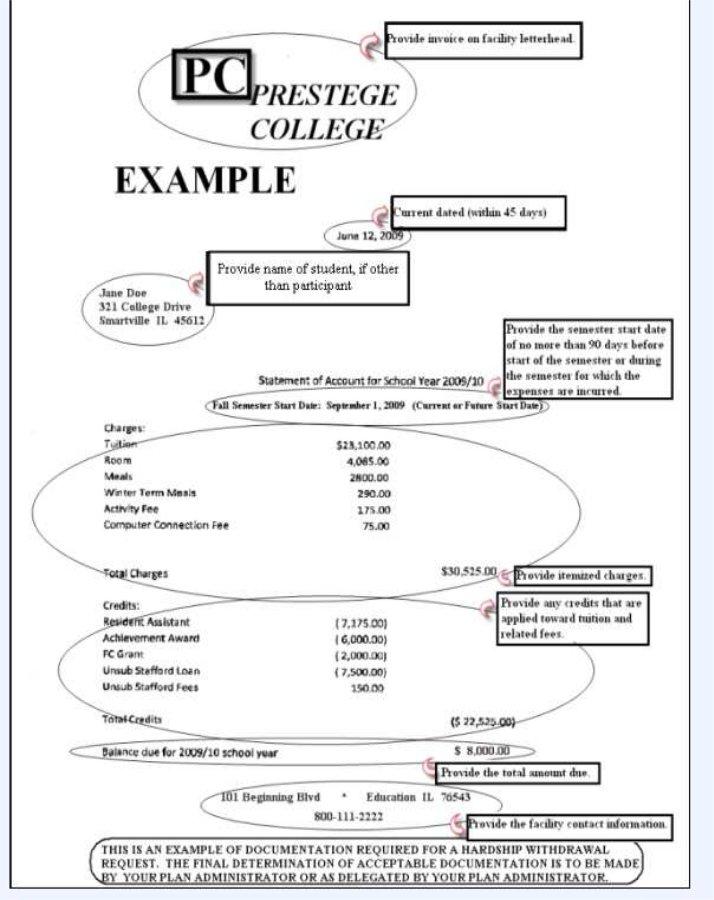

Payment of Tuition & Related Fees

Definition: Payment of tuition, related educational fees, and room and board expenses, for up to the next 12 months of post – secondary education for the employee, or the employee’s spouse, children, dependents See the discussion of ‘dependent’ in the earlier section of this form packet.

IMPORTANT: PLEASE READ AND COMPLETE BEFORE SUBMISSION OF REQUEST

The approved hardship loan amount will be limited to the amount deemed necessary to satisfy the immediate need as determined by the supporting documentation provided.

REQUIRED

Payment of Tuition & Related Fees Documentation (Check all that apply and enclose with Hardship Loan Withdrawal Request Form and documentation)

Copies of actual invoices for future tuition on school’s letterhead, of up to the next 12 months of

The next 12 months of post

Copy of the bill for dormitory fees or housing fees (or estimate of dormitory fees that is signed by the educational institution) that appears on the school’s letterhead containing the name of the dormitory or housing provider and the name of the participant or student. A copy of a lease agreement indicating rent and signed/dated by all interested parties. The bill must specify the amount due and must refer to a future period ending not more than one year later than the date of submission.

Copy of the bill for board (meals) expenses (or estimate of boarding expenses that is signed by the owner or manager of the boarding establishment) that appear on the school’s letterhead containing the name of the establishment providing the board and meals and the name of the participant or student. The bill must specify the amount due and must refer to a future period ending not more than one year later than the date of submission.

I am requesting this amount due to my:

Own educational expenses |

|

Spouse’s educational expenses |

|

Child’s educational expenses |

|

Dependent’s educational expenses |

|

Dependent Name______________________________ |

Relationship ___________________ |

Post – secondary education generally refers to education that commences after the completion of high school. Expenses that would qualify for a hardship loan withdrawal would include tuition, fees charged for the use of technological or other facilities required for the post – secondary program (such as computer fees or gym facility fees), dormitory expenses and expenses of a room or apartment close to the educational facility, and meals while attending the educational program. Loan repayments of student loans are not educational expenses for this purpose.

