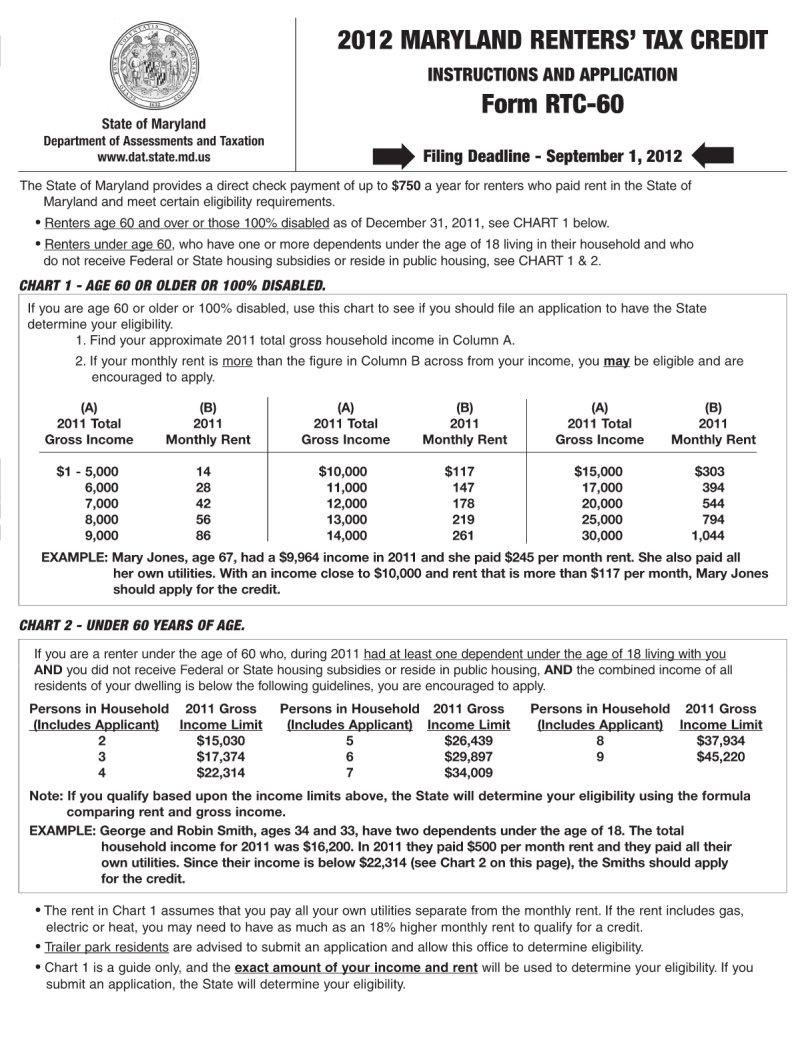

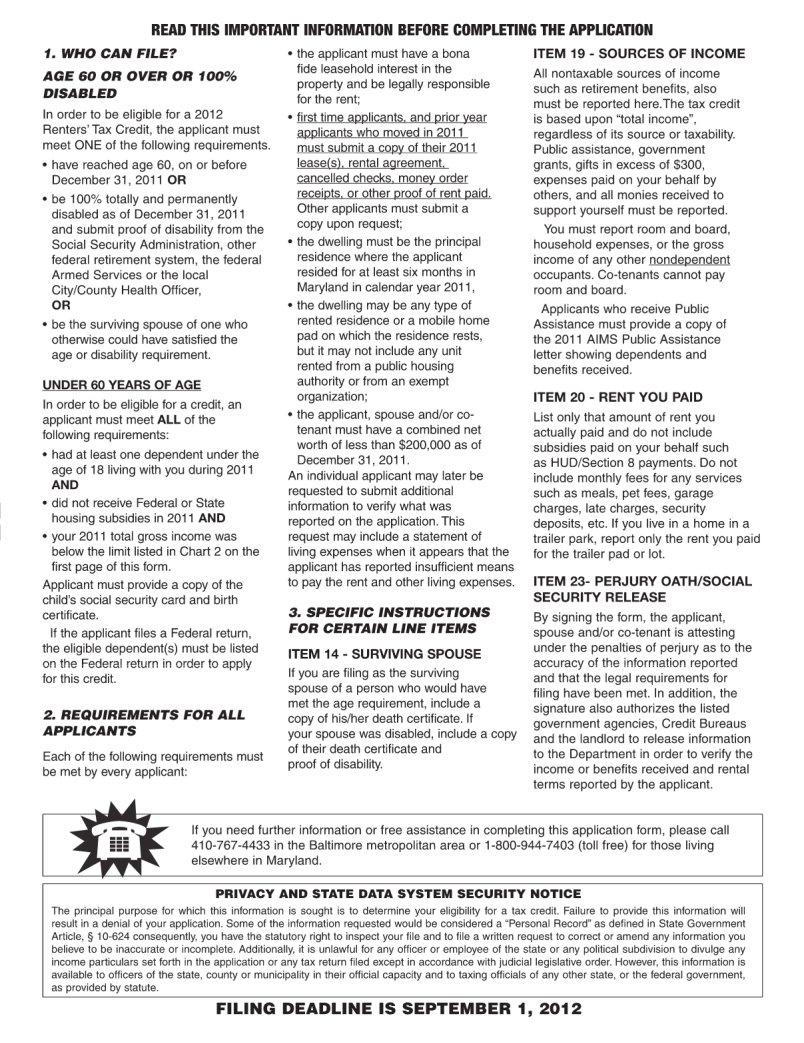

Navigating the complexities of tax documentation can often feel overwhelming for individuals and businesses alike. Amidst the myriad forms and filings, the RTC 60 form stands out as a crucial document for certain tax-related processes. This form is commonly utilized for reporting specific types of transactions or changes to the authorities, ensuring compliance with regulations and maintaining accurate records. Its role is integral in facilitating the smooth operation of tax administration, serving as a bridge between taxpayers and the tax body to ensure transparency and accountability. Throughout this