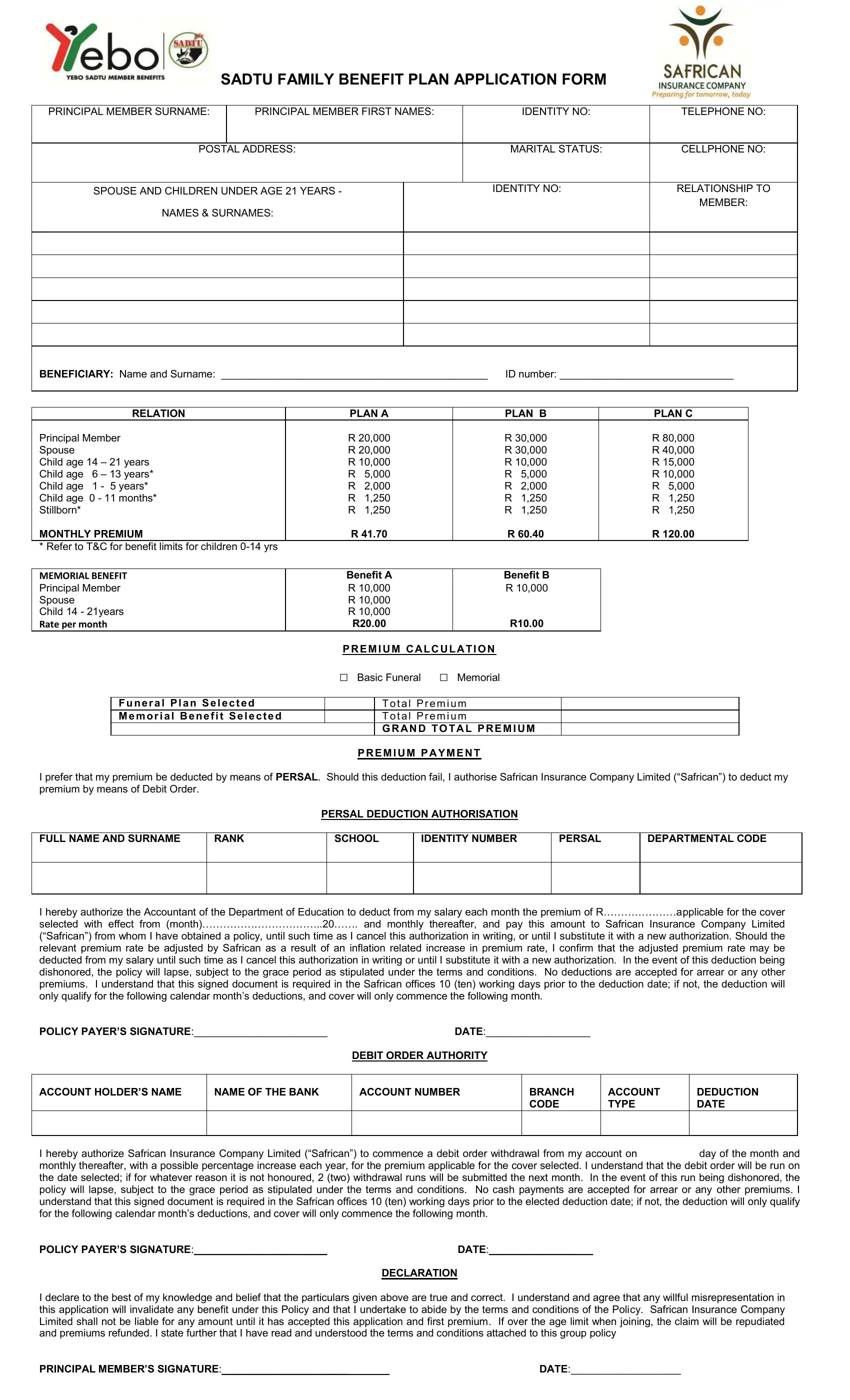

FUNERAL BENEFITS:

The basic funeral plan provides for a cash benefit to be paid in settlement of a death claim of a Principal Member, his/her Spouse and/or Children.

Principal Member: a permanent, genuine member of SADTU, who is allowed to elect participation in the Policy, in accordance with the eligibility conditions as stated in the Policy,. The maximum entry age to the Plan for the Principal Member is 70 years.

Spouse: a person married to the Principal Member by law or tribal custom or under the tenets of any Asian religion, which shall include a Common Law Spouse of the Principal Member. A maximum of 2 (two) Spouses per Principal Member can be covered during the life of the Policy. The maximum entry age for a Spouse is 70 years.

