Our PDF editor was developed with the purpose of allowing it to be as effortless and user-friendly as possible. The following actions can make creating the acquired asset form quick and simple.

Step 1: Find the button "Get Form Here" on the site and select it.

Step 2: Once you've got entered the editing page acquired asset form, you should be able to notice every one of the actions readily available for your file within the top menu.

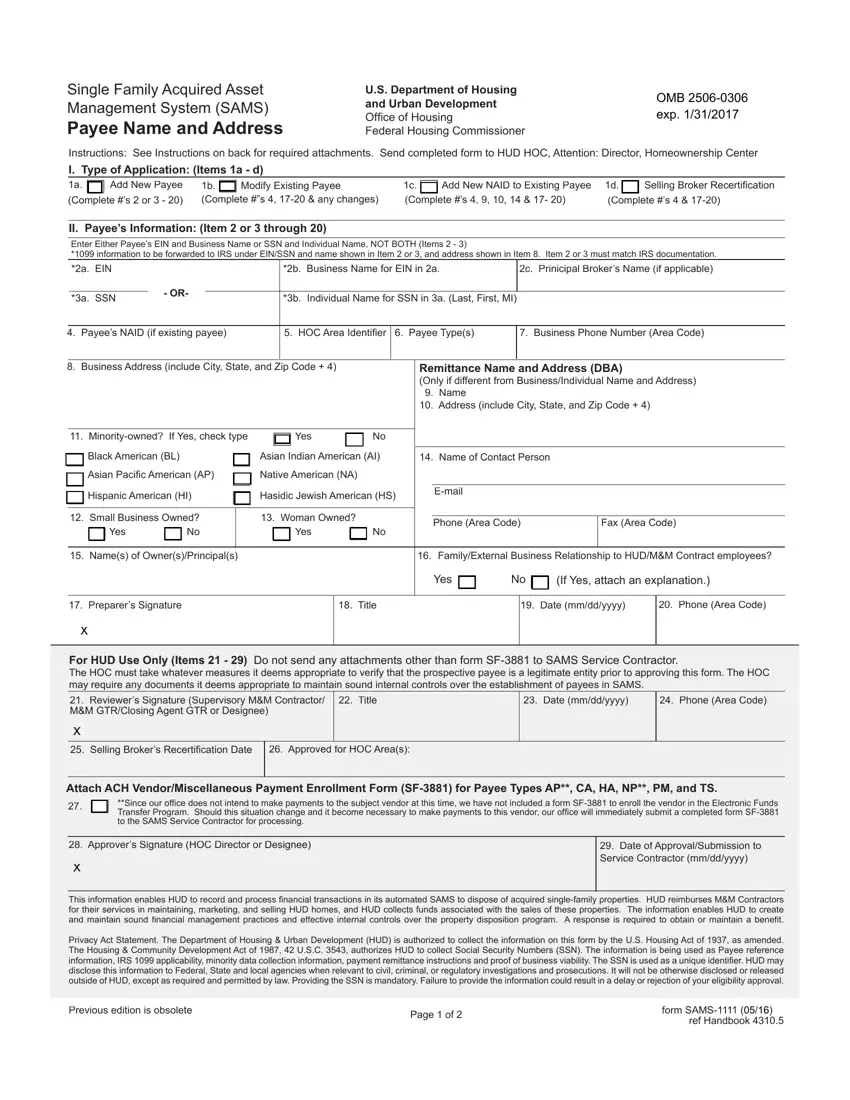

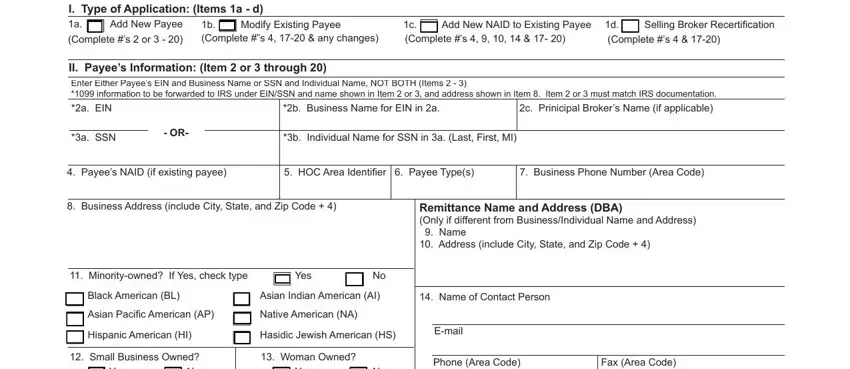

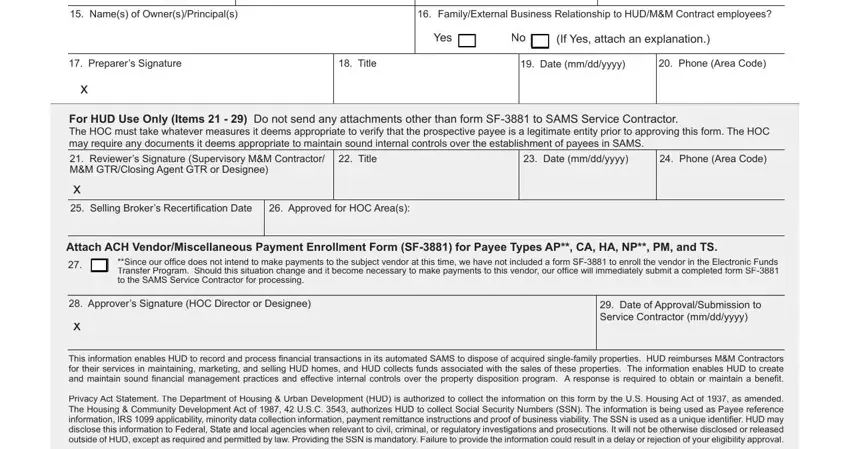

Type in the data requested by the application to fill out the form.

Type in the requested particulars in the Names of OwnersPrincipals, FamilyExternal Business, Yes, If Yes attach an explanation, Preparers Signature, Title, Date mmddyyyy, Phone Area Code, For HUD Use Only Items Do not, Reviewers Signature Supervisory, Approved for HOC Areas, Title, Date mmddyyyy, Phone Area Code, and Attach ACH VendorMiscellaneous section.

