INSTRUCTIONS FOR PAGE 2 OF VESSEL/BOAT APPLICATION (PWD 143)

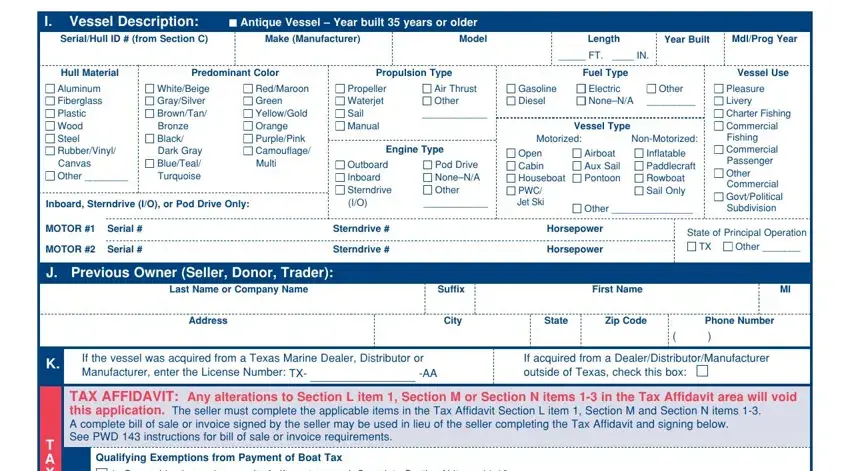

Section I: Vessel Description.

•Completeeachofthefieldswiththeappropriatevesselinformation.Forvesselswithinboardmotor(s)enterthemotorserialnumberandthehorsepowerforeach motor listed. For vessels with inboard/outdrive motor(s) enter the motor serial number and outdrive number and the horsepower for each motor listed. If your vessel has an outboard motor, you must title the outboard motor separately by completing an Outboard Motor Application (PWD 144).

Section J: Previous Owner (Seller, Donor, Trader).

•Providethename,address,andphonenumberoftheperson(s)orcompanythatpreviouslyownedthevessel.Thiswouldapplytotheseller,donor,dealer,or trader of the vessel.

Section K: Marine License Number (complete this section and Section C, third line).

•IfthevesselwasacquiredfromaTexasMarineDealer,DistributororManufacturer,entertheirlicensenumberinthespaceprovided.Example:TX-0321-AA.

If this vessel was not acquired through a Texas Marine Dealer, Distributor or Manufacturer, leave this blank.

•IfthevesselwasacquiredfromaDealer,DistributororManufacturerfromoutsideofTexas,checkthebox.Ifitwasnot,leavethisboxblank.

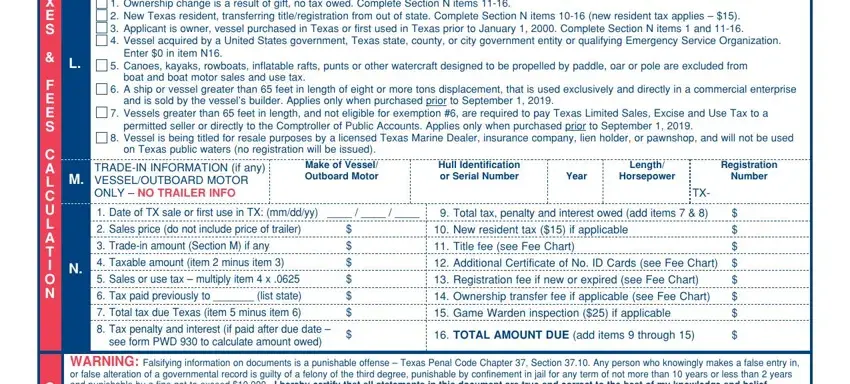

TAX AFFIDAVIT: Sections L-P.

•Any alterations in Section L item 1, Section M or Section N items 1-3 will void the application.

•The seller must complete Section J and the applicable items in the Tax Affidavit Section L item 1, Section M and Section N items 1-3 and sign Section O.

