Should you would like to fill out form 26, it's not necessary to download any sort of software - just use our PDF tool. To make our editor better and simpler to work with, we consistently develop new features, with our users' suggestions in mind. Here's what you would need to do to get going:

Step 1: Click on the orange "Get Form" button above. It's going to open up our pdf tool so you could begin completing your form.

Step 2: This tool will allow you to customize your PDF file in various ways. Modify it with customized text, adjust original content, and put in a signature - all close at hand!

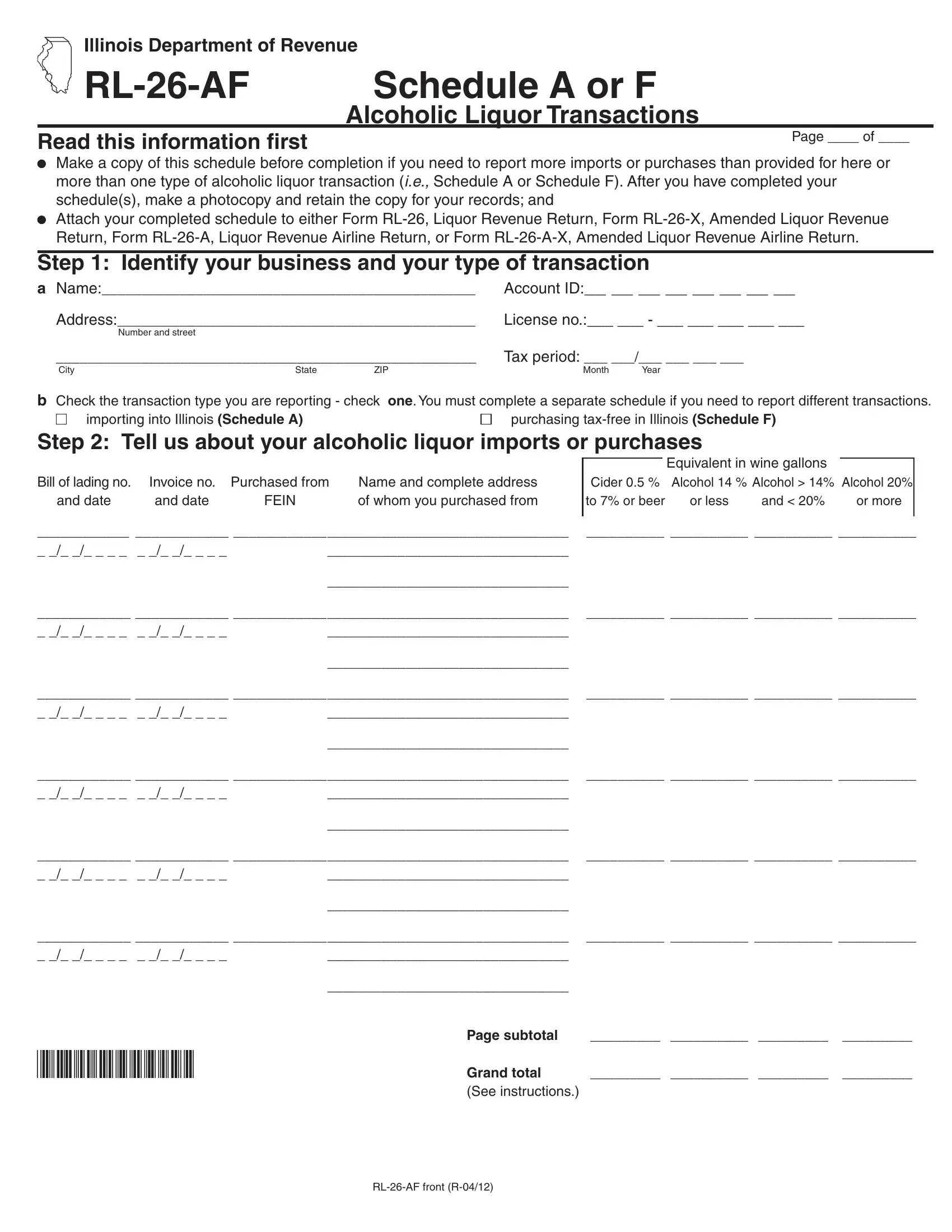

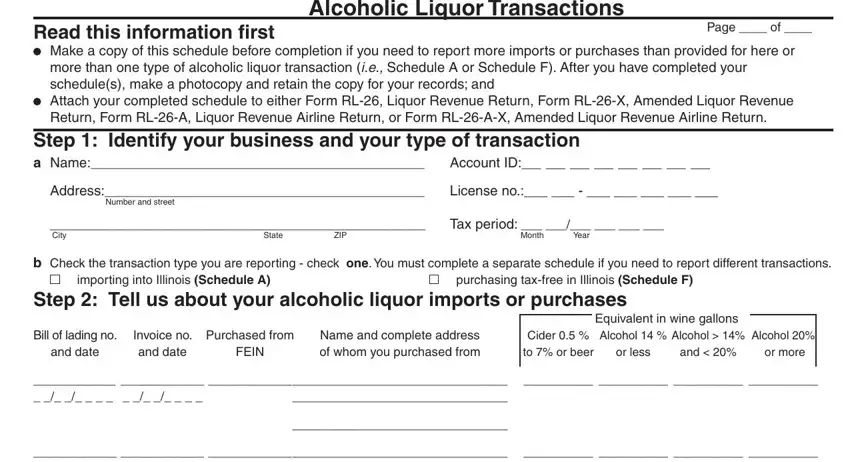

This PDF form will require particular info to be filled out, therefore be sure you take some time to type in what is expected:

1. To begin with, once filling in the form 26, start with the area that has the subsequent blanks:

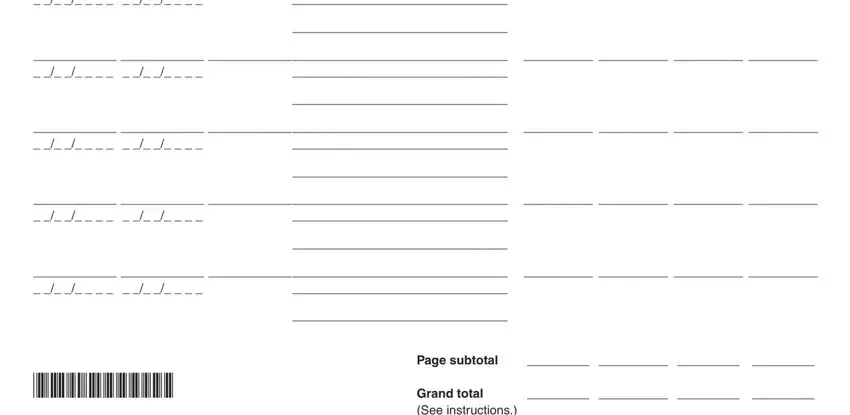

2. Once your current task is complete, take the next step – fill out all of these fields - Page subtotal, and Grand total See instructions with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Be really careful while filling in Page subtotal and Page subtotal, since this is the section in which many people make some mistakes.

Step 3: After proofreading the form fields you have filled out, press "Done" and you're done and dusted! After creating a7-day free trial account with us, it will be possible to download form 26 or email it right off. The PDF will also be readily accessible in your personal cabinet with all your changes. FormsPal is devoted to the personal privacy of all our users; we make certain that all information put into our editor continues to be protected.