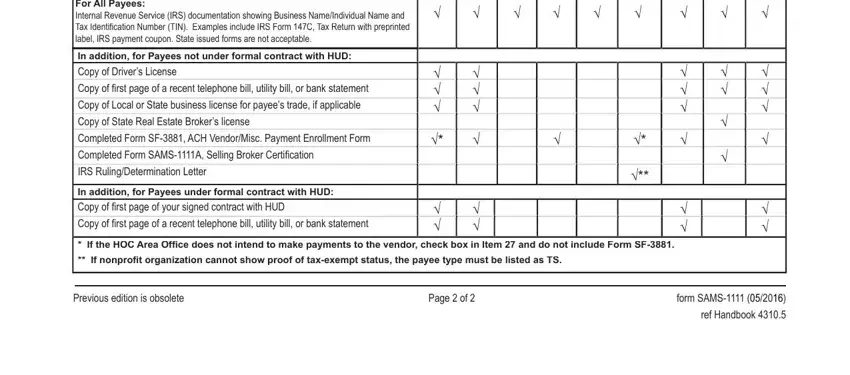

The software will require you to present certain valuable info to instantly submit the segment For All Payees Internal Revenue, In addition for Payees not under, Copy of fi rst page of a recent, Copy of Local or State business, Copy of State Real Estate Brokers, Completed Form SF ACH VendorMisc, Completed Form SAMSA Selling, IRS RulingDetermination Letter, In addition for Payees under, Copy of fi rst page of a recent, If the HOC Area Offi ce does not, If nonprofi t organization cannot, Previous edition is obsolete, Page of, and form SAMS.

Step 3: At the time you select the Done button, your finalized file is simply exportable to all of your devices. Or alternatively, you might send it by means of mail.

Step 4: Generate duplicates of your document - it will help you stay away from upcoming worries. And don't get worried - we do not publish or watch the information you have.