article, we will delve into the major aspects of the RTC 60 form—from its purpose and the circumstances under which it must be filled out, to the detailed information that needs to be provided and how it ultimately impacts the reporting and compliance obligations of the entities involved. Understanding this form is essential for anyone who needs to complete it accurately and in a timely manner, as it plays a key role in managing financial responsibilities and avoiding potential legal complications.

| Question | Answer |

|---|---|

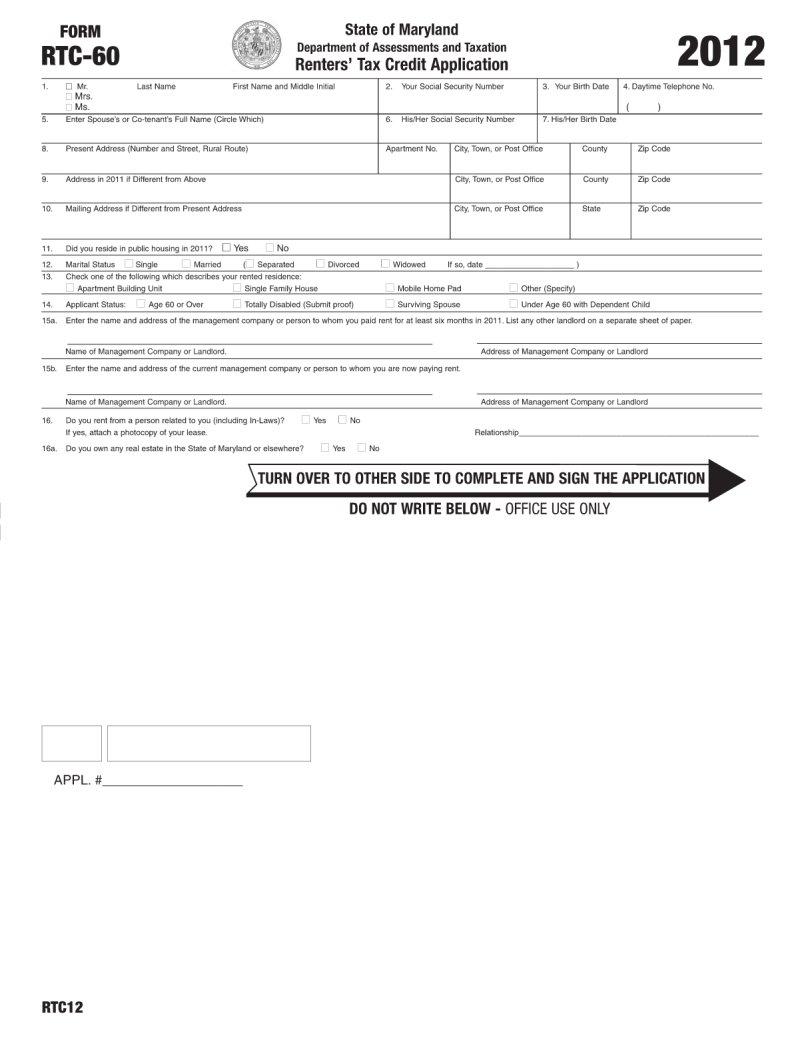

| Form Name | Rtc 60 Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | RTC 60 rtc 60 formpdffillercom |