Dealing with PDF forms online is a piece of cake with our PDF tool. You can fill out how to ptax 300 r here in a matter of minutes. To have our tool on the forefront of efficiency, we strive to put into operation user-oriented features and enhancements regularly. We are always grateful for any feedback - join us in remolding PDF editing. Should you be seeking to get started, here is what you will need to do:

Step 1: Click the "Get Form" button at the top of this webpage to open our editor.

Step 2: With this handy PDF tool, it is possible to accomplish more than merely fill in blanks. Express yourself and make your docs seem professional with custom textual content incorporated, or adjust the original input to perfection - all that supported by an ability to add stunning photos and sign it off.

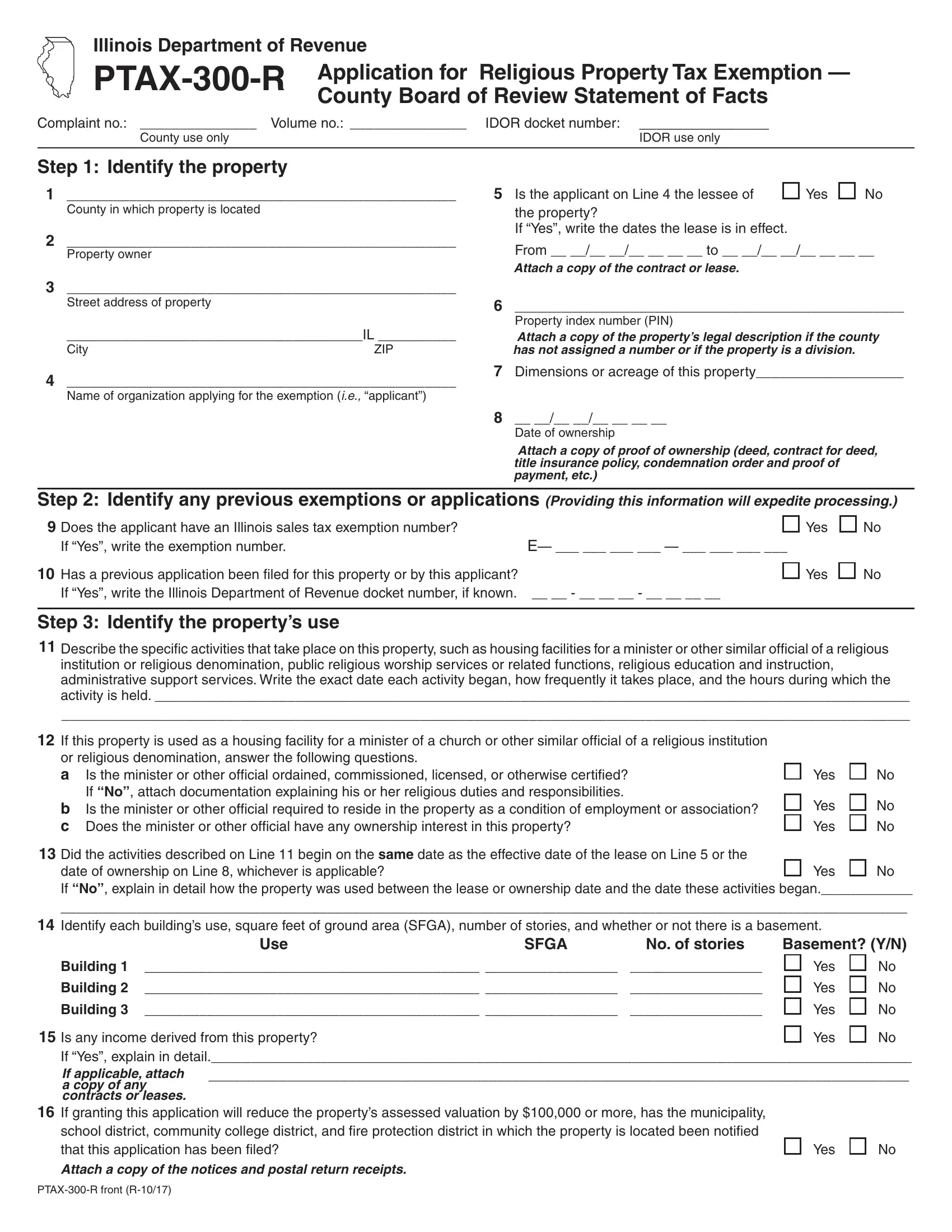

