Our leading computer programmers have worked collectively to develop the PDF editor that you're going to operate. The app makes it simple to submit ccyymmdd documents shortly and with ease. This is everything you should do.

Step 1: Look for the button "Get Form Here" on this webpage and click it.

Step 2: Now you are on the file editing page. You may edit, add text, highlight particular words or phrases, place crosses or checks, and put images.

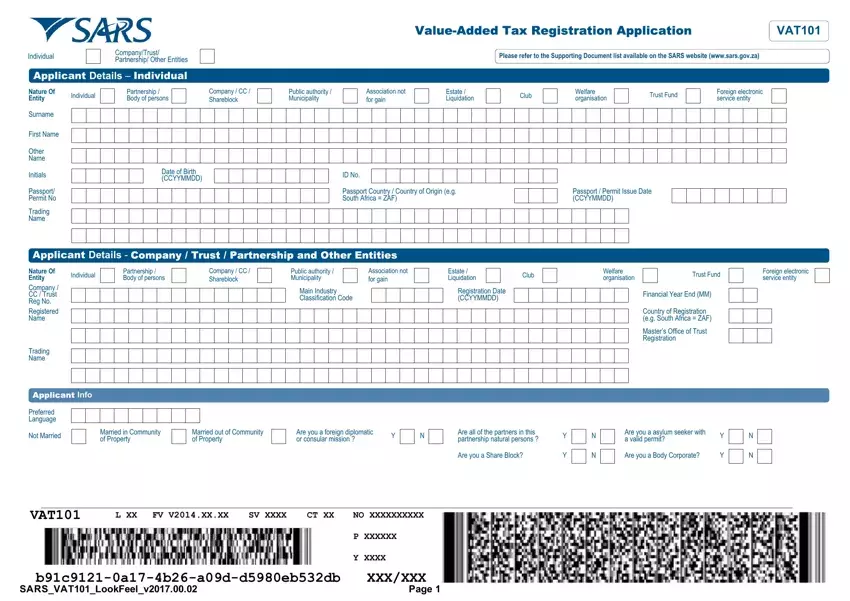

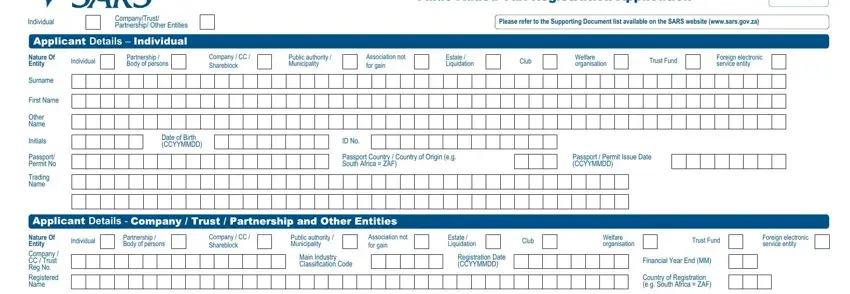

It is essential to provide the following information if you need to create the document:

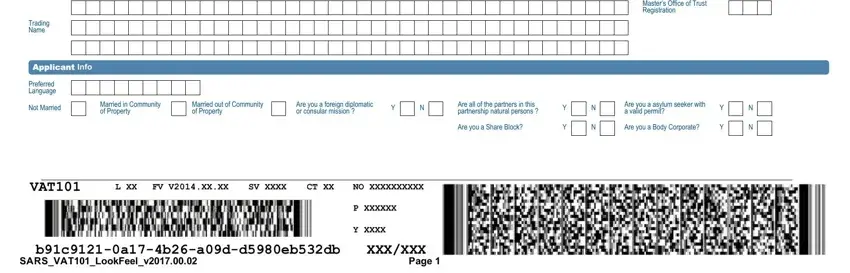

The software will expect you to complete the Masters Office of Trust, Trading Name, Applicant Info, Preferred Language, Not Married, Married in Community of Property, Married out of Community of, Are you a foreign diplomatic or, Are all of the partners in this, Are you a Share Block, Are you a asylum seeker with a, Are you a Body Corporate, VAT, L XX, and FV VXXXX area.

