Any time you intend to fill out illinois rmft 11 a instructions, it's not necessary to download and install any programs - just try our PDF tool. FormsPal professional team is always endeavoring to enhance the tool and help it become much faster for clients with its many functions. Take your experience to another level with continually growing and exceptional opportunities we provide! Should you be looking to get started, here is what it's going to take:

Step 1: Access the form in our editor by pressing the "Get Form Button" at the top of this webpage.

Step 2: As you open the file editor, you'll notice the document ready to be filled in. Apart from filling in different blanks, you can also do several other actions with the form, particularly writing custom text, modifying the original textual content, inserting illustrations or photos, placing your signature to the form, and much more.

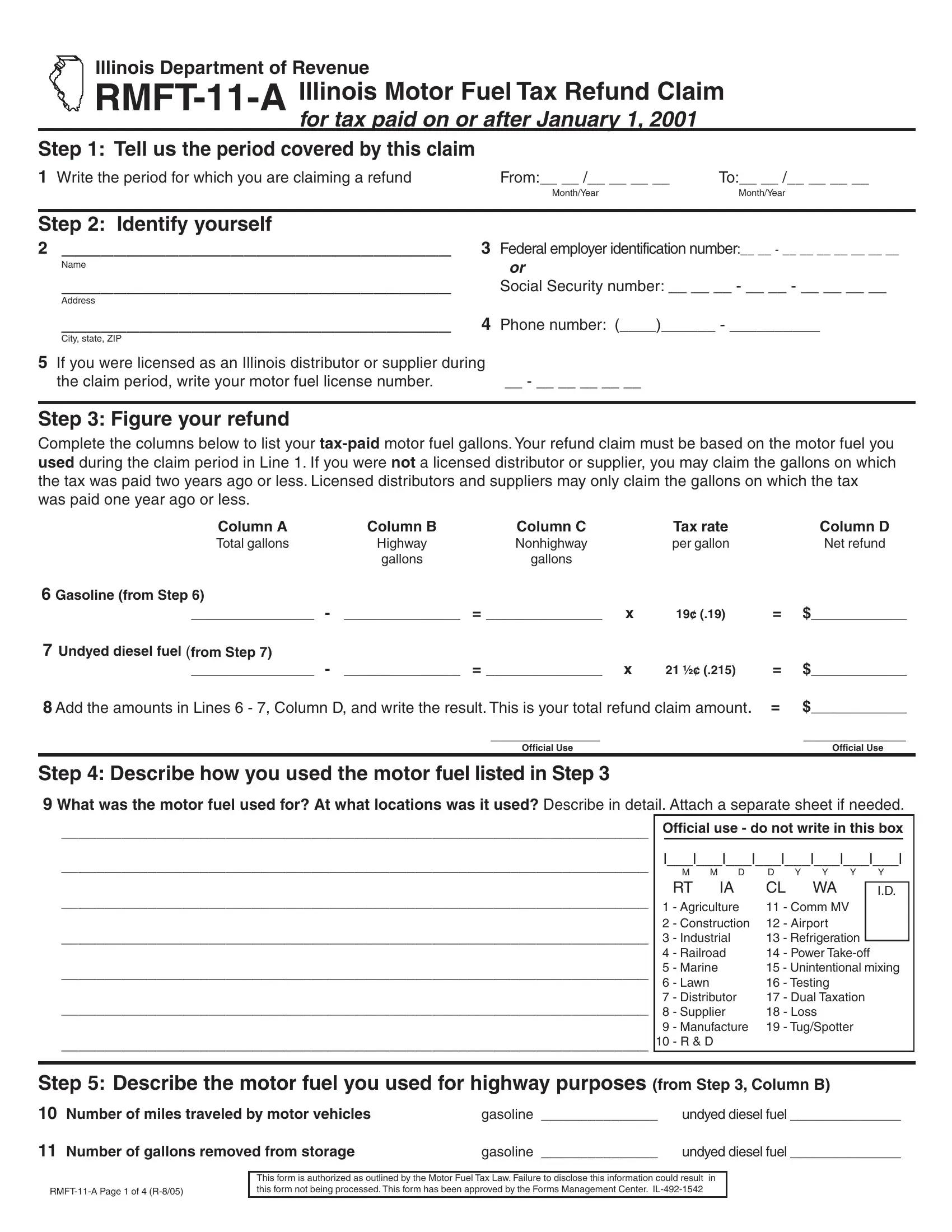

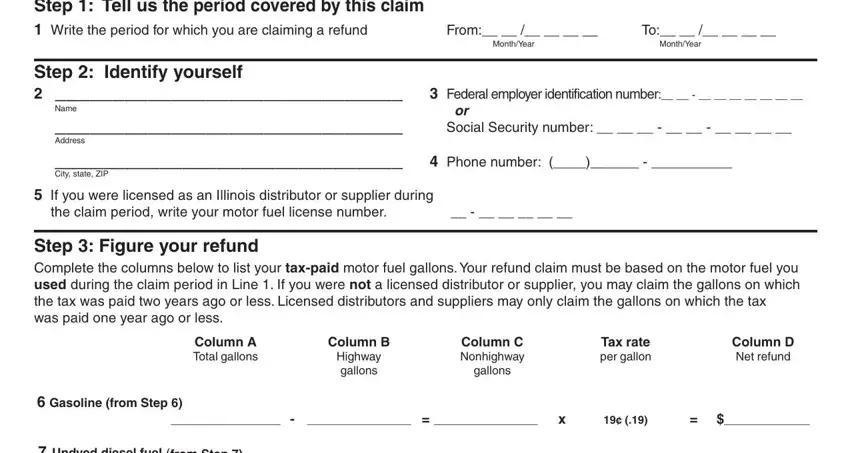

This form will need specific info to be entered, therefore you should take whatever time to enter what's requested:

1. Complete the illinois rmft 11 a instructions with a number of essential blank fields. Consider all the required information and make sure there's nothing neglected!

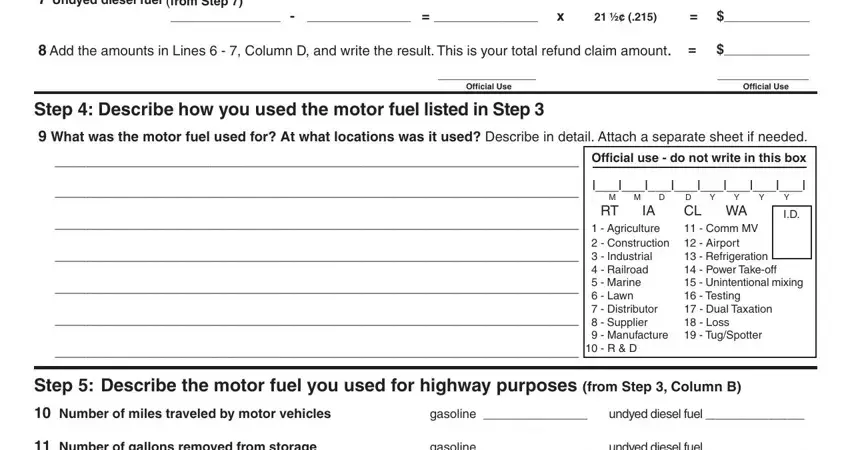

2. Once your current task is complete, take the next step – fill out all of these fields - Undyed diesel fuel from Step, Add the amounts in Lines, Step Describe how you used the, What was the motor fuel used for, Official use do not write in this, Official Use, Official Use, lllllllll, M RT, IA Agriculture Construction, D CL WA Comm MV Airport, R D, Step Describe the motor fuel you, Number of miles traveled by motor, and gasoline with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

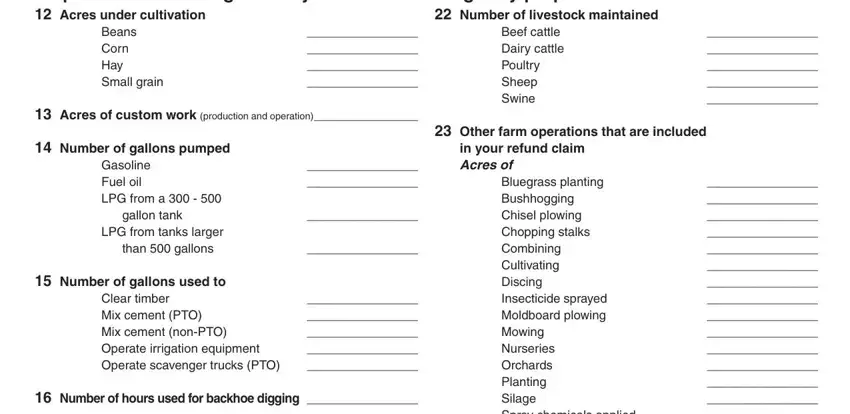

3. This third stage is generally hassle-free - fill in all the empty fields in Step Describe the gasoline you, Number of livestock maintained, Beans Corn Hay Small grain, Beef cattle Dairy cattle Poultry, Acres of custom work production, Number of gallons pumped, Gasoline Fuel oil LPG from a, Number of gallons used to, Clear timber Mix cement PTO Mix, Number of hours used for backhoe, Other farm operations that are, in your refund claim Acres of, and Bluegrass planting Bushhogging in order to complete this segment.

