Our top level developers worked hard to obtain the PDF editor we are now proud to deliver to you. The software will allow you to instantly complete tcc001 and can save precious time. You just have to comply with this specific guideline.

Step 1: To get started, choose the orange button "Get Form Now".

Step 2: It's now possible to modify your tcc001. Our multifunctional toolbar makes it possible to add, delete, adapt, and highlight content material or conduct other commands.

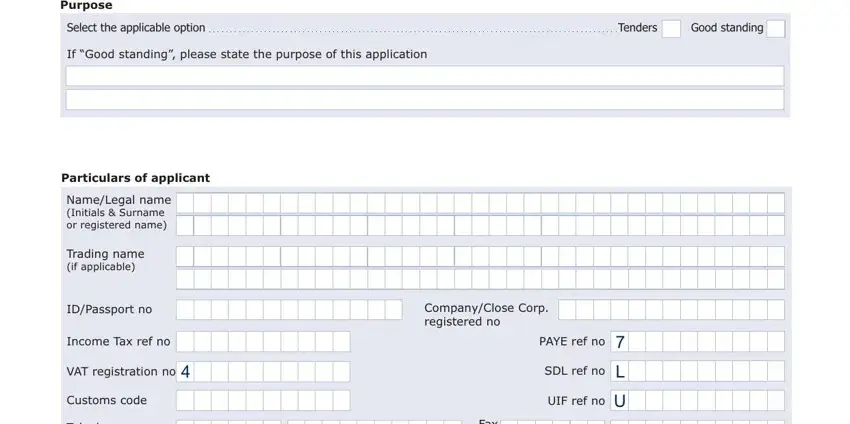

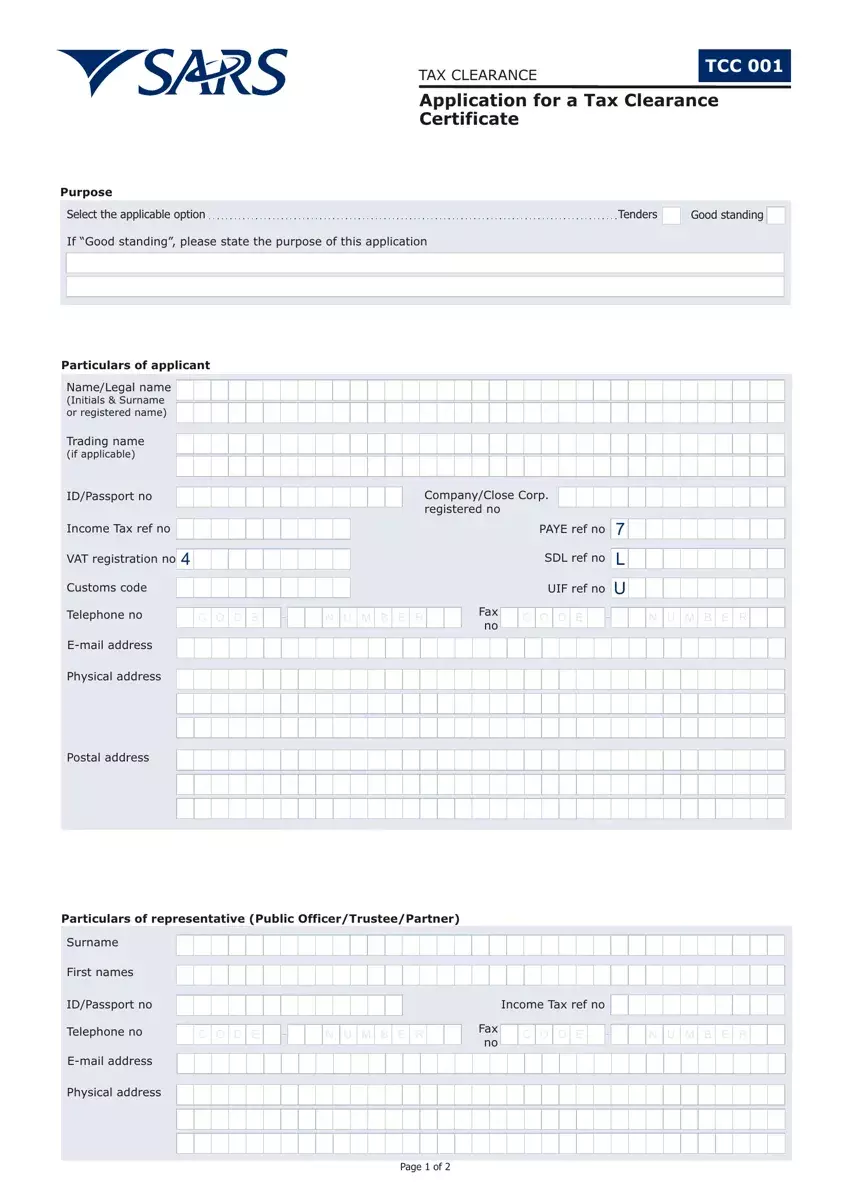

All of the following areas will make up your PDF file:

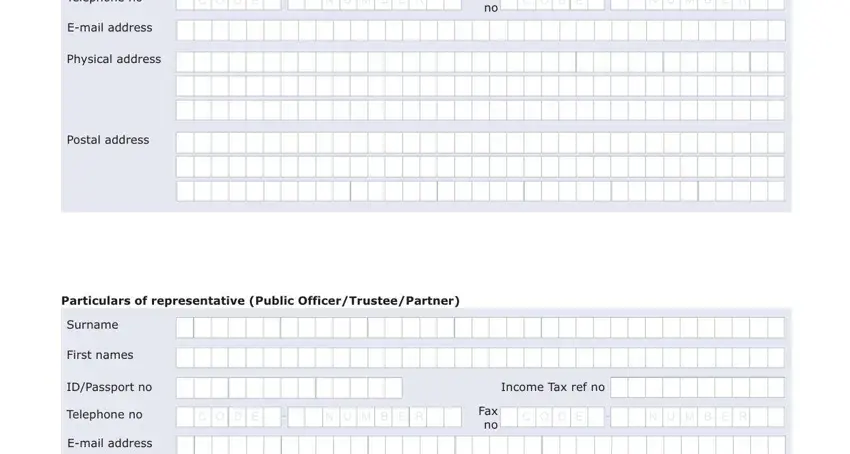

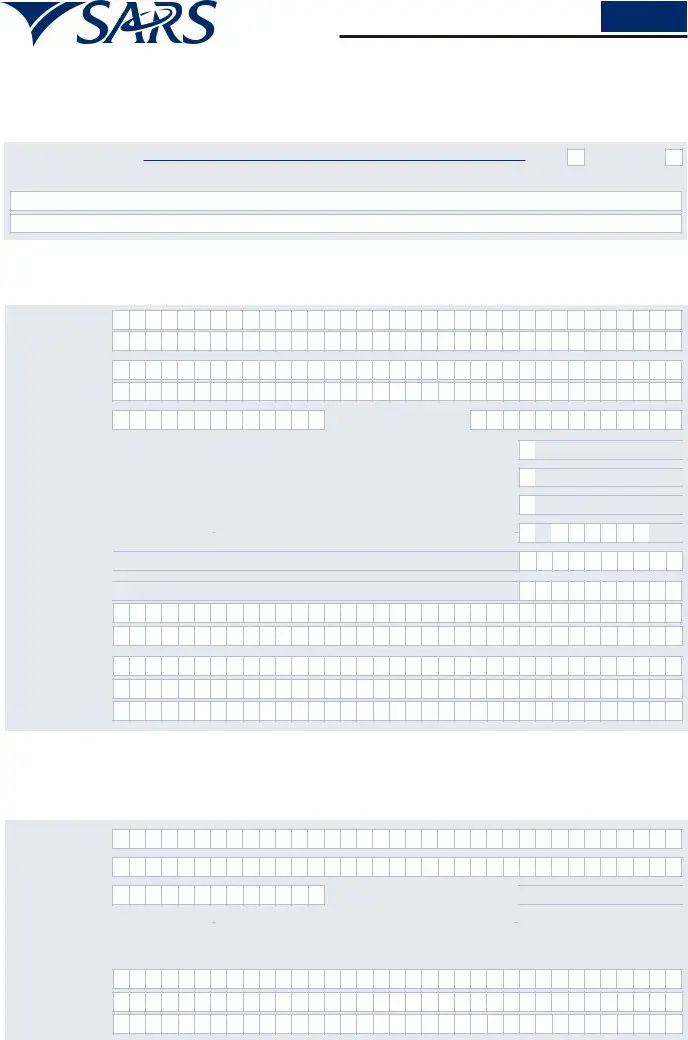

Complete the C O D E, N U M B E R, Fax no, C O D E, N U M B E R, Telephone no, Email address, Physical address, Postal address, Particulars of representative, Surname, First names, IDPassport no, Telephone no, and Email address field using the data requested by the software.

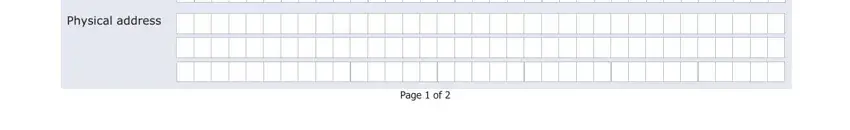

You'll have to provide specific particulars in the section Physical address, and Page of.