•AbillofsaleorinvoicemaybeusedinlieuofthesellercompletingtheTaxAffidavitsectionandsigningSectionO.Abillofsaleorinvoicemustcontainthe purchaser’s name, description of vessel (make, year built, TX# or HIN), date of sale, sales price, and an original signature of the seller.

Section L: Qualifying Exemptions from Payment of Tax.

If any of the following exemptions are checked, enter $0 in Section N item 9.

1.If the ownership change is the result of a gift or inheritance, the donor must check this box. Complete Section N items 11-16.

2.If you are a new resident to Texas and are transferring title/registration from another state, check this box. Enter the new resident tax fee of $15 in Section N item 10. Complete Section N items 11-16.

3.Tax will not be collected if the applicant purchased the vessel in Texas or first used the vessel in Texas prior to January 1, 2000 and subject to assessment limitation. If this situation applies to you, check this box and complete Section N items 1 (date of sale or date first used in Texas) and 11-16.

4.If the applicant is a (U.S.) federal or Texas government entity (political subdivision), or a qualifying Emergency Service Organization who can claim a tax exemption, check this box. Enter $0 in Section N item 16.

5.If this vessel is a canoe, kayak, rowboat, inflatable raft, punt or other vessel designed to be propelled by paddle, oar, or pole, check this box. Complete Section N items 11-16.

6.A vessel purchased from the builder (manufacturer), used specifically for commercial purposes, greater than 65 feet in length and has a displacement of eight or more tons.

7. Ifthisvesselisgreaterthan65feetinlengthcheckthisbox.TexasLimitedSales,Excise,andUseTaxmustbepaidtoapermittedsellerordirectlytotheTexas

Comptroller of Public Accounts. Complete Section N items 11-16.

8. IftheapplicantisaMarineDealershipthatacquiredthevesselforresale,aninsurancecompanythatacquiredthevesselasaresultofaclaim,alienholderor pawn shop that acquired the vessel as a result of a repossession or forfeiture and is required by a state or governmental entity to title for resale purposes only and not for use on Texas public waters, check this box. No registration will be issued. Complete Section N items 11-16.

Section M: Trade-in Information.

•Trade-inInformation–Ifyouhavetradedavesseloroutboardmotortowardsthepurchaseofthevessel,thesellermustcompleteSectionM.Includethemake, hull identification/serial number, year built, length and/or horsepower and, if applicable, the registration or TX number of the vessel/outboard motor traded in. Any trade other than a vessel or outboard motor requires the seller to provide the value of the item traded as the sales price in Section N item 2.

Section N: Date of Sale, Sales Price, Taxes, and Fees Owed.

1.Date of Sale – The seller must fill in the date that the purchaser took delivery of the vessel in Texas or if purchased elsewhere, the date of first use in Texas.

2.Sales Price – The seller must fill in the sales price for the vessel.

3.Trade-in Amount – The seller must fill in the amount you were credited for a taxable vessel and/or outboard motor that was accepted as trade-in for the transaction.

4.Taxable Amount – Subtract the amount of the trade-in from the sales price and enter that value on this line. (Item 2 minus item 3)

5.Sales or Use Tax – Multiply the amount on item 4 by .0625 or use form PWD 930 to calculate this amount for you. Enter that amount here. For additional informationregardingsalestax,contacttheComptrollerofPublicAccountsat(800)252-5555or(512)463-4600orTTDat(800)248-4099.

6.Tax Paid – If the applicant previously paid sales tax in Texas or in another state on this vessel, enter the abbreviation of the state where the tax was paid and the amount of tax paid. You will have to provide proof for any tax claimed under this item.

7. TotalTaxDueTexas–SubtractsalestaxpreviouslypaidtoTexasoranotherstatefromTexasSalesTax.(Item5minusitem6)

8. TaxPenaltyandInterest–Ifyoudonotoweapenalty,enterzero($0).Ifyouhavenotpaidsalestaxwithin20workingdaysfromthedateofdeliveryorthe date the vessel is brought into Texas, you will owe a tax penalty and interest may be due. To calculate the amount of penalty and interest owed, please use form PWD 930 which can be found at www.tpwd.texas.gov/boat/forms.phtml. You will need to enter the date of sale, the sales price, any trade-in amount (Section N items 1-3), and any tax previously paid in Texas or another state (Section N item 6).