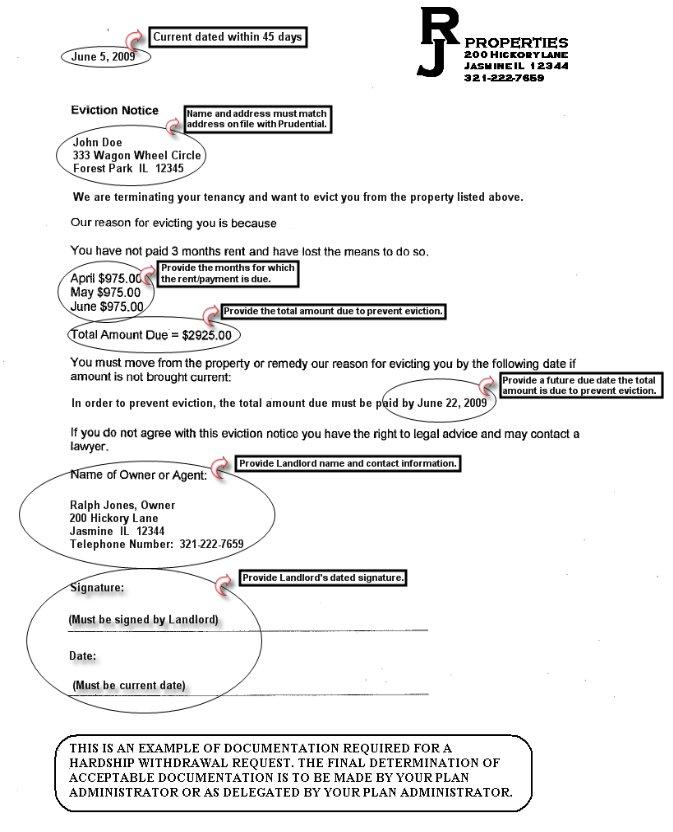

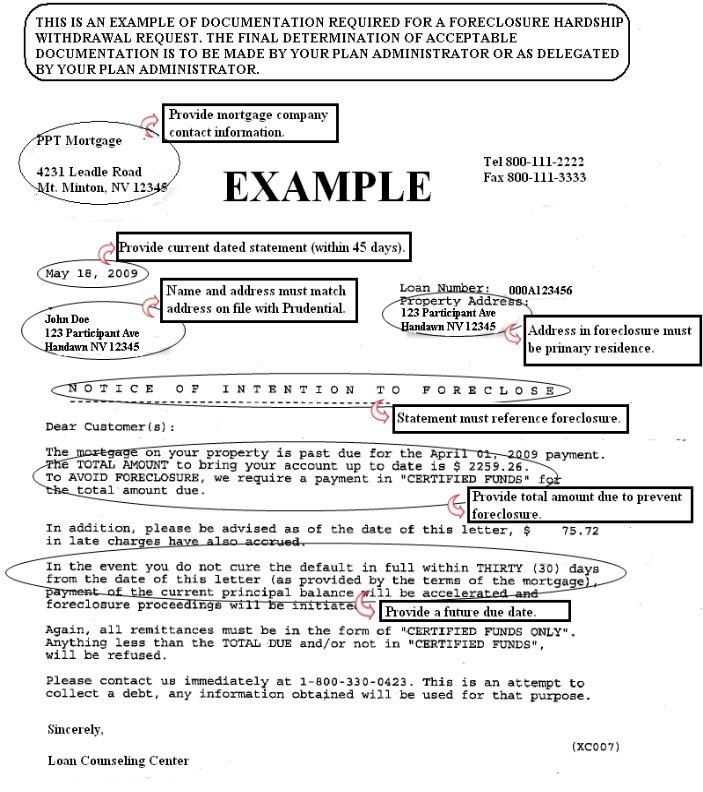

ATTACHMENT TO THE HARDSHIP LOAN WITHDRAWAL REQUEST

Payments to Prevent Eviction or Foreclosure

Definition: Expenses necessary to prevent the eviction of the employee from the employee’s principal residence or foreclosure on the mortgage of that residence.

IMPORTANT: PLEASE READ AND COMPLETE BEFORE SUBMISSION OF REQUEST

The approved hardship loan amount will be limited to the amount deemed necessary to satisfy the immediate need as determined by the supporting documentation provided.