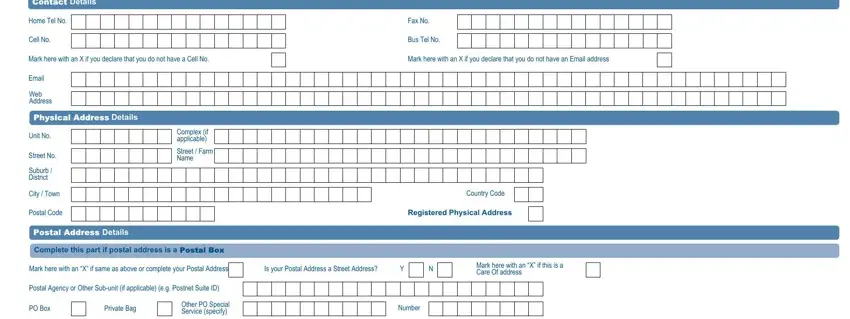

In the Contact Details, Home Tel No, Cell No, Fax No, Bus Tel No, Mark here with an X if you declare, Mark here with an X if you declare, Email, Web Address, Physical Address Details, Unit No, Street No, Suburb District, City Town, and Postal Code part, highlight the vital particulars.

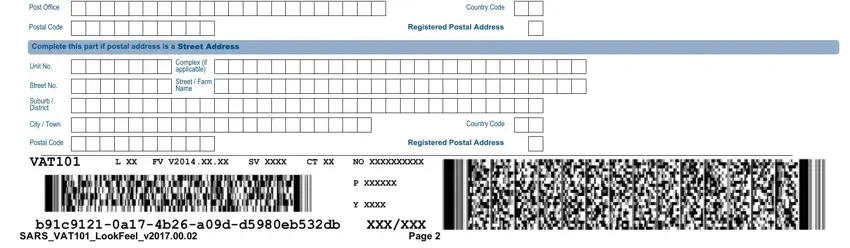

You have to identify the rights and responsibilities of all parties in paragraph Post Office, Postal Code, Complete this part if postal, Complex if applicable, Street Farm Name, Unit No, Street No, Suburb District, City Town, Postal Code VAT, Country Code, Registered Postal Address, Country Code, Registered Postal Address, and L XX.

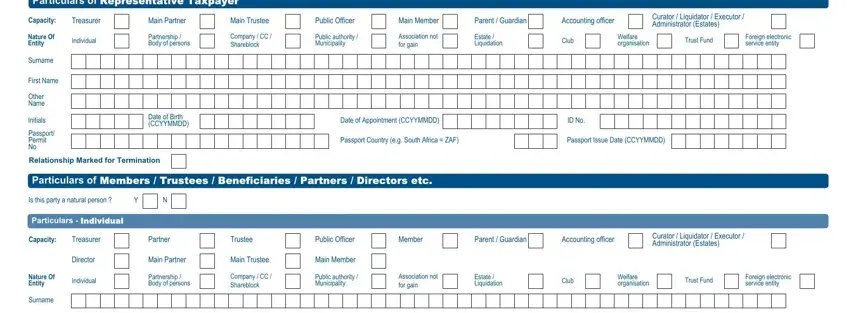

Finish by reviewing these areas and writing the appropriate details: Particulars of Representative, Capacity, Treasurer, Main Partner, Main Trustee, Public Officer, Main Member, Parent Guardian, Accounting officer, Curator Liquidator Executor, Nature Of Entity, Surname, First Name, Other Name, and Initials.

Step 3: Hit the Done button to save the document. So now it is obtainable for export to your gadget.

Step 4: Have minimally a few copies of your document to keep clear of any kind of potential concerns.