9. TotalTax,PenaltyandInterestOwed–Additems7and8andenterthetotalonthisline.

10.New Resident Tax – If you owned the vessel in another state where it was titled and/or registered, you will need to pay New Resident Tax of $15.

11.Title Fee – If you are titling this vessel, enter fee for a regular title or enter bonded title fee if this is an application for a bonded title.

12.If you are registering, you will receive one (1) Certificate of Number ID Card. If you would like to purchase additional cards, enter the fee for the number of cards you are requesting.

13.If you are registering this vessel for the first time, or are transferring ownership with registration expiring within 90 days, or if the registration has expired, enter the appropriate registration fee according to the fee chart. Registration provides a set of decals for display on the vessel and expires after two years.

14.Ownership Transfer Fee – If ownership and registration of a vessel with a TPWD record is being transferred, then enter the ownership transfer fee on this line.

15.Game Warden Inspection – If you are paying for an inspection by a Texas Game Warden, enter $25 on this line.

16.Total Amount to Be Paid – Add the amounts from items 9 through 15 and enter the total on this line. This is the amount you owe.

A fee chart can be obtained:

• onlineatwww.tpwd.texas.gov/fishboat/boat/forms

• bytelephoneutilizingtheBoatInformationSystem(800)262-8755

• attheTexasParksandWildlifeHeadquartersinAustin

• fromanyofthe28TPWD Law Enforcement field offices throughout the state

• fromanyparticipatingTaxAssessor-Collectoroffice(contactyourlocaltaxofficetoconfirmiftheyprocessboatregistrationtitles)

Section O: Seller(s), Previous Owner(s), or Lawful Representative – Original signatures are required, copies will not be accepted.

•Thepreviousowner(s)mustsigntheirnameanddatethissection.Abillofsaleorinvoicemaybeusedinlieuoftheseller(s)completingtheTaxAffidavitand signing this section. A bill of sale or invoice must contain the purchaser(s) name, description of vessel (make, year built, TX# or HIN), date of sale, sales price, and an original signature of the seller(s).

Section P: Purchaser(s), Applicant(s), or Lawful Representative – Original signatures are required, copies will not be accepted.

•Theapplicant(s)mustsigntheirnameanddatethissection.