Common Law Spouse: a person who is deemed by Safrican, at its sole discretion, to be the common law spouse of the Principal Member, having regard to the particular circumstances of each case, and shall include, where applicable, customary marriages or a relationship between two people of the same gender, or a relationship between two people after a continuous cohabitation period of 6 (six) months.

Child: an unmarried child, age 21 years and younger, of the Principal Member, including a stepchild, posthumous child, an illegitimate child, a legally adopted child or a stillborn child (from the 26th week of pregnancy). Only 2 stillbirth claims will be accepted per family during the term of the Policy. Children are covered to the age of 21 years and this is extended to age 25 years if the child is a full-time student at a recognised institution. This does not include part-time and correspondence students. Children who are mentally disabled or totally and permanently disabled before age 21 years, who are unable to care for themselves, are covered until death or until the Principal Member ceases to be covered. Details of any children of a Common Law Spouse, illegitimate child and stepchild must be supplied to Safrican at the time that the Principal Member joins the scheme, or within 1 month of the child becoming eligible for cover. Failing this, Safrican will require satisfactory proof to support any claim.

SADTU: The South African Democratic Teachers Union

MEMORIAL BENEFIT:

The Benefit is optional and should be taken on a voluntary basis where a 6 (six) months waiting period will apply. The Benefit shall be due for payment where there has been a valid claim of a Principal Member, Spouse and/or Child Dependant age 14 -21 years. The Memorial Benefit payee must contact Safrican with a request for payment of the Benefit within 3 months following the date of death of the deceased, in order to prevent the Benefit from lapsing. The maximum benefit payable is R10 000. Termination conditions for the Benefit apply.

COMMENCEMENT OF COVER:

Commencement of cover will be effective from the date of receipt of the first premium, provided that the premium is received by the 7th of the month to which it relates. If the first premium is received after the 7th of the month, cover will only commence on the first day of the following month.

WAITING PERIODS:

∙From the start date of the Policy, there is a 6 (six) months waiting period for claims due to natural causes, for persons below age 74 years.

∙Only claims due to accidental death will be paid immediately, provided the first premium was received and the policy is not in arrears.

∙In the event of a person electing a higher benefit, a 6 (six) month waiting period will apply to the increased benefit amount only for persons less than age 74 years.

∙Where premium payments are missed and resumed again at a later stage, the applicable waiting period will apply from the date the payment of premiums is resumed and received.

EXCLUSIONS:

This benefit will not be paid if death is directly or indirectly caused by, or attributable to:

∙Terrorism or war (whether declared or not).

∙Radioactive contamination, whether directly or indirectly.

∙Self-inflicted injuries, whilst sane or insane.

∙Death as a result of participation in illegal activities.

∙Participation in any riot, strike or civil commotion.

∙Consumption of alcohol or the taking of any poisons or drugs.

∙Participation in any hazardous pursuit as determined by Safrican.

∙Suicide will not be covered during the first 2 (two) years of membership.

∙Divorced spouses at inception of the policy are not covered, and cover for spouses who divorce during the term of the policy will cease immediately on divorce.

GENERAL:

∙Each Principal Member must complete an application form electing his/her dependants.

∙Benefits cease on the date of death of the Principal Member, non-payment of premiums (subject to the Grace Period), or withdrawal from the Plan by the Principal Member, which ever event may occur first.

∙No arrear premiums will be accepted.

∙A person may be covered any number of times under a SADTU Family Benefit Plan and/or a SADTU Extended Family Benefit Plan as long as the total benefit does not exceed R120 000.00.

∙Eligible Children may be covered multiple times under the Plan, provided that:

∙The benefit for children younger than 6 years cannot exceed the maximum benefit limit of R10 000 across all Safrican plans.

∙The benefit for children younger than 14 and older than 6 years cannot exceed the maximum benefit limit of R30 000 across all Safrican plans.

GRACE PERIOD:

A one-month grace period is allowed to pay any premium once the policy is in force (i.e. first premium has been received). If the premium is not paid within that month, the cover will cease without further notice.

COOLING OFF PERIOD:

∙The policyholder has a 30 (thirty) day cooling off period from receipt of this document to examine the Policy.

∙Should the policyholder decide not to take up the Policy, he/she must inform Safrican in writing of the intention not to accept, provided that no death or claim has taken place in this period.

∙All premiums already paid shall be refunded, less the cost of any risk cover.

CANCELLATION:

After the 30 day cooling off period has ended, the policyholder, as well as Safrican, reserves the right to cancel this Policy at any time after giving the other party 3 (three) months written notice of such intention

PREMIUM RATE AND POLICY TERMS REVIEW:

The premium rate payable, and the terms and conditions of the policy, shall be subject to alteration by Safrican at any time on 3 (three) months written notice to SADTU.