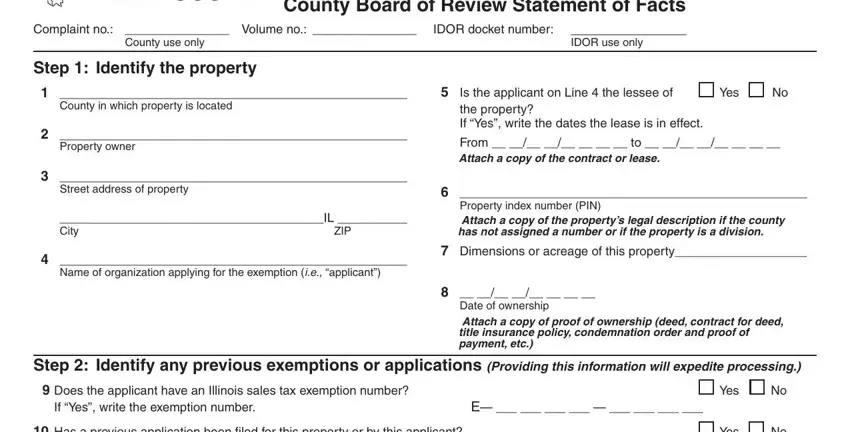

To be able to complete this PDF form, make sure you enter the right information in each area:

1. Fill out your how to ptax 300 r with a selection of essential blank fields. Gather all of the information you need and be sure there's nothing missed!

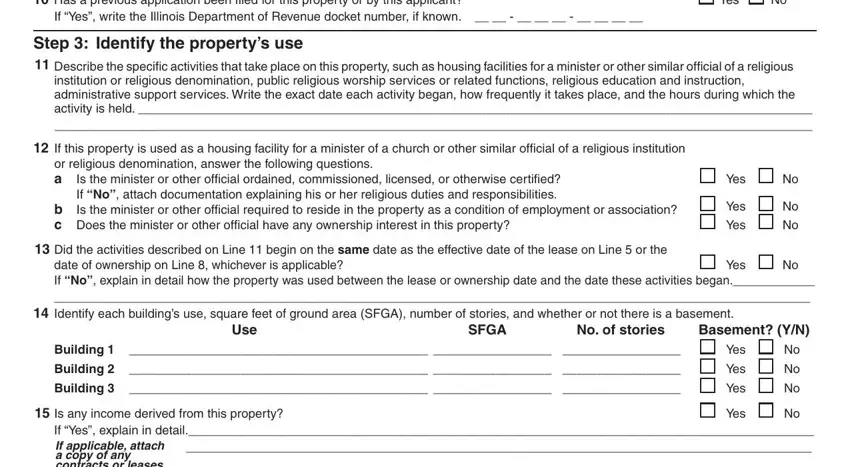

2. Soon after the prior part is filled out, go to type in the applicable details in these: Does the applicant have an, If Yes write the Illinois, Yes, Step Identify the propertys use, or religious denomination answer, date of ownership on Line, Is the minister or other official, Yes Yes Yes, Basement YN, No of stories, No No, SFGA, Yes, Use, and Building.

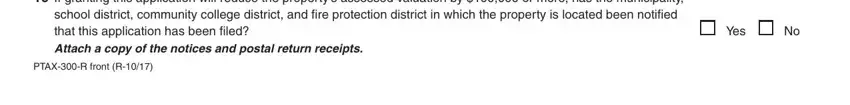

3. The following part focuses on Is any income derived from this, Yes, and PTAXR front R - fill in all of these empty form fields.