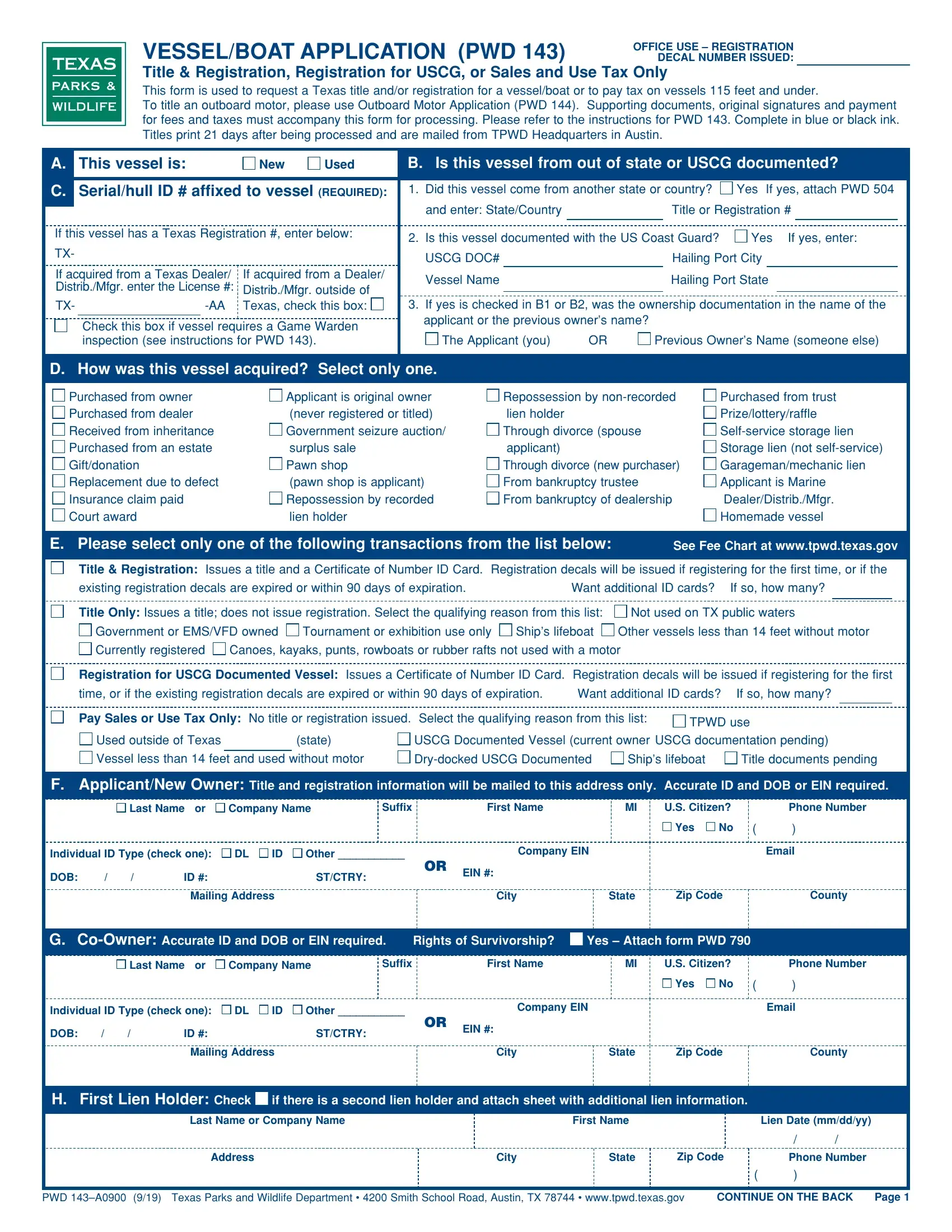

INSTRUCTIONS FOR PAGE 1 OF VESSEL/BOAT APPLICATION (PWD 143)

Additional forms and information may be obtained at www.tpwd.texas.govunderthe“Boating”category.FortelephoneassistancecontactTPWDat(800)262-8755 or(512)389-4828.TheformPWD143mustbecompletedandsubmittedwithanysupportingdocumentationandappropriatefeestoTPWDHeadquartersinAustin,

a TPWD local law enforcement office, or a participating County Tax Assessor-Collector office. Effective 1/1/94, all vessels/boats and outboard motors are required to be titled unless exempt. Registration is required for use on all Texas public waters. Outboard motors must be titled separately using PWD 144.

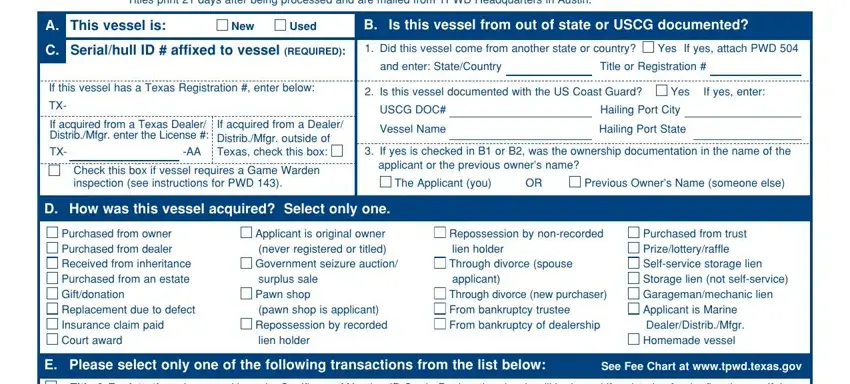

Section A: Is the Vessel New or Used?

