When you wish to fill out 403general, you don't need to download and install any programs - simply try our online PDF editor. To make our editor better and easier to utilize, we continuously work on new features, with our users' feedback in mind. It just takes several basic steps:

Step 1: Click on the "Get Form" button above on this webpage to open our tool.

Step 2: This tool allows you to work with PDF documents in a range of ways. Transform it with any text, adjust what is originally in the file, and include a signature - all when you need it!

It is simple to complete the document using out helpful guide! Here's what you want to do:

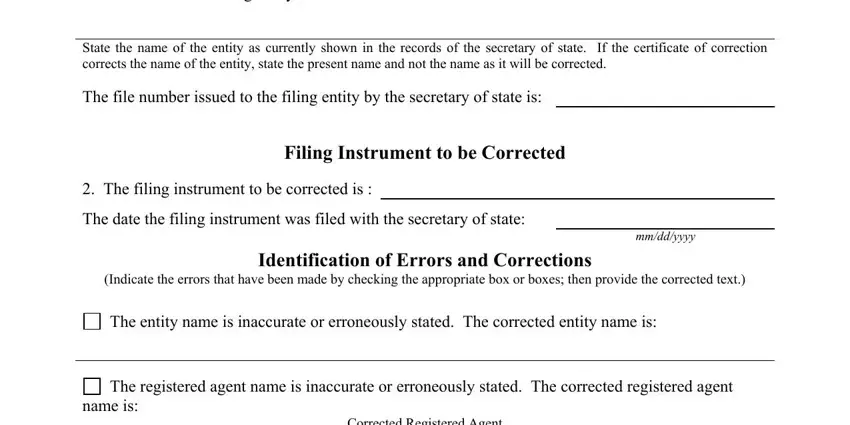

1. Begin completing the 403general with a group of major blank fields. Consider all the necessary information and be sure there is nothing neglected!

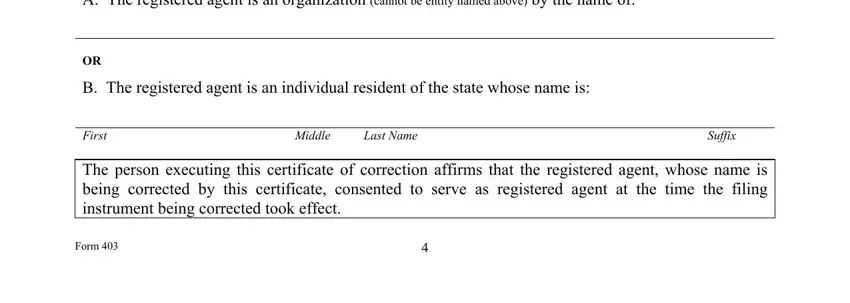

2. Once the first section is filled out, proceed to enter the suitable details in these - A The registered agent is an, B The registered agent is an, First, Middle, Last Name, Suffix, The person executing this, and Form.

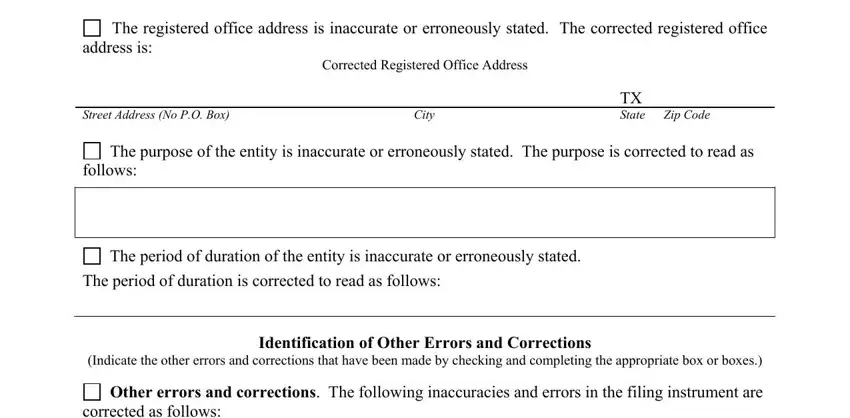

3. This next part is mostly about The registered office address is, address is, Corrected Registered Office Address, Street Address No PO Box, City, TX State, Zip Code, The purpose of the entity is, follows, The period of duration of the, The period of duration is, Indicate the other errors and, Identification of Other Errors and, Other errors and corrections The, and corrected as follows - fill out all these fields.

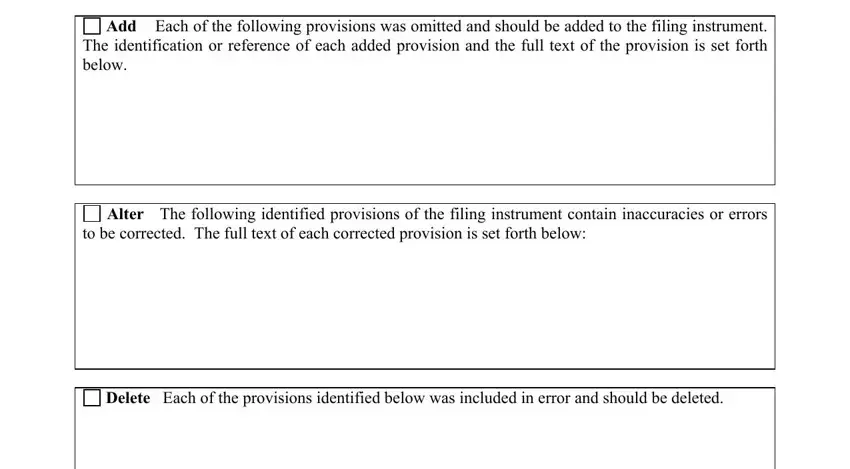

4. This next section requires some additional information. Ensure you complete all the necessary fields - corrected as follows, Add Each of the following, Alter The following identified, to be corrected The full text of, and Delete Each of the provisions - to proceed further in your process!

Regarding Add Each of the following and corrected as follows, be sure that you don't make any mistakes here. These are thought to be the key ones in this page.

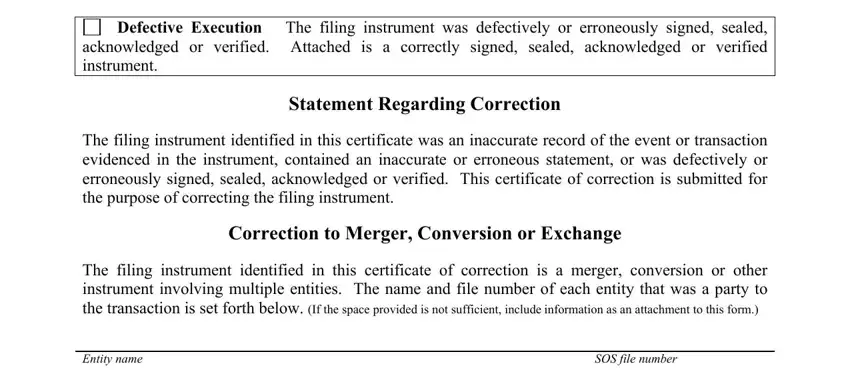

5. Because you come near to the end of the file, there are actually a few more requirements that must be satisfied. In particular, Defective Execution The filing, Statement Regarding Correction, The filing instrument identified, Correction to Merger Conversion or, The filing instrument identified, Entity name, and SOS file number should be filled in.

Step 3: Revise the details you have typed into the blanks and hit the "Done" button. After creating afree trial account with us, you'll be able to download 403general or email it right off. The PDF file will also be readily available through your personal account page with your each and every modification. FormsPal guarantees your information privacy by using a secure system that in no way saves or shares any personal information typed in. Be assured knowing your files are kept safe whenever you work with our tools!