REQUIRED

Payments to Prevent Eviction or Foreclosure Documentation (Check all that apply and enclose with Hardship Loan Withdrawal Request Form and documentation)

Include a copy of the eviction/foreclosure notice or Court Order. The notice or Court Order must:

•Include your name and address (address on documentation must match address on file with Prudential)

•Be dated within 45 days of your request

•Clearly state a future due date by which the amount is due to prevent Eviction/Foreclosure

•Provide the months for which the rent/payment is due

•Clearly identify the Landlord and the Landlord’s contact information

•Include Landlord’s dated signature and TITLE (Examples: landlord, property manager, etc.)

If your address on file with Prudential does not match the address of your primary residence on the foreclosure or eviction notice, please submit a copy of your current driver’s license which shows your primary residence address. If your current driver’s license has not yet been updated with your primary residence address, you may also submit a signed, dated, notarized letter stating that the home in foreclosure, or the residence you are being evicted from, is your primary residence.

Provide a copy of the foreclosure notice from the financial institution (on the financial institution’s letterhead) or Court Order (dated within 45 days). The notice or Court Order must clearly state the dollar amount that is due and a future date that it is due in order to remedy foreclosure proceedings.

Delinquent property taxes qualify if they are taxes on the participant’s primary residence and will result in foreclosure or sale of the property. The tax notice (dated within 45 days) must reference the tax year(s), it must state the dollar amount due and a future date that is needed to prevent the sale of the property.

The participant can only qualify for a hardship loan withdrawal for this reason if they must pay some dollar amount by some certain date in order to prevent foreclosure or avoid eviction.

ATTACHMENT TO THE HARDSHIP LOAN WITHDRAWAL REQUEST

Payment for Burial or Funeral Expenses

Definition: Payments for burial or funeral expenses for the employee’s deceased parent, spouse, children, dependents.

IMPORTANT: PLEASE READ AND COMPLETE BEFORE SUBMISSION OF REQUEST

The approved hardship loan amount will be limited to the amount deemed necessary to satisfy the immediate need as determined by the supporting documentation provided.

REQUIRED

Payment for Burial or Funeral Expenses Documentation (Check all that apply and enclose with Hardship Loan Withdrawal Request Form and documentation)

Unpaid invoices (dated within 45 days) from other parties to pay additional expenses associated with the funeral.

•Covered expenses including opening/closing of a grave, a burial plot, a burial vault or grave liner, a market or monument, a crypt, cemetery perpetual care charges, honoraria for clergy, a funeral breakfast/luncheon/dinner expenses associated with the funeral/memorial service, flowers, guest registers and acknowledgment cards, music, an urn or casket.

•Expenses that are not covered include invoices that have been paid, burial expenses to the extent that they are covered by Veteran’s benefits, travel expenses incurred by family members to attend the funeral, and prearranged/prepaid funerals.

Provide a copy of the current (dated within 45 days) unpaid invoice signed by the funeral home/director. The itemized bill must show the name of the deceased, the unpaid balance due and the responsible party for payment.

Provide a copy of the current (dated within 45 days) unpaid invoices from other parties to pay additional expenses. The itemized bill must show the name of the deceased, the unpaid balance due and the responsible party for payment.

Copy of the death certificate.

I am requesting this amount due to my:

Parent’s death |

|

Spouse’s death |

|

Child’s death |

|

Dependent’s death |

|

Dependent Name______________________________ |

Relationship ___________________ |

ATTACHMENT TO THE HARDSHIP LOAN WITHDRAWAL REQUEST

Expenses for the Repair of Damage to the Employee’s Principal Residence that Qualifies for a Casualty Deduction

Definition: Expenses for the repair of damage to the employee’s principal residence that would qualify for the casualty deduction under section 165 (determined without regard to whether the loss exceeds 10% of adjusted gross income).

IMPORTANT: PLEASE READ AND COMPLETE BEFORE SUBMISSION OF REQUEST

The approved hardship loan amount will be limited to the amount deemed necessary to satisfy the immediate need as determined by the supporting documentation provided.

REQUIRED

Documentation (Check all that apply and enclose with Hardship Loan Withdrawal Request Form and documentation)

Evidence of casualty (a detailed description of the events that resulted in the casualty). You may submit pictures and/or articles of newspaper clippings as evidence.

The reason for the loss and any documentation supporting that loss. You must sign/date your letter of explanation.

The location of the loss (the address of the loss must be the participant’s primary residence).