SURRENDER VALUES:

∙There are no surrender values to this Policy.

∙Benefits under this Policy may not be ceded or pledged in any way.

∙No loans will be accepted against this Policy.

DEBIT ORDER PROCEDURE:

∙If the Policy has lapsed, the Principal Member must apply to have his/her membership reinstated; if approved, the waiting periods will once again come into force with effect from the date on which the debit order is successful. During this period, and until the actual debit order is honoured no claims will be paid.

∙Please ensure that the debit order is drawn from your bank account on the date selected. If it is not deducted on the selected date, please contact our offices immediately.

FRAUDULENT CLAIMS:

If any fraudulent claim is made against this Policy, Safrican will be under no further obligation whatsoever to pay this claim, and shall, at its own discretion, be entitled to cancel this Policy, and any other Policy held by the Principal Member, with immediate effect, should any such fraudulent claim

be lodged with the knowledge or intent of the claimant to Safrican’s detriment.

CLAIMS PROCEDURE:

∙In the event of a death, a Claim Notification Form must be requested from a Safrican office, and submitted together with the relevant supporting documents.

∙Failure to submit all required supporting documentation within 12 (twelve) months of the

date of death will result in the benefit being forfeited.

Documents to be submitted include, but are not limited to:

∙Fully completed Claim Notification Form.

∙Proof of Death:

∙(BI-5) Original or faxed certified copy of computer produced Death Certificate; or

∙(BI-18) Original or faxed certified copy of unabridged Death Certificate; or

∙(Bl – 20) Original or faxed certified copy of Abridged Death Certificate in respect of stillborn, together with supporting medical documents; and

∙(BI-1663) Original or faxed copy of the Notification of death

∙Certified copy of Principal Member’s Identity

Document if a South African citizen or certified copy of Principal Member’s Passport if a foreign national

∙Certified copy of deceased’s Identity Document

if a South African citizen or certified copy of deceased’s Passport if a foreign national.

∙Copy of Principal Member’s pay slip for pay period immediately prior to death or the month in which the death occurred

∙In the event of a claim for a full-time student, confirmation satisfactory to Safrican (e.g. last academic report), from a recognised educational institution, to confirm full-time study at the time the death occurred.

∙For a disabled child, confirmation satisfactory to Safrican of State Disability Grant, copy of Medical Aid Application of the Principal Member or Medical Report.

Safrican reserves the right to request further documentation or information as it may deem necessary to accurately assess a claim.

∙Safrican will endeavour to settle the claim within 48 hours, provided all the claim procedure criteria have been met.

∙Claims will be rejected once the maximum benefit per individual has been reached. Safrican accepts no liability for loss of premiums or benefit where an individual was insured for more than the maximum benefit permitted.

∙Faxed copies must be clearly certified. The details of the Commissioner of Oaths with all the relevant details must be clear.

∙Documentation submitted other than that listed, will not be accepted. Affidavits are not accepted.

NB: The policyholder is entitled to be provided, upon request, with a copy of the Policy.

Your policy is underwritten by:

Safrican Insurance Company Limited (“Safrican”)

Reg No. 1935/007463/06

An authorised Financial Services Provider FSP No. 15123

www.safrican.co.za

Safrican is authorised to sell the following products: Long-term Insurance: Category A, B1, B2

Safrican holds professional indemnity and/or fidelity Insurance cover.

For assistance with information on the SADTU Family Benefit Plan, kindly contact:

Tel: (011) 778 8000 / 8075 / 8131 / 8132

Email: clientretention@safrican.co.za

Tel: (012) 348-9260, Fax: (012) 348-7078

Email: hq@phakama.co.za

Please fax completed application forms to the following numbers: (011) 778-8152/8186

If you have any reason to complain, kindly contact the Compliance Officer of Safrican on the details set out below.

Post: P O Box 616, Johannesburg, 2000

Fax: (011) 778-8130

E-mail: compliance@safrican.co.za

Should a complaint not be resolved to your satisfaction, you may escalate the complaint to the FAIS Ombudsman or the Long-term Insurance Ombudsman. Contact details are listed below. Please note that you should be able to show that you have already attempted to resolve the matter with Safrican first.

FAIS Ombudsman

P.O. Box 74571, Lynnwood Ridge, 0040 Tel: (012) 470 9080 Fax: (012) 348 3447

The Ombudsman of Long-term Insurance Private Bag x45, Claremont, 7735

Tel: (021) 657 5000 Fax: (021) 674 0951

AM Shikwambana Consultants CC is the intermediary for the Policy, and obtains a fee up to 25.60%, which includes commission, admin fee and marketing fee, and which is included in the premium.