You can work with raffle tax effortlessly with our online PDF tool. To have our editor on the forefront of practicality, we work to implement user-oriented features and enhancements regularly. We're at all times looking for feedback - help us with remolding PDF editing. In case you are seeking to get started, this is what it will require:

Step 1: Firstly, access the editor by pressing the "Get Form Button" at the top of this page.

Step 2: After you access the file editor, you will get the form all set to be filled out. Besides filling in various fields, you may also do various other actions with the file, that is putting on custom words, editing the original text, adding images, placing your signature to the form, and a lot more.

Filling out this PDF calls for attentiveness. Make sure all mandatory fields are completed properly.

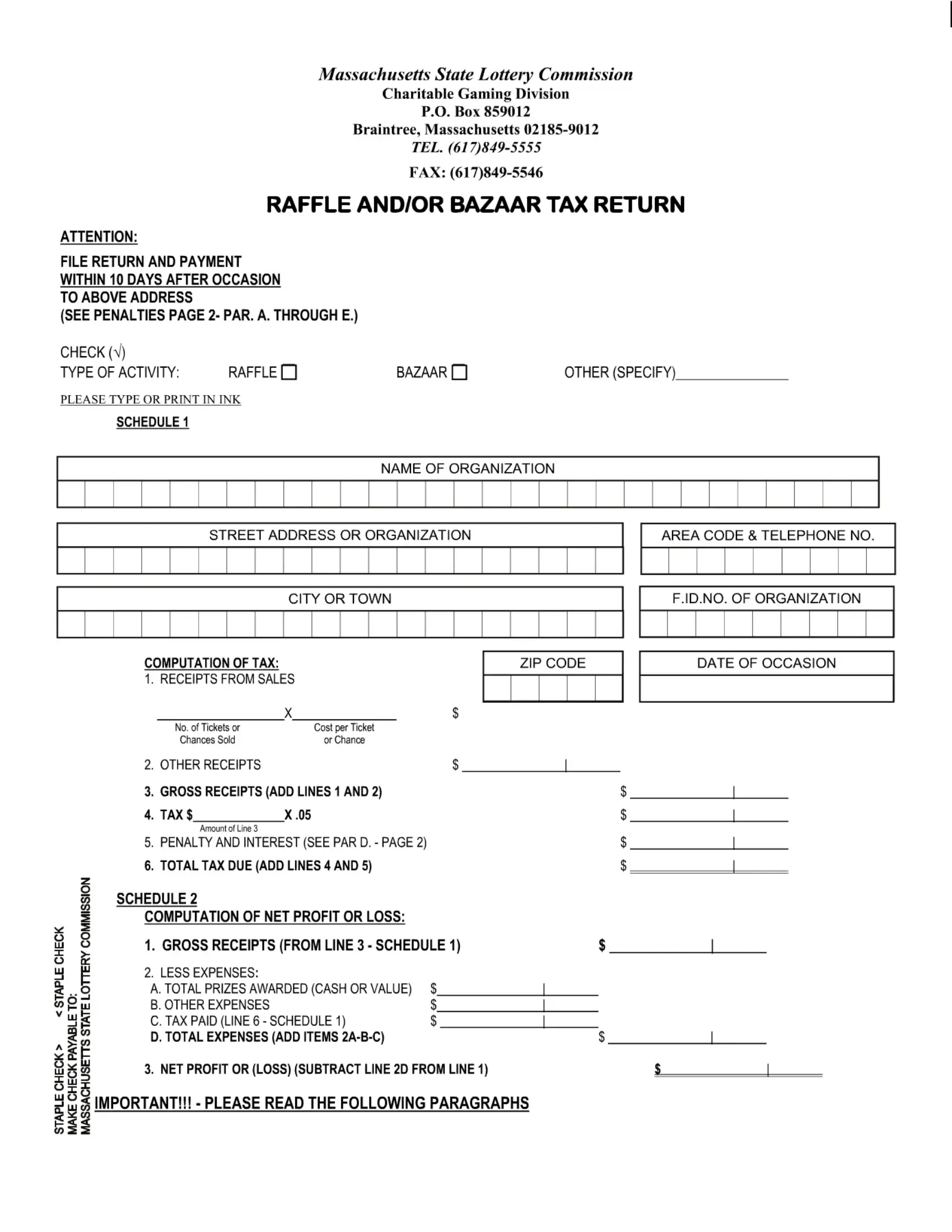

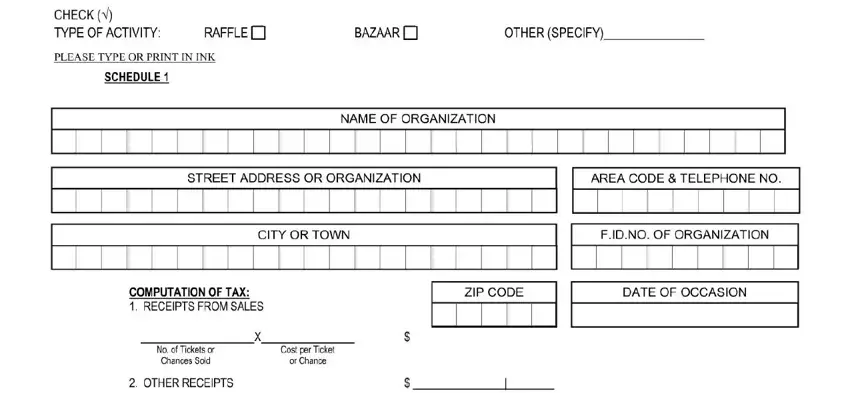

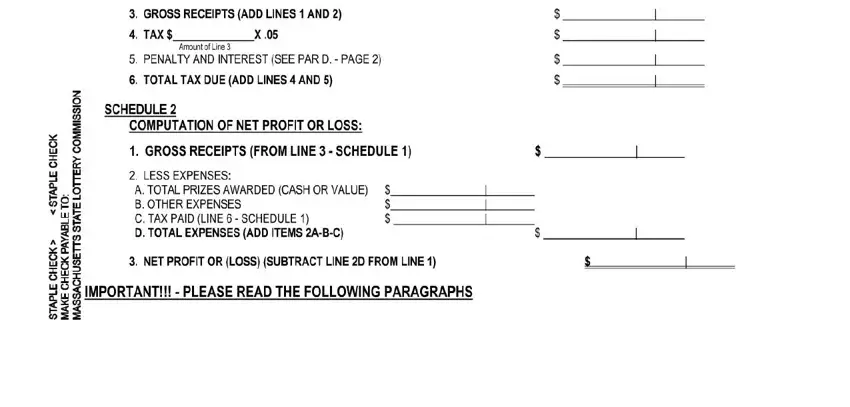

1. It is advisable to fill out the raffle tax properly, thus be careful while working with the segments including all of these blank fields:

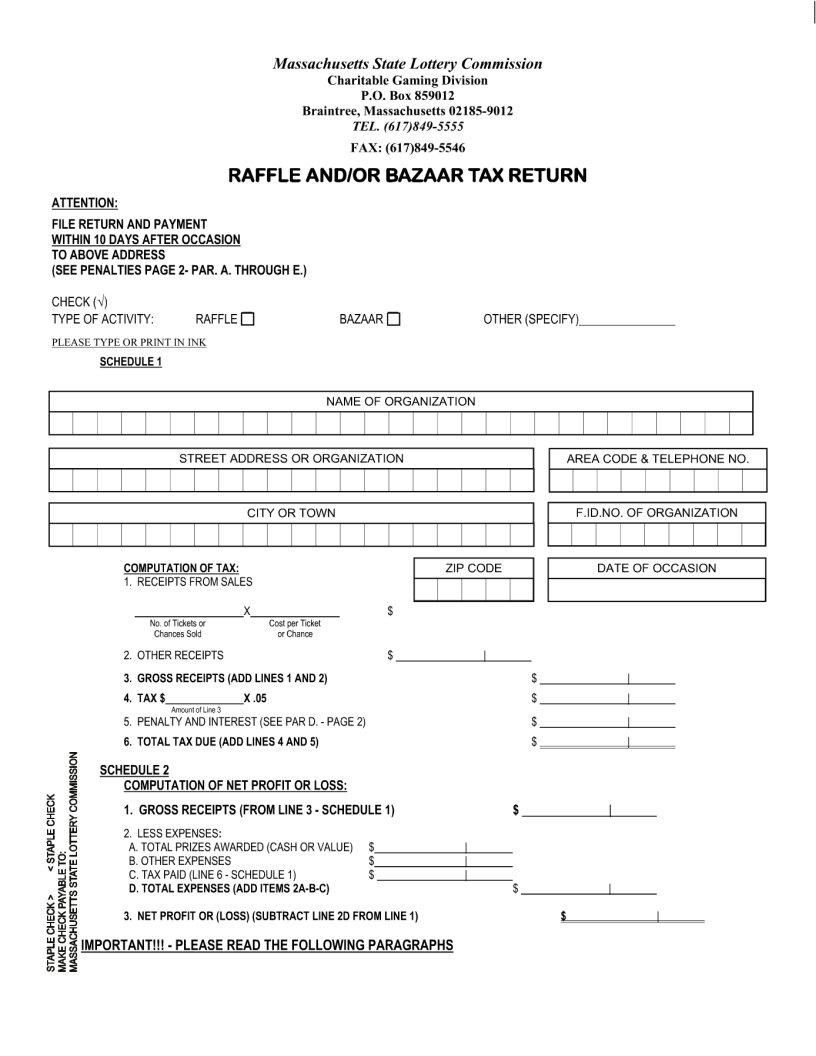

2. Just after this array of blank fields is completed, go on to enter the relevant details in all these - .

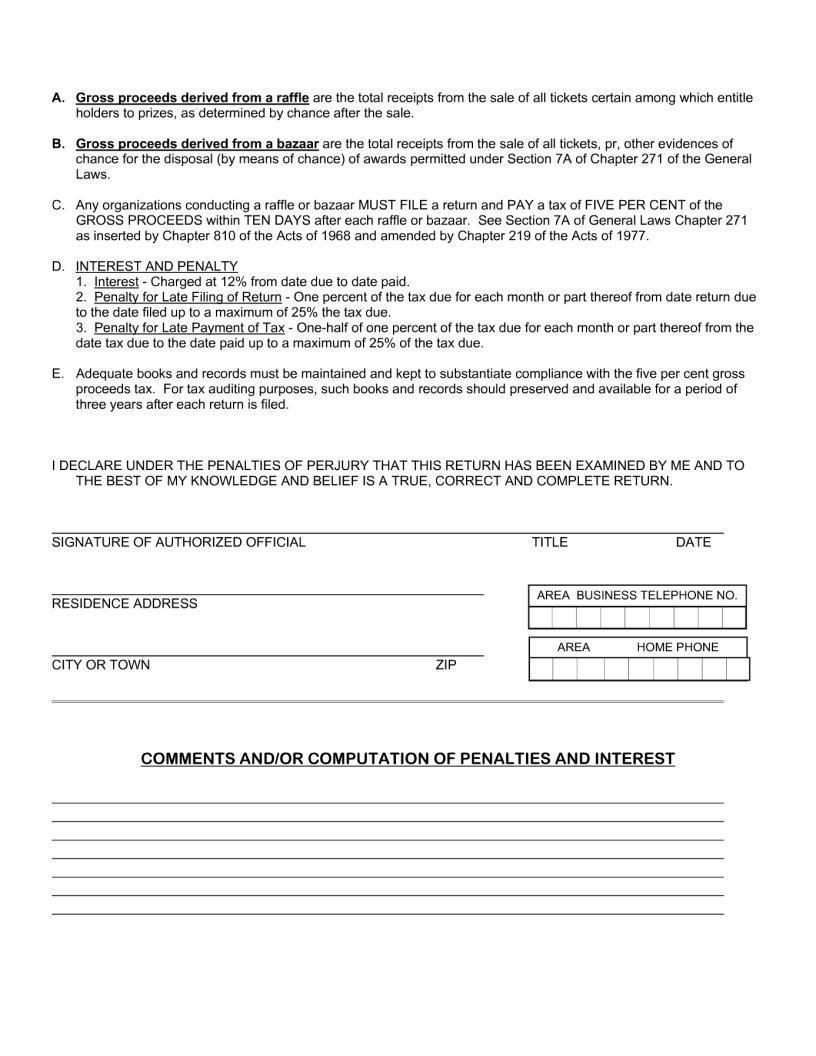

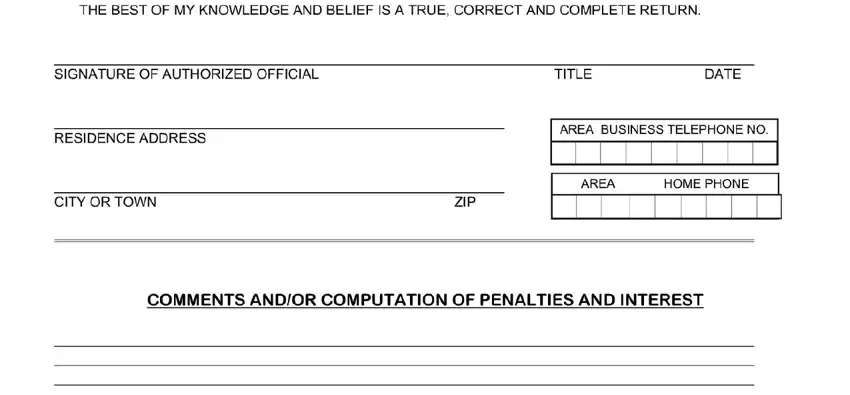

3. This next part is usually easy - fill out all of the empty fields in to complete this segment.

In terms of this field and next field, be sure you don't make any mistakes in this current part. These two are the key fields in this file.

4. Completing is vital in this next section - you'll want to invest some time and be attentive with every single field!

Step 3: Make certain your details are correct and then simply click "Done" to proceed further. Grab the raffle tax once you join for a 7-day free trial. Conveniently gain access to the pdf form within your personal account, together with any edits and changes conveniently kept! Here at FormsPal, we strive to be certain that all of your information is stored protected.