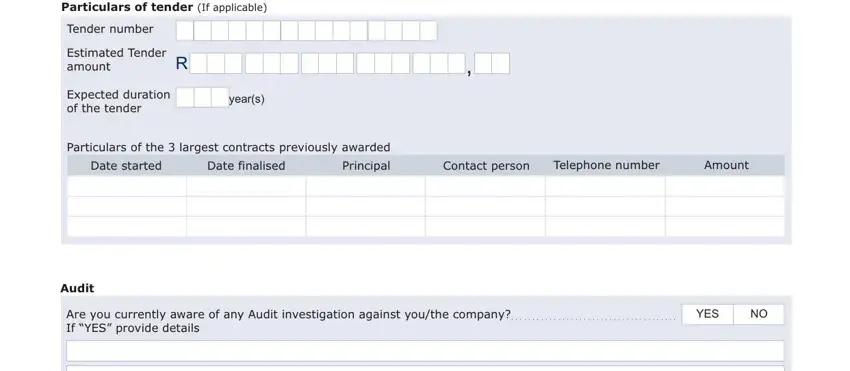

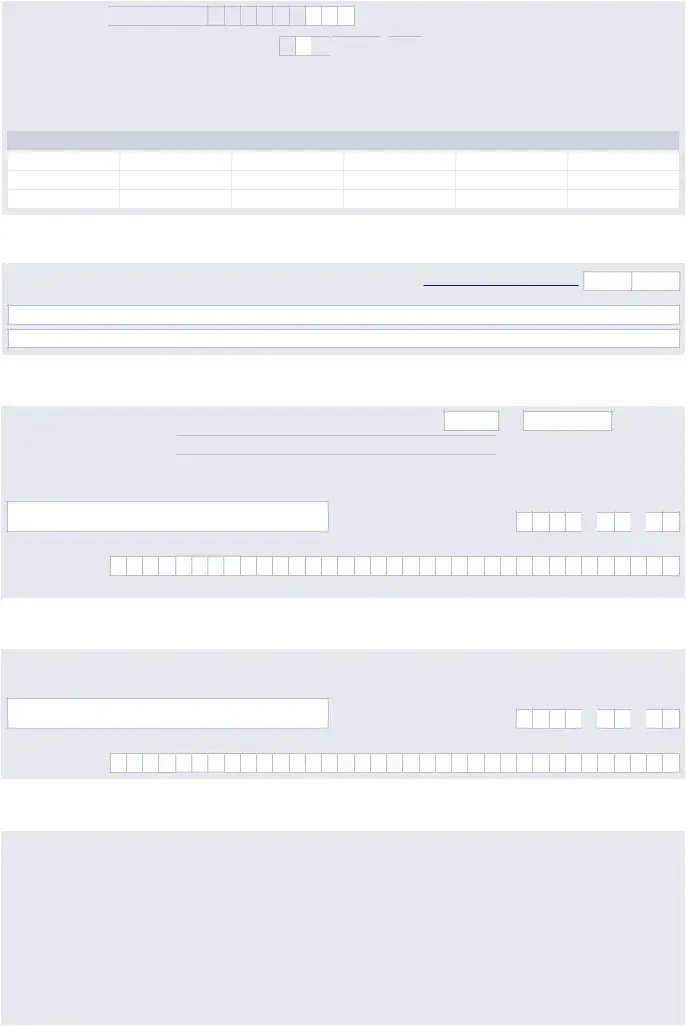

The space Particulars of tender If applicable, Tender number, Estimated Tender amount, Expected duration of the tender, years, Particulars of the largest, Date started, Date finalised, Principal, Contact person, Telephone number, Amount, Audit, Are you currently aware of any, and YES should be where you can add both parties' rights and responsibilities.

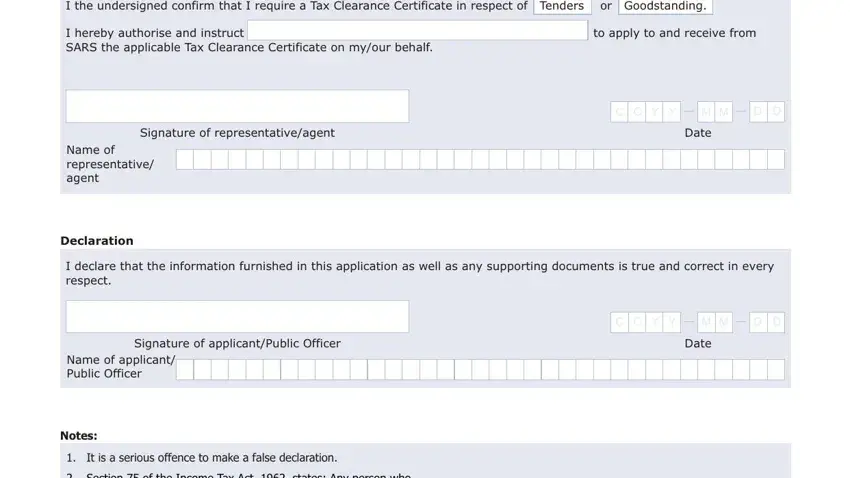

End by reviewing the next sections and completing them as required: I the undersigned confirm that I, I hereby authorise and instruct to, Signature of representativeagent, C C Y Y, M M, D D, Date, Name of representative agent, Declaration, I declare that the information, Signature of applicantPublic, Name of applicant Public Officer, Notes, It is a serious offence to make a, and Section of the Income Tax Act.

Step 3: Choose "Done". You can now export the PDF document.

Step 4: It can be more convenient to create copies of your document. You can rest assured that we won't display or check out your information.

U

U

N U M B E R

N U M B E R

,

,

SARS the applicable Tax Clearance Certificate on my/our behalf.

SARS the applicable Tax Clearance Certificate on my/our behalf.

M M

M M

D D

D D

M M

M M

D

D