•‘New’isdefinedas:BrandnewvesselspurchasedfromaDealer,Distributor,orManufacturer;oranewlybuilthomemadevessel.Typically,thesevesselshavenot

been used other than in a demonstration by the Dealer, Distributor or Manufacturer.

•‘Used’isdefinedas:AnyvesselwithanexistingTPWDtitleorregistrationrecord,anyvesselthatisrecordedinanotherstateorcountry,anyUSCGdocumented vessel, or any vessel that is not currently on record and does not have a Manufacturers Statement of Origin or is not newly homemade.

Section B: Is the Vessel From Out of State or USCG Documented?

1.If the vessel is coming from another state or country, check “yes,” attach completed PWD 504, and enter the name of the state or country. Enter the title or registration number or if the vessel was not registered or titled, leave the “title/registration number” box blank. If the vessel is titled in another state, you must submit the original out-of-state title with this application (form PWD 143). If the vessel is registered in another state that does not title vessels, you must submit the original out-of-state registration certificate with this application (form PWD 143).

2.If the vessel is United States Coast Guard (USCG) documented, check “yes” and enter the USCG documentation number, vessel name, and the hailing port city and state.

3.If the vessel is coming from out of state or is USCG documented, check the box to indicate whether the ownership documentation is in the name of the applicant or the previous owner’s name.

Section C: Identify the Vessel.

•Enterthevesselserial/hullIDnumberinthespaceprovided.ThisisREQUIREDinformationandistypicallyfoundatthebackoftheboatonthetransom.

The vessel serial/hull ID number can also be found on the title and Certificate of Number ID Card.

•IfthevesseliscurrentlyrecordedwithTPWDentertheTexasregistrationnumberinthespaceprovided.Thisnumbershouldbedisplayedonbothsidesofthe bow. Example: TX–0123–AB. The vessel registration number can also be found on the Certificate of Number ID Card and on the title. If you do not have this

number, leave this space blank.

•IfthevesselwasacquiredfromaTexasMarineDealer,DistributororManufacturerentertheirlicensenumberinthespaceprovided.

Example: TX-0321-AA. If this vessel was not acquired through a Texas Dealer, Distributor or Manufacturer, leave this blank.

•IfthevesselwasacquiredfromaDealer,DistributororManufacturerfromoutsideofTexas,checkthebox.Ifitwasnot,leavethisboxblank.

•IfaGameWardeninspectionisrequired,checkthebox.Ifthevesselisnewlyhomemade,orifthevesselismanufacturedbuthasnoserialnumber,aGame Warden inspection is required. Your ownership documents and applications must be reviewed prior to requesting an inspection in order to verify that you have all

the relevant and necessary information completed. Contact the nearest TPWD law enforcement office to review documents and make arrangements for an inspection.AttachacompletedPWD736.

Section D: How Did You Acquire this Vessel?

•Makeoneselectionthatbestdescribeshowtheapplicantacquiredthevessel.

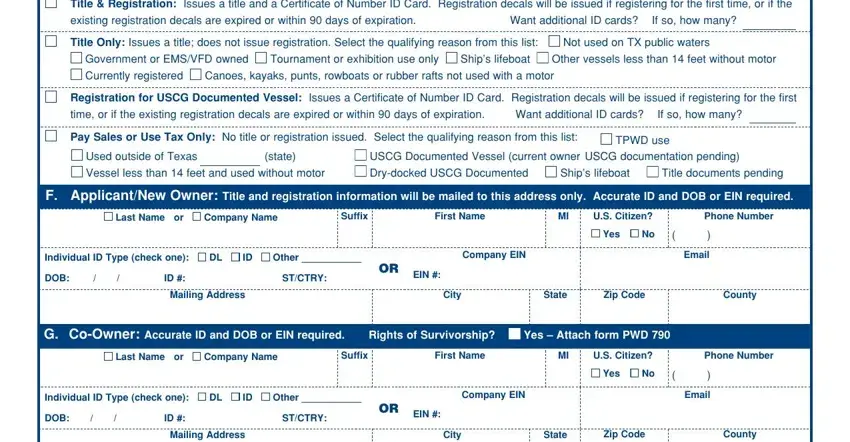

Section E: Select the Type of Transaction You are Requesting.

