You may work with usda loan application form without difficulty by using our online PDF editor. To retain our editor on the cutting edge of efficiency, we aim to put into operation user-oriented features and improvements regularly. We are at all times happy to get feedback - join us in revolutionizing how we work with PDF forms. This is what you will need to do to get going:

Step 1: Press the orange "Get Form" button above. It's going to open our editor so you could begin completing your form.

Step 2: With our handy PDF editing tool, you could do more than simply fill out blank form fields. Edit away and make your documents seem perfect with customized textual content incorporated, or optimize the file's original content to excellence - all that comes with the capability to insert your own graphics and sign the document off.

It really is straightforward to finish the document with our practical guide! This is what you need to do:

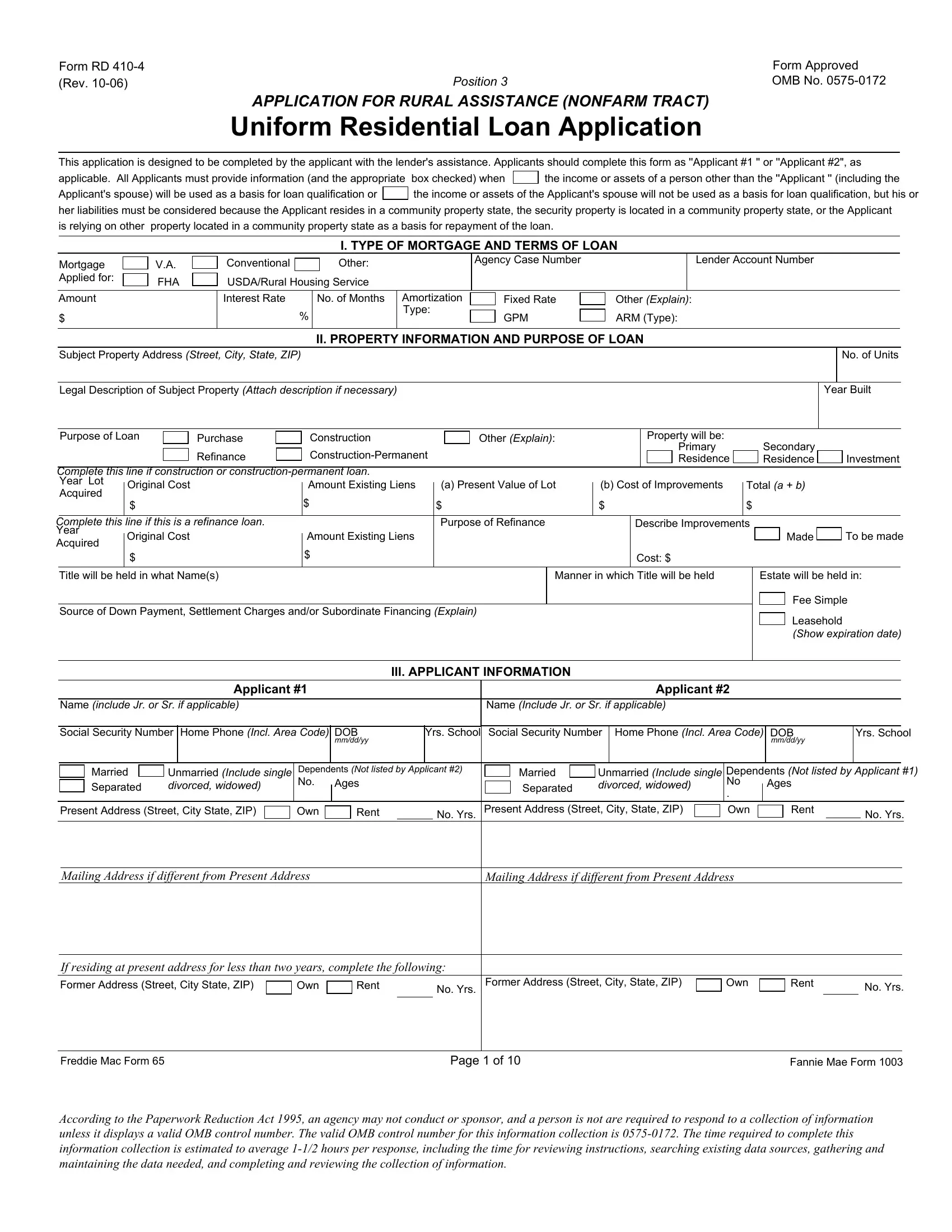

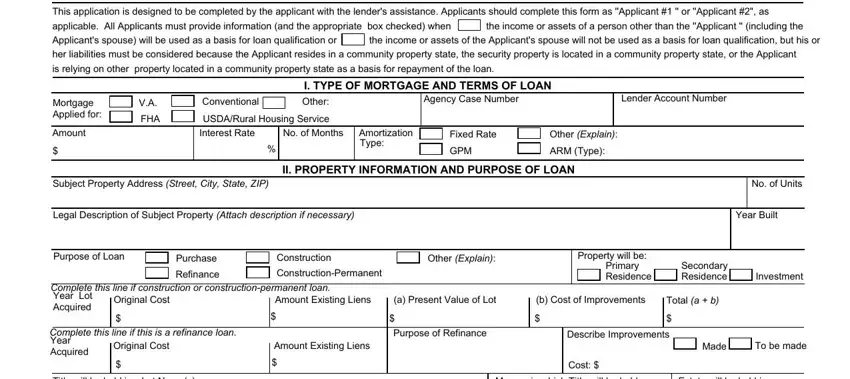