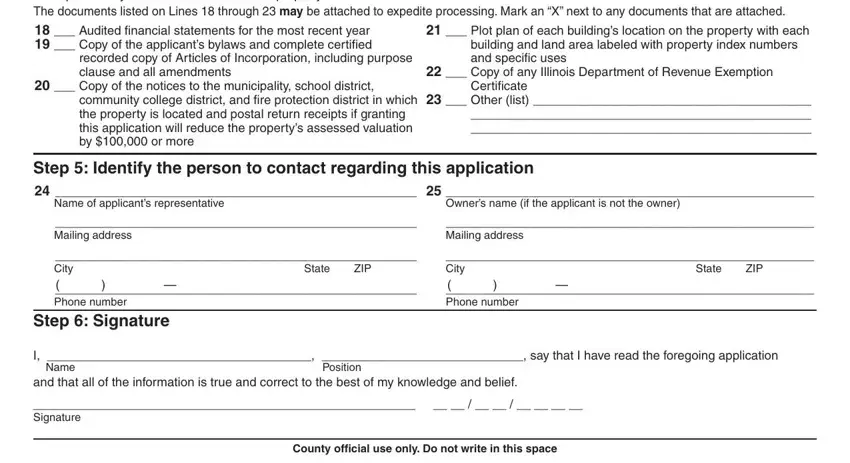

4. You're ready to fill out this next part! Here you'll have these cid Proof of ownership copy of the, recorded copy of Articles of, The documents listed on Lines, community college district and fire, building and land area labeled, Plot plan of each buildings, Copy of any Illinois Department, Certificate, Step Identify the person to, Owners name if the applicant is, Name of applicants representative, Mailing address, Mailing address, City Phone number, and State form blanks to complete.

As to Mailing address and Plot plan of each buildings, be sure that you don't make any errors here. These are the key fields in this form.

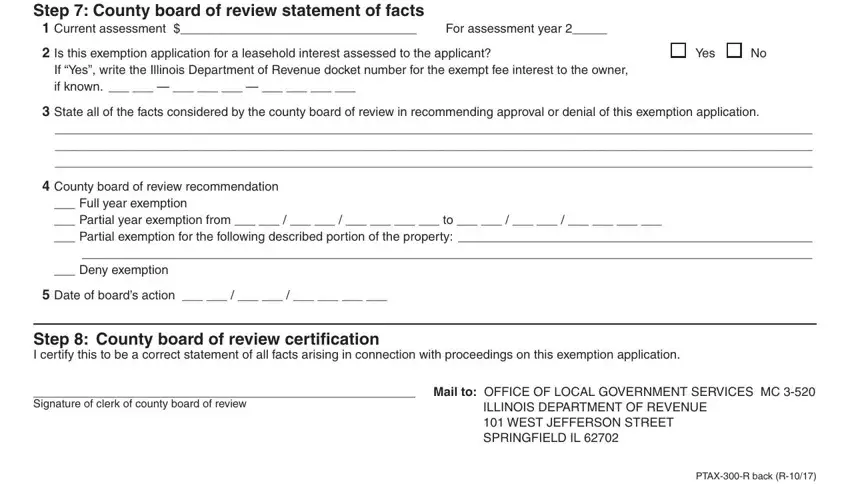

5. Lastly, this final segment is precisely what you have to finish prior to submitting the document. The fields in this instance are the next: Step County board of review, For assessment year, Is this exemption application for, If Yes write the Illinois, Yes, State all of the facts considered, County board of review, Full year exemption Partial year, Date of boards action, Step County board of review, Mail to OFFICE OF LOCAL, ILLINOIS DEPARTMENT OF REVENUE, and PTAXR back R.

Step 3: Prior to submitting the document, check that blanks have been filled in right. Once you think it is all fine, press “Done." Grab the how to ptax 300 r the instant you subscribe to a 7-day free trial. Easily use the pdf file from your FormsPal cabinet, with any modifications and changes automatically saved! FormsPal guarantees your data privacy by using a secure system that never records or shares any personal information typed in. Be confident knowing your docs are kept safe any time you use our tools!