Handling PDF files online is actually surprisingly easy with our PDF editor. Anyone can fill in qildro calculation here within minutes. To have our editor on the forefront of convenience, we strive to put into action user-oriented features and enhancements on a regular basis. We are routinely happy to get feedback - join us in reshaping the way you work with PDF docs. If you are seeking to begin, this is what it requires:

Step 1: Click on the orange "Get Form" button above. It's going to open our pdf tool so you could begin completing your form.

Step 2: Using our advanced PDF file editor, you may accomplish more than just complete blanks. Try all the features and make your docs look perfect with custom text added in, or modify the file's original input to perfection - all accompanied by an ability to add any type of photos and sign it off.

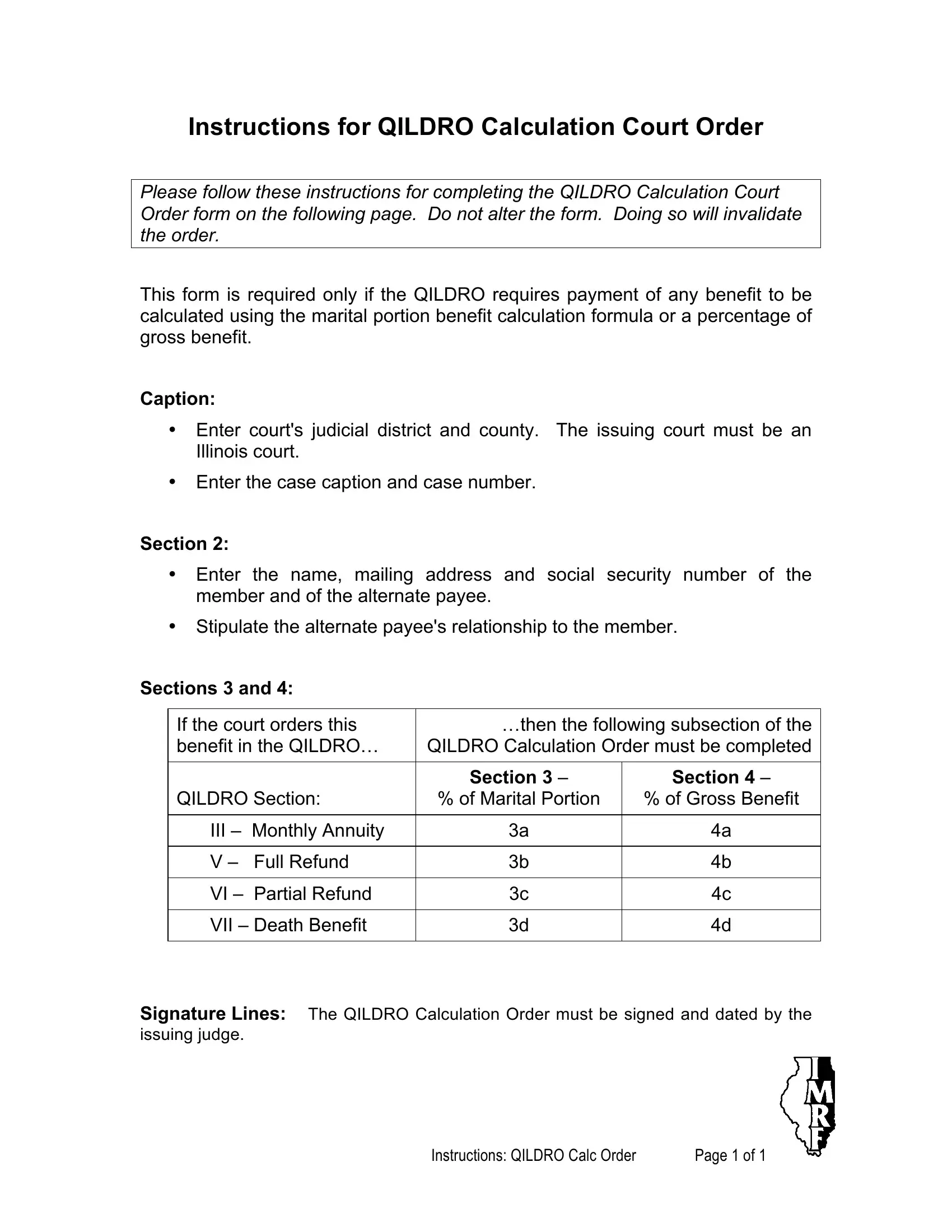

This PDF form will involve specific details; to guarantee consistency, you need to take note of the recommendations directly below:

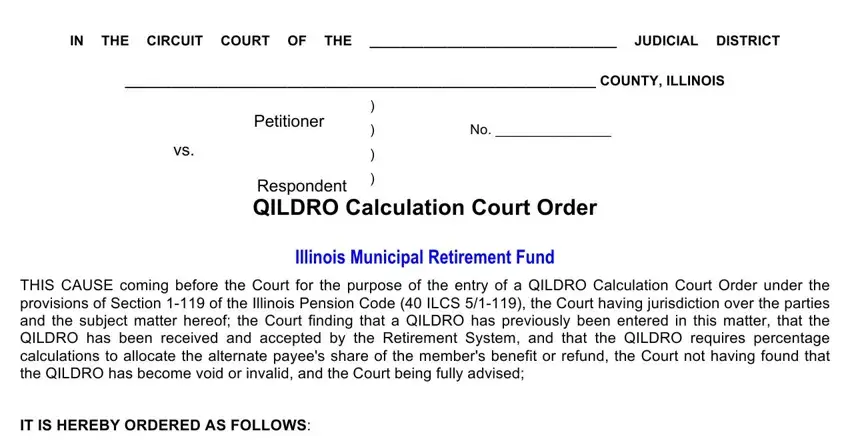

1. You need to fill out the qildro calculation properly, hence pay close attention while filling in the segments including all of these blanks:

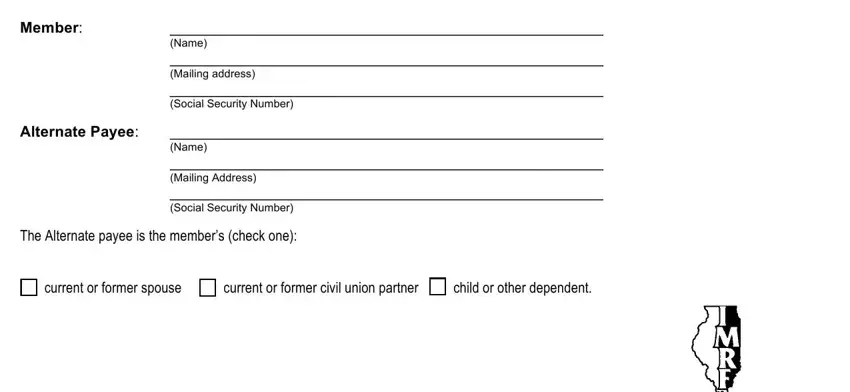

2. Once your current task is complete, take the next step – fill out all of these fields - Retirement System Illinois, Member Alternate Payee The, Name Mailing address Social, Name Mailing Address Social, current or former spouse, current or former civil union, child or other dependent, and Instructions QILDRO Calculation with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

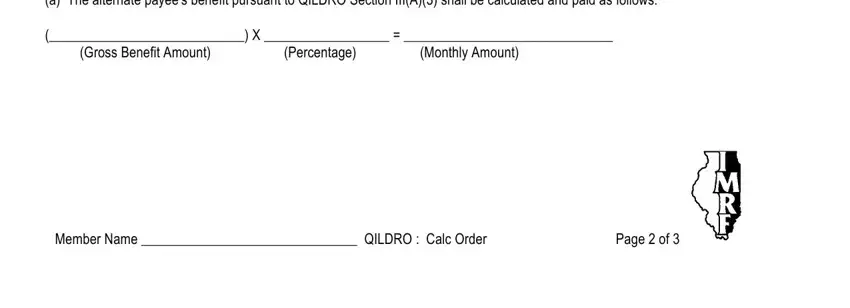

3. The third step is usually hassle-free - fill out every one of the fields in Member Name QILDRO Calc Order, and Instructions QILDRO Calculation in order to finish the current step.

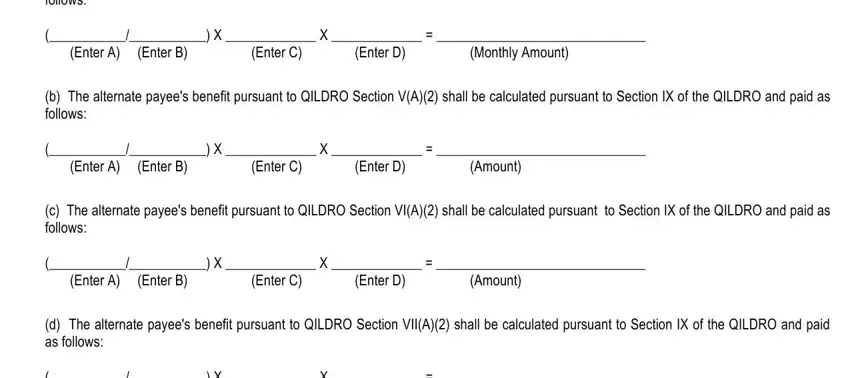

4. Filling in a The alternate payees benefit, Enter A Enter B, Enter C, Enter D, Monthly Amount, b The alternate payees benefit, Enter A Enter B, Enter C, Enter D, Amount, c The alternate payees benefit, Enter A Enter B, Enter C, Enter D, and Amount is key in this next section - ensure to don't rush and fill in each and every blank area!

You can potentially make a mistake when filling in the b The alternate payees benefit, hence make sure you go through it again before you'll submit it.

5. To finish your document, this particular part involves a few additional blank fields. Filling out a The alternate payees benefit, Monthly Amount, Percentage, Member Name QILDRO Calc Order, and Instructions QILDRO Calculation should conclude everything and you're going to be done in an instant!

Step 3: You should make sure the information is right and simply click "Done" to proceed further. Create a free trial subscription at FormsPal and gain direct access to qildro calculation - with all transformations saved and accessible in your FormsPal cabinet. At FormsPal, we strive to make sure that your information is stored protected.