1. While filling in the usda loan application form, be sure to include all of the needed blank fields in the relevant section. This will help to speed up the process, which allows your information to be handled promptly and accurately.

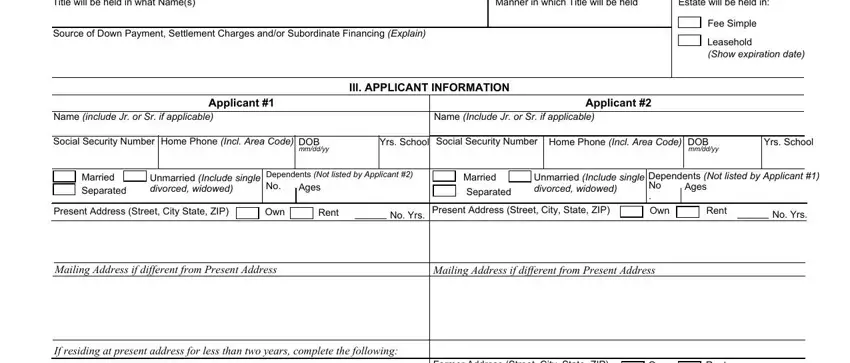

2. The subsequent stage is to submit the next few blank fields: Title will be held in what Names, Manner in which Title will be held, Estate will be held in, Source of Down Payment Settlement, Fee Simple, Leasehold Show expiration date, Name include Jr or Sr if applicable, Name Include Jr or Sr if applicable, Applicant, Applicant, Ill APPLICANT INFORMATION, Social Security Number, Home Phone Incl Area Code, DOB mmddyy, and Yrs School.

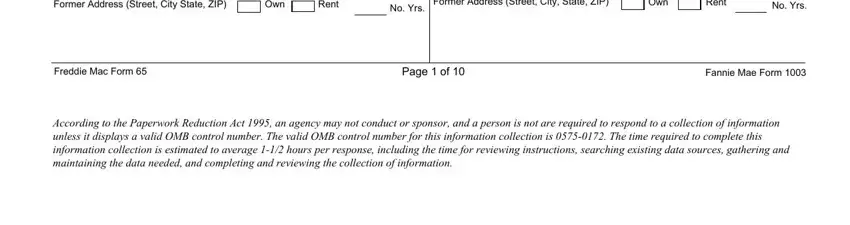

3. The third stage is simple - fill out all the fields in Former Address Street City State, Own, Rent, No Yrs, Former Address Street City State, Own, Rent, No Yrs, Freddie Mac Form, Page of, Fannie Mae Form, and According to the Paperwork in order to complete this process.

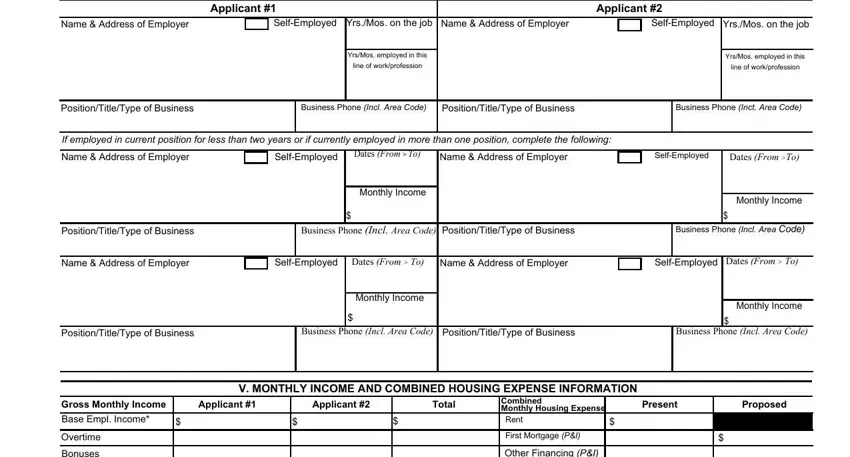

4. To go onward, this step involves filling in a couple of blank fields. Examples include Name Address of Employer, SelfEmployed, YrsMos on the job, Name Address of Employer, SelfEmployed, YrsMos on the job, Applicant, Applicant, YrsMos employed in this, line of workprofession, YrsMos employed in this, line of workprofession, PositionTitleType of Business, Business Phone Incl Area Code, and PositionTitleType of Business, which you'll find vital to continuing with this process.

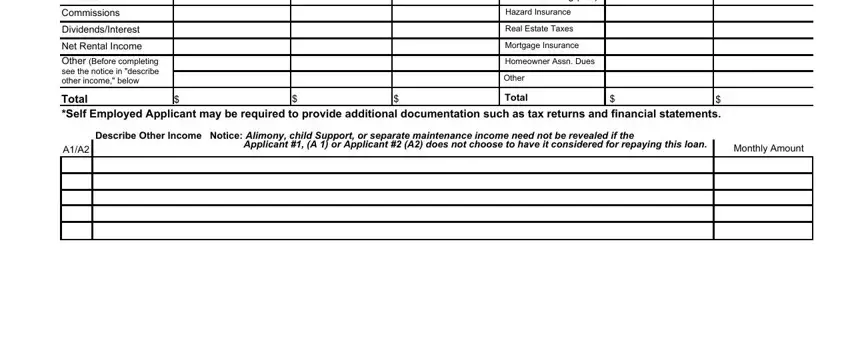

5. Because you get close to the conclusion of this document, there are several more points to complete. Specifically, Bonuses, Commissions, DividendsInterest, Net Rental Income, Other Before completing see the, Other Financing PI, Hazard Insurance, Real Estate Taxes, Mortgage Insurance, Homeowner Assn Dues, Other, Total Self Employed Applicant may, Total, Describe Other Income Notice, and Applicant A or Applicant A does should be done.

It is easy to make a mistake while filling in your Other Financing PI, therefore make sure to go through it again before you'll finalize the form.

Step 3: After you have reread the details entered, simply click "Done" to conclude your form. After setting up afree trial account with us, you'll be able to download usda loan application form or send it through email right off. The document will also be readily available in your personal account with your adjustments. FormsPal is focused on the personal privacy of our users; we ensure that all personal information handled by our tool continues to be secure.