If your address on file with Prudential does not match the address of your primary residence as listed on the casualty description or invoices, please submit a copy of your current driver’s license which shows your primary residence address. If your current driver’s license has not yet been updated with your primary residence address, you may also submit a signed, dated, notarized letter stating that the home affected by the casualty is your primary residence.

Unpaid current (dated within 45 days) invoices and/or contracts, signed by participant and contractor, evidencing the cost of the repair, and which indicates that insurance does not cover the cost of repairs. Please note: We cannot accept an estimate of these charges.

Copy of any insurance claims from your insurance company as evidence that the damages have/have not been covered by your homeowners insurance.

I am requesting this amount because of damages that were caused to my principal residence due to:

Fire

Storm

Shipwreck

Other Casualty* This may require further review by plan, legal, etc.

Theft*

*Describe casualty or theft: _____________________________________________________________________________

___________________________________________________________________________________________________

___________________________________________________________________________________________________

A “casualty loss” is defined as a “sudden, unusual or unexpected” event resulting in an uninsured loss. Causes of such rapid losses include flood, fire, earthquake, wind damage, water damage, theft, accident, vandalism, hurricane, tornado, riot, shipwreck, snow, rain and ice. To be deductible, a casualty loss must occur quickly, usually instantly or over a few days. Slow losses that occur over months or years, such as mold damage, dry rot, moth or termite damage, or normal home maintenance to repair or replace windows, roofs or plumbing generally are not

The participant can only qualify for a hardship loan withdrawal for this reason when there is a casualty loss to his principal residence that arose from fire, storm, shipwreck, or some other casualty, or from theft. Only the portion of the expense that is not covered by insurance is eligible for this purpose.

The amount of loss is based upon the lesser of the difference between the market value of the property before and after the casualty occurrence or the loss in the basis of the property.

Because of the difficulties of ascertaining the timing of the casualty loss and the dollar amount of the loss, your claim can only be processed through this procedure using the specified documents, and you are strongly urged to discuss with your own tax, accounting or legal advisors the proper measurement of the amount of the casualty deduction loss and the taxable year for which it qualifies as a casualty loss.

ATTACHMENT TO THE HARDSHIP LOAN WITHDRAWAL REQUEST

Adoption Expenses

Definition: Costs directly related to the placement of a child with the Participant in connection with the adoption of such child by the participant or by the participant and his or her spouse.

IMPORTANT: PLEASE READ AND COMPLETE BEFORE SUBMISSION OF REQUEST

Requirements:

•The child must be under the age of 18 at the time of adoption for the expenses to qualify. A copy of the child’s birth certificate is generally not required but may be provided as evidence if the age of the adoptee is in question.

•Adoptions that take place outside the United States require proper documentation from the Department of Justice and the United States Immigration and Naturalization Services to be considered eligible.

•Paperwork must clearly identify the participant or participant and his/her spouse as the potential adoptive parents, where applicable, and the responsible party for payment of expenses.

•The paperwork must meet the general requirements of a formal unpaid bill, with all expected/incurred charges outlined in detail.

•A formal estimate of expected charges may be accepted in place of a bill if all charges have been outlined in detail and there is sufficient evidence of the participant’s intent to accept the terms of the contract. The formal estimate must be signed, titled, and dated by an authorized representative to be considered valid.

Qualified expenses must be substantiated by supporting documentation such as formal adoption paperwork or legal correspondence if the bill would not otherwise be identified as an adoption expense. For example, a bill for airline travel to a different state where the birth mother or adoption agency resides in order to pick up the adopted child may not be included in the adoption agency’s fees, but may be submitted separately if the destination can be verified. The participant may provide a signed statement if additional clarification is needed.

REQUIRED

Documentation (Check all that apply and enclose with Hardship Loan Withdrawal Request Form and documentation)

A copy of the adoption paperwork with the amount required to pay for the adoption, including airfare and additional travel expenses. All documentation must be current dated (within 90 days of request).

Legal costs, including attorney’s fees and the cost of legal proceedings.

Medical expenses of the natural mother associated with the actual childbirth.

Charges for temporary foster care before placement provided by a licensed agency.

Reasonable and customary transportation and lodging expenses to obtain physical custody of the adopted child.

Additional Adoption specific list of guidelines could be found on the Prudential’s web site at www.prudential.com/online/retirement.