Select one of the transaction options listed:

•Title and Registration – Titling a vessel provides a Certificate of Title, which is the legal documentation of ownership. Registration of a vessel is required when you want to use this vessel on Texas public waters such as lakes, rivers, creeks or coastal waters. Sailboats less than 14 feet, canoes, kayaks, punts, rubber rafts and rowboats when they are paddled, poled, oared or windblown are not required to be registered. Registration provides a set of decals for display on the vessel and expires after two years. Once registered, you will receive a registration renewal notice prior to expiration. If you are transferring ownership of a titled vessel, you must submit the original title along with this application (form PWD 143).

Note: If a title correction is needed or if the applicant wishes to obtain extra Certificate of Number ID Card(s) for a vessel that has already been titled and registered in the applicant’s name in the state of Texas, please use Vessel/Boat Records Maintenance (PWD 143M).

•Title only – Titling a vessel provides a Certificate of Title, which is the legal documentation of ownership. Selecting this option will not add or renew registration on

a vessel. If the vessel has never been registered, no registration will be provided. If a vessel has been previously registered, the registration will remain in effect.

•Registration for USCG Documented Vessel – Effective 1/1/2004, vessels 115 feet or less in length that are documented with the United States Coast Guard are required to be registered if used on Texas public waters such as lakes, rivers, creeks or coastal waters. USCG documented commercial vessels engaged in coastal shipping (tugs, crew boats, pilot boats) are exempt from registration. Registration provides a set of decals for display on the vessel and expires after two years. Once registered, you will receive a registration renewal notice prior to expiration.

Note: The purchaser of a vessel that is 65 feet or less in length is required to pay tax (6.25%) to TPWD. The purchaser of a vessel longer than 65 feet is required to pay sales and use tax to a permitted seller or to the Texas State Comptroller. Taxes are due within 20 working days from the date of delivery. If payment for tax has already been made, verification of payment must be provided at the time of registration. Boat sales tax has been a state law since 10/1/1991.

•Pay Sales or Use Tax Only – This applies when the vessel is exempt from titling and registration or you have a qualifying reason to pay tax only. A qualifying reason must be chosen from the list provided. The seller must fill in the date of sale and sales price under the Tax Affidavit Section N items 1-3 and sign Section O.

Section F: Purchaser/Applicant – This Should Be the Name and Address of the Primary Owner.

•Providethename,address,phonenumber,andcitizenshipinformationfortheprimaryownertowhomthevesselwillberegistered/titledorwhoispayingTaxOnly. If the applicant is a business, or another entity other than an individual, list the citizenship status for the individual who is financially responsible for the business or entity.

Section G: Co-Owner(s).

•Ifthereareadditionalowners,providethename,address,phonenumberandcitizenshipinformationfortheco-owner(s)ofthevessel.

•RightsofSurvivorship–Indicatesthatboththeownerandtheco-owner(s)agreethattheownershipofthevesselistobeheldjointlyandintheeventofthedeath

of any party the ownership of the vessel will belong to the survivor(s). To make this selection, check the Rights of Survivorship box on the application and attach a completed RightsofSurvivorshipOwnershipAgreementforaBoatand/orOutboardMotor(PWD790).

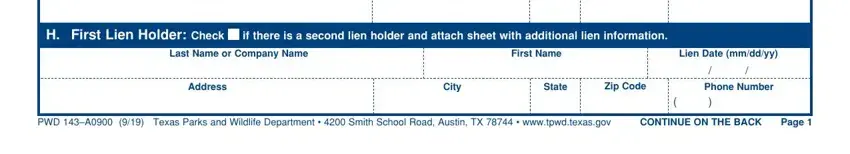

Section H: Lien Holder(s).

•Ifyouhavefinancedthepurchaseofthisvessel,providethename,address,phonenumber,andthedatethelienwasissuedforthefirstlienholderofthevessel. If there is a second lien holder, check the box and attach another sheet to the application that includes the lien holder name, address and the date the lien was issued. If you have not financed the purchase, leave this section blank.