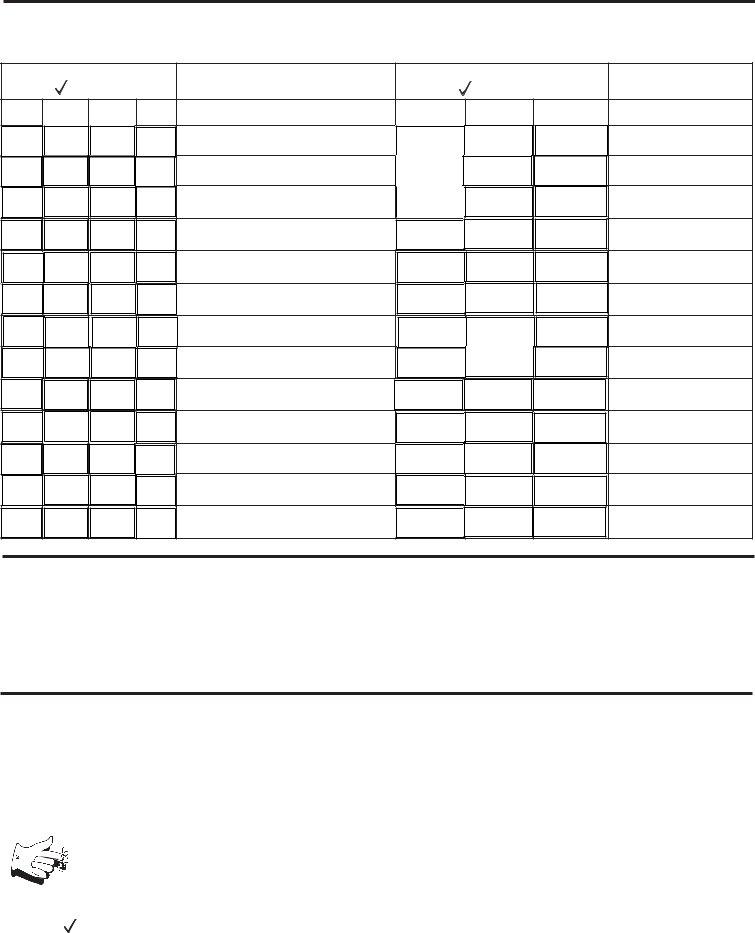

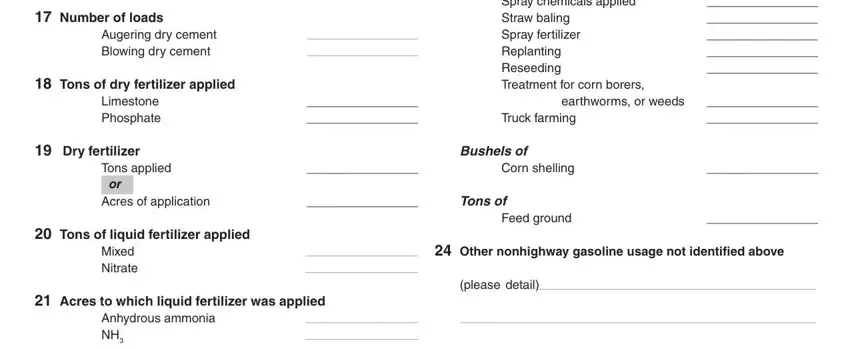

4. It is time to fill in this next segment! Here you'll have all these Number of loads, Augering dry cement Blowing dry, Tons of dry fertilizer applied, Bluegrass planting Bushhogging, Limestone Phosphate, earthworms or weeds, Truck farming, Dry fertilizer, Tons applied, Corn shelling, Bushels of, Acres of application, Tons of, Tons of liquid fertilizer applied, and Mixed Nitrate empty form fields to complete.

It's easy to make a mistake while filling in the Bluegrass planting Bushhogging, hence be sure to go through it again before you submit it.

5. While you come close to the conclusion of the form, you will find just a few extra points to do. Notably, RMFTA Page of R must be filled in.

Step 3: Right after going through your entries, click "Done" and you are good to go! Get the illinois rmft 11 a instructions when you sign up for a 7-day free trial. Readily view the document inside your personal account page, along with any edits and changes being conveniently preserved! FormsPal is dedicated to the privacy of all our users; we always make sure that all information coming through